This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Vanguard Total Stock Market ETF (Ticker: VTI) is an exchange-traded fund that aims to track the performance of the CRSP US Total Market Index. This particular ETF is passively managed, which means that the ETF tracks the performance of a specific index or benchmark, such as the S&P 500. These ETFs often charge lower management costs than actively managed funds and are meant to replicate the performance of the index they follow. This index – as the name reveals – tracks nearly 100% of the US stock market, including all types of companies, small, mid, and large-cap stocks from different industries.

Table of Contents

Characteristics, Performance Analysis, and Expectations

Characteristics

A type of investment fund traded on stock exchanges, much like stocks, is an ETF, or exchange-traded fund. ETFs are meant to replicate the performance of a certain index, such as the S&P 500, Dow Jones, or other indices. ETFs contain a group of assets, such as stocks, bonds, commodities, or a mix of these. ETFs offer a simple and affordable option for individuals to participate in a range of markets and sectors by giving them access to a diverse portfolio of assets with just one purchase.

ETFs have the benefit of being transparent, allowing investors to view the underlying assets that comprise the fund every day. This enables investors to comprehend the risk and return profile of the fund and make wiser investing choices. Overall, ETFs are a convenient, adaptable, and affordable investing alternative that gives investors access to a range of markets and industries.

The cost of purchasing and selling equities on an ongoing basis is a significant benefit of investing in ETFs as opposed to choosing stocks individually. The Vanguard Total Stock Market ETF is an established portfolio since it combines several large stocks. In this manner, the labor and expense of trading stocks individually are minimized, and the risk is decreased by extensive diversification.

There are several benefits when choosing VTI as an investment, such as:

- It is a straightforward approach to getting diversified exposure to the US economy

- It provides wide exposure to the US stock market

- It applies market capitalization-based weighting of the fund’s assets, hence the portfolio is dominated by larger companies

Furthermore, the Vanguard Group is a sizable asset manager founded in 1975 and headquartered in Malvern, Pennsylvania, and manages this ETF. The group achieves returns that closely resemble its goal benchmarks by utilizing sophisticated portfolio creation methodologies and effective trading tactics. Since 2001, they have been managing the Vanguard Total Stock Market ETF.

The inexpensive cost of VTI is one of its prominent advantages. VTI is only one of several low-cost investing choices that Vanguard offers. The fund has one of the lowest fee ratios among those for investors seeking wide exposure to the US equity market at only 0.03%. Comparatively, the industry average ETF cost ratio ranges from 0.2% to 0.4%.

VTI, for instance, has a broadly diversified portfolio that includes equities from almost all industries imaginable, as it includes almost all US stocks, including the biggest industries nowadays:

- Renewable energy

- Fossil fuels

- Healthcare

- Technology

- Financials

- Others

Performance Analysis

With significant daily trading volumes and narrow bid-ask spreads, VTI is also quite liquid. Due to this, investors may easily purchase and sell shares in the fund, even in huge amounts. VTI can act as a core holding for investors trying to create a diverse portfolio. For individuals who want to invest in a single ETF, it may also be utilized to have exposure to all of the US stock market. VTI is, all things considered, a desirable choice for budget-conscious investors seeking extensive exposure to the US stock market.

Overall, VTI has been on a bullish run since its IPO in May 2001. The financial year 2023 also started off performing well, as it resulted in a surprising Year To Date of +6.67% as we write this. This results from the broader market recovery brought on by the slowdown in inflation rates. As VTI tracks all of the US market-included stocks, and the overall market had a huge pull-back in fiscal 2022, Vanguard Total Stock Market ETF wasn’t an exception. The share price dropped by around 20%.

In its 22-year lifetime, VTI has only had 6 negative years. The largest magnitude of which was in 2008 during the financial crisis. VTI experienced a plummet of -37%. Nevertheless, even during the pandemic year of 2020, the ETF performed well with an increase of +21%. The increase despite the stock market crash is assumed to be the diversification of the different industries, as this particular ETF also tracks stocks from the healthcare industry. As we all know, the health industry performed well during the Covid-19 pandemic, which most likely led the ETF share to rise.

