This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

The world of cryptocurrencies is one that’s growing by the minute. New digital coins are being introduced all the time, each promising something different and exciting for potential users. But with so many different options out there, it can be difficult to know where to begin.

One such option is staking, which is essentially another way of saying ‘earning passive income from your digital currency’.

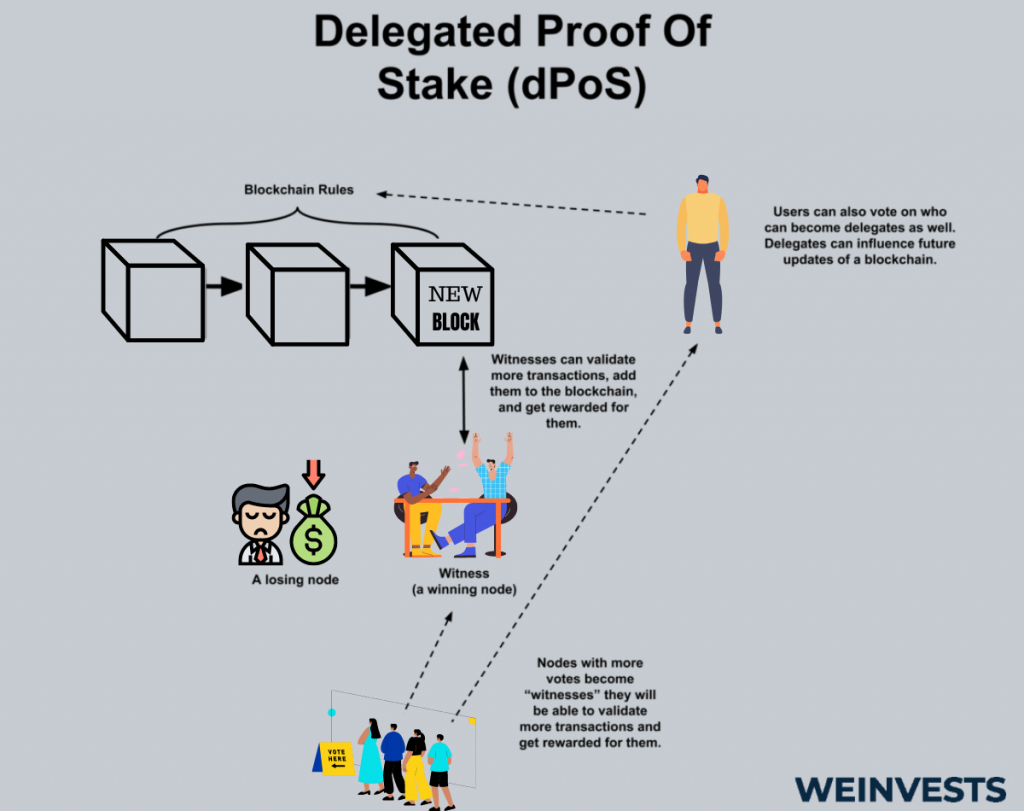

Staking Moonriver (MOVR) is possible because it uses a Delegated Proof of stake (dPoS) consensus mechanism that allows users to earn rewards just for holding MOVR assets.

In this article we will explore what Moonriver staking is and how it works.

Pros and Cons of Staking Moonriver

When you decide to invest in any type of cryptocurrency, you’ll always have to consider the potential pros and cons. Staking Moonriver comes with a few advantages, but also a few disadvantages you’ll need to keep in mind.

Among the advantages of staking Moonriver we can list:

- The opportunity to earn crypto passive income without needing complex technical knowledge.

- MOVR staking is supported by popular crypto wallets like Metamask.

- Staking plays a major role in PoS blockchains, since it helps the network to be more decentralised and secure.

- Staking is a relatively low risky activity if compared to trading.

- Rewards for staking MOVR largely depend on the amount of Moonriver you own – a small budget doesn’t produce high rewards.

- Moonriver staking requires a minimum amount of tokens, set at 5 MOVR.

- Staked MOVR are not directly available for sale – if you want to sell your MOVR, you need to unstake those assets first.

Table of Contents

What is Moonriver Staking?

When it comes to staking cryptocurrency, it is similar to earning returns on your savings in traditional financial markets.

Staking is not always possible in the crypto space: only blockchains with PoS or derived consensus mechanisms allow it.

