Let’s embark on a journey into the fascinating world of algorithmic trading, where finance meets cutting-edge technology. Algorithmic trading involves employing computer programs, also known as algorithms, to automatically execute trading decisions based on predetermined criteria.

Imagine having a tireless assistant continuously analyzing markets and making trades according to your strategies — that’s the essence of algorithmic trading. In recent years, algorithmic trading has witnessed an exponential rise in popularity. From institutional investors to individual traders, everyone is increasingly drawn to its speed, precision, and capacity to execute complex trading strategies.

Our mission here is to make algorithmic trading accessible and understandable for beginners. We’ll start from the ground up, exploring various strategies, diving into the software options, and even venturing into the integration of Python and machine learning. Get ready for an enlightening journey into the world of algorithmic trading!

Table of Contents

- The Basics of Algorithmic Trading

- Algorithmic Trading Strategies

- Algorithmic Trading Software

- Algorithmic Trading with Python

- Machine Learning for Algorithmic Trading

- Case Study: Predictive Modeling for Forex Trading

- Risk Management and Algorithmic Trading

- Regulatory and Ethical Considerations

- The Future of Algorithmic Trading

- Conclusion

- Frequently Asked Questions (FAQs)

- What skills do I need to start with algorithmic trading?

- Can I do algorithmic trading as a part-time endeavor?

- How much capital do I need to start algorithmic trading?

- Is algorithmic trading more profitable than traditional manual trading?

- Can I trade cryptocurrencies using algorithmic trading?

- How do I deal with system failures or technical glitches during live trading?

The Basics of Algorithmic Trading

Algorithmic trading’s history is a captivating journey through the annals of finance. Picture the shift from frantic traders on bustling floors to today’s lightning-fast trades executed with the tap of a screen: it’s a tale of how technology transformed the landscape of trading.

At the heart of algorithmic trading are the following fundamental concepts:

- Algorithms, the brains behind the operation, are sets of rules that govern trading decisions;

- Trading signals, derived from a multitude of indicators and patterns, serve as the triggers for these algorithms;

- Execution algorithms, the final piece of the puzzle, bring the trades to life.

Stay tuned as we delve deeper into these concepts, peeling back the layers to reveal the core of algorithmic trading and how it has evolved over time.

Algorithmic Trading Strategies

In this section, we’ll discuss various algorithmic trading strategies, each embodying a unique approach and purpose in the dynamic world of financial markets.

Here’s an overview of some prominent strategies:

Trend-Following Strategies

Trend-following strategies aim to ride the market’s momentum by identifying and trading in the direction of an established trend. Traders utilizing this approach believe that once a trend is in motion, it’s likely to continue. They leverage technical indicators and statistical analysis to identify these trends and automate trade executions accordingly.

Mean Reversion Strategies

Mean reversion strategies are built on the principle that asset prices tend to revert to their historical average over time. Traders employing this approach believe that prices deviating significantly from the historical average are likely to revert, presenting an opportunity for profitable trades. Algorithms are programmed to identify these deviations and execute trades to capitalize on price reversals.

Market-Making Strategies

Market-making strategies involve providing liquidity to the market by placing both buy and sell orders. Market makers earn profits from the spread between the buying (bid) and selling (ask) prices. Algorithmic market makers continuously adjust their quotes based on market conditions and execute trades swiftly to capture the bid-ask spread.

Statistical Arbitrage Strategies

Statistical arbitrage strategies utilize statistical models and analysis to identify price inefficiencies in financial instruments. These models identify relationships or price divergences between related securities. Traders then execute trades to capitalize on these pricing discrepancies, aiming to achieve a risk-free or nearly risk-free position.

The choice of strategy is crucial and should align with your risk tolerance, prevailing market conditions, time horizon, and the specific asset class you are trading. Exploring these strategies allows you to craft a strategy that suits your trading goals.

Algorithmic Trading Software

Understanding the software that powers algorithmic trading is essential to effectively implement trading strategies. In the following sections, we’ll navigate through the diverse software options available to traders.

Imagine the software as the canvas on which the masterpiece of algorithmic trading is painted. We’ll emphasize the significance of choosing the appropriate software and highlight some popular algorithmic trading platforms such as AlgoTrader. Each platform has its strengths and caters to different trading styles and preferences.

Furthermore, we’ll discuss the crucial factors to consider when selecting software, including backtesting capabilities, customization and flexibility, data feeds and connectivity, and cost implications. Armed with this knowledge, you’ll be better equipped to choose the right tool to bring your algorithmic trading strategies to life.

