This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Barrick Gold Corporation was launched in 1983 and is based in Toronto, Canada. The company primarily engages in exploring and developing mines, extracting gold and copper ores, and trading gold and copper compounds. It owns multiple active gold mines in Canada, Argentina, multiple countries in Africa and the United States of America. It also has exploratory rights in mineral rich locations in Asia, Africa, and North and South America. It has a reputation for being an ethical and sustainability-focused mine operator.

Despite working in a highly volatile sector, Barrick Gold offers its shareholders relatively stable earnings in the form of dividend. Since gold is highly speculated on, and copper demand varies according to industrial use, economic cycles significantly impact the company.

Barrick Gold is amongst the top producers of both gold and copper globally due to its significant holdings of Tier 1 mines. It is the biggest gold miner in the world, and it is known for using progressive and cost-effective mining techniques in its mines. These help it cut operating costs and earn profits due to the cost advantage it creates due to its mining efficiencies.

Table of Contents

- Barrick Gold Corporation Stock Price Prediction 2023

- Historical DATA

- Barrick Gold Corporation Stock in 2022

- Barrick Gold Corporation Stock in 2021

- Barrick Gold Corporation Stock in 2020

- Barrick Gold Corporation Stock in 2019

- Barrick Gold Corporation Stock in 2018

- Barrick Gold Corporation Stock in 2017

- Conclusion

- FAQ

Barrick Gold Corporation Stock Price Prediction 2023

Barrick Gold Share prices have been stressed since November 2022 due to weakening operational efficiencies and weaker recovery compared to the industry. This weakness has carried on to the current year. The February results for Q4 and annual results were also weak, due to which the share is not doing as well as expected. Its internal issues aside, gold is a sector doing well so far. With expectations of a global recession growing, the European and Chinese economies are already slowing down, and the US is also expected to slow down.

This makes gold prices the better option, as bullion is a traditional safe option during an economic recession. This means that bullion stocks like Barrick Gold can be expected to stabilize further, which would also help Barrick’s stock stabilize further.

Overall, the company is a stable performer with strong operational efficiencies and a focus on organic growth. This is expected to help it face further economic challenges.

Historical DATA

Understanding the historical price of a specific stock is crucial for both investors and financial analysts. This data provides a comprehensive overview of a company’s financial performance over time, offering valuable insights into its stability and growth potential.

Historical stock prices are a reflection of a company’s past economic decisions, market conditions, and overall industry trends. They serve as a benchmark for evaluating current stock prices, helping investors make informed decisions about buying, holding, or selling a stock.

Moreover, historical data is a fundamental component in various financial analysis methods. For instance, it’s used in technical analysis to identify price patterns and trends, which can predict future price movements. In fundamental analysis, it’s used to assess a company’s intrinsic value by comparing its current price to past performance.

In essence, the historical price of a stock is a valuable tool that can guide investment strategies, minimize financial risks, and maximize returns. Including this data on your website will not only enhance its informational value but also empower your users to make more informed investment decisions.

Barrick Gold Corporation Stock in 2022

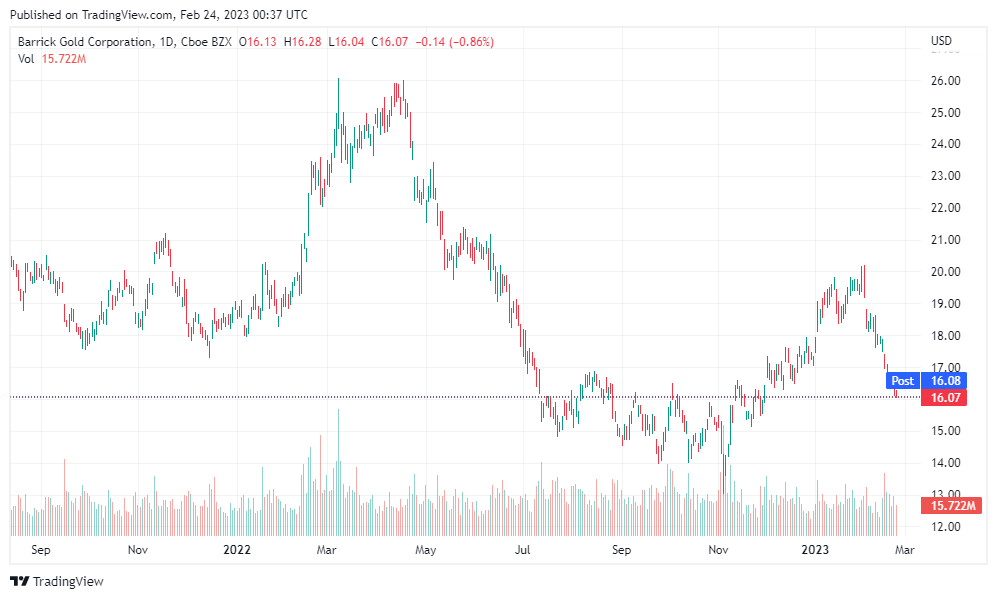

2022 started well, with Barrick Gold delivering on its earnings and dividend estimates and announcing a share buyback before March 2022. All these factors helped to sustain its stock price on an upwards trend up to April.

Q1 reports were positive, and dividends were increased, but prices started on downward trends based on overall sector performance trends. This dip correlates with an overall sector decline due to changing geopolitical situation, which affected energy and commodity prices. The lowest price occurred in November around its Q3 returns amidst strong performance and financial returns. The global tumble in gold and silver prices affected all stocks of gold and silver producers. Due to the Fed’s lowering of prices and interest rate hikes, investors moved towards treasury bills and more liquid investment options, which caused further weaknesses in the bullion stocks.

