This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Social trading is a particular feature of some modern online brokers that try to focus more on people and provide less stressful trading and investing experiences to their customers.

It mixes trading and investing with social media features, allowing traders and investors to be part of a community of people with similar interests.

Via social trading people can follow each other, share analysis, information and thoughts. There are also subcategories of social trading, like copy trading.

In this article, we will cover the best social trading platforms available in 2024: we will take into account key factors like availability of financial instruments and variety of trading platforms, regulatory compliance, costs associated with trading and investing.

In this list you will find the top social trading platforms available in 2024. Don’t worry, this is just a tease: you’ll find all the information you need to know about each broker throughout the article!

- eToro – Overall Best Social Trading Platform

- NAGA – Best for Flexibility

- Avatrade – Best for Low Cost Crypto Trading

- ZuluTrade – Best for Account Protection

- Pepperstone – Best for Forex Trading

1. eToro – Best Overall

eToro is a pioneer in the field of social and copy trading.

It allows traders to follow each other, easily create a community, use specific copy trading features – like copying single portfolios.

Each trader, even if not part of the copy trading program, can share thoughts and news. To be a part of the popular investors program, traders need to go through a strict selection set up by the broker – so traders who use the copy trading feature can rely on the fact that the traders and investors they copy have being selected accurately.

eToro keeps costs low, charging no commissions on most of its products. Its main stream of compensation relies on market spreads.

Along with the social and copy trading features, eToro offers a wide variety of financial instruments and CFDs across several asset classes – traders can directly have access to shares by setting no leverage.

The minimum deposit needed is $10, which is quite inclusive and allows a larger audience to get access to financial markets.

eToro also has its proprietary payment method – eToro Money – as well as a club with different tiers and perks.

Its trading platform – available both online as a web application and as a mobile application – is among the most intuitive currently available.

- Low costs

- Low minimum deposit

- Extensive educational resources

- The broker charges withdrawal fees

- eToro applies inactivity fees

- Analytical tools might seem too basic for advanced traders

2. NAGA – Best for Flexibility

For what concerns the social trading features of the broker, they can fit the needs of traders who are looking for reliable ways to interact with other community members and get additional information and strategies.

NAGA Autocopy is an intuitive feature that allows traders to find the portfolio that better suits their needs and goals – thanks to the leader dashboard – and copy it, but they choose the budget they want to allocate. This is an important point for traders who want to benefit from this feature, since they don’t have strict requirements to use copy trading.

NAGA offers over 1000 financial instruments to trade. Crypto CFDs can be traded 24/7 – which is not something very usual among online brokers.

Also the leverage offered is unusual: NAGA offers up to 1000:1 – something that can be risky for beginners, but that can suit the needs of more advanced traders.

There are different asset classes available – namely ETFs, commodities, stocks, indices and cryptocurrencies.

NAGA offers a demo account and several payment methods for deposits and withdrawals – including electronic payment methods that allow instant transactions.

The broker also offers extensive educational and analytical resources, as well as a comprehensive news feed.

- Multi currency accounts available

- Real time execution of trades

- Several payment methods

- High minimum deposit required ($250)

- The high levels of leverage offered might be too risky for beginners

- It might not be the most competitive broker in terms of available tradable assets

3. AVATRADE – Best for Low Cost Crypto Trading

AvaTrade provides social trading features thanks to its proprietary platform, AvaSocial.

The application has all teh features of a social media – people can join real-time chats, follow each other, get additional news, ideas and strategies.

The application – available for Android and iOs – is designed accurately – precisely to resemble a social media and make it as intuitive as possible – but of course, the copy trading platform involves the possibility to copy experienced and professional traders.

Copy traders can also take into account the reputation and flexibility of the broker.

AvaTrade is among the award-winning online brokers that managed to gain the trust of customers over time: it won prizes like the Most Trusted Broker, Hot Brand of the Year, Most Trusted Trading Platform EU, Best Overall Broker, Best Online Broker, Most Innovative CFD Broker UK.

It is regulated by top international regulators – for instance, regulators of Ireland, Japan, by the ASIC.

AvaTrade offers instruments across several asset classes – to be more specific, forex markets, bond, options, ETFs, commodities, indices, stocks, and cryptocurrencies. For what concerns cryptocurrencies, it lists both digital assets and crypto indices (something not very common among online brokers).