There is no exception to this rule when it comes to Moonriver. Using the Delegated Proof of Stake function which is a feature of the blockchain underpinning this cryptocurrency, users will be able to earn rewards simply by keeping their assets in their wallets – that is, they will not be selling or trading their MOVR cryptocurrency.

As a result, these users are rewarded because they contribute to avoiding a major threat that could negatively impact distributed and decentralised ledgers – the threat of a network becoming centralised.

By avoiding the network being threatened by a single point of failure – like it happens with traditional, centralised databases – they secure the network. That’s why they earn a certain amount of MOVR staking rewards, an amount affected by the time they hold their currencies and the amount they decide to stake.

Let’s delve deeper into the topic of Mooriver stakes in order to gain a better understanding of it.

How to stake Moonriver?

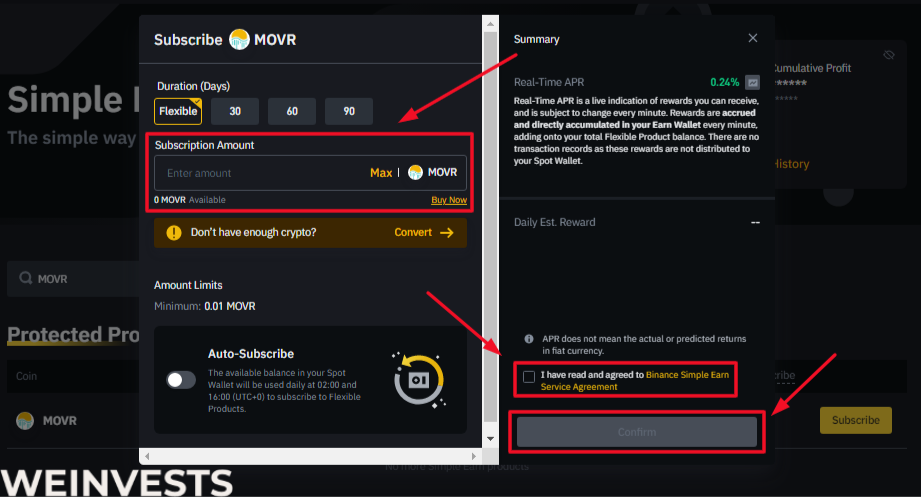

Staking Moonriver (MOVR) using the Simple Earn feature on Binance is a straightforward process that allows you to earn rewards by locking up your tokens. Here is a step-by-step guide on how to do it:

