This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Vanguard S&P 500 ETF (VOO) is an ETF (exchange-traded fund), which is a type of investment fund that holds a collection of assets such as stocks or bonds and can be bought and sold on stock exchanges like individual stocks, for example using eToro and other brokerage accounts. In general, ETFs are similar to mutual funds they allow you – as an investor in the stock market, to diversify your portfolio since by buying or selling an ETF you gain access to a broad range of assets. There are many advantages when investing in ETFs. They are pre-made portfolios, including stocks either with a particular industry or characteristics or from many different industries across asset classes.

Taking Vanguard S&P 500 ETF as an example, the objective of VOO is to track, or mirror, the return of the S&P500 index as its benchmark. To understand what exactly Vanguard’s aim is, we first need to understand what the S&P500 index is. The S&P 500, with its full name Standard & Poor’s 500, is a stock market index that tracks the performance of 500 of the largest companies in the United States. Listed on the stock exchanges in the United States, it calculates and moves as the weighted average of all individual 500 stock performances. The index is also considered a benchmark for the overall performance of the U.S. stock market. The index is market-capitalization weighted, which means that the companies with the highest market value have a greater influence on the index’s overall performance.

Therefore, by tracking the S&P500 index, Vanguard S&P 500 ETF has exposure to stocks from different branches including technology, banking, healthcare, etc. One of the most attractive factors is that the costs are significantly lower when investing in VOO in comparison with buying or selling each or a part of the stocks included in this ETF individually. Another important aspect is risk diversification by investing in various companies from different industries since there are 500 stocks included, and the ETF moves as the weighted average of all stocks, the probability of all stocks reducing significantly is relatively low.

Table of Contents

Characteristics, Performance Analysis, and Expectations

Some of the key characteristics of Vanguard S&P 500 ETF are summarized below:

Diversification: as already mentioned, VOO includes a broad range of 500 different companies, which investors can acquire and use to diversify their portfolio by spreading the risk.

Low cost: as we can see on VOO, ETFs generally have lower expense ratios than actively managed mutual funds, which makes them a cost-effective way to invest in the stock market.

Trading flexibility: VOO can be bought and sold throughout the trading day on stock exchanges, just like individual stocks. This allows investors to take advantage of market fluctuations and execute trades at the price they choose.

Although historical performance is not an indicator of future performance, it is always recommended to look at the historical price moves in different market conditions to understand how the fund behaves in various market situations. VOO started the year off with a 3.85% year-to-date YTD) rebound against last year’s decrease, which was due to the overall market conditions, high inflation, war, etc. VOO had its lowest level in October trading around USD 328 per share. The highest level was at the start of the year when the price was around USD 433 per share. That’s a share price reduction of around -16% compared with the price today.

Although Vanguard S&P 500 ETF is tracking a market index and is thus expected to be less volatile, it has seen significant volatility for the past years due to COVID-19 and high inflationary environments.

The share price jump in early 2023 and the continuous market uncertainty allow us, and many analysts, to think that we will expect to see a volatile year for 2023 and that there are going to be just as many or slightly fewer ups and downs. Although the inflation rates are coming down, the financial market still needs time to recover from the previous headwinds. At the moment the markets are still highly volatile and sensitive to the news on inflation and central bank decisions on rate hikes to fight inflation.

In addition to the capital appreciations that you can expect to receive while investing in the VOO, some of the companies listed in the basket pay also dividends so those dividends are distributed quarterly. The most recent dividend yield stands at around 1.6% which is closely aligned with the S&P500 current dividend yield of 1.7%.

It is always important to consider conducting more thorough research before investing in VOO.

How to Buy in Vanguard S&P 500 ETF?

Investors based in the United States can easily invest in the Vanguard S&P 500 ETF (VOO) by opening an account directly with Vanguard or through major banks and online brokerages that offer the fund. However, for investors outside the United States, access to Vanguard ETFs may be delivered either by your banking service provider or depending on your country of residence you can check with online brokerage platforms such as eToro which provides VOO as an instrument to trade in or you can check with other similar platforms.

When considering investing in the VOO ETF, it is important to review the overall allocation of the fund, including the distribution of holdings among different industries and stocks. As a passively managed ETF, the VOO’s allocation will typically mirror that of the S&P 500 index with the largest weights allocated to the top tech companies such as Apple, Microsoft, and Alphabet to name a few given that those are the highest market cap companies listed in the US stock market at the moment.

There are also certain risks involved with an investment in VOO that you need to thoroughly consider before making an investment decision. Some of those risks are covered briefly below.

Market Risk

The risk of loss due to negative market conditions is known as market risk. This represents the potential for the value of an investment to decrease due to factors such as a general market downturn, changes in interest rates, stock prices, foreign exchange rates, and unfavourable economic or political events.