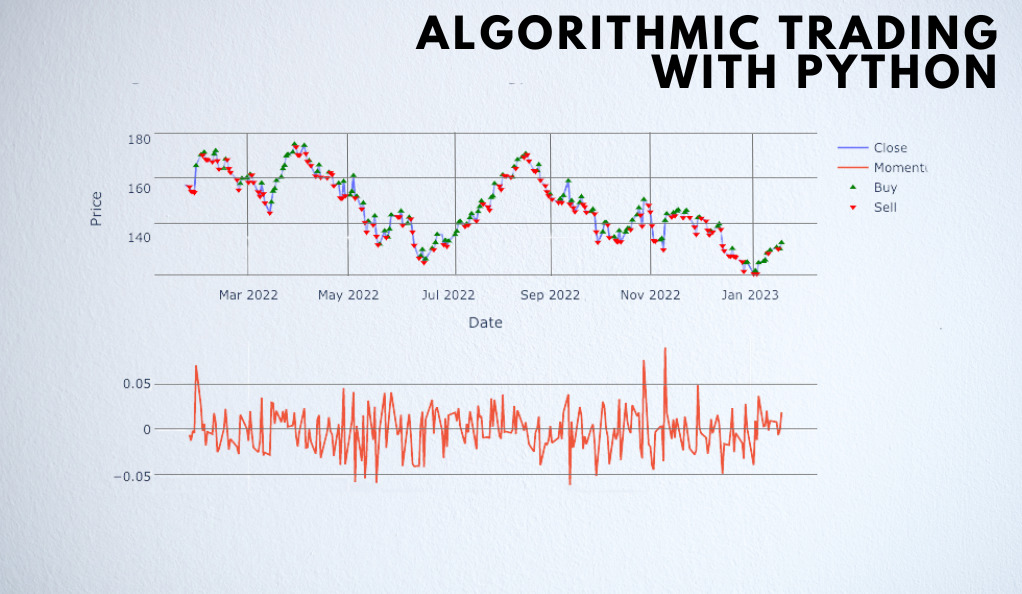

Algorithmic Trading with Python

Python has experienced a meteoric rise in algorithmic trading for several compelling reasons: its simplicity and readability make it accessible for both beginners and experienced programmers; moreover, the extensive standard library, open-source nature, and a massive ecosystem of third-party libraries enrich its functionality.

Here are some key libraries that revolutionize the way traders interact with financial markets:

- NumPy and Pandas: These libraries are the foundation, facilitating data manipulation, analysis, and preparation;

- Backtrader: Tailored for strategy development and backtesting, Backtrader provides a flexible framework for traders to validate and optimize their trading ideas using historical data;

- PyAlgoTrade: A robust library for event-driven algorithmic trading, enabling traders to react to market events and signals in real-time, automating trade execution;

- Zipline: Ideal for research and live trading, Zipline facilitates rapid strategy prototyping, testing, and deployment in live trading environments.

Machine Learning for Algorithmic Trading

Traditionally, traders relied on predefined rules and technical indicators. However, with machine learning, trading systems can learn from vast amounts of data and adapt, essentially learning from the market itself.

This adaptability enhances decision-making processes, enabling strategies to evolve and stay relevant in dynamic market conditions.

We’ll introduce you to key algorithms that are integral to algorithmic trading:

Predicting numerical values based on historical data, fundamental for price forecasting;

Categorizing data into specific groups, critical in market sentiment analysis or asset classification;

Grouping similar data points together, aiding in identifying market segments or behavioral patterns;

Analyzing time-ordered data, essential for understanding and predicting price movements.

Each of these algorithms plays a unique role in extracting valuable insights from the abundance of historical data available, enabling traders to make informed decisions.

Case Study: Predictive Modeling for Forex Trading

Background

A seasoned forex trader aimed to enhance their trading performance by integrating machine learning into their strategy: they wanted to predict short-term price movements for currency pairs accurately.

Solution

The trader collaborated with data scientists to create a predictive model using historical forex data. The model employed machine learning algorithms to identify patterns and trends, generating predictions for future price movements.

Outcome

The predictive model significantly improved trading outcomes. By leveraging the predictions, the trader executed trades with higher confidence and accuracy, resulting in consistent profits over a sustained period. This case illustrated the potential of machine learning in forecasting and enhancing trading decisions in the forex market.

Risk Management and Algorithmic Trading

Algorithmic trading, despite its automated nature, necessitates diligent risk management practices to mitigate potential losses and safeguard capital.

Risk management serves as the backbone of algorithmic trading strategies. It involves a set of processes to identify, assess, and prioritize risks, followed by the implementation of strategies to monitor and control these risks effectively.

Implementing stop-loss orders is a common risk management technique. These predefined exit points help limit losses by automatically closing a trade when a certain loss threshold is reached.

