This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

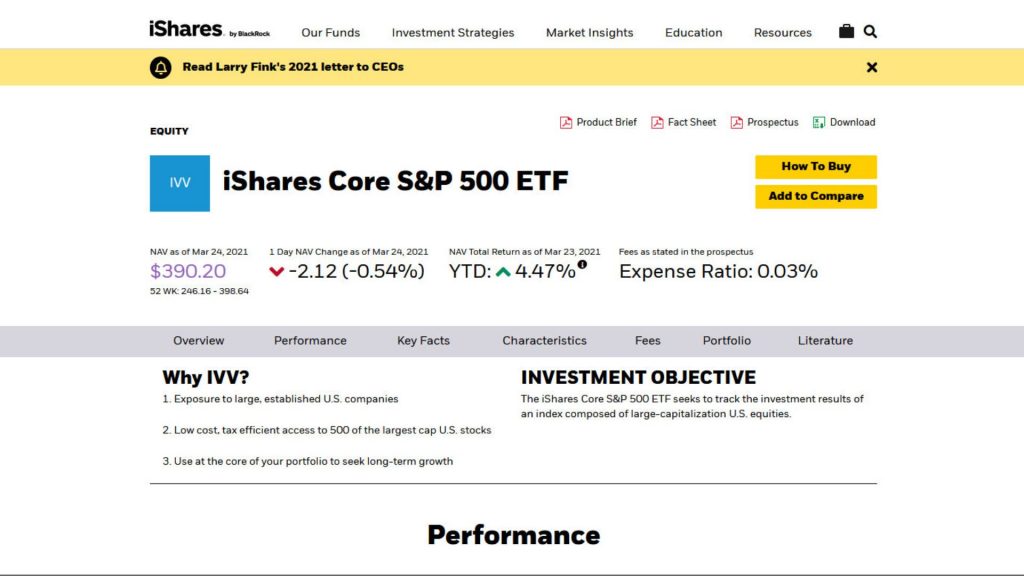

iShares Core S&P500 ETF (IVV) is an exchange-traded fund (ETF) established in May 2000 that is trying to track the performance of the S&P500 index. IVV ETF is owned and managed by Black Rock one of the largest asset managers in the world. The ETF is passively managed which means that it is not trying to actively outperform the benchmark index by betting on market directionality but rather replicating passively the performance of the S&P500. Thanks to that the iShares Core S&P500 ETF has a low expense ratio of around 0.03% which is significantly lower than the market average of 0.2-0.4% per year.

The IVV ETF is a market capitalization-weighted index that is similar to the benchmark index as both try to invest in a similar manner which is investing in the 500 largest market cap companies listed in the US stock market. Hence the main industries that the ETF gives exposure to are technology, finance, and healthcare to name a few.

iShares Core S&P500 ETF currently has more than USD 320 billion assets under management (AUM) which are the money of investors that are invested in the IVV ETF. This makes the IVV ETF relatively large in the industry as investors look for a cheap alternative to gain exposure to the S&P500 index.

The current dividend yield of the IVV ETF is around 1.4. Since some of the companies in the basket do pay dividends, the ETF then distributes the dividend to the investors on a quarterly basis.

Table of Contents

Characteristics, Performance Analysis, and Expectations

The most recent net asset value (NAV) of the fund is around USD 397 per share. Its year-to-date (YTD) performance is closely aligned with that of the S&P500 index and is around +3.8% as the market starts to rebound from the last year’s losses and is on the positive expectations that inflation might start to decline.

If it comes to the performance the IVV still managed to closely track the S&P500 index performance while trying to slightly lower the volatility of the performance by closing the year with a result of -17.2% vs the S&P500 index result of about -20% for the year.

This indicates that iShares Core S&P500 ETF has some power to make directional views to reduce the downside risk as it did in 2022 but still needs to be majorly tracking the performance of the benchmark index. This is particularly due to the fact that the IVV ETF is using a sampling method called stratified sampling or representative sampling which is a technique to replicate the performance of the index while investing in some of the stocks but not all of them. By using this sampling technique the fund is majorly matching the style and sector characteristics of the S&P500 index at same time lowering the costs associated with full replication where you have to purchase each stock that is available in the benchmark index.

Its mandate also states that at least 80% of the assets of the IVV should be invested in the constituents of the S&P500 index whereas the other 20% can be used to invest in other asset classes such as options, future, swaps, or cash and cash equivalents which may further cause deviations from the index performance.

With the above-mentioned in mind, we can expect the fund to perform similarly to the benchmark index in 2023 with lower volatility. Assuming that the market’s expectation of inflation slowing down comes to reality we should also expect to see a somewhat better year in terms of the performance of the overall market compared to the ceteris paribus.

As usual, you will need to check with your banking service provider whether the brokerage account there might enable you to invest in the IVV ETF. At the same time, it is worth comparing with other online brokerages such as eToro which also enables you to invest in the iShares Core S&P500 ETF. This will let you understand what are the best alternatives for you and make a decision based on your preferences.

