This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

SPDR S&P 500 ETF Trust (SPY) is an exchange-traded fund (ETF) launched back in January 1993 and is considered one of the first ETFs of its kind to be listed in the stock market. It is also considered one of the most popular ETFs in the world. SPY is managed by the State Street Global Advisors and its benchmark is the S&P500 index – a basket of the largest 500 US companies by market capitalization across around 24 industries that are listed in the US stock exchanges. So the top industries that the fund has holdings in are Information Technologies, Health Care, Financials, and Consumer Staples with respective weights that are closely matched to the index at the moment. So SPDR S&P 500 ETF Trust tries to closely and passively track the pre-tax/expense performance of the benchmark index making it a passively managed index ETF in nature.

The fund currently holds 503 shares which are in line with the number of holdings of its benchmark. Currently, the gross expense ratio of the fund is around 0.09% which is lower than the overall industry average of 0.2-0.4%.

The ETF is not a dividend fund but since some of the companies in the S&P500 benchmark pay dividends the ETF has an annual dividend yield of around 1.6% which is quite close to its benchmark index dividend yield of 1.7%. Currently, SPDR S&P 500 ETF Trust has assets under management (AUM) of around USD 361 billion making it one of the largest ETFs in the world.

Table of Contents

Characteristics, Performance Analysis, and Expectations

The net asset value (NAV) per share which is equivalent to the price of the share of SPDR S&P 500 ETF Trust is trading around USD 390. Comparing the year-to-date (YTD) performance of 2.5% and -18%, respectively, for SPY vs the S&P500 index those are almost identical as expected given the fact that the ETF is meant to track the index passively without major deviations. The overall negative performance was driven by the high inflationary environment and the central bank’s aggressive rate hikes that caused the overall market downturn.

Markets started 2023 with a rebound after some key data from the US showed more optimistic economic conditions and pointed to the fact that inflation might be starting to reduce. Therefore market expectation is that the central banks will be less aggressive in their rate hikes to fight inflation and bring it back to the long-term target rate of 2%.

Nevertheless, since the inflation is still high relative to where it was before, it is expected that central banks will still raise the rates in 2023 to bring the consumer price index (CPI) to the target level. This will certainly cause some market volatility and hence have an impact on the SPDR S&P 500 ETF Trust’s price, but hopefully, less than what we saw back in 2022 given the expectation is less aggressive rate hikes.

In addition, the estimated 3-5 year earnings per share growth (EPS) for the fund based on the actual holdings is at 10.9% which is also in line with the same estimate for the S&P500 index for the same period.

One of the key indicators to watch as well is the premium or discount of the daily trading price compared to the SPY’s NAV which is currently around 0.01%. This means that trading during trading hours you might be paying a slightly higher or lower price than what the actual NAV of the ETF is at the moment.

How to Buy in SPDR S&P 500 ETF Trust?

The traditional option to invest in SPDR S&P 500 ETF Trust is to see with your banking service provider whether the brokerage account offered by them enables you to invest in the SPY. Another option is to use one of the online brokerage platforms such as eToro which also offers SPY as a financial instrument that you can invest in.

Before investing it is worth checking to see what are the current holdings of the fund. You can always check the official page of the SPDR S&P 500 ETF Trust’s provider where you can also find some key information as well as documentation related to historical performance, performance comparison to the benchmark, information regarding people who manage the fund, and more. Below are the top holdings of the SPY fund and their respective weights as we write this:

- Apple Inc. – 6%

- Microsoft Corporation – 5.2%

- Amazon.com Inc. – 2.4%

- Berkshire Hathaway Inc. Class B – 1.7%

- Alphabet Inc. Class A – 1.6%

These holdings and the weights are almost identical to