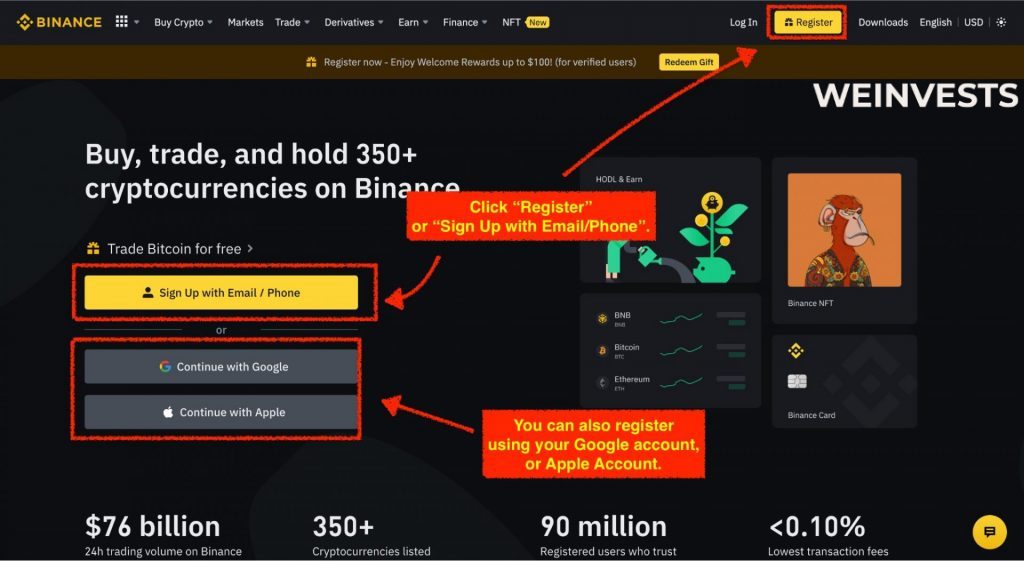

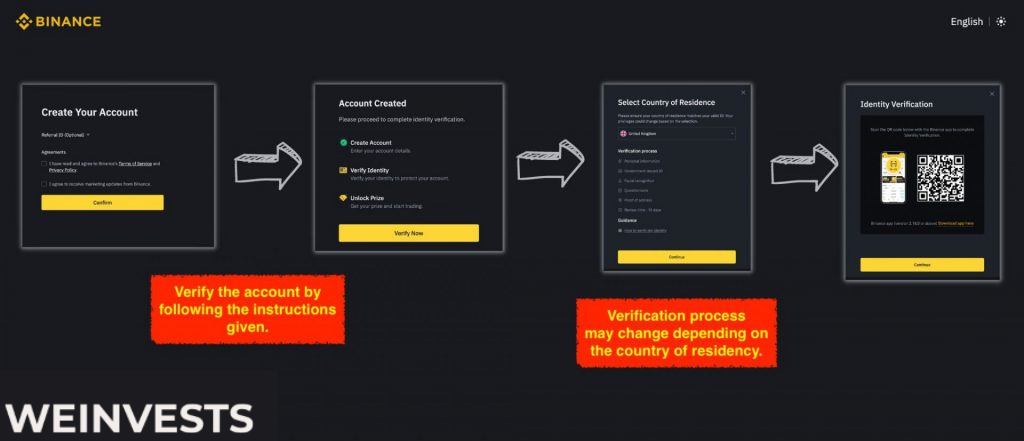

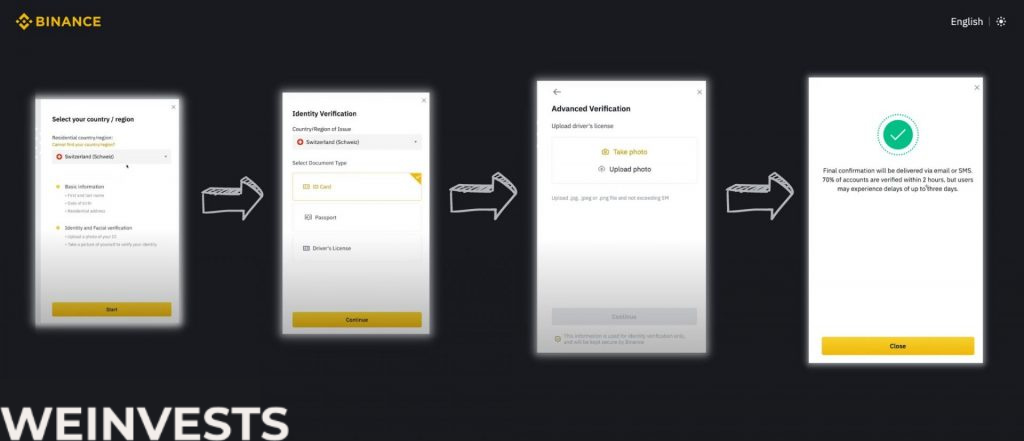

Step 1: Sign Up and Verify your Account

Create a Binance account: If you don’t already have an account on Binance, sign up by visiting the Binance website (www.binance.com) and completing the registration process. You will need to provide an email address and set a strong password. Complete the necessary verification steps to secure your account.

Then go through the verification steps to provide Binance with proof of identity.

