This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Mining stocks are shares of companies that are formed to search, explore, extract, and process commercially viable minerals and ores. These include industrial metals like iron, copper, zinc, lithium, and aluminum. Minerals are used for energy like coal, bitumen, and uranium. Mining companies also extract materials used in construction and fertilizers. Such materials include sand limestone potash and phosphate. The more well-known precious metals like gold, platinum, and silver are mined too.

The mining industry is highly volatile as it depends on the global economy for its success. Since mined ores use depends on industrial use, economic cycles significantly impact the mining industry.

This is why we have curated the most stable, and reliable stocks to invest in during this time.

Table of Contents

What are Mining Stocks?

Mining stocks can be broken into two broad categories. One is major, and the other is junior. as the name implies, majors are companies that have been in the mining business for a long time and have an established history. Such companies usually have long-running mines in different areas of the world. Most of these mines are active. Major mining companies have established protocols for exploring and extracting orders from mines.

In contrast, junior stocks are newly launched companies working in risky or speculative areas for exploration. However, they are popular among more speculative investors because if they strike an active ore line, they can yield huge returns on their stocks. However, we will not recommend any juniors on this list for obvious reasons. They do not make the cut to be listed amongst the top mining stocks.

TOP 5 Mining Stocks

The short-term outlook for the mining sector is cloudy due to the global recession in economic activity that we are experiencing. This, coupled with rising interest rates, high inflation, and a strengthening dollar, creates a high-pressure scenario for commodities. The other aspect to consider is that there is a surge in demand for what we call battery metals, lithium, cobalt, copper, and nickel.

We have selected our five picks based on their mining resources, active mineral lines, and performance. Market sentiment and project solidity are also factors behind the selection.

Barrick Gold Corporation (GOLD)

This is a Toronto, Canada-based company founded in 1983. GOLD is involved in the exploration, development, and extraction of gold and copper products. Barrick owns mines in Canada, the Democratic Republic of Congo, the Dominican Republic, Mali, Tanzania, and the US for extracting gold.

Barrick’s active copper holdings are in Saudi Arabia, Zambia, and Chile. There are other holdings spread throughout the Americas, Africa, and Asia.

What makes Barrick a part of this list is the categorization of its holdings. The company lists its holding according to their production levels, productive life, and ease of extraction (low extraction costs).

Barrick Gold Corporation is amongst the top producers of both gold and copper globally due to its significant holdings of Tier 1 mines.

BHP Group Ltd. (BHP)

The BHP group is the largest mining company in the world, producing copper, iron ore, and coal used specifically in steelmaking. BHP makes it to this list due to its solid and successful market history and a double-digit dividend yield record.

BHP is based in Melbourne, Australia Anne and was founded in 1851. Its core strength is operating as a low-cost copper, iron ore, and coal producer. It is also involved in extracting copper, zinc, silver, uranium, and metallurgical coal. It also has concerns in mining, smelting, and processing nickel and potash development. The company also offers trading, freight, marketing, finance, and administrative services to smaller companies in the segment.

The company has a concerted focus on reducing all the costs associated with extracting and processing earth minerals. Its strategy of running resource-rich mines and customized vehicles helps to reduce its operating expenses and labor overheads. The company frequently sells off low-profit and low-yield mines. This ensures that BHP group will come out of this period of economic recession with its balance sheet strength intact. It is also expected that it is going to continue to pay dividends and carry out stock repurchases.

Rio Tinto Group (RIO)

The Rio group is involved in exploration mining and the extraction of mineral resources globally. It mainly with borates, aluminum, copper, diamonds, lithium, iron ore, and titanium dioxide. The company operates open and underground mines, processing mills, smelting centers, power stations, and research facilities.

The group was founded in 1873 and remains headquartered in London. The company is in this group of top shares because it’s the leading producer of the most demanded industrial metals globally. These are aluminum, copper, and iron ore. The business also makes it its focal point to be a low-cost producer. It does this by running integrated and large-scale operations.

The Rio Group is actively managing its non-core and non-producing mines to ensure its cash is locked up in solid options. The prime example is its exit from the coal mining sector during the reducing outputs from its coal mines as well as concerns about climate change. The group makes it a point to pay 40 to 60% of its earnings in dividends, which makes it popular amongst shareholders.

