This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Since there are so many potential stocks under $3 that people are already looking for, this is a great place to start looking at interesting stocks. However, before you start investing in penny stocks, it’s important to understand the risks involved.

Table of Contents

What are Penny Stocks?

Small-cap stocks are often referred to as penny stocks. Typically, if a company’s market capitalization is less than $300 million, then it’s a penny stock.

A microcap stock is a type of stock that’s typically valued at less than $300 million. On the other hand, a nanocap stock is a type of stock that’s typically valued at less than $50 million. Due to the rise of online trading, interest in small-cap stocks has grown. While these securities are often cheap, they have some significant risks that investors should be aware of.

Penny stocks are typically low-priced and high-risk. However, this type of stock is risky and can lead to losses if you don’t do due diligence.

With that in mind, here are the top 5 picks for the best penny stocks you can choose to buy and invest in 2023.

TOP 5 Penny Stocks – 2023

Bolt Biotherapeutics – (BOLT)

Bolt Biotherapeutics, Inc., is focused on developing immuno-oncology agents. The company is currently in its clinical development stage. These agents are designed to target cancer cells.

The company is developing multiple cancer immunotherapies, including BDC-1001 for the treatment of patients with advanced solid tumors, who are known to be HER2-expressing. It is also developing BDC-2034 for the treatment of pancreatic and non-small cell lung cancers. These programs are designed to repolarize the microenvironment of the tumor by targeting the cell surface receptors of macrophages.

It is developing a program that targets programmed cell death-ligand 1 for patients with non-responsive solid tumors. In July 2015, the company changed its name from Bolt Therapeutics, Inc. to Bolt Biotherapeutics, Inc. The company was incorporated in California.

TRACON Pharmaceuticals – (TCON)

TRACON Pharmaceuticals Inc is focused on developing various cancer immunotherapies through its contract research organization. Through its drug development platform, it is able to partner with other companies to develop innovative cancer therapies. Its product candidates include TRC102, TRC253, and Bispecific Antibodies.

Through its CRO-based product development platform, TRACON is able to advance its pipeline of cancer immunotherapies. It is also able to partner with other companies to develop new cancer therapies.

Currently, the company’s pipeline includes multiple clinical-stage products. Some of these include Envafolimab, which is a single-domain antibody that is being studied in the ENVASARC trial for patients with sarcoma. It is also developing TRC102, a small molecule that is designed to treat lung cancer. In addition, it is developing TJ004309, a CD73 antibody.

The company is also looking for other corporate partnerships that can help it develop its product pipeline. It can provide a solution to companies that are looking to become CRO-independent or have limited commercial capabilities in the US.

Compass Therapeutics – (CMPX)

The clinical-stage company, Compass Therapeutics, Inc., focuses on developing targeted immunotherapies for the treatment of cancer and other diseases. Its lead product candidate is CTX-009, a bispecific antibody that is designed to block vascular growth factor A and Delta-like ligand 4. It is also developing CTX-471, an IgG4 antibody that is designed to stimulate CD137.

The company’s product pipeline includes CTX-8371, which is a bispecific inhibitor of PD-1 and PD-L1. It was founded in 2014 and is located in Boston, Massachusetts.

Through its proprietary discovery engine, the company is able to identify optimal combinations of its product candidates.

Through its platform, known as StitchMabs, the company can quickly translate its knowledge about various immune targets into a variety of targeted bispecifics. It has also generated a pipeline of multiple multi-specific and immuno-targeted therapeutic candidates that can potentially transform the care of patients with cancer and autoimmune diseases.

TELUS International – (TIXT)

TELUS International (Cda) offers digital business services and customer experience. It operates in four regions: Europe, North America, Asia-Pacific, and Central America. It offers various digital experience solutions such as cloud contact center, mobility, and AI and bots. It also provides customer experience solutions that help organizations improve their sales and customer care.