Step 2: Fund your Account

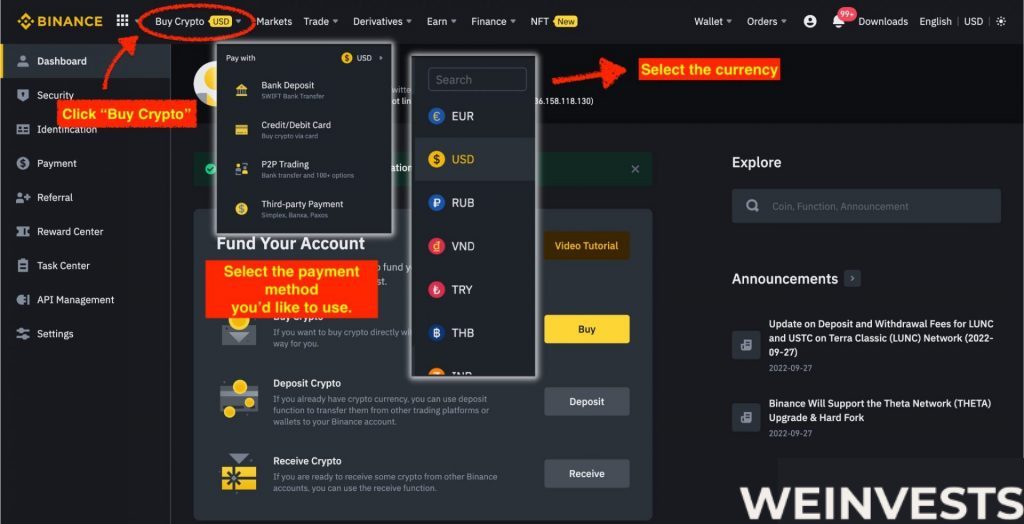

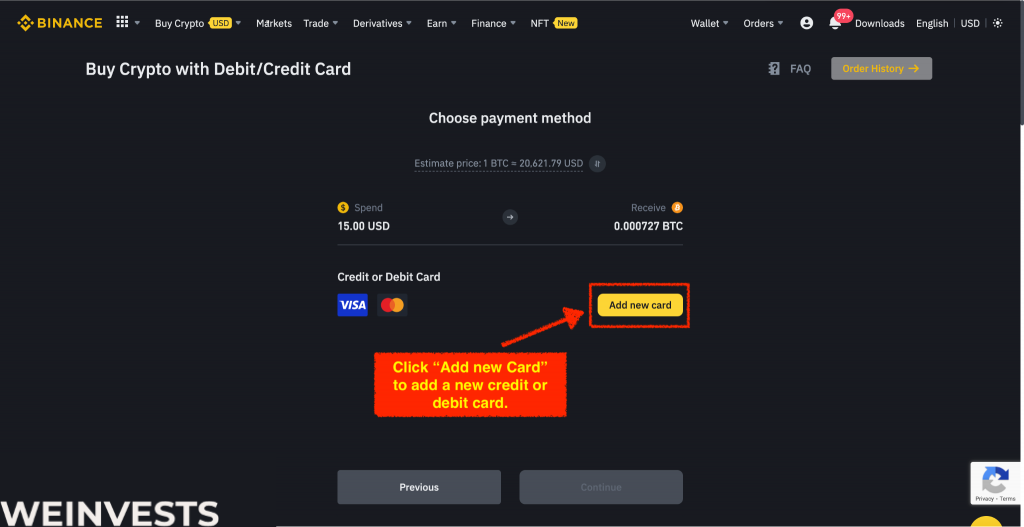

In order to stake MOVR tokens, you will need to have them in your Binance account. If you don’t already own MOVR tokens, you can deposit them from an external wallet or purchase them on Binance using other cryptocurrencies or fiat currency.

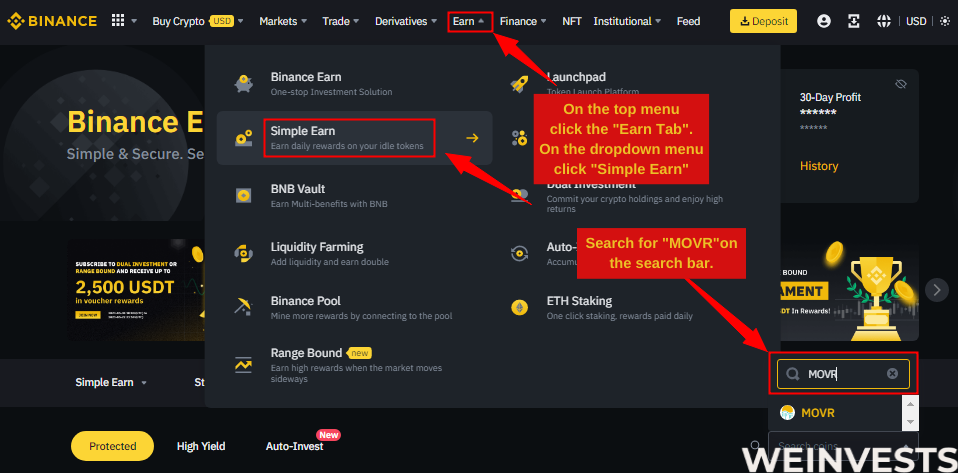

Once logged in, navigate to the ‘Earn’ tab at the top of the page, and click on it to open the Binance Earn section.

In the Binance Earn section, scroll down until you find the ‘Simple Earn’ option. This feature allows you to stake various cryptocurrencies, including MOVR, without the need for any technical knowledge.