Another key factor to check before investing in the fund is the industry and company holdings that are currently available in the IVV basket. You can expect to see mostly names that are listed in the S&P500 index but since the mandate of the ETF allows slight deviations it is worth doing a thorough analysis to see if the current allocation is in line with your investment goals. Some of the top companies and their respective weights held by the ETF are mentioned below:

- Apple Inc. – 6%

- Microsoft Corp – 5.3%

- Amazon Com Inc. – 2.5%

- Berkshire Hathaway Inc – 1.7%

- Alphabet Inc – 1.6%

Since the fund is market cap weighted as its index there is no surprise to see famous tech companies being in the top list of the IVV ETF, since those have the largest valuation in the US market at the moment.

In general, the fund is made for passive investors who try to gain efficient access to the market performance with an expectation of long-term capital appreciation rather than short-term growth. It is always worth making your own analysis and research to understand whether the investment is the right fit for you.

Market Risk

Market factors that may negatively affect your investment value are considered to be the market risk that you are exposed to. In the case of the iShares Core S&P500 ETF, your main market risk exposure is the prices of the underlying stock holdings such as Apple, Microsoft, and others.

The price of these stocks may be negatively affected due to several factors such as those related to company-specific news – earnings, annual events, and new product launches to name a few or failure to meet certain expectations. Other external factors may also negatively impact the stock prices and hence the price of the IVV ETF such as the economic crisis, interest rate hikes, or geopolitical events which might cause overall market turbulence.

These are just some of the market risks that the iShares Core S&P500 ETF may be exposed to you will need to perform thorough research to identify what are all associated market factors that may adversely affect your investment value in IVV ETF.

Credit Risk

Usually meant for investments in fixed income and derivative instruments credit risk is associated with the counterparty default risk. It is usually assumed that the credit risk component associated with ETFs and stocks, in general, is relatively low and hence it is usually ignored as a risk for these asset classes.

Nevertheless, since the fund has a mandate that allows a maximum of 20% of its holdings to be invested in derivatives it is worth analyzing the holdings of the IVV ETF before making an investment decision to identify whether the investment might expose you to any credit risk as well.

Liquidity Risk

It is the risk associated with the lack of enough buyers and sellers in the market which makes it harder to sell your holdings and convert those into cash. It is assumed that liquidity risk associated with large-cap stocks and ETFs such as the iShares Core S&P500 ETF is relatively low since these are exchange-traded products with high daily volumes.

For the most recent trading day, IVV had a daily trading volume of more than 6 million shares and a 30-day average daily trading volume of more than 5 million shares. These numbers are large enough to assume that the liquidity risk associated with the IVV ETF is relatively low. Nevertheless, it is worth checking before investing since the numbers might change depending on the market conditions.

Valuation Risk

The risk of the price of the IVV not being valued in line with the actual net assets held by the fund is relatively low as well. During the day the market demand and supply might cause the price to be slightly above or below its actual NAV, however, with the end-of-the-day revaluation the price should mostly be aligned with the NAV on the next day. It is worth making your own due diligence to identify whether the price is in premium or discount to its NAV at the time of making a trading decision.

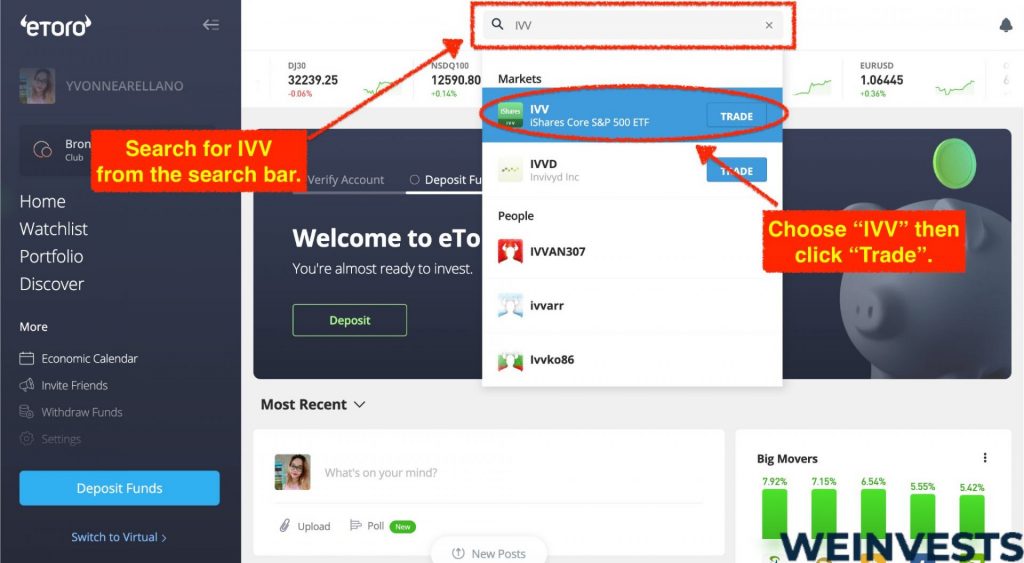

If you are interested in investing in iShares Core S&P 500 ETF (IVV) stocks, eToro is an online brokerage platform that is well-known for its user-friendly interface and excellent reputation among beginner and professional traders.

