This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

20K is not a small amount of money. But maybe it’s not enough to invest in certain assets.

Having money for investments is actually a great way to create different streams of income – in fact, it’s for sure better than leaving that money aside doing nothing.

But it is pivotal to understand that there aren’t investments that can guarantee you profits.

Before investing, and finding out what to do with 20K, there are some important things to take into account.

Table of Contents

What to do before investing 20K?

Before telling you what you can do with 20K, we want to list some steps that can keep you safe if followed:

Prepare a Plan

discipline is pivotal when it comes to investing. Set your goals and a realistic process to pursue them.

Never invest more than you can afford to lose

This is, for sure, the most important thing to do to avoid dramatic consequences.

Study markets

knowledge is always the first step towards successful activities.

Use the right tools

fortunately, today you can find tools that can fit the needs of every trader and investor.

Now that we analysed the most important things to take into consideration, let’s see what you can do with your 20K.

Create a savings account

Before investing, you should have enough money to keep yourself safe even if things don’t go as you wish – or as you planned. This is always a possibility because, as we said, there are no secure investments.

Moreover, a savings account can be an investment, since there are financial products based on savings – in general.

Pay off your debts

This is another important thing you can do to invest your 20K – or at least a part of your budget.

The reason is straightforward: when you have debts, you keep paying interests that constantly erase your budget – and for no fruitful purpose.

Invest in your education

Fortunately, we live in times when you can learn almost anything for free, but usually professional certifications and masters have a cost. They can help you to advance in your career or personal life, and help you to have additional profits if you put at work your acquired skills.

Invest in stocks

Stocks can be intimidating, but today’s opportunities to invest can fit the needs of beginners and professional investors.

You can find countless investment accounts, stock price apps, along with detailed information and news that can help you understand how markets are performing and where the market is headed.

The best part is that most of the platforms that offer you the opportunity to invest in stocks allow very low minimum deposits – sometimes, the amount can be as low as £1.

In fact, you can also choose options like fractional shares. So, with a budget of 20K, you can reach a considerable level of diversification and set balancing strategies that will help you to avoid too many risks when investing in stocks – moreover, at the end of this article, we will talk about two of the safest investment strategies.

Invest in cryptocurrencies

Cryptocurrencies are, without doubt, riskier than other assets, mainly because of their high volatility.

Additionally, even if there are more stable crypto projects like stablecoins, make sure that the team behind the asset you’re interested in has invested enough funds to allow the stablecoin to keep its peg to its reference asset.

There are also projects – like Bitcoin – that earned the reputation of safe havens, in the sense that they are designed to protect the value of your investment over time – also against inflation.

So, there are countless possibilities when it comes to cryptocurrencies – including staking, which consist in holding your cryptos.

All these options require a deep knowledge of markets – here at WeInvests we provide you with useful and actionable info concerning cryptos – and if you don’t feel comfortable with this kind of investment, you can always make a different choice.

The reason why many people choose to invest in cryptos is that their volatility is the cause of higher risk –but it’s pivotal to understand how to correctly invest in digital assets.

Invest in real estate

20K might not seem enough for an investment in real estate – and in fact, it’s probably not enough if you want to make a “traditional” investment in real estate.

But, also in this case, opportunities are countless, and today it’s possible to invest in this market even if you don’t have a large budget.

To mention just a couple of options available in today’s financial system, NFTs (non-fungible tokens) allow you to invest in fragments of real estate assets, and crowdfunding, which allows you to join other investors to trade real estate – and then share possible profits with them.

Crowdfunding

Crowdfunding is not only available for real estate, but for several other use cases and assets.

If you want to know what to do with 20K and you want a real example of crowdfunding investment opportunity, consider a platform like Crowdcube: this platform was designed to allow businesses to gather funds, and those funds are made available by investors that decide to invest in the shares of those companies – also for really low budgets.

So, crowdfunding investing is one of those cases in which your 20K is a considerable budget to reach diversification and limit risks.

P2P lending

P2P (peer-to-peer) lending is another viable option if you’re wondering what to do with 20K.

This practice consists in directly lending your money to people who need it, and profiting from interests that the borrower has to pay back along with the principal.

The income is profitable if the process you choose to lend your money is safe and guarantees you that the amount you lended will be repaid.

