This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Choosing the right CFD broker is an important decision for any investor. Not only do you need to make sure that your broker meets your trading needs, but also that they are reliable and trustworthy. It’s essential to compare different brokers and their services before making a decision, as this will ensure that you get the best value for your money. Without further ado, let us look at some of the best CFD brokers for 2024.

Table of Contents

- Top CFD Trading Platforms 2024

- 1. eToro – Overall Best CFD Trading Platform

- 2. Avatrade – CFD Broker with Free Deposits and Withdrawal Options

- 3. Markets.com – Best CFD Trading Platform Offering Educational Content

- 4. IG Group – Best CFD Web Trader Experience

- How we test our brokers

- What is CFD Trading?

- How are CFDs different from stocks?

- How are CFDs different from crypto?

- Pros & Cons of CFD Trading

- What CFD brokers charge the lowest fees?

- Best CFD Brokers Summary

- CFD Brokers FAQ

Top CFD Trading Platforms 2024

For those looking to get started with Contracts for Difference (CFD) trading, there is a wide range of platforms available to choose from. To help you find the right CFD trading platform for your needs, here is a list of our top-rated CFD providers, along with a review of each one.

- eToro – Overall Best CFD Trading Platform

- Avatrade – CFD Broker with Free Deposits and Withdrawal Options

- Markets.com – Best CFD Trading Platform Offering Educational Content

- IG Group – Best CFD Web Trader Experience

1. eToro – Overall Best CFD Trading Platform

eToro is often recognized as one of the leading brokers for CFD trading, offering a range of features that make it a preferred choice for many traders. One of the key strengths of eToro lies in its user-friendly platform. It’s designed to cater to both beginners and experienced traders, with an intuitive interface that simplifies the process of trading CFDs.

Another advantage is the diversity of assets available. eToro provides access to a wide variety of CFDs, including commodities, stocks, indices, currencies, and cryptocurrencies, allowing traders to diversify their portfolios.

Perhaps one of eToro’s most distinctive features is its social trading functionality. This feature allows users to follow and copy the trades of successful traders, which can be particularly beneficial for beginners looking to learn from more experienced individuals.

Furthermore, eToro is regulated by reputable financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). This adds an extra layer of security and trustworthiness to their operations.

- Intuitive desktop and mobile interfaces

- Platform for copy trading among peers

- Access to CFDs on multiple assets

- Simulation of a full portfolio with $100K in virtual funds

- Single base currency for accounts

- Certain features unavailable to US clients (crypto/FX only)

- Only one type of account available to retail traders

2. Avatrade – CFD Broker with Free Deposits and Withdrawal Options

AvaTrade, a pioneering online broker, has been at the forefront of offering CFD trading, providing individual traders with access to a broad range of markets previously inaccessible. AvaTrade’s unique features and services make it a highly recommended broker for CFD trading.

AvaTrade offers multiple cutting-edge trading platforms, including its award-winning AvaTradeGO app and WebTrader platform. These platforms provide advanced trading features and charts, which work seamlessly on any device. Traders can manage their Metatrader accounts in one app and protect their trades up to one million dollars with AvaProtect, AvaTrade’s built-in risk management feature.

With AvaTrade, traders can choose from over 1,000 instruments to trade, including forex, stocks, commodities, and cryptocurrencies. This wide asset selection provides opportunities for diversification and helps traders find the market most suitable for their trading style and strategies.

AvaTrade stands out for its competitive trading conditions. The only CFD trading costs on AvaTrade platforms are spreads and rollovers; there are no hidden fees or commissions. Furthermore, AvaTrade offers leverage of up to 30:1 on CFD trading, allowing traders to spread their capital and potentially earn magnified profits. However, it’s important to note that leverage can also lead to significant losses if the market moves against your prediction.

- The broker does not charge any deposit or withdrawal fees

- Competitive CFD trading fees

- Quick and straightforward account opening process

- 24/7 customer support available in 14 languages

- Charting tools need to be improved

- High fees for inactive accounts

- Withdrawal processing time can be slow at times

3. Markets.com – Best CFD Trading Platform Offering Educational Content

Markets.com is a popular CFD trading platform that caters to both beginner and experienced traders. It offers a wide range of trading instruments, including stocks, forex, commodities, indices, and cryptocurrencies. These options provide traders with the flexibility to diversify their investment portfolio.

One of the unique features of Markets.com is its advanced technology. The platform uses high-grade charting and unique analytic tools to help traders make informed decisions. Its smart and secure trading platform ensures a seamless and secure trading experience. It also provides access to expert insights and educational resources to help traders enhance their trading skills.