Barrick Gold Corporation Stock in 2021

This year’s graph shows a lot of volatility, mainly centered around market and share buybacks, as the company did well operationally and either met or exceeded production targets. It also did not deviate from its earnings estimates.

If you look at the graph in detail, the peaks and troughs are centered around earnings and estimated release dates, where most shares usually experience above-average volatility.

The graph also correlates to the general markets. These were also more volatile this year due to repeated lockdowns and supply chain issues in different sectors due to different regions being shut down in different periods.

The last peak price of the year occurred in November, around when the company announced Q3 results, and the entire year seemed ready to close on a strong note.

Barrick Gold Corporation Stock in 2020

The positive trend for 2019 continued into 2020 when the Covid-19 lockdown-induced market crash in March also affected Barrick Gold prices. The prices rose during the market recovery from April onwards and peaked in May when Q1 results helped boost share performance. After a slight recovery in early June, around the Q2 announcement, the stock continued to rise to August 10, when the dividend announcement caused the market to adjust slightly. The year remained strong for the share as its Q3 announcement also showed strong performance. This performance was supported by strong operational and production performance and continued strategic partnerships with governments, other mining businesses, and additional operations becoming live.

The stock rating was also upgraded in October to a BAA1 with a stable outlook. The company solidified this with an increased dividend announcement and a stable outlook forecasted for Q4.

Barrick Gold Corporation Stock in 2019

The rising trend continued through late 2018 and did not continue this year. Prices fell in the build-up to Q4 and annual results in January. Post results, prices recovered as the company released news of shuffling internal and external alliances and operation agreements. The prices also grew due to a strengthening sector as gold prices grew in contrast to oil and gas prices due to the oil crisis.

Prices plunged in May as investors divested post-dividend and Q1. Announcements. The oil factor also played its role as things stabilized in that sector, lowering prices as investors moved away from gold, which is a traditional haven when oil is volatile. July onwards, prices rose as Barrick Gold announced investments and launched new mines. This rise peaked in late august when the company announced dividends for Q2. September onwards, a slight fall in prices was seen as earnings estimated were positive for Q3 and increased dividends sustained prices in the last calendar quarter.

Barrick Gold Corporation Stock in 2018

Mid-January, the company released a preliminary earning forecast where it laid out that the yearly performance may not be as good as expected. This led to a sustained and deep drop in share prices until mid-February, when estimated Q4 and annual reports were released. In April, the company released Q1 results and its plans for sustainable organic growth in its mining projects to ensure they continue offering long-term value to investors. Its investment grading was also upgraded by Moody’s. This positive sentiment led to improving prices up to me of the year.

Improving Q2 figures meant that prices remained somewhat stable for the company throughout June, July, and August. From early September onwards, prices started to fall in anticipation of Q3 results. Investment by existing shareholders as well as improving external factors, led to an overall improved price performance from October onwards, when the share followed a rising trend all through the end of the year.

Barrick Gold Corporation Stock in 2017

2017 started strong for Barrick Gold, with the first peak price of the year occurring in February when Q4 and annual results were announced. Since these were more positive than expected, prices remained buoyant until April. Post-April, as a build-up to Q1 results, prices started to decline, with the lowest point occurring in May when Q1 results were officially announced. Since the forecast performance was not as weak as expected, prices remained upward throughout July, when Q2 results and dividends were announced.

Post-September, when Q3 results were announced to be released in October, prices started to drop. You can see the graph to understand better how steady the drop was. This downward trend continued till the end of the year.

Conclusion

Barrick Gold Corporation is one of the top stocks in the gold and silver extraction group and has some of the major global holdings of gold. The company is known for its strong focus on deliverability and production capability. Most projects have long timelines and paybacks while operating in a capital-intensive industry. With the current global slowdown, the sector is expected to do well primarily due to gold (which is Barrick’s major output).

Economics aside, Barrick is also performing well operationally and seems to have its operations under control. It is known for its strong sustainability focus, which is usually a critical success factor for mining operators.

As an investor, the debt level on a company’s balance sheet, production costs, and earnings over time should be important. Barrick Gold Corporation’s debt level is low, and the company has a cash surplus. This means that even if the economic tough times catch up with its operations, the company is not expected to struggle too much during the economic recession. Its low production costs suggest the company will do well during economic slowdowns.

People already holding the stock should hold on to it for the short-term rise expected by April, when Q1 results are expected. However, keep an eye on gold and copper news and see how things pan out.

FAQ

What is Barrick Gold’s dividend policy?

Barrick Gold’s dividend policy is to pay out 40% to 60% of its free cash flow generated in the previous fiscal year. The company aims to maintain a stable dividend payout to its shareholders, which reflects its commitment to creating long-term value for its investors. However, like all investments, there are risks involved, and dividend payments are not guaranteed.

What is Barrick Gold Corporation’s history?

Barrick Gold Corporation was launched in 1983 and is based in Toronto, Canada. It primarily engages in exploring and developing mines, extracting gold and copper ores, and trading gold and copper compounds. Over the years, the company has grown to become one of the top producers of both gold and copper globally due to its significant holdings of Tier 1 mines.

What are Barrick Gold Corporation’s mining operations?

Barrick Gold Corporation owns multiple active gold mines in Canada, Argentina, multiple countries in Africa, and the United States of America, as well as exploratory rights in mineral-rich locations in Asia, Africa, and North and South America. The company primarily engages in exploring and developing mines, extracting gold and copper ores, and trading gold and copper compounds.

What is Barrick Gold Corporation’s financial performance?

Barrick Gold Corporation’s financial performance is subject to various economic and geopolitical factors that impact the mining industry. The company is a stable performer due to its efficient mining techniques, focus on organic growth, and reputation for ethical and sustainability-focused operations. However, like all investments, there are risks involved, and investors should conduct thorough research before making any investment decisions.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More