This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

While the industry did suffer a major hit due to the global pandemic, it is on its way to recovery. Not just that, car manufacturers across the globe sees a huge demand.

Many people are looking to upgrade their cars and try out new vehicles with various features. The massive demand presents the manufacturers, such as Geely Global, to expand into different territories, particularly the US and European markets.

Geely Auto Group is a huge name in the automobile industry. The company was founded in 1997 and is based in Hangzhou, China. Zhejiang Geely Holding Group is the parent company of the Geely Auto Group and has various other subsidiaries, including:

- Geometry

- Lynk & Co

- Proton Cars

Over the past years, Geely Global has seen a massive change in its share price. The company’s stock value increased from $1 to $3.5 in 2017. However, it started to go down before rising up by the end of 2020. These are the company’s recent financials to give you a better idea:

Below is a glimpse of the company’s recent financials:

Table of Contents

Geely Global Statistical Overview

Geely Global (GELYF) Forecast 2023

Analysts have made an average stock prediction of $7.32 with a high forecast of $8.96, and a low prediction at $5.5.

From the most recent price of 11.58, the average stock forecast for 2023 depicts a decline of -36.8%. In the course of the year, the stock price is expected to be 140.14% higher.

In other words, if you invest $100 on the stock today, it might be worth $241.114 by December 2023. However, all of these are only predictions based on the current market, meaning they are subject to change.

Geely Global (GELYF) Stock 2022

Geely Global recently published its first half of the year review and results showed their significant progress in the automobile industry. They garnered 58.2 billion RMB in revenues and 1.28 billion RMB in net income.

The Automobile giant advanced its intelligence and electric transition during this period, making strides in the premium market categories. They sold 613,845 vehicles, placing it among the top three Chinese automakers.

Electrified and new energy cars accounted for 109,000 of those sales, up 398% year over year and making up 17.9% of total revenue for the business. R&D spending on intelligent and new energy vehicle technology grew by 71.7% to 3.63 billion RMB, underscoring the company’s continued transition.

The company’s average selling price per vehicle climbed 21.1% to 102,000 RMB thanks to the introduction of more modern models and better product pricing. The Xingyue L Hi-F (HEV) and Emgrand L Hi-P (PHEV) under the Geely Auto brand, as well as the Geometry E (BEV) under the Geometry brand, are just a few of the clever and electrified new models that the firm successfully debuted.

They concentrated on both growing its electrified product line and enhancing the intelligence of its products from the start of 2022.

Additionally, the company’s international expansion has advanced dramatically with export sales topping 88,000 units, an increase of 64% YoY, and accounting for 14.3% of the company’s overall sales. Delivering 10,912 units to owners and customers in the first half of the year marked a new milestone for Lynk & Co’s European business, an increase of 3,986%.

Geely Global (GELYF) Stock 2021

The year 2020 was challenging for companies in the automobile industry. Many companies in the automobile sector faced significant losses and reductions in their revenues due to the supply chain issues that are grappling with the world. Consumers are facing delays in receiving their orders, and for that reason, the automobile industry is suffering significantly.

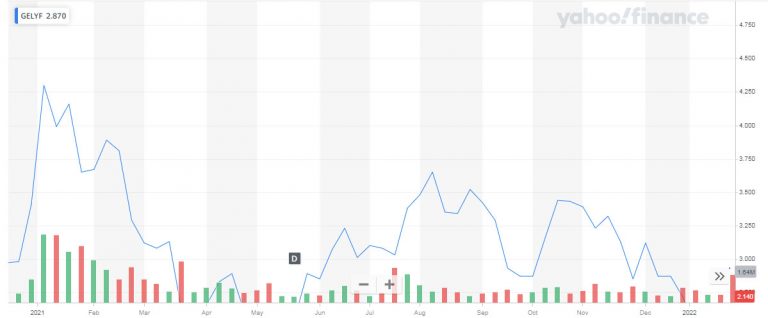

The case is no different for Geely Global, witnessing amazing growth after the pandemic. However, the share price of Geely Global went down from $4.3 at the start of January 2021 to $2.8 by the last week of December 2021.

Low sales volume was a big disappointment for the company’s investors, which caused the share price to go down. The overall sales of the Geely Group, including LYNK and other subsidiaries, were around 135,000 units. It decreased by 10% from year on year but increased by 20% month on month.

Moreover, the company announced the development of the latest auto chips that give its consumers many more features. The 7nm intelligent cockpit chip is a great sign for the Geely Global investors as it shows that the company is working towards revolutionizing the automotive industry.

Geely Global (GELYF) Stock 2020

The year 2020 was a challenging year for companies in various sectors as the world had to face the impact of the Covid-19 pandemic. The automobile industry was one of the most severely impacted ones. Many companies saw a massive fall in demand for their cars as people were not traveling anywhere.

