This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Founded in 1998, PayPal Holdings is a great example of a fintech company that was able to anticipate the times.

This California-based company was initially named Confinity and went public in 2002 on the Nasdaq.

After its status as a subsidiary company of eBay, it became independent once again in 2015. The company has already merged with x.com, the company founded by Elon Musk in 1999: the merge occurred in 2000, and it was a great step towards electronic payments and the capability to offer people an alternative to traditional payment methods.

Since then, PayPal developed into a fully online financial company. People can transfer money seamlessly and instantly, connect different payment methods, set automatic payments – and all this only thanks to an email address.

People can benefit from an additional layer of security – actually, they don’t need to fully disclose their personal details and PayPal works more as a buffer between your financial account and the recipient.

Despite the strong competition in the fintech industry, PayPal is still strong and able to acquire new users year after year – according to Oberlo, there were over 200 million users worldwide in 2022.

When it comes to PayPal Holdings (PYPL), a forecast and historical analysis of the prices of this stock are worth your time if you are interested in fintech stocks.

Table of Contents

PayPal Holdings (PYPL) Stock Forecast 2023

At the time of writing, the price of PYPL stands slightly below $78.5.

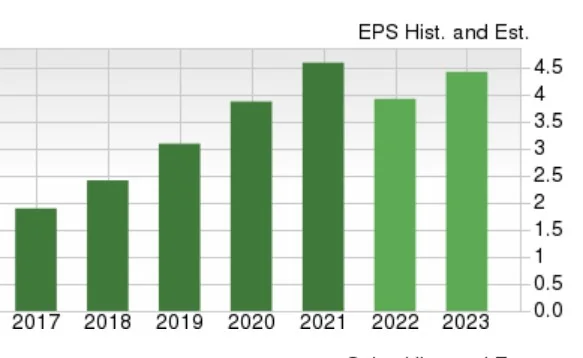

Before diving into our historical analysis, it is worth noting that forecasts for the next years are positive.

In fact, PYPL suffered a natural downtrend that saw its support price at above $69. The price of PYPL should hit a price between $102 and $123 by the end of 2023 if buyers won’t be able to break the resistance of sellers at this price level.

Accomplice to this moderate growth is the general uncertainty of the global market, but companies like PayPal can rely on the growing use of alternative payment methods – especially in emerging markets. Moreover, the company is part of the group of fintechs that are rebalancing spending after the impressive growth during the peak of the pandemic – and this also implies layoffs.

According to Seeking Alpha, layoffs and cost cuts, along with the fact that the stock seems currently undervalued, are the top reasons behind the positive sentiment that surrounds the stock.

Despite the retirement of the CEO Dan Schulman in December 2023, the executive will help with the transition – in fact, the company hadn’t chosen a successor yet, as reported by The Wall Street Journal.

PayPal Holdings (PYPL) Stock 2022

2022 wasn’t as bright as 2023 forecasts for PYPL.

The year was populated by a constant downtrend that was just a confirmation of the previous developments of PYPL prices.

On January 3, 2022 – the first day of the year available for trading – buyers won their battle against sellers and made the stock close at $194.94 – slightly below the high set at $196.

The short body of the candlesticks, along with a relatively stable trading volume, were signaling a weak sentiment among traders and investors. Actually, 2022 looked like the final downtrend tail that usually precedes accumulation – another point that confirms bullish forecasts for 2023 and beyond.

After a short selloff that met a support price above $160 on January 24, PYPL experienced a rebound that led to a price over $ 175 on February 1. That same day, the company shared its earnings report, and the consequences are evident on February 2. Despite we’re talking about a Tuesday and a Wednesday, we can see a price gap that usually occurs after weekends.

The report showed earnings slightly below expectations, with a negative surprise of 0.95%.

The effects on the price are evident: on February 2, PYPL reached its low at $129.01 and a close at $132.57, with a dramatic peak in selling volume.

The positive reports of April, August and November helped the price of PYPL, but we can only witness slight rebounds – the natural distribution phase was stronger, and the price of PYPL closed at $71.22 on December 30, 2022.

PayPal Holdings (PYPL) Stock 2021

2021 was the year of the uptrend peak and of the downtrend for PayPal Holdings (PYPL).

The first day available for trading was January 4, 2021. The year started with a negative candle – closed at $231.92, -0.97% compared to the previous trading day. But this is nothing unusual – prices are usually lower on Mondays.

For the first months of 2021, the price of PYPL moved between support set by buyers at around $225, and a resistance set by sellers at above $254.

The first unusual movement we witness occurs between February 3 and 4: the positive earnings report of February 3 caused a price gap that led PYPL to $270.43 on February 4 (+7.36% compared to the day of the report), and the positive effects lasted even until the unusually positive following Monday.

But on February 16, the price of PYPL met strong resistance at around $309. Despite the positive news that surrounded the companies that had invested in cryptos – among which there was PayPal – and whose move was proven good by the BTC high, buyers weren’t strong enough to break the resistance.