The company provides various IT lifecycle services, such as app development and management, cloud and platform services, system operations, engineering solutions, and IT service desk. It also offers advisory services that include customer experience consulting, digital strategy, workforce management, data and customer analytics, business process transformation, supply chain management, and robotic process automation. Its social media and content moderation capabilities are additionally utilized.

The company serves various industries, such as gaming, communications, and media. It was founded in 2005 and is based in Vancouver, Canada. Its subsidiary, TELUS International (Cda), is a national telecommunications company.

TELUS International (Cda) seems to have a decent ROE. Yet, the fact that the company’s ROE is lower than the industry average of 16% does temper our expectations.

Hyperfine – (HYPR)

Magnetic resonance imaging, monitoring, and imaging systems are offered by Hyperfine, Inc. The company’s products are designed to address the needs of healthcare providers. Its flagship product, the SWOOP portable MR system, is a combination of software and hardware.

The stock’s price history during the 52 weeks following a high or low from its previous high can provide a good indication of its current state and potential future performance. For instance, Hyperfine Inc.’s stock price has dropped -94.52% over the past 52 weeks. However, it has maintained a steady performance, trading between $0.79 and $16.61.

The stock of Hyperfine, Inc., which is focused on the healthcare industry, managed to top a trading volume of around 635056 shares. This represents a higher volume compared to the average daily trading of the company’s stock.

For the year-to-date period, the company’s performance has been negative as it has exhibited a decline of -87.45% in its market share. On a quarterly basis, its revenues have exhibited a negative showing of -38.93%. Its total market value is currently set at $63.42 million.

Related Penny Stocks

How to Invest in Penny Stocks?

To invest in penny stocks it is important to gather as much information as possible and find platforms that can allow traders and investors to buy penny stocks without paying too high fees.

In fact, since penny stocks don’t have high prices, it is important to choose platforms that don’t charge fees that are higher than the price of a stock.

These stocks take their name not only in cases in which the companies that issue them have low market caps, but also in those cases in which higher value stocks were downgraded – the so-called “fallen angels”.

In both cases, it is important to acquire the information needed to carefully evaluate the company that issued them.

To invest in this type of stocks, it is important to understand under which category the company falls.

Moreover, it is important to avoid over-the-counter – OTC – markets.

OTC markets involve stocks that are not listed on major exchanges. As we will see, penny stocks present liquidity-related drawbacks that shouldn’t be worsened by using OTC.

Penny Stocks Drawbacks

When it comes to penny stocks, usually investors don’t find different types of investments like penny stocks derivatives, funds or crowdfunding-based investments.

This occurs because usually penny stocks don’t involve a high number of investors, or prices are so low that a few investors manage to acquire large penny shares.

This implies, of course, liquidity related issues. When a market is not sufficiently liquid – that is, it is not easy to find a counterpart at a fair price when investors open a buy or sell order, prices are more subject to the activity of a few investors.

This causes possible peaks of volatility when it comes to investing in penny shares.

Penny stocks are usually seen as high speculative assets, precisely for this level of volatility. And this implies another possible issue.

Investors should be able to invest in an amount of penny stocks that doesn’t make them acquire too many shares, but enough to open significant positions. In this sense, investing in penny stocks might require more expertise than investing in stocks of large cap companies.

Another risk involved in investing in penny stocks is the possible low amount of information related to the company that issues them.

In fact, this type of stock is sometimes issued by new companies, and it is hard to do a complete technical analysis. For what concerns fundamental analysis of these types of companies, the fact that they can’t produce enough data doesn’t help traders and investors.

Because of the many risks involved, penny stocks are usually considered by experienced traders, and often by traders who prefer short-term trades.

Nevertheless, there are also cases in which penny stocks are issued by companies that stand the test of time.

How to Choose Penny Stocks to Invest In?

Before you invest in any company, it’s important to take the necessary steps to ensure that you are aware of the risks associated with its operations. This includes conducting due diligence on the company through different sources such as the SEC website, online screening services, and brokerage firms.