Cameco Corp. (CCJ)

Cameco Corporation was launched in 1987 and is based in Saskatoon, Canada. The company works through two branches. One is uranium, while the other is fuel services. The uranium segment is concerned with the probing, mining, extraction, processing, and trading concentrated uranium. The fuel services segment is also involved in purifying and formulating concentrated uranium, but it is also focused on trading conversion services. This segment manufactures fuel bundles for nuclear reactors commonly used in energy production.

Cameco Chemical sells its uranium products and offers its fuel services to nuclear utility plants in North and South America, Europe, and Asia. We have added this company to the list because uranium is the fuel that is expected to help do away with the demand for fossil fuels. With climate change, growing concern, and green energy a growing criterion, uranium is gaining importance as an energy substitute. Experts already state that uranium is in scarce supply. This situation means that Cameco is uniquely positioned to gain from the growing need for energy independence from fossil fuels. This is further highlighted after the war in Ukraine and the boycott of Russia, a leading uranium supplier to Europe.

Livent Corporation (LTHM)

Livent Corporation is the youngest company on our list, incorporated in 2018 in Philadelphia,

PA, USA. This company makes and sells lithium compounds mainly used in lithium batteries. Its specialty polymers and chemical synthesis applications are in demand in North America, Europe, the Middle East, Latin America, and the Asia Pacific. Its customized lithium compounds are used in battery-grade lithium hydroxide (a key component of lithium-ion batteries).

The company also manufactures butyllithium, commonly used in polymer production, and specialty lithium compounds, used in non-rechargeable batteries and lightweight materials used in aerospace manufacturing. It is also used in the manufacture of lithium phosphate, pharmaceutically treated lithium carbonate, lithium chloride, and other specialty organics used in manufacturing high-performance lithium compounds.

Lithium is essential in batteries used in commonly personal electronics like cell phones, tablets, smartwatches, and laptops. This means that lithium will be in demand and continue to grow in the long term for the foreseeable future. The company is planning a 10,000 metric ton expansion of lithium carbonate production in its Argentina location by 2024. this is expected to be followed by another 10,000 metric tons by the end of 2024.

How to Invest in Mining Stocks

Besides direct investment in the mining stocks such as purchasing the company shares from the stock exchange, investors can use also other financial instruments such as ETFs and mutual funds as well as bonds when it comes to establishing exposure to the mining industry.

ETFs and Mutual Funds

It is generally accepted amongst the market participants that investment in ETFs and mutual funds comes with lower costs and additional diversification benefits compared to investment in single mining stocks or building your portfolio through investment in several mining company shares. ETFs and mutual funds can be focused on the mining industry solely or can have some exposure as part of their investment strategy.

Bonds

In addition, to the ETFs and mutual funds, investors could also identify corporate bonds – part of the fixed-income investment family, offered by well-established mining companies which can be an additional way of establishing portfolio exposure to the mining industry.

Crowdfunding

Since the technology is disrupting many sectors including mining as well, start-ups that are bringing innovative solutions to the mining industry may offer their company shares in the early stage as part of the crowdfunding campaigns which are used to raise additional capital and financing to be able to grow the firm.

Derivatives

Finally, for more sophisticated investors, there are also derivatives markets and instruments such as futures and options which can be used to create various exposures to the mining industry.

Where to Buy Mining Stocks?

If you are looking to invest in mining stocks, eToro is one of the best options available in the market. As a reputable online broker, eToro offers many options for beginner and professional traders alike. In this mini guide, we will explain how to open an account on eToro and start investing in mining stocks.

Step 1: Open your Personal Account

The first step is to open an account on eToro. To do so, you need to visit the eToro website and click on the “Join Now” button located on the top right corner of the homepage. You will then be redirected to the registration page, where you will be required to enter your personal information such as your name, email address, and password. Once you have filled in all the necessary information, click on the “Create Account” button to proceed.

Step 2: Upload ID

The next step is to upload proof of identity. This is an important step to ensure the security of your account and prevent any fraudulent activities. To do so, you need to log in to your newly created account and click on the “Complete Profile” button. You will then be asked to upload a copy of your ID or passport, as well as a proof of address such as a utility bill or bank statement. Once you have uploaded all the necessary documents, click on the “Submit” button to proceed.

