Investing in the stock market has always been considered a great way to earn extra passive income, but it is also considered very risky and one of the possible causes of financial distress in the event of an economic downturn.

Although it is not possible to completely eliminate the risks associated with investing, it is possible to significantly reduce them by diversifying the investment portfolio.

More specifically, there are two types of risk associated with investing: systematic risk and specific risk. Systematic (or market) risk affects all securities on the market in the same way. It is the risk of an economic downturn or other external factors that could cause the price of a security to fall. Specific (or diversifiable) risk, on the other hand, is the individual risk of security arising from its internal organization and operation.

Market risk is uncontrollable and cannot be reduced. Specific risk, on the other hand, can be reduced to zero if a portfolio is perfectly differentiated.

Types of Assets and Diversification

Differentiation is the process of adding more and more assets belonging to different categories to the portfolio to ensure that even if one or more sectors fall in the market, the remaining ones will save your portfolio from significant losses.

From a purely theoretical point of view, the Capital Asset Pricing Model (CAPM) introduced in the late 900s, developed the idea that the optimal portfolio would be a combination of the market index and bonds. This concept was based on the fact that the market index is, by definition, the most diversified security on the market and bonds have zero volatility and a fixed return. Therefore, any portfolio consisting of a combination of the two securities would have the maximum return for any given unit of volatility.

Despite the fact that we have many more categories of assets to choose from these days, the key insight remains the same. In order to differentiate, it is not only necessary to choose different stocks from different sectors, but also to consider other asset classes.

Diversification Examples

For example, if we talk about stocks, we should not only choose stocks from different industries but also introduce ETFs and indexes to increase diversification. Another great investment option to reduce market risk in a portfolio is to buy Real Estate Investment Trusts (REITs), which allow investors to earn dividends from real estate without having to buy a property.

The same concept applies to bonds. A balanced portfolio should include bonds with different maturities and from different issuers. For example, corporate bonds tend to be riskier but offer a higher payment, while Treasury bills are considered a “risk-free” investment but yield a much lower payment. In addition, it is often a good idea to buy government bonds from other countries outside the United States.

Finally, it is also important to consider other investments such as hybrids, commodities, and futures that can be used to hedge a portfolio, especially during economic downturns.

Diversification Strategies

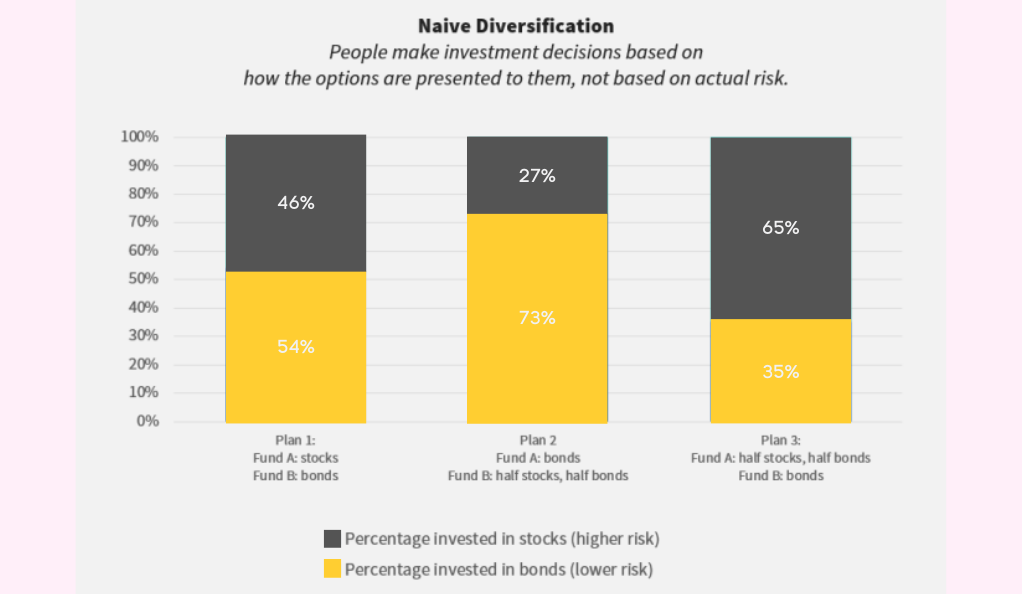

There are two main types of diversification strategies: naive diversification and optimal diversification. Despite the fact that these two methods are substantially different from each other, it has been shown over time that both are viable options to reduce portfolio market risk.