Despite the risks associated with investing in penny stocks, you can still do so through online brokerages. Some of these firms may restrict the transactions of their customers due to concerns about the potential loss of money. Before you start trading, make sure that you thoroughly understand all of the details of the company.

When it comes to investing in penny stocks, one of the most important factors that you should consider is the fees that you’ll be charged by the broker. If the fees are high, you might be able to lose some of the money that you’ve made from your investments. Some of the best brokers for trading penny stocks are Fidelity or Charles Schwab.

Where to Trade Penny Stocks?

A dedicated online broker like eToro can be very advantageous when it comes to investing in penny stocks. It eliminates the need to search through various platforms and allows investors to get the best possible service. Due to the digital age, it has become harder for investors to choose the right broker.

Step 1: Open an Account

After you’ve filled out the application form, you’ll be able to access your new eToro account. It’s a great way to start investing in the high-performance car stocks of 2023.

Step 2: Upload ID

One of the most important steps that you’ll need to take in order to start working with eToro is to update your ID. This process is carried out to ensure that the company follows the regulations set by Know Your Client (KYC) and Anti Money Laundering (AML). You can also upload various documents such as your passport, bank statement, and utility bill.

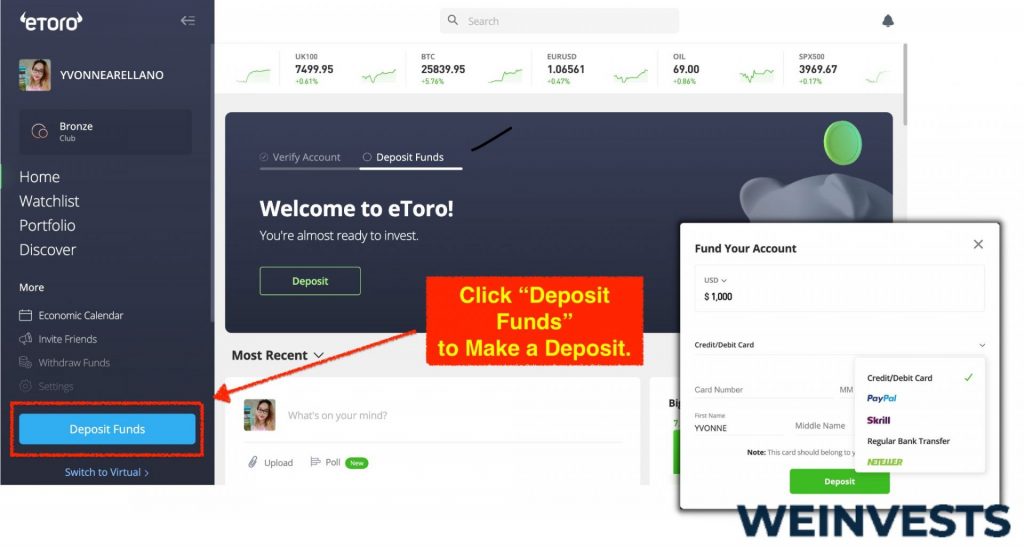

Step 3: Make a Deposit

After you’ve received the necessary documents, you still have to complete one more step in order to deposit the necessary funds into your eToro account. This will involve using a debit or credit card or a wire transfer.

Step 4: Search for Stock

Through eToro’s search feature, you can easily find the most lucrative car stocks to invest in. After you’ve chosen a car stock, you’ll be able to get a trading ticket by clicking on the “trade” button. This feature allows investors to set their own stop-loss and profit prices.

Conclusion

The nature of penny stocks makes them a specific type of investment not suitable for everyone. They can provide solid returns but you need to be able to tolerate risk. Investing in these types of securities doesn’t require a large sum since they are more affordable than the stocks of tech giants like Alphabet and Microsoft, for example.

Investing in penny stocks is one alternative to investing in exchange-traded funds or index funds, which are popular ways for generating steady, long-term returns. Penny stocks, on the other hand, are often attractive to investors due to their low prices. However, they can also lead to significant losses or even double-digit gains. This is because a low price can allow large swings in value.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More