For many people, being able to enjoy a successful retirement at the end of their working years is a defining life goal.

But as the saying goes, a goal without a plan is just a wish.

Being able to step back from the world of work and enjoy your golden years requires you to have the financial resources to support yourself during that time.

And those resources don’t just appear out of thin air – instead, they’re accumulated over the course of years, through diligent saving, budgeting, and investing.

Today, we’re going to take a step-by-step walkthrough on the basics of financial planning for retirement for Americans.

At the end, we’ll provide a list of resources you can use to explore this process in even greater depth.

But by implementing what we discuss in this article, you’ll be well on your way to enjoying the retirement you deserve.

Table of Contents

Understanding Retirement Needs

The first step in constructing a financial plan for retirement involves establishing exactly what your needs will be during that period.

Retirement needs look different for different people – there’s no one-size-fits-all solution here.

Some people have a family history of longer-than-average life expectancy – meaning they might need to prepare for a few more years of retirement than most.

Others have health issues that they expect to flare up during their older years.

While individual situations can vary, in general, a good rule of thumb is to plan on replacing between 70-90% of your pre-retirement income.

That target should ensure that your standard of living doesn’t change too much between working and retirement.

Why not 100%? While some people do like to target fully replacing income for peace of mind, that’s not usually necessary.

There are a couple of reasons why, but the main one is that retirees usually drop into a lower tax bracket once they stop working, as their taxable income drops.

For the purposes of this article, we’ll assume we’re planning for a couple with a current household income of $200,000. For 90% replacement, they’ll want $180,000.

What about inflation? $180K won’t buy the same in 20 years as it will today.

There are a couple of ways to deal with inflation when financial planning for retirement – but the easiest is to use “real” rates of return (which subtract the inflation rate) when calculating investment returns.

In other words, we’ll discuss everything in terms of present dollars.

Social Security and Pensions

Of course, our investment accounts won’t be our only source of income during retirement.

We need to factor in expected payments from Social Security and any company pensions.

Pensions aren’t as common as they used to be, but many employees (particularly public sector ones) are still eligible to receive them.

Every pension plan is different, but most specify that they’ll cover a portion of previous employee salary, calculated over some set of years.

The size of Social Security payments can also depend on a number of factors, most notably lifetime earnings and the age at which you take your benefits.

While you’re eligible to start taking Social Security at 62, your benefits will increase if you can delay until you’re 70.

Now, we established that the couple we’re planning for will need a $180K annual income in retirement. Let’s assume that both of them will begin taking social security at age 65.

Using the average benefit at that age, they’ll each receive about $1,500 from Social Security per month – or $36,000 for the whole year.

Assuming they don’t have any pensions, that brings the amount of income their investments will need to fund down to $144,000.

Portfolio Size and Withdrawal Rates

Once you’ve determined the amount of income that your investments will need to fund, you can start making progress on creating a portfolio plan.

For most people, investments will likely be their greatest source of funds in retirement. Social Security and pensions are often insufficient on their own to support someone who is no longer working.

To ensure your investments can support you, you’ll need to grow your portfolio to a point where you can withdraw sufficient income from it.

One common hurdle when creating a retirement financial plan is determining how much of your portfolio you can safely withdraw.

Ultimately, there’s no one right answer to this question. The percentage you can withdraw each year will depend on how market conditions evolve and what your expenses look like.

It’s important to not withdraw too much, or you might run out of money. However, if you withdraw too little, you may not be using your assets as effectively as possible.

One common rule of thumb is to withdraw 4% of your portfolio each year to start. Then, if you need to adjust that figure up or down, you can do so.

Using that rule of thumb, you can calculate roughly how large your portfolio needs to be in retirement based on your expected income needs.

Using our example, where a couple needs $144,000 after their Social Security and pensions, their portfolio should grow to about $3.6 million to withdraw that amount of income in their first year.

That’s a sizable amount. To achieve portfolio goals like that, it’s important to choose not just the right investments, but also the right investment accounts.

Choosing Retirement Accounts

When you think of building a portfolio, you might want to just set up an individual brokerage account and start picking investments.

But if you want to have a successful retirement, it’s imperative that you pick the right account types to hold those investments in.

Individual accounts fall under the umbrella of ‘taxable’ investment accounts. That means you’ll need to pay income or capital gains tax on profits in the account.

But the government allows you to skip out on paying certain tax obligations in one category of investment accounts, known as ‘retirement’ accounts.

Assets in these accounts are allowed to grow tax-free.

Retirement accounts come in different forms. To find the right one for you, it’s best to consult with a financial advisor or tax professional.

However, here are a few ideas for retirement accounts you can explore, as well as some of their defining traits.

• Traditional IRA.

With a Traditional IRA (Individual Retirement Account), you don’t pay money on the taxes you contribute, as you deduct it from your taxable income for the year of the contribution.

When you withdraw your money, though, you’ll have to pay taxes.

• Traditional 401(k).

A Traditional 401(k) is similar to a Traditional IRA in the sense that pre-tax money goes in, but you pay taxes when the money comes out.

But a 401(k) is an employer-sponsored plan, meaning you’ll need to work for a company that offers it to access one.

• Traditional 403(b).

A Traditional 403(b) is the public sector version of a Traditional 401(k). It’s only available to certain government and non-profit workers.

• Roth IRA.

A Roth IRA is the inverse of a Traditional IRA. Money you’ve already paid taxes on goes in, but you don’t pay any taxes when the money comes out.

Some 403(b) and 401(k) plans also come in Roth form.

Investment Allocation and Portfolio Growth

Once you’ve established the right mix of investment accounts, you can start structuring your investment allocation in order to meet your portfolio goals.

Investment allocation refers to the percentage of your portfolio that’s invested in different asset classes. That mix will play a big role in impacting your investment returns – and therefore the size of your portfolio when you retire.