Markets.com also stands out for its user-friendly interface, which makes the trading process hassle-free. It offers 0% commissions, making it an attractive option for those looking to minimize their trading costs. The platform’s deposit and withdrawal services are fast and free, and traders can use multiple options, including credit/debit cards and electronic wallets.

For those who prefer trading on the go, Markets.com offers a mobile trading app that is user-friendly and engaging. The app offers responsive news and analysis, integrated trading view charts, and a swift, clear, and responsive interface. This allows traders to stay updated on market trends and make trades from anywhere at any time.

- Overall, a great platform for beginner-level traders

- Comprehensive tools and resources to help traders manage their portfolios

- Rapid deposit and withdrawal processes, with no additional charges

- Straightforward account opening process for quickly getting started

- Relatively high conversion fees for certain order types

- Lacking specialized accounts for more advanced traders

- In the pursuit of user-friendliness, some essential features are sacrificed

4. IG Group – Best CFD Web Trader Experience

IG Group has consistently been at the forefront of the trading industry, providing a platform that is not only robust but also designed to enhance the trading experience.

The platform’s functionality is one of its key strengths, enabling traders to monitor market trends, manage their portfolios, and make informed decisions based on real-time data. This increases the chances of executing profitable trades and achieving a positive return on investment.

One of the standout features of IG Group’s platform is its web trader. Known for its intuitive interface, the web trader is designed to streamline the trading process by providing easy access to essential tools and information. Traders can view charts, monitor news, and analyze other essential data all within the platform.

The web trader’s real-time market data analysis capabilities are another significant strength. Market movements and trends can change rapidly, and having access to real-time data allows traders to stay up-to-date and adjust their strategies accordingly. This feature can be incredibly beneficial when it comes to making informed decisions and managing risk.

Moreover, the platform’s web-based nature means that traders can access their accounts from any device with an internet connection. This flexibility makes it possible for traders to stay connected to the markets, even when they’re on the go.

- The Web Trader is designed for various levels of trading experience

- Resources are available to assist with education and research

- Competitive non-trading fees for customers

- A rather large array of investment options to choose from

- CFD trading generally has high fees

- No possibility of accessing passive investing products

- Customer service is reportedly slow in responding to inquiries

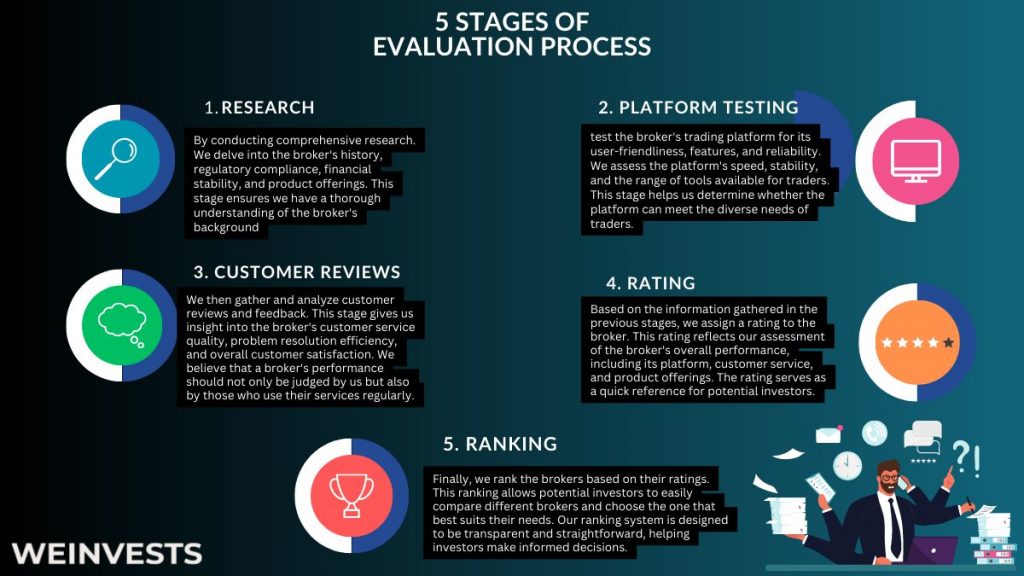

How we test our brokers

At Weinvests.com, we take a thorough and meticulous approach to testing and ranking our brokers. Our process begins with an exhaustive research phase, where we gather detailed information about each broker, including their services, fees, regulatory compliance, and customer support.