The broker offers tight spreads – which are also its main form of compensation – and low to no commissions on most products – especially cryptocurrencies.

The broker offers different trading platforms – including the proprietary platforms AvaOptions and AvaTradeGO, along with MT4 and MT5.

The broker also offers extensive educational resources – including eBooks.

- Low to no commissions

- No commission on crypto trading

- The broker is regulated worldwide

- High inactivity fees – at $50

- Possible administration fees

- High minimum deposit ($100)

4. ZuluTrade – Best for Account Protection

The copy trading feature offered by ZuluTrade is intuitive, to fit also the needs of beginners – who are usually more prone to use copy trading.

The broker provides a leader dashboard: here, users can find top traders and investors who use the broker and whose portfolios can be copied.

Similarly to eToro, ZuluTrade specifies the level of risk associated with each portfolio, along with more specific infomration about the type of investments and trades made by the top trader.

This allows anyone to copy other traders not only for their results, but also for the budgets, levels of risk they can afford and financial goals.

This is for sure a useful way to make informed decisions and use realistic strategies.

The intuitiveness of this broker doesn’t negatively affect the quality of the services it provides.

ZuluTrade offers several trading and investing financial instruments across different asset classes – forex, stocks, crypto CFDs, indices and commodities.

The broker offers an intuitive trading platform, a simulator, economic calendars, and educational resources.

Its outstanding tool is ZuluGuard. This innovative protection tool allows traders to set a specific level of risk and a capital protection amount. If a trade deviates from these levels, it is automatically closed to protect the capital of traders.

- Proprietary capital protection tool – ZuluGuard

- Intuitive design

- Educational resources available

- Paid plan

- Advanced tools and lower costs are available only to subscribers

- It is not the most competitive broker in terms of tradable assets

5. Pepperstone – Best for Forex Trading

The copy trading feature of the broker allows traders to copy the strategies, investments and trades of professional traders.

To provide this type of service, Pepperstone mainly relies on third-parties copy trading patforms and marketplace.

An example is DupliTrade, the popular automated social trading platform: users can open an account through Pepperstone and integrate all its social trading features with Peppertsone’s MT4 platform.

Myfxbook – as the name suggests, this social trading platform focuses on forex – is another tool that can be integrated with Pepperstone accounts: users can get real-time data and statistics, and copy successful trading system used by top traders.

Social trading and copy trading are not the only advantages linked to the broker.

Pepperstone is a well established and popular online broker that offers a wide variety of financial instruments and types of accounts.

Users can choose among forex markets, commodities, indices, currency indices, cryptocurrencies, shares derivatives, and ETFs.

Pepperstone offers a forex account and a CFD account – subject to different costs.

Forex accounts can use up to 1:500 leverage, and start trading with minimum trading sizes – starting from 0.01 lot size. More complex strategies, like scalping, and risk management strategies, like hedging, are allowed.

CFD accounts offer over 1200 tradable assets, starting from 0 commissions and 0 pips.

For these accounts, the highest leverage level is 1:30.

The broker offers extensive educational resources and news feed, has a TradingView integration, and uses popular trading platforms like MT4, MT5 and cTrader.

- Low costs

- Several types of accounts available

- Popular trading platforms available

- Pepperstone doesn’t have a proprietary trading platform

- Most advanced tools require higher commissions if compared to standard accounts

- It is not among the most competitive brokers in terms of number of tradable assets