For example, stocks have historically had a higher return than bonds have. However, stocks are also riskier than bonds in the short term.

The right allocation mix for you will depend largely on your timeframe.

For instance, let’s say that you’re a young professional who is not planning on touching your investment accounts for many years.

In this case, it might make sense to invest a larger portion of your portfolio in riskier assets in order to target a higher rate of return.

Over the long run, riskier assets tend to generate better returns.

If you’re older and nearing retirement, however, you might want to consider toning down the risk of your portfolio. Since you’ll need to start taking income from your investments soon, you don’t want them to wildly swing in value.

Based on how you expect your allocation mix to evolve over time, you can start calculating the returns you anticipate from your portfolio.

Working with a financial professional is the best way to generate an accurate estimate of the returns you can expect from the investment opportunities available to you.

However, investors often rely on a 6% real rate of return (that is, factoring in inflation) as a rule of thumb. That’s based on the return of standard portfolio allocations over time.

From here, you can use a variety of calculators to see how much you’d need to save to achieve the portfolio size you need. The SEC runs one such calculator here.

Using that calculator, we see that our example couple would each have needed to invest about $1,000 a month ($2,000 for their household total) at a 6% interest rate starting at the age of 25 in order to retire at 65 with a portfolio around their desired size.

To reliably save that much each month, we’ll have to turn to the next part of our financial planning process: budgeting.

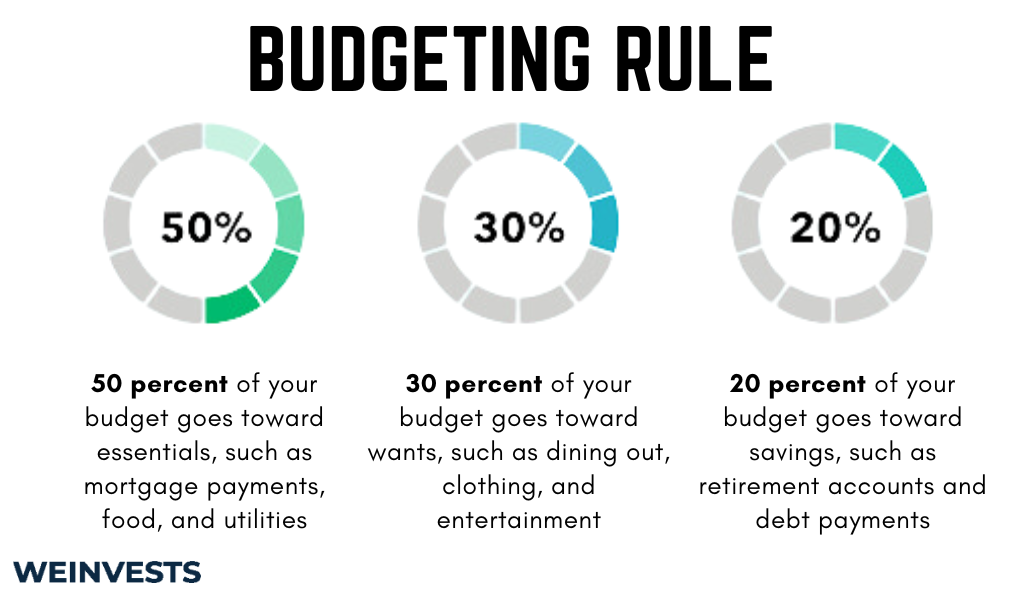

Budgeting and Saving

By constructing a smart budget, you can take the necessary short-term steps to achieve the long-term goal of retirement.

Even though some of the portfolio sizes we’ve discussed today might seem daunting, they’re realistic to achieve so long as you follow a disciplined budgeting process.

There are lots of budgeting methods out there, and the right one for you will depend on your mindset.

But what they all have in common is clearly understanding where your money is going each month so that you can keep track of your finances.

One way people stick to a disciplined savings plan is by automating the process.

Depending on your broker, you can likely set up an automated withdrawal from your bank account each month at regular intervals.

Then, you can have extra cash in your accounts invested into a specific portfolio each month.

This frees you from needing to “remember” to save each month – instead, it treats saving like a necessary expense.

For our example couple, who needed to save $2,000 a month between them, the right move might be to set up an automated $1,000 transfer from their joint bank account twice a month after each payday.

For you, the process might look different – but some form of budgeting and saving is essential to achieve a successful retirement.

Conclusion and Resources

To reach your goal of enjoying your golden years without needing to worry about working, you’ll need to organize a thorough financial plan.

In this article, we’ve outlined the basic steps of that plan, from establishing your retirement needs in the future to developing a saving process today.

To dive deeper into these topics and start putting together your own financial plan for retirement, we’ve assembled some key resources that you might find useful.

Remember, working with a tax professional, investment specialist, or financial advisor can also help you prepare for retirement.

Top 10 Ways to Prepare for Retirement (Department of Labor)

Planning for Retirement (Consumer Financial Protection Bureau)

Retirement planning: What to do (Vanguard)

FAQs

How to save for retirement?

Saving for retirement starts with creating a monthly budget so you know how your expenses stack up with your income. A common method to effectively save for retirement is to automate the saving and investment process with regular transfers and asset purchases.

How much money do I need to retire?

The amount of money you need to retire is highly dependent on your anticipated expenses, healthcare costs, and living situation. In general, the earlier you start saving and investing, the better the chance that you have enough money saved for retirement.

What is the best retirement account?

Ultimately, no one retirement account can be considered “best.” Traditional IRAs, Roth IRAs, 401(k)s, and other accounts all come with their own unique benefits. What they all have in common, though, is allowing the profits in your portfolio to grow tax-free before you withdraw them.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More