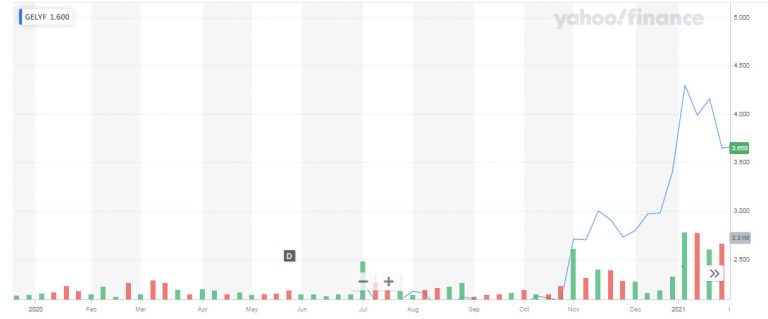

Consequently, the sales for many car companies, including Geely Global, fell by a significant number. The company’s share price decreased to $1.7 after the market crashed in March 2020. The stock price hovered around the $1.7-$1.9 mark throughout the next 6 to 7 months.

After the markets opened up and the automobile and vehicles increased, Geely Global’s share price experienced a massive change. It went to $3.4 on the last day of trading in 2020 and reached an all-time high value of $4.3 at the start of next year. However, the boom in the stock price was short-lived, and the share value fell in the first few months of 2021.

Geely Global (GELYF) Stock 2019

Many developments took place in 2019 that helped Geely Global’s share price to go from $1.4 at the start of January to $2 by the end of December. The company did see slight up and downs throughout 2019, but Geely Global’s stock value saw a change of more than 50%. Here are some notable developments that helped the share price to increase:

- The company got the honor of becoming a prestige partner of the 2023 Asian Games

- Joint venture with Daimler for the project Volocopter

- Another joint venture with Daimler AG to develop a smart brand

- Released the Geometry Brand

- Increased cooperation with Baidu for internet-related services

Geely Global (GELYF) Stock 2018

2018 was a difficult year for Geely Global investors as the stock saw a fall in its value by 50%. Geely Global’s share price witnessed an optimal rise in 2017, but it plummeted by the end of 2018. Opening at around $3.5 at the start of January, the stock price fell to $1.5 by the last week of December.

Even though the company acquired a 9.69% stake in Daimler, shareholders were not impressed by the company’s performance and overall revenue growth. Therefore, the company faced a massive sell-off as shareholders wanted to invest their money elsewhere.

Geely Global (GELYF) Stock 2017

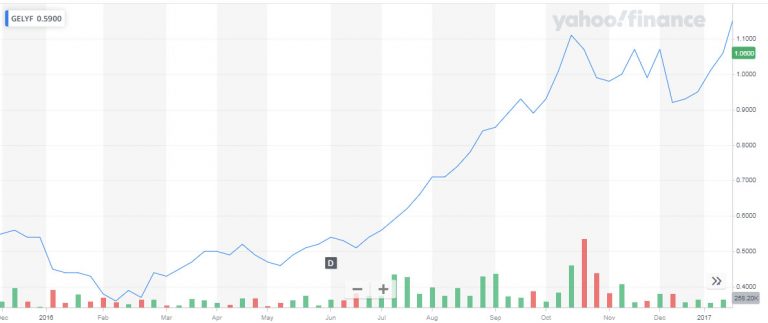

Geely Global’s stock price throughout the first four months of 2017 stayed between the ranges of $1 to $1.5. It started to increase over the next few months, ending at $3.54 by the end of December 2017. The primary reason for this was the joint venture with Volvo trucks.

Geely Global purchased a stake of more than 8.2% in the Swedish company. It opened the possibilities for this automobile manufacturer to expand in the European markets. Furthermore, the company acquired Terrafugia, which is an American car company. In addition, Geely Global was also planning on further acquisition deals with various other companies.

Geely Global (GELYF) Stock 2016

2016 was a good year for Geely Global as the company’s share since the stock prices doubled within 12 months. The company’s share price reached $0.95 by the last week of December from $0.45 on the first day of trading in 2016. Volvo’s acquisition was the driving force for the share price.

Investors started to gain more confidence in the company and believed it could outperform its set expectations. Volvo Cars had tremendous finances with an operating profit margin of 5% and 3.5% for the 3rd quarter of 2016 and 2016, respectively. Thus, the demand for Geely Global shares increased rapidly, causing the stock prices to go up.

Conclusion

Geely Global has prospects to expand its operations throughout different regions. The company is making rapid progress in understanding the market dynamics of various regions. Therefore, this is a stock worth keeping an eye on for the next couple of years.

The acquisition of Volvo cars gives the company an amazing opportunity to enter the European market. Geely Global has been looking to expand into different regions for the last couple of years. It finally has the opportunity to do so, and the company has a complete plan ready for its expansion. Therefore, investors should follow all the latest developments from Geely Global closely.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More