We then test the brokers’ platforms ourselves, assessing usability, functionality, and reliability. Next, we consider customer reviews and feedback to gauge user satisfaction.

Finally, we rank the brokers based on these factors, ensuring that only those offering superior service, competitive fees, robust platforms, and excellent customer support make it to our top spots. Our methodology ensures transparency and fairness in our rankings.

What is CFD Trading?

CFD trading, or Contract for Difference trading, is a method of speculating on the price of an underlying asset – such as shares, indices, commodities, cryptocurrencies, forex, and more. It involves a contract between the trader and the broker, where they agree to exchange the difference in the price of an asset from when the position is opened to when it is closed.

The key aspect of CFD trading is that you do not actually own the asset you’re trading in, but rather, you’re trading on the price movements of the asset. This allows for potential profits or losses from both rising and falling markets, depending on whether the trader decides to ‘buy’ or ‘sell.’

One important feature of CFD trading is the use of leverage, which means you only need to deposit a small percentage of the full value of the trade to open a position. This is known as ‘trading on margin.’ While this can magnify profits, it can also amplify losses if the market moves against your position.

However, CFD trading carries a high level of risk due to its use of leverage and the volatility of the financial markets. Therefore, it’s essential for traders to have a thorough understanding of the process and risks involved before engaging in CFD trading.

How are CFDs different from stocks?

CFDs, or Contracts for Difference, and stocks are two different financial instruments. When you buy a stock, you gain ownership of a piece of the company.

With CFDs, you’re not buying the underlying asset; instead, you’re entering into a contract with a broker, speculating on the price movement of the asset. The profit or loss is determined by the difference between the entry and exit prices.

CFDs provide leverage, meaning you can control a large position with a small amount of capital. However, this can magnify both profits and losses. It’s important to understand these differences before trading.

How are CFDs different from crypto?

CFDs and cryptocurrencies are two distinct types of financial instruments. Cryptocurrencies are digital or virtual currencies that use cryptography for security, and they exist as tokens or coins. When you invest in cryptocurrencies, you own the actual tokens.

On the other hand, a CFD is a type of derivative trading where a trader speculates on the price movements of a financial asset, in this case, cryptocurrencies, without owning the underlying asset.

The main difference lies in ownership – with cryptocurrencies, you own the asset, whereas with CFDs, you’re simply betting on price changes.

Pros & Cons of CFD Trading

- Profit from both rising and falling markets

- Low margin requirements, less capital upfront

- Access to global markets

- Generally lower transaction costs

- High risk due to potentially significant losses

- No actual ownership of the asset

- Less regulated, potential transparency issues

What CFD brokers charge the lowest fees?

social trading, user-friendly, and low fees

low fees on forex CFD instruments

cheap commissions across multiple markets

low commission costs on non-crypto CFDs

biggest CFD forex platform with low spreads (starting at 0.1 pips)

Best CFD Brokers Summary

Contracts for Difference (CFD) trading allows traders to speculate on the price of an underlying asset without actually owning it. CFDs provide leverage and profit potential from both rising and falling markets but carry high risks due to their use of leverage and market volatility. Popular brokers include eToro, AvaTrade, Markets.com, and IG Group, with varying fees and services.

CFD Brokers FAQ

What is CFD trading?

CFD trading, or Contract for Difference trading, is a method of speculating on the price of an underlying asset – such as shares, indices, commodities, cryptocurrencies, forex, and more. It involves a contract between the trader and the broker, where they agree to exchange the difference in the price of an asset from when the position is opened to when it is closed.

What are the benefits of CFD trading?

CFD trading provides traders with leverage, meaning they can control a larger position with less capital upfront, and allows for potential profits or losses from both rising and falling markets. However, CFD trading carries a high level of risk due to its use of leverage and the volatility of the financial markets.

How are CFDs different from stocks?

When you buy a stock, you gain ownership of a piece of the company. With CFDs, you’re not buying the underlying asset; instead, you’re entering into a contract with a broker, speculating on the price movement of the asset.

What can I do to reduce the risks associated with CFD trading?

It’s essential for traders to have a thorough understanding of the process and risks involved before engaging in CFD trading. This includes having an effective risk management strategy, such as setting stop losses and taking advantage of tools such as hedging and diversification.

What happens if the market moves against my CFD position?

If the market moves against your position, you could potentially experience significant losses due to the leverage used in CFD trading. It’s important to understand the risks involved before engaging in CFD trading.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More