Expectations

As VTI tracks the total US market, it is susceptible to all global changes, for example economic, geopolitical, currency exchange rates or new pandemics, climate change, tensions armed conflicts between countries, etc. the ETF is dependent on all of the US stock movements due to these events. Since 2023 comes with positive news around inflationary slow-down and less aggressive central bank policy on rate hikes we could expect a better year for VTI assuming no black swan events occur during the year which is unrealistic to predict.

How to Buy in Vanguard Total Stock Market ETF?

First, depending on your location you could try to open an account with Vanguard directly. If your location is restricted next step would be to check whether your bank provides a brokerage account that can be leveraged to trade in VTI. Otherwise, there are other online brokerage platforms with whom you could trade VTI such as eToro or others. You need to do your research and see which channel is best suited for your needs, and location restrictions or is the most cost-effective one. Below is a step-by-step guide on how to invest in VTI through eToro.

- Sing up to create an account with eToro if you don’t have one yet.

- Go through the account completion and verification process which is guided and straightforward to follow.

- Share your ID to get verified and be able to transfer money.

- Once verified transfer fiat money to your eToro account.

- Search for VTI and trade it using eToro’s user-friendly platforms either web or app.

Risks associated with VTI

Market Risk

The term “market risk” refers to threats that originate from the wider market. This implies that several variables, such as a market downturn or changes in stock prices, as well as major global economic or political events, that have a significant impact on the market performance, can negatively affect the share price of a company, or in this case the price of VTI ETF.

The share prices of the tracked stocks have the most impact on the performance of the Vanguard Total Stock Market ETF. This implies that the share price of the ETF is directly impacted if some firms tracked by VTI perform poorly owing to weak financial results or a high inflationary environment and aggressive interest rate hikes, as happened in 2022 when the majority of the stocks in VTI underperformed and partially sank.

Market risk includes occurrences like wars and pandemics in addition to stock performance, as was previously indicated. Due to the impact on the market as a whole, this has an indirect impact on an ETF’s performance. As a result, it is advisable to conduct in-depth research on potential dangers before the implementation of an investment.

Credit Risk

The probability that a borrower will not pay back a loan or other financial obligation is known as credit risk. This may be determined by looking at the borrower’s credit history, past financial performance, and present financial standing. As this particular risk is more relevant for fixed incomes when there is a probability of one party failing to fulfill its debt obligations, ETFs are generally not regarded to have a significant credit risk.

Vanguard Total Stock Market ETF, as we are already aware, is a collection of almost all US equities. This indicates that the diversification of equities reduces the danger of the ETF being harmed by the bankruptcy of some companies in the basket due to failure in their financial obligations. However, it is still advisable to investigate VTI’s stock holdings to see whether any of them pose direct or indirect credit risks.

Liquidity Risk

It is the risk of not being able to quickly sell your positions and convert them into cash. In the case of ETFs, this risk is relatively low since those are traded on the exchange and particularly VTI which is a market cap-weighted ETF it contains mostly the stocks of large corporations which are actively traded in the market.

Valuation Risk

The risk that bonds, stocks, and in this case, ETFs would be improperly valued is known as valuation risk. As exchange-traded assets, such as VTI or other ETFs, their prices are determined by the market, or more specifically, by supply and demand, the valuation risk is quite low. Negative occurrences can still affect the price of VTI, thus even while the valuation risk is low, it is not completely eliminated since those events might create a mismatch between the market price and the actual net asset value of the share.

Risk Summary

| Risk | Relatively Low | Average | Relatively High |

| Market Risk | – | – | X |

| Credit Risk | X | – | – |

| Liquidity Risk | X | – | – |

| Valuation Risk | X | – | – |

How to Buy in Vanguard Total Stock Market ETF (VTI)

If you’re looking to invest in Vanguard Total Stock Market ETF (VTI), eToro is an excellent option. eToro is a reputable online broker offering a range of options for both beginner and professional traders. In this mini-guide, we’ll walk you through the process of opening an account on eToro to invest in VTI.