Vanguard S&P 500 ETF is dependent on the 500 big companies in S&P500. This means that every change in price in those individual companies has a direct effect on the VOO price. However, it is worth noting that if some of the 500 companies underperform, the other part may outperform causing benefits of diversification assuming that there is no broad market event that causes the entire stock market to fall in value.

So the market risk, in this case, is dependent on both market and external events, which would impact part or most of the stocks held by VOO ETF.

Credit Risk

The risk that a counterparty will fail to cover its financial obligations is known as credit risk. This risk is typically associated with fixed income and derivative products, as there is a counterparty involved in the transaction who is responsible for certain payments. In contrast, stocks and ETFs are generally considered to have lower credit risk. However, it’s worth noting that even investments that are considered low credit risk such as VOO may have some credit risk exposure so it is worth doing your due diligence to identify any potential risk associated with credit factors.

Liquidity Risk

Liquidity risk is the possibility of investors not being able to cash out their investments. Since VOO is holding large company stocks and it is a large ETF itself, the chances of those stocks becoming illiquid are relatively low hence the overall ETF liquidity risk is low as such.

A good indicator of the liquidity risk is average daily volume numbers and the 20-day and 65-day average daily volumes for Vanguard S&P 500 ETF stand at above 4 million shares which means that the fund is actively traded in the market every day making the liquidity risk to be relatively low.

Valuation Risk

Valuation risk is the possibility that a financial instrument is priced inaccurately. For exchange-traded investments like ETFs and stocks, this risk is generally considered to be low, because these financial instruments are actively traded in the stock exchange.

How to Buy Vanguard S&P 500 ETF

eToro is an excellent option for those looking to invest in Vanguard S&P 500 ETF. As one of the leading online brokers, eToro has a strong reputation and offers a wide range of options for both beginner and professional traders. In this mini guide, we will walk you through the steps to open an account on eToro and start investing in Vanguard S&P 500 ETF.

Step 1: Open an Account

To get started, you’ll need to create an account on eToro. Visit their homepage at www.etoro.com and click on the “Sign Up” or “Join Now” button. You will be directed to the registration page, where you’ll need to provide your email address, create a username and password, and agree to the terms and conditions. Alternatively, you can also sign up using your Facebook or Google account. A confirmation email will be sent to the email address provided, and you’ll need to verify your account before proceeding.

For more information, visit the eToro customer service page on how to open an eToro account.

Step 2: Upload ID

Next, you’ll be required to verify your identity by uploading a proof of identity document. This can be a government-issued ID card, passport, or driver’s license. Ensure that your document is clear and valid, as eToro uses this information to comply with regulatory requirements.

For more information on uploading your ID, visit the eToro customer service page on how to open an eToro account.

Step 3: Make a Deposit

Before you can start investing, you’ll need to fund your eToro account. Log in to your account and click on the “Deposit Funds” button, which is usually located at the bottom left corner of the platform. You’ll be presented with various payment methods, such as credit/debit card, PayPal, bank transfer, and more. Choose your preferred method and follow the instructions to complete the deposit process. Keep in mind that there may be minimum deposit requirements and fees associated with certain payment methods.

For more information on depositing funds, visit the eToro customer service page on deposit FAQ.