Position sizing is equally crucial—it involves determining the appropriate amount of capital to allocate to each trade based on risk tolerance and overall portfolio objectives.

Overfitting, a common challenge in algorithmic trading, occurs when a trading model is excessively complex and fits precisely to historical data but fails to perform well in real-time trading. Data snooping bias refers to the overemphasis on historical data that worked well in the past but might not work in the future.

Regulatory and Ethical Considerations

Algorithmic trading operates within a well-defined regulatory framework. Depending on the region, financial markets are subject to oversight by regulatory bodies. Compliance with regulations ensures fair and transparent trading, providing protection to market participants and maintaining market integrity.

Ethical considerations are central to algorithmic trading, particularly in the realm of high-frequency trading (HFT). Ethical conduct encompasses fair practices, market transparency, and responsible use of technology. In the high-speed world of HFT, ethical considerations guide the use of technology to prevent market abuse, manipulation, and unfair advantages.

Compliance with regulations and adherence to best practices are non-negotiable in algorithmic trading. Firms and individuals engaged in algorithmic trading must stay updated with the evolving regulatory landscape, ensuring they align their operations with the stipulated guidelines. Best practices encompass transparency, fairness, data protection, and a commitment to responsible trading.

The Future of Algorithmic Trading

The trajectory of algorithmic trading is a fascinating journey into the future. In this section, we’ll delve into the crystal ball, examining the potential shifts and technologies that are set to redefine this dynamic field.

From quantum computing to decentralized finance (DeFi), emerging technologies are poised to disrupt the traditional fabric of algorithmic trading. Quantum computing holds the promise of solving complex problems at an unparalleled speed, potentially optimizing trading strategies and risk management.

Artificial intelligence (AI) and deep learning are propelling algorithmic trading into a new era. Predictive analytics, natural language processing (NLP), and reinforcement learning are advancing trading strategies. These technologies can analyze vast amounts of data, adapt to changing market conditions, and optimize trading decisions in real-time.

The realm of cryptocurrencies is witnessing exponential growth and innovation. Algorithmic trading in cryptocurrencies is gaining traction, presenting a playground of possibilities. The inherent volatility and liquidity of crypto markets make them an enticing domain for algorithmic traders.

Conclusion

We’ve covered the basics, explored various strategies, delved into software and programming, and peered into the exciting intersection of machine learning and trading. Now, armed with knowledge and insights, it’s time to take that step into the world of algorithmic trading.

Continuous learning, staying engaged with the community, and persistently honing your skills will be your allies on this journey. Algorithmic trading is a dynamic and evolving field — embrace it with enthusiasm, and let your trading endeavors be marked by success and innovation.

Frequently Asked Questions (FAQs)

What skills do I need to start with algorithmic trading?

While a background in finance, economics, or computer science can be beneficial, it’s not mandatory. To start with algorithmic trading, you’ll need a strong grasp of financial markets, trading strategies, and programming languages like Python.

Can I do algorithmic trading as a part-time endeavor?

Yes, many individuals engage in algorithmic trading as a part-time activity. With the right knowledge, tools, and strategies, you can create and automate trading systems that operate even when you’re not actively managing them. It’s essential to dedicate time to strategy development, backtesting, and ongoing monitoring.

How much capital do I need to start algorithmic trading?

The amount of capital needed for algorithmic trading varies based on your trading strategy, risk tolerance, and targeted returns. Some strategies can be applied with a relatively small capital, while others may require a more substantial investment. It’s advisable to start with an amount you can afford to lose while learning and refining your strategies.

Is algorithmic trading more profitable than traditional manual trading?

Profitability in algorithmic trading depends on various factors, including the effectiveness of your strategies, risk management, market conditions, and the ability to adapt to changing landscapes. Algorithmic trading offers the advantage of speed, automation, and discipline, which can enhance profitability. However, success ultimately depends on the skill and knowledge of the trader.

Can I trade cryptocurrencies using algorithmic trading?

Yes, algorithmic trading is widely used in cryptocurrency markets. Cryptocurrencies, known for their high volatility, present ample opportunities for algorithmic traders. Popular cryptocurrencies like Bitcoin and Ethereum are actively traded using automated strategies. However, it’s essential to consider the unique characteristics and risks associated with the cryptocurrency market.

How do I deal with system failures or technical glitches during live trading?

System failures or glitches can happen, and it’s vital to have contingency plans in place. Implement fail-safes like redundancy in data feeds, backup systems, and failover mechanisms to ensure uninterrupted trading. Additionally, have clear protocols for handling technical issues and know how to quickly revert to manual trading if needed.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More