Step 1: Open an Account

To open an account on eToro, visit their homepage at https://www.etoro.com/. Click on the “Join Now” or “Sign Up” button to start the account creation process. You will be directed to a registration page where you’ll need to enter your personal information, including your name, email address, and password. After providing the required information, you will receive a confirmation email. Click on the link in the email to verify your account.

For a visual guide, visit: https://www.etoro.com/customer-service/how-to-open-etoro-account/

Step 2: Upload ID

eToro requires you to verify your identity before you can start trading. You’ll need to upload a proof of identity, such as a passport or a government-issued ID card. To do this, log in to your eToro account, go to the “Settings” menu, and select “Verify Account.” Follow the on-screen instructions to upload your ID document.

For a visual guide, visit: https://www.etoro.com/customer-service/how-to-open-etoro-account/

Step 3: Make a Deposit

Before you can start investing, you’ll need to deposit funds into your eToro account. To do this, log in to your account and click on the “Deposit Funds” button. You can fund your account using various payment methods, including credit cards, debit cards, PayPal, and wire transfers. Select your preferred payment method and follow the on-screen instructions to complete the deposit.

For more information on depositing funds, visit: https://www.etoro.com/customer-service/deposit-faq/

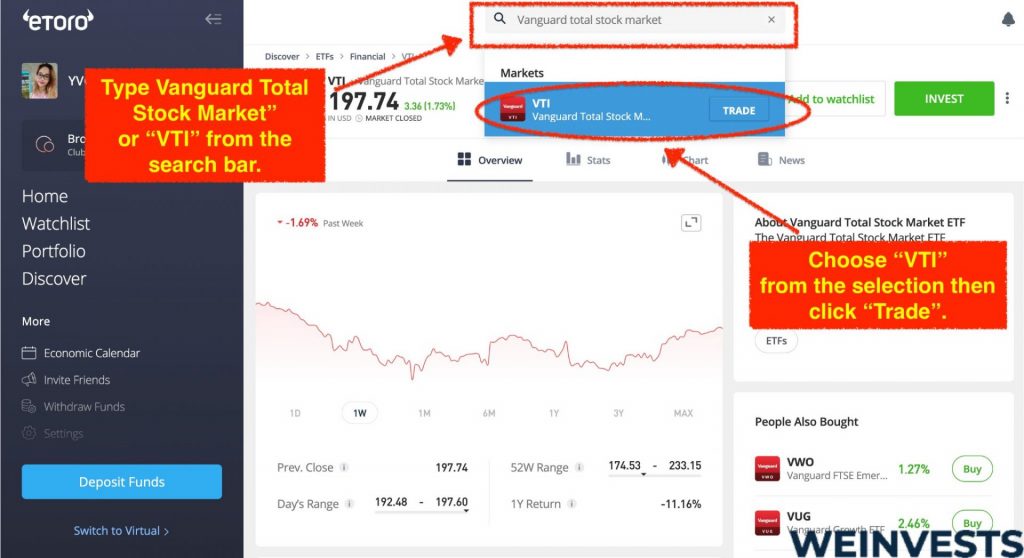

Step 4: Search for Vanguard Total Stock Market ETF (VTI)

Once your account is funded, you can search for the Vanguard Total Stock Market ETF (VTI) on the eToro platform. Log in to your account and use the search bar at the top of the page to find the VTI ETF. Type “VTI” or “Vanguard Total Stock Market ETF” in the search bar and select the appropriate result.