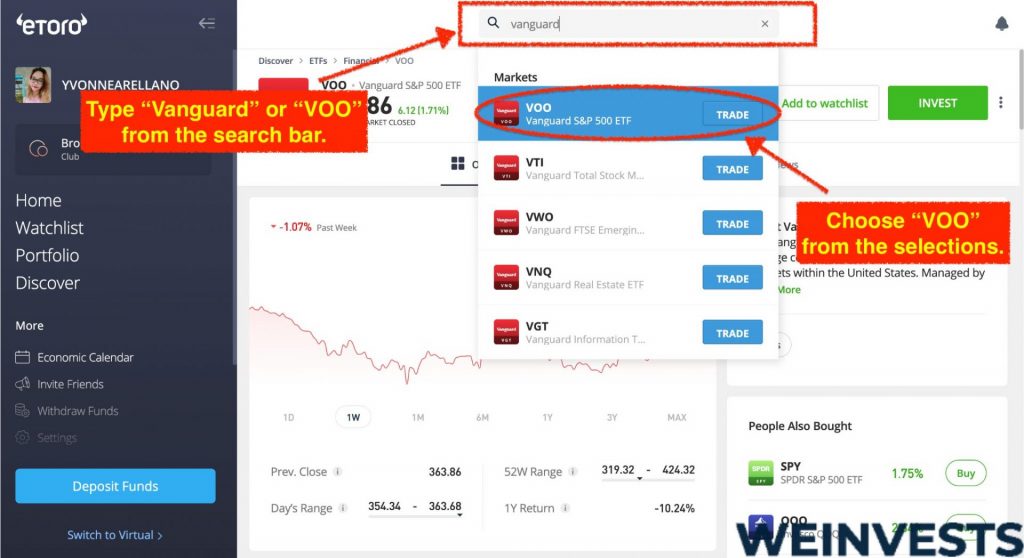

Step 4: Search for VOO

Now that your account is funded, you can start searching for the Vanguard S&P 500 ETF. On the eToro platform, locate the search bar at the top of the screen and type “Vanguard S&P 500 ETF” or the ETF’s ticker symbol, “VOO.” The platform will display the search results, and you can click on the Vanguard S&P 500 ETF option to access its trading page.

For more information on discovering assets on eToro, visit the eToro discover page.

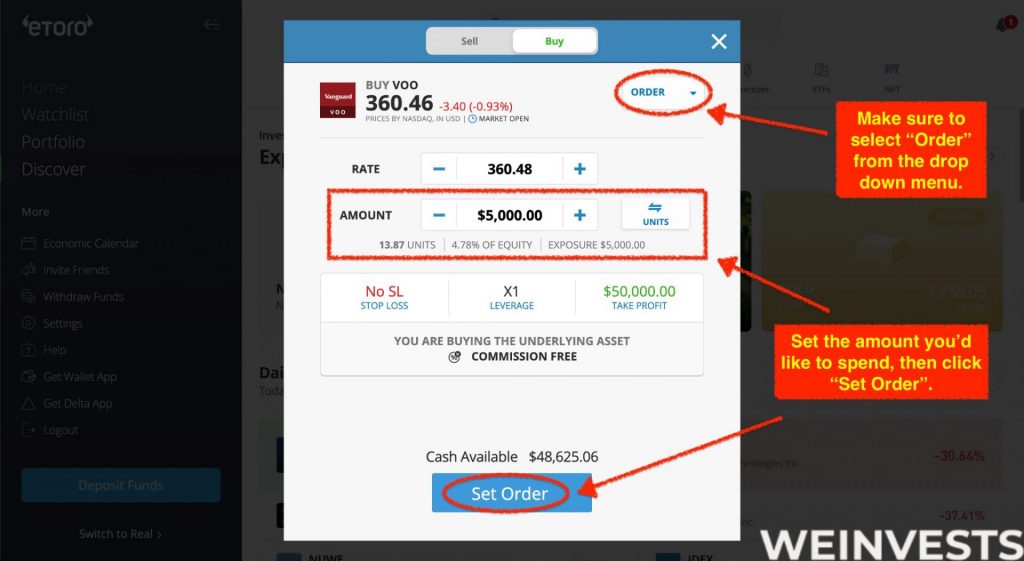

Step 5: Buy/Sell VOO

On the Vanguard S&P 500 ETF trading page, you’ll find an overview of the ETF, including its performance, historical data, and relevant news. To purchase the ETF, click on the “Trade” button, which is usually located at the top right corner of the page. A trade window will open, where you can enter the amount you want to invest, set a stop loss or take profit level, and choose between a market or limit order. Once you’ve entered your desired settings, click on the “Open Trade” button to execute the order. Congratulations, you’ve just invested in the Vanguard S&P 500 ETF on eToro!

Remember to monitor your investments regularly and adjust your portfolio as needed to meet your financial goals. Always conduct thorough research and consider consulting a financial advisor for personalized advice.

Conclusion

As discussed earlier, Vanguard S&P 500 ETF (VOO) tracks the S&P500 index which includes the performance of the top 500 companies in the United States. The ETF’s performance is closely tied to the performance of its benchmark, and historically it generally tends to trend upward due to the fact that it is composed of the largest and most stable companies listed on the US stock market.

The VOO ETF is one of the largest in the industry with a large AUM and active daily trading volume. It has also a relatively low expense ratio and comes with diversification benefits which makes it an attractive alternative for investors. It has also some dividend yield thanks to the fact that some of the companies in the basket pay dividends.

VOO is generally recommended to be considered as a long-term investment option with at least a 5-year holding period to capture the benefits of long-term capital appreciation. In any case, it is recommended to perform your own analysis to identify whether this investment is the right fit for your needs.

FAQs

What is VOO?

Vanguard S&P 500 ETF (VOO) is an exchange-traded fund, which follows 500 of the largest companies in the US. This means that this ETF price moves as the US market performs based on the S&P500 index.

Can I buy fractions of VOO?

Some of the brokerages enable clients to buy fractional shares. You need to contact your brokerage account provider to understand the minimum investment requirements on your account as well as options to purchase fractional shares.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More