Click on the ‘Simple Earn’ option, and a list of supported cryptocurrencies will appear. Locate and select ‘Moonriver (MOVR)’.

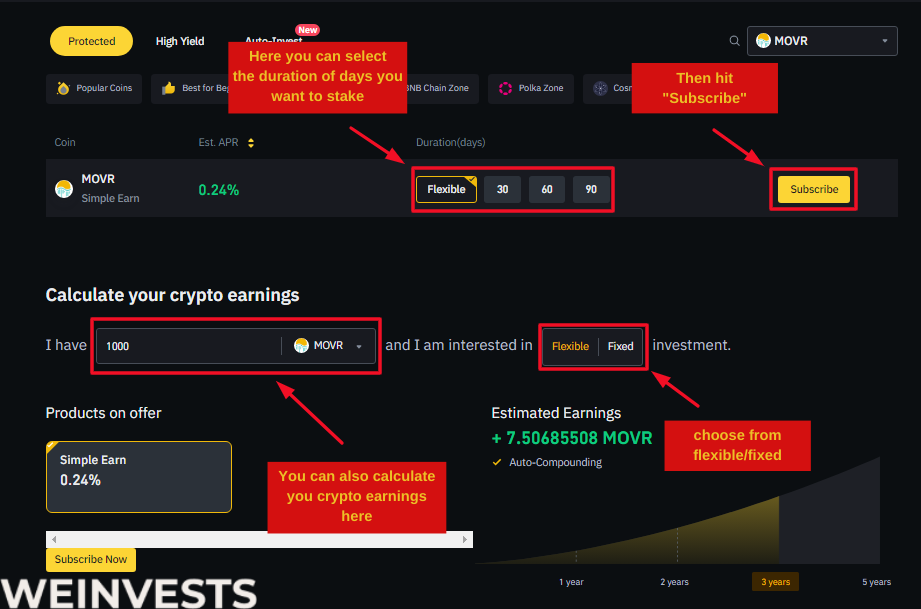

Step 4: Analyze the Staking Parameters and Stake

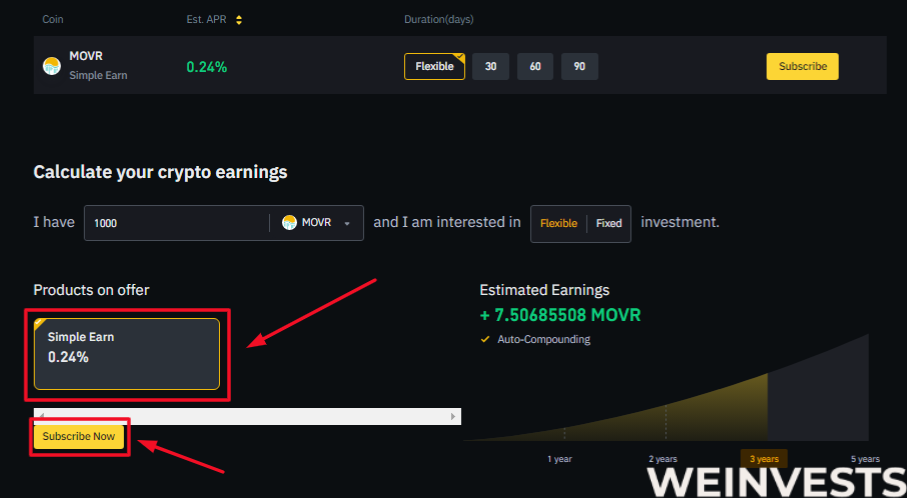

Here, you can analyze MOVR using the ‘Calculate your crypto earnings’ feature. You can input the amount you want to invest and see the projected earnings for 1 year, 2 years, 3 years, or 5 years. Simply click on the desired number of years to invest in ‘MOVR’.

If you want to earn rewards with your MOVR on Binance.com, you can go to the “Products on Offer” section under “Earn” and choose between two options: “Simple Earn” and “Flexible DeFi Staking”.

“Simple Earn” lets you deposit your MOVR in flexible or locked products and earn daily rewards. You can subscribe or redeem at any time, so you can maintain your assets’ flexibility and liquidity. The rewards are sourced from Binance’s own funds and are based on the market conditions.

Moonriver Staking Tax

The taxation of crypto across the globe continues to be a grey area, as you will notice if you take a closer look at the topic.