Also in this case the web comes to rescue, since there are platforms specialised in making it possible for borrowers and lenders to meet in a secure and regulated environment.

Safest investment strategies

As we mentioned earlier, even if investing is always risky, there are some strategies that can help you to lower risks.

We want to mention two of these strategies, since they are probably the most popular among investors who don’t want to deal with high levels of risks: holding and DCA.

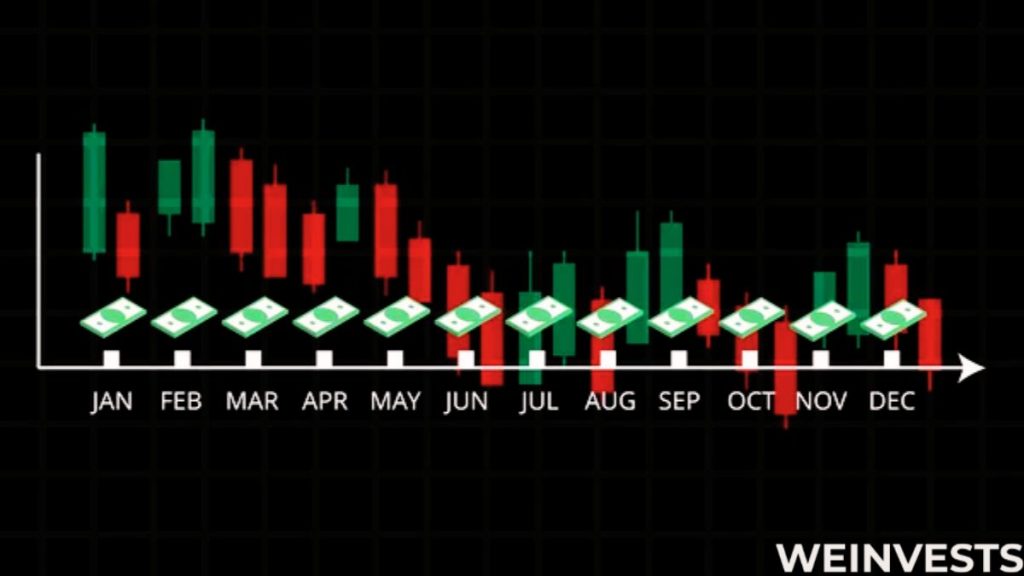

Holding

Holding is a very straightforward practice – it consists in investing in an asset and then holding that asset on a long-term basis.

The price of an asset goes up if the asset is backed by a reliable project.

The reason why the price of an asset should go up, in the long run, is that even if there are always uptrends and downtrends, a downtrend usually reaches a price that is higher than the one reached by the previous downtrend.

DCA – Dollar Cost Averaging

Dollar-cost averaging – DCA – is an investing method that consists of trading assets according to a specific schedule, without considering the price of that asset.

For example, if you trade £200 worth of a certain stock every month, you’re using DCA.

Most tools used by traders and investors also allow their clients to set scheduled deposits at specific dates, so the process becomes very smooth and straightforward.

Use the right tools

Thanks to the digital economy, you can find countless tools without leaving your home.

But make sure that the tools you use are compliant with the regulations of the countries where they offer their services.

Regulation can be a complicated topic, but it’s important to know that all those tools that allow you to manage your finances need to be compliant – precisely because they deal with money.

So, when you choose a broker, or a management tool, checking if it’s regulated is the first step, since it also guarantees higher levels of security for your funds.

Then, have a look at functionalities. Every investor has different needs, but the more functionalities a tool has, the more probable that you can continue using it as you become more skilled as an investor.

The crypto space alone offers you different opportunities, mainly divided into two macro categories – centralised and decentralised solutions (the latter allows you to be in full control of your assets).

In general, every financial product you’re looking to invest in is supported by sophisticated financial services and platforms that can help you during your journey.

Conclusion

20K is a considerable budget. Maybe it’s not enough for certain investing activities, but you’ve still plenty of ways to put that money at work.

In this article, we showed you some of the most useful and profitable things you can do with 20K.

Remember, it’s never too early to start investing, but it’s pivotal to have healthy personal finances, to know more about markets, and to have a plan that can avoid useless risks before starting investing.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More