Actually, the price of PayPal was in line with the 261.8% Fibonacci extension level – so, if we look at the price of PYPL from a pure technical perspective, this might be the only reason why the peak in price was witnessed at that specific level.

Sellers came into the scene and led the price to a strong support level, set by buyers at around $235, on May 11. Buyers, also thanks to the positive effects of the successful earnings report shared on May 5, were able to drive the price high.

But the resistance was tested again: on July 26, PYPL reached its high at $310.16.

This was enough for bears, made even stronger by the announcement that the earnings reported by the company weren’t in line with expectations.

The downtrend had officially started. Another lower-than-expected revenue report led to a new negative price gap in November 2021, and the year closed at $188.58.

PayPal Holdings (PYPL) Stock 2020

2020 was the year of the uptrend. During this year, the price of PYPL witnessed an astonishing increase of over 185%.

But remember: 2020 was also the year of the breakout of the pandemic. This led to an impressive growth of most fintech companies and, in general, companies that allowed people to use services and products without leaving their homes.

The year started with PYPL at $110.75 on January 2, 2020. After a short bounce that led the price to a support level set at around $85 in March, the uptrend began.

The first impressive and positive price gap occurred between May 6 and 7, while PayPal was making headlines – also because of the increasing number of active accounts, especially for the pandemic.

After a new positive earnings and revenue report that led the price to a new positive gap at the end of July, buyers and sellers tested the support level at around $175 (in line with the 100% Fibonacci extension level) twice.

After the second attempt, buyers confirmed their strength and on November 3, 2020, we witnessed a peak in buying volume that will lead the price to $234.2 on December 31, 2020.

PayPal Holdings (PYPL) Stock 2019

2019 was the year of a minor uptrend and of a short bounce before, as we analyzed, the major uptrend of 2020.

In general, 2019 was a positive year for PayPal Holdings stock.

The first day available for trading was January 2, 2019 – and PYPL closed at $85.75.

The first earnings and revenue report dates back to January 30. The earnings report resulted in a positive surprise (+3.59%), but the revenue declared was below expectations – resulting in a negative surprise that missed expectations by over 8 million dollars (-0.19%).

This resulted in a negative price gap that led the price to $88.76 on January 31. But it was just a short bounce. The price went higher for another six consecutive months, without major events. The peak for 2019 was reached on July 16 – at around $119. This price was in line with the 50% Fibonacci extension level, and it proved to be a strong resistance zone: it was tested three times in a few days – from July 16 to July 24. Then, the bears won. After the second test, bears’ expectations were confirmed by the report shared by the company on July 19 – this time, analysts’ expectations were missed by over 25 million (the surprise amounted to -0.58%).

Bears managed to take the price to the 23.6% Fibonacci extension level and, on October 23, the price of PYPL reached $96.64. The October report was extremely positive, and bulls take it as an occasion to recover.

The weakness of bears was proved by volume – a strong peak in selling volume wasn’t confirmed by the body of the candle. The year ended positively, with the stock closing at $108.17 – +26.15% compared to the beginning of the year.

PayPal Holdings (PYPL) Stock 2018

2018 was quite a stable year for PayPal Holdings – PYPL stock.

The price moved within a range between $73.84 – closing price of the first day available for trading, January 2, 2018 – and $84.09 – closing price of the last trading day of the year, December 31, 2018.

The most significant price movements witnessed occurred between January 31 and February 1, and between October 18 and October 19.

In the first case, we can see a negative price gap, fully confirmed by volume, occurred after the first earnings and revenue report of the year – which positively exceeded expectations.

In the second case, we see a positive price gap occurred after the report shared on October 18 – which, once again, exceeded expectations (earnings surprise exceeded expectations by 7.21%, revenue by almost 20 million, which corresponded to +0.54%).

PayPal Holdings (PYPL) Stock 2017

2017 saw a constant uptrend. The peculiarity is that even if we can see strong peaks in selling volume, the price went constantly up – and for a few reasons:

- Earnings and revenue reports well above expectations,

- New integrations – like the use of Venmo and Facebook,

New agreements – like the one with Synchrony Financial, which allowed PayPal to free up billions of dollars available for new investments and growth strategies.

Conclusion

PayPal Holding anticipated the times and, despite the different economic conditions it went through, despite different acquisitions, and despite the rising competition, the company was able to stay strong.

This fintech company benefited from the growth reserved for similar companies with the breakout of the pandemic, but it now needs to rebalance – as most of its peers.

The company has already started with its expenditure review, and analysts are bullish for 2023.

FAQ

Is PayPal a good investment?

Analysts are bullish on the future of PayPal holdings, at least for the next years. These opinions are supported by the fact that the company started cutting costs to make the impressive growth experienced during the pandemic more sustainable.

What will PayPal be worth in 2023?

The price of PayPal stocks should move in a range between $102 and $123 – but remember, no forecast is 100% secure.

Is PayPal overvalued?

According to analysts, as we said throughout our article, PayPal Holdings is currently undervalued.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More