For a visual guide, visit: https://www.etoro.com/discover

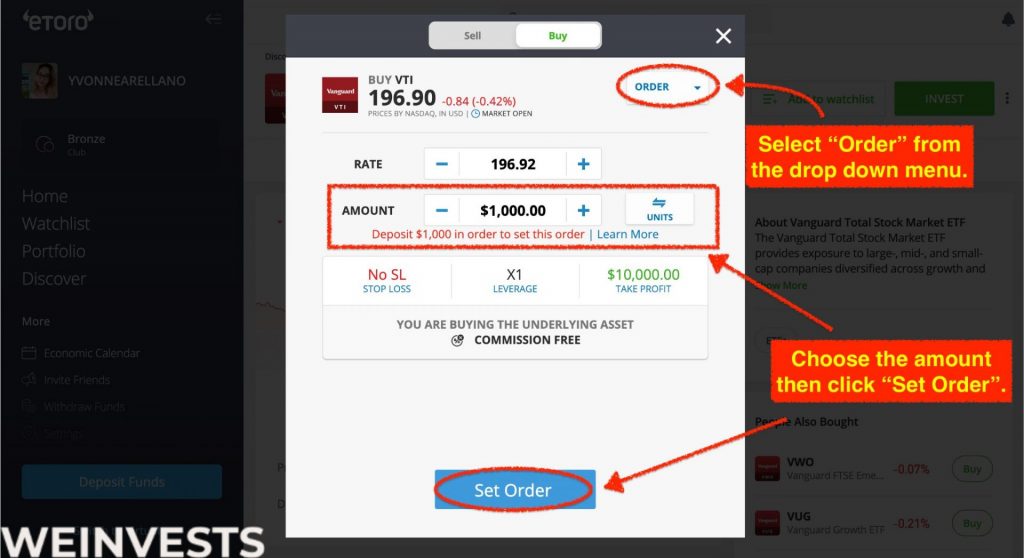

Step 5: Trade Vanguard Total Stock Market ETF (VTI)

After finding the Vanguard Total Stock Market ETF (VTI) on eToro, you can proceed to trade the ETF. Click on the VTI listing, which will take you to the ETF’s trading page. Here, you can view relevant information about the ETF, such as its performance, fees, and recent news. To trade the ETF, click on the “Trade” button and enter the amount you wish to invest. Review your order and confirm the transaction to complete the purchase.

For a visual guide, look for an image of the eToro platform with an arrow pointing to the trade button where you can trade the Vanguard Total Stock Market ETF (VTI).

Conclusion

The performance of the CRSP US Total Market Index is tracked by the Vanguard Total Stock Market ETF (VTI), an exchange-traded fund that is passively managed. By offering investors access to a varied portfolio of equities from various industries and market capitalizations, it seeks to give investors broad exposure to the US market. The Vanguard Index Group manages the ETF, which is one of the numerous low-cost investing choices provided by Vanguard.

The expense ratio for VTI is merely 0.03%, which is much less than the industry average ETF expense ratio. VTI is a liquid and affordable choice for investors on a tight budget who want extensive exposure to the US stock market. Since its initial public offering, VTI has been on a positive run.

The ETF saw a 37% decline in 2008, the year of the financial crisis, which was the most unfavorable year. The ETF did well despite the 2020 stock market meltdown, increasing by 21%, perhaps due to the diversification of several businesses, including the healthcare sector. However, it is vulnerable to all global changes, including monetary policies, exchange rates, pandemics, as well as geopolitical and economic turmoils.

FAQ’s

What makes VTI unique?

VTI is passively managed, meaning it tracks a specific index and is meant to replicate its performance, often with lower management costs than actively managed funds. It also offers broad exposure to the US stock market with low fees (0.03%) and high liquidity.

What are the benefits of investing in VTI?

VTI offers a simple, low-cost, and diverse way to invest in the US stock market. It combines several large stocks, minimizing the cost and risk of individual trading, and offers transparency in viewing the underlying assets.

What are the potential risks of investing in VTI?

As VTI tracks the entire US stock market, it is susceptible to global changes such as economic conditions, geopolitical events, and pandemics. It depends on the movement of all US stocks and is affected by their performance.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More