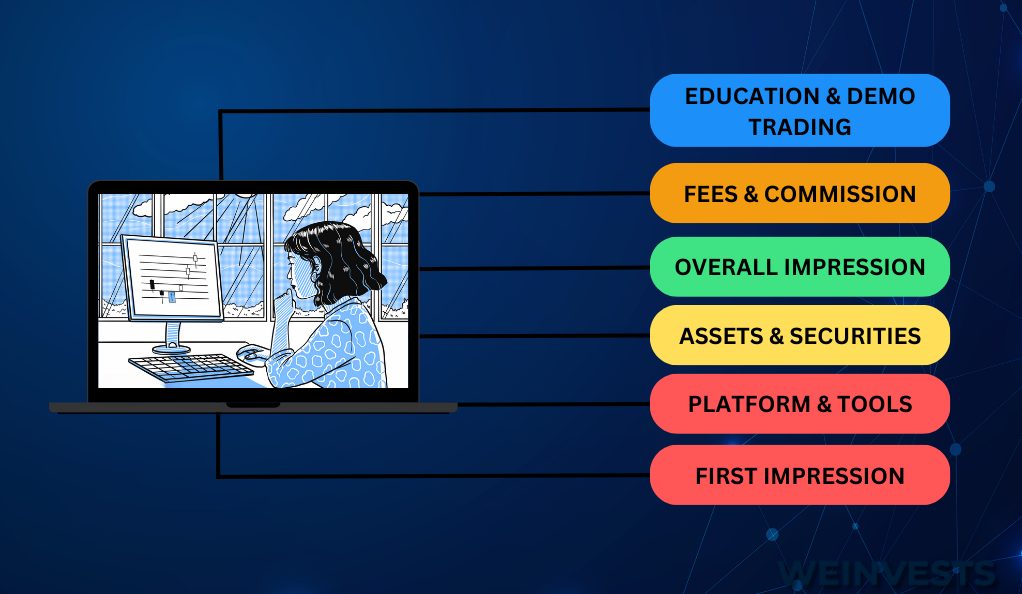

How we test our brokers

The current brokerage market is crowded with online brokers that include different characteristics, tend to focus on customers, intuitiveness, transaction speed and variety of trading platforms and financial instruments.

That’s why it can be hard to choose a broker. In this case, we focused on top social trading platforms, but before preparing our list, we answered some questions to filter brokers. These are the key elements we took into account:

- Regulatory compliance,

- Variety of tradable symbols offered,

- Costs involved in trades and maintenance commissions and fees,

- Intuitiveness of trading platforms.

All these elements are pivotal because they significantly impact the activity of traders and investors:

- A regulated broker offer a strong level of security and guarantees the respect of quality standards, protection of data and capitals;

- The higher the amount of tradable assets, the higher the number of opportunities traders and investors have to diversify their portfolios and manage risk;

- High commissions and fees negatively impact the capitals of traders and investors – who want to use their funds for their trading and investing activities;

- High levels of intuitiveness and good design allow faster decisions – an element that is pivotal in trading.

All these elements led us to prepare the list of the top 5 social trading platforms we analyzed throughout this article.

What is Social Trading?

Social trading is a form of online trading that mixes the features of online brokers and social media.

When trading platforms include social trading they allow traders and investors to connect with other people with similar interests, tìknow what their thoughts are about the markets, and get additional information and insights.

Social trading is a good way to get a more extensive knowledge about trading, investing and markets. Especially beginners can learn more from experienced and professional traders, and this usually doesn’t involve any additional cost for the final user.

How is Social Trading different from Traditional Trading?

Traders and investors who don’t use any social trading features tend to trade fully autonomously – or to use services that guarantee professional advice.

This might lead traders and investors to have more stressful experiences, since they need to develop strategies and plan their activities.

On one hand, this allows traders and investors to enhance their skills autonomously, but on the other hand, it is harder for them to connect with other traders and investors and get additional information and educational resources.