Some countries choose to take a severe approach towards cryptocurrencies, others still haven’t a clear framework for what concerns crypto taxation, others can be considered more crypto-friendly.

The UK seems to lie somewhere between these approaches, but the taxation in this country tends to follow the majority of governments.

Despite this, many are the doubts of traders and investors when it comes to handling taxes concerning crypto assets.

We should take into account that taxation for blockchain-based tokens and coins is not a totally new framework that adapts to this particular market, but it heavily inherits from taxation rules related to traditional financial assets.

Generally speaking, crypto assets are treated as capital gains or income taxes. As it happens when earning returns on stocks, those returns are taxed also when it comes to cryptos – the only difference is that crypto gains need to be converted to GBP taking into account the exchange rate at the moment when those returns were earned.

This type of taxation works also for Moonriver staking rewards, but there is a subtle exception – what makes the difference is withdrawal.

If you withdraw your earnings, the taxation will work as we’ve just described. If you just hold your tokens, they’re not subject to taxation.

In any case, you should always consult a tax accountant to understand how to deal with crypto assets taxes – also because the crypto space tends to evolve rapidly, as well as the regulatory frameworks that should regulate it.

Why do people like staking Moonriver?

Staking has become more popular among crypto users, and projects like Moonriver attracts many crypto enthusiasts because it solves major issues – like costly and low transactions, sometimes affecting more popular networks – while giving investors easy-to-use solutions.

Moonriver in particular is an exciting project that constantly evolves, and even if it is managed thanks to a complex process, which uses several protocols, it is able to look intuitive for the final user.

Moreover, staking Moonriver is a low risky activity when compared to other activities like trading: it doesn’t require you to have relevant tech skills, but it still allows people to earn streams of crypto passive income seamlessly.

Another important point is that Moonriver has a small total supply – set at 10,553,928 MOVR – and this may favour a price increase over time by protecting the value of the crypto.

Conclusion

Moonriver defines itself as a project that allows Solidity smart contracts on Kusama. In these few words we can find many of the characteristics of the network:

- It benefits from the advantages of different protocols,

- It is fully compatible with Ethereum, giving you the opportunity to use all the tools used to make transactions with Ether and develop smart contracts and dApps.

The process to stake Moonriver is technically complex, working thanks to a delegated proof of stake that requires the participation of collators. But the final user won’t perceive this difficulty and the only difference between staking Moonriver and staking PoS cryptos consists in the fact that you directly have to choose the collator when you stake in a decentralised environment.

As any other project, Moonriver has advantages but also disadvantages – like the minimum amount required for staking – but, in general, people seem to appreciate the staking process for being straightforward and relatively low risk.

Moonriver Staking FAQ’s

How does Moonriver staking work?

Moonriver staking is possible thanks to the so-called delegated proof of stake mechanism. Users who want to stake MOVR need to delegate other network participants – known as collators – who have been proved trustworthy by the whole network.

Despite this, the final staking process doesn’t look very different from the process put in place by other PoS blockchains.

Users still have the opportunity to choose the decentralised or centralised path – in the first case, they’ll just need a compatible crypto wallet to store their assets, in the second case they’ll need to activate an account on a centralised exchange that provides staking services.

The following steps consist of choosing the amount to stake and earning staking rewards.

How are collators selected to stake Moonriver?

Collators with the highest amounts of MOVR staked can enter the pool of available stakers. If you choose to use a centralised exchange you don’t have to follow any particular step to start staking, but if you choose the decentralised path you’ll need to select the collator, among the ones available, thanks to the decentralised app developed by Moonbeam.

Are MOVR staking rewards taxed in the UK?

Yes. They can be considered as capital gains, but private users have also the opportunity to treat them as savings to reduce taxes. If the rewards are not withdrawn they can even avoid taxation, but we suggest consulting a tax accountant if you’re in doubt.

Can you stake Moonriver on Metamask?

Yes. Moonriver is compatible with Ethereum and the tools used by this network – like Metamask.

To use this popular crypto wallet you’ll just need to add the Moonriver network to your wallet – you can do that also by connecting the wallet directly from the official web page of the project.

How do I earn Moonriver staking rewards?

You can earn Moonriver staking rewards by choosing a centralised exchange or thanks to your crypto wallet. In both cases you’ll first need to get some MOVR and select the amount you want to stake to start earning staking rewards.

Is there a minimum amount of Moonriver I need to stake?

Yes. The minimum amount you can stake corresponds to 5 MOVR.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More