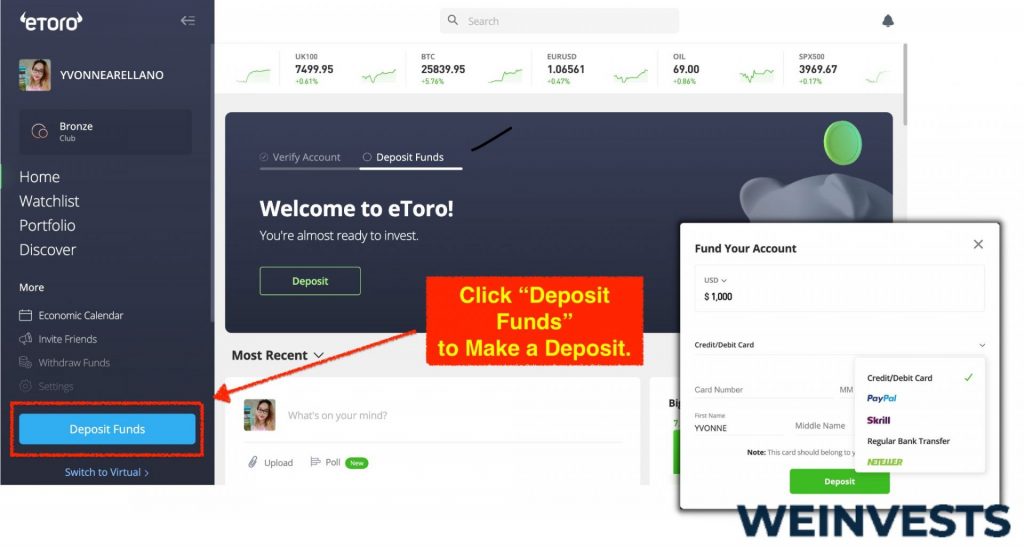

Step 3: Make a Deposit

After your account has been verified, you can fund your account by making a deposit. To do so, log in to your account and click on the “Deposit Funds” button located on the left-hand side menu. You will then be able to choose from various payment methods such as credit card, bank transfer, or e-wallets. Follow the instructions provided to complete the deposit process.

Step 4: Search for Mining Stocks

Once you have funded your account, you can start searching for mining stocks on the eToro platform. To do so, click on the “Trade Markets” button located on the left-hand side menu. You will then be redirected to the Discover page, where you can search for mining stocks by typing “mining stocks” in the search bar. You can then filter the results by using various criteria such as market capitalization, dividend yield, or P/E ratio.

Drawbacks Of Investing In Mining Stocks

One of the largest limitations of the mining shares is the operational risk involved with the mining process. There were several cases where the mining company had significant losses due to issues related to safety, hazards, and incidents in the mining process. Such situations and cases are causing both financial and reputational damage to the mining company and thus negatively impacting the stock prices.

Another drawback is related to commodity price volatility. Since the mining industry is heavily dependent on commodity prices the fluctuations of the prices in the commodity market would lead to volatility in the mining shares prices.

As the environmental social and governance (ESG) topic grows in popularity and gets more scrutiny both from the private and public sectors, mining companies need to watch for this trend given the specific nature of the mining industry since it is known for being emission heavy. If the transition to a more sustainable mining process is not performed in a timely manner the mining companies may receive regulatory fines as well as encounter reputational damage which would then lead to mining share price volatility.

The mining industry is also known for its capital intensity which leads to heavy investment requirements in machinery and equipment in order to be able to establish and maintain the operations. This can lead to dilution of the shares as the companies in the mining industry would need to constantly raise capital either equity or debt in order to invest in the maintenance of the existing technologies as well as bring new technologies to become more efficient and stay up to date with the current market trends and developments.

Conclusion

The mining industry it’s very capital-intensive and severely dependent on the global economy. Mining companies usually expand during economic booms. Since mining is time intensive process, most expansion projects have extended lead times. This can cause problems for mining companies because projects launched during the boom usually go live after the cycle has gone down, affecting project returns.

As an investor, you need to pay attention to the amount of debt on a company’s balance sheet, its production costs, and its earnings over time. The company’s debt level is essential because high debt means that the company will struggle during economic recessions. Low production costs generally suggest that the company will do well during economic slowdowns.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More