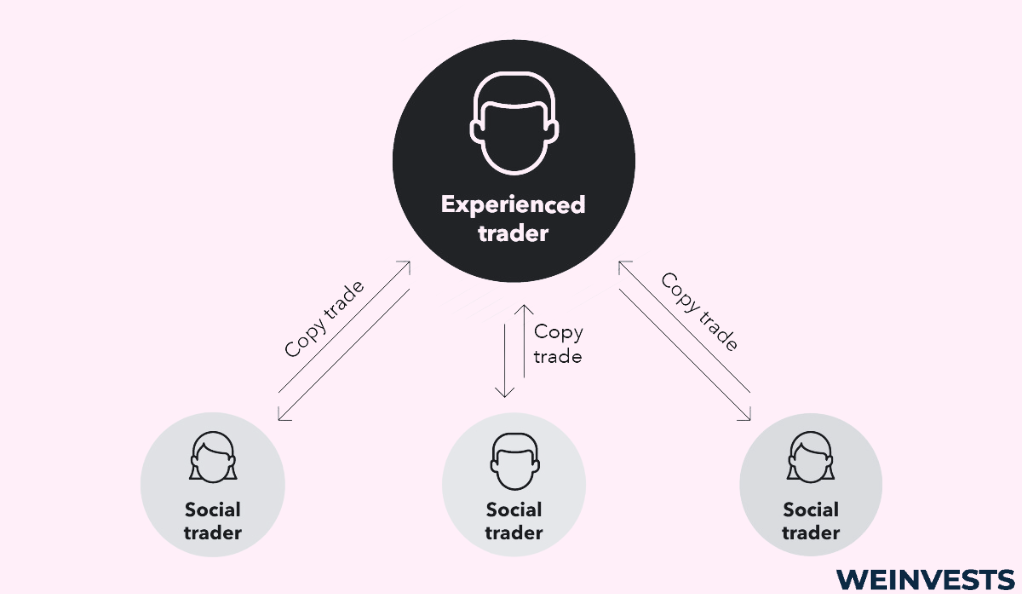

How is Social Trading different from Copy Trading?

Copy Trading can be considered as a subcategory of social trading.

With pure social trading, investors and traders can connect with other people and get additional insights, but they still have to take action autonomously.

On the contrary, copy trading allows traders and investors to automatically copy the trades of a trader they appreciate because of results. This means that beginners can also benefit from the experience of professionals.

Pros & Cons of Social Trading

Social trading has both advantages and disadvantages traders should be aware of.

- Social traders can learn from other traders

- Access to a wider range of information

- Beginners might reduce risk by following more experienced and professional traders

- Copy trading is not always secure: even if traders, also beginners, can have access to pro strategies and information, there is no infallible strategy

- Even if social traders have access to more information, this doesn’t mean that all information is reliable or released by reliable sources or companies

- Traders who use social trading might not be motivated enough to do their own research and enhance their trading skills

What social trading brokers charge the lowest fees?

Fees are an important aspect for any trader and investors. High fees can significantly impact their budgets and not allow them to allocate the amount of capitals they planned to invest or trade. Let’s see what are the costs charged by the brokers we listed.

- eToro – this broker charges 0% commissions and fees on most of its products – its source of revenue mainly relies on market spreads. Users should also take into account overnight and inactivity fees.

- NAGA – this broker keeps costs as low as possible, and charges commissions on most products – set at around 0.2% of the transactions – and overnight fees – that might considerably increase during weekends.

- AvaTrade – this broker tends to charge no fees – for instance, for what concerns derivatives and cryptos – and spreads are tight.

- ZuluTrade – lower costs are available only to paid subscribers.

- Pepperstone – standard accounts trade starting from 0 commissions and pips.

Summary

Social trading is a feature of some modern online brokers that mixes brokerage services and the most interesting features of social media.

Social media trading usually without any additional cost. Traders and investors who use this type of trading can enjoy a less stressful experience, get additional insights, ideas and educational resources, and connect with other traders and investors.

In this article, we covered the top social trading platforms currently available, but it’s up to users to choose according to their needs and goals.

FAQ

What are the advantages of using a social trading platform?

The advantages of using social trading platforms mainly involve the amount of information traders and investors can gather.

While connecting with other traders and investors, social traders cna get additional insights, ideas, and learn new strategies.

In the meantime, social traders can get feedback on their own ideas.

What are the risks of using a social trading platform?

Copy and social trading are risky activities. First off, not all traders and investors are reliable enough to share valuable information or insights, and it is always important for you to do your own research. Moreover, traders and investors who use social trading might not be motivated enough to autonomously enhance their skills.

What are some of the most popular social trading platforms?

After testing brokers – we filtered those currently available by considering key elements like fees and commissions, regulatory compliance, variety of tradable assets and intuitiveness of platforms – we listed eToro, NAGA, AvaTrade, ZuluTrade and Pepperstone, which are both valuable and popular online brokers that include social trading.

How do I choose the right social trading platform for me?

The most important aspect is to choose according to your financial plans and goals, and your risk tolerance.

But there are some key elements that should be considered before choosing any broker – namely costs, regulatory compliance, availability of tradable assets and intuitiveness of trading platforms.

What are the future trends in social trading?

Social media trading might continue to thrive, especially because it allows traders and investors to enjoy less stressful experiences, and get more information and insights than those provided by online brokers.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More