Naive Diversification

Naive diversification is based on a random selection of investments, without regard to their correlation. Even though this method is not based on mathematical calculations, it still leads to a satisfactory result, since each stock that is not perfectly correlated with the current portfolio reduces its volatility.

Naive diversification works exceptionally well when the number of stocks in the portfolio increases. This is because, since the probability of finding two stocks with near-perfect correlation is very low, the correlation tends to reach an optimal level as the number of stocks in the portfolio increases, according to the law of large numbers.

On the other hand, naive diversification does not work so well when the portfolio contains a small number of assets. In this case, it could be that all assets are perfectly correlated, negating any potential diversification benefit.

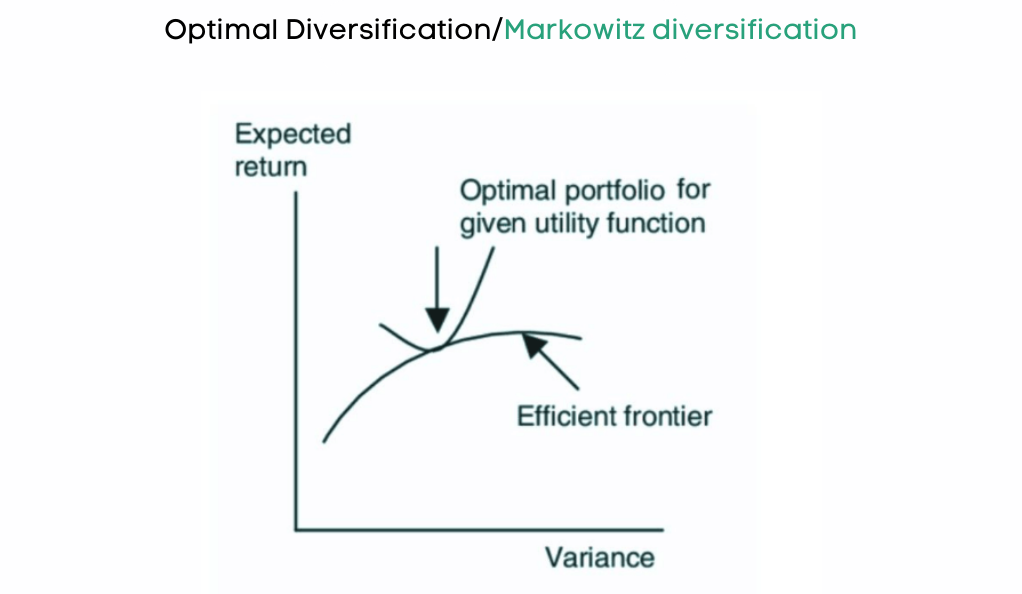

Optimal Diversification

Optimal diversification, also known as Markowitz diversification, is based on mathematical calculations to determine which stocks would be a great addition to the portfolio and which would not.

The easiest way to achieve optimal diversification without calculating any correlation or standard deviation is to look at the beta of each stock that you want to include in your portfolio. The beta of a stock measures the change in the price of the stock divided by the change in the price of the market index over a given period of time.

Therefore, the goal of this strategy would be to achieve a weighted average beta of your portfolio close to zero, indicating the independence between the portfolio’s returns and those of the market.

Although this parameter does not represent correlation and therefore could provide inaccurate results, it is still a valid option to eliminate some degree of randomness that would otherwise arise. However, when using betas, it is important to remember that you are only individually comparing a stock to the market and not to the investment portfolio.

The exact

optimal diversification method, on the other hand, is based on calculating the correlation between the current investment portfolio and the new stock. To do this, you must first calculate the standard deviation of the portfolio and the stock, and then determine the covariance between them.

However, this method is more precise and states that any stock that has a correlation lower than 1 (perfect correlation) with the current portfolio reduces the specific risk of the portfolio and thus its volatility.