To open an account on eToro, follow these simple steps:

Step 1: Open your Personal Account

To open an account, go to the eToro homepage and click on the “Start Investing” button. You will be directed to the registration page where you can enter your personal information such as your name, email address, and password. Once you have entered the required information, click on the “Create Account” button to complete the registration process.

Step 2: Upload ID

Once you have created an account, you will need to upload proof of identity to verify your account. This can be done by uploading a copy of your ID or passport. To do this, click on the “Complete Profile” button on the dashboard and follow the prompts to upload your ID or passport.

Step 3: Make a Deposit

To start trading on eToro, you will need to fund your account. Click on the “Deposit Funds” button on the dashboard and choose your preferred payment method. Follow the prompts to complete the deposit process. eToro accepts various payment methods, including credit/debit cards, bank transfers, and e-wallets.

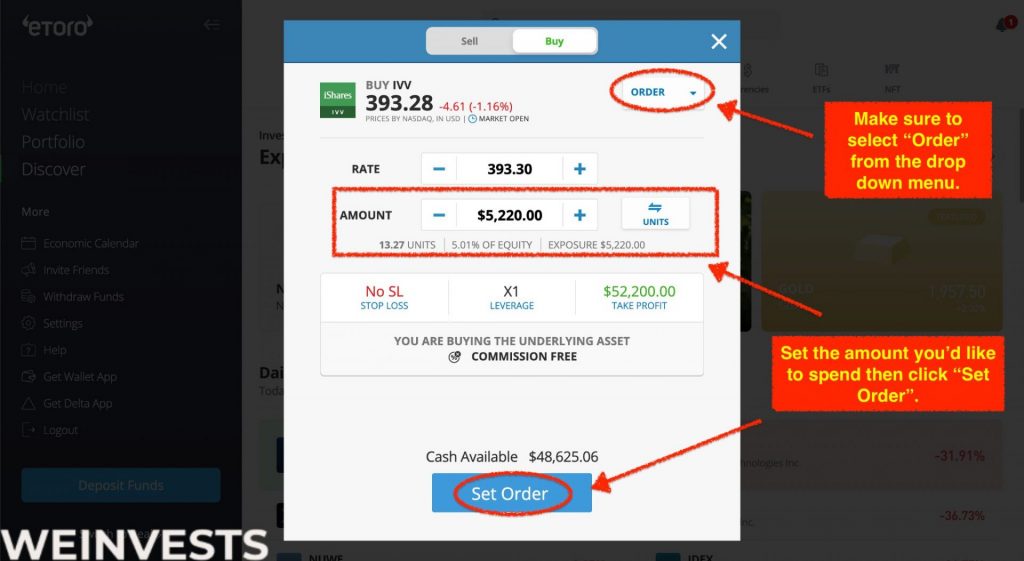

Once your account has been funded, you can start searching for iShares Core S&P 500 ETF (IVV) on the eToro platform. To do this, click on the “Trade Markets” button on the dashboard and search for “iShares Core S&P 500 ETF (IVV)” in the search bar. You will be able to see the latest price information, historical charts, and other relevant details about the stock.

To buy/sell iShares Core S&P 500 ETF (IVV) on eToro, click on the “Trade” button next to the stock. This will open the trading window where you can enter the amount you want to invest and set your stop loss and take profit levels. Once you are ready to buy, click on the “Open Trade” button to complete the transaction.

Conclusion

iShares Core S&P500 ETF is an exchange-traded fund that is tracking the performance of the S&P500 index with the technique of stratified sampling. The mandate of the fund is to invest at least 80% of the assets into the benchmark index and it has the ability to invest the rest in other asset classes. IVV ETF comes with a low expense ratio and is meant for investors who are looking for long-term capital appreciation by tracking the market index in a cheap and efficient manner.

FAQs

The fund is using a replication method that is called stratified sampling, which is an index tracking method by investing in part of the asset of the benchmark index just enough to replicate the main characteristics of the benchmark. In addition, the IVV ETF has the mandate to trade at least 80% of its assets in the S&P500 index, and the rest of the portfolio can be allocated to other asset classes depending on the time period. These were reasons why the IVV ETF performed slightly better than the benchmark.

What are the main risks to consider when investing in IVV ETF?

The most important risk to be aware of is the market risk associated with the iShares Core S&P500 ETF which are all the market factors that can negatively impact the value of your investment. Other risks such as credit, liquidity, and valuation are less material but it is always worth considering before making any investment.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More