Understanding Correlation in Diversification

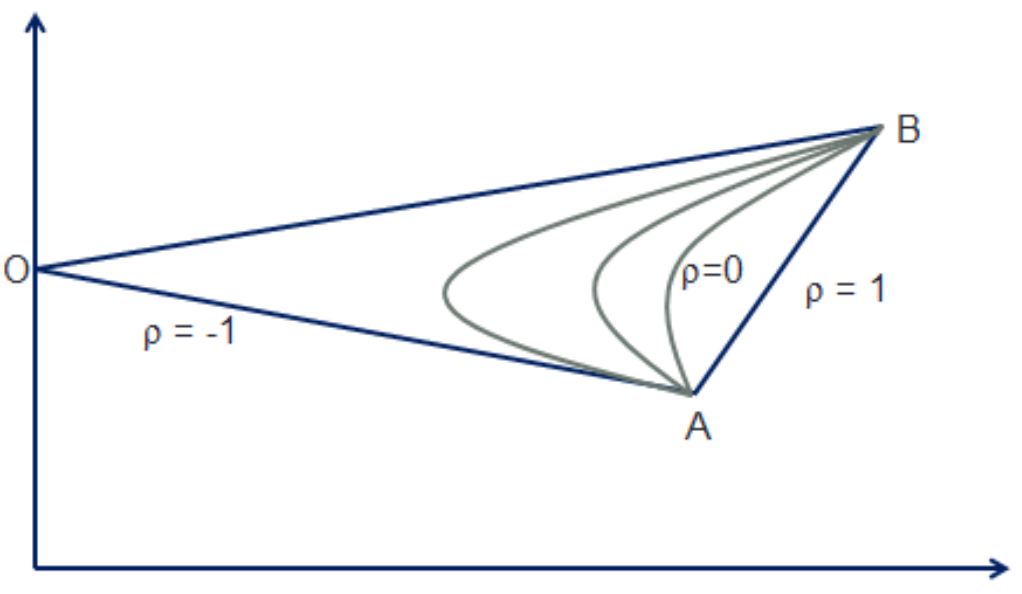

Correlation is a key concept in diversification, especially when someone is pursuing an optimal diversification strategy. It measures the extent to which two separate numerical values (in this case, assets) move together.

Unlike covariance, correlation has no unit of measurement and is a standardized value between 1 and -1. A positive correlation means that two assets move in the same direction, i.e., when the price of one increases, the price of the other also increases. A negative correlation, on the other hand, is when the two prices move in the opposite direction, i.e. when the value of one increases, that of the other decreases. Finally, a correlation of zero means that the prices of the two assets are uncorrelated.

Thus, if we add a new asset to the portfolio that has a perfect correlation with it, the result would be the same level of portfolio volatility and risk as before, since the new stock will move exactly like the old portfolio.

Even though any correlation below 1 will help reduce volatility, it would be better to choose stocks with a correlation close to zero (or perhaps even negative) to maximize the diversification bonus.

Limits of Correlation

On the other hand, it is also important to consider certain factors that can lead to significant miscalculation or misinterpretation of a correlation coefficient.

First of all, it is important to evaluate correlation on a large time frame, otherwise the results could be heavily biased during a certain period.

Also, it may happen that two assets are correlated by a non-linear relationship. Since the correlation is only a linear indicator, it is likely that the final result will be a correlation close to zero, even if the two assets are heavily correlated.

For this reason, it is often important not only to look at the mathematical numbers, but also to compare the performance of the assets using the charts to spot any cyclical correlation or any other type of similar behavior.

Conclusion

In summary, while complex mathematical models may seem impressive, the benefits that flow from them are not always clear. In particular, the optimal diversification method requires considerable mathematical skill and time to perform correctly, while it is possible to obtain similar resources using the naive diversification method.

Regardless of which method you consider more appropriate for your investment strategy, portfolio diversification is an important measure that allows investors to reduce unsystematic risk while keeping returns constant.

For this reason, it is not enough to buy assets in different sectors and categories, but it is also necessary to keep diversifying the investment portfolio in order to achieve the best possible results.

FAQs

Is portfolio diversification important?

Diversification is a critical activity that absolutely must be done to manage risk and maximize profits. Even if it is true that risk and return move in the same direction, i.e. the more the return increases, the more the risks increase, this only works for systematic risk.

Specific risk (also called unsystematic or diversifiable risk) can be completely eliminated while the return remains constant.

Which diversification method is the best?

The answer depends on your personal preferences. Although the method of optimal diversification seems to be more accurate and sophisticated than the naive diversification, it has been proven that the results of both methods are not statistically different.

What is correlation?

Correlation is a coefficient used in statistics to determine the relationship between the movement of two random variables. Applied to the financial world, we can identify the random variables as the prices of two securities or assets, so the correlation will describe the relationship between the two prices.

Moreover, the correlation is a coefficient, that is, it has no unit of measurement and can only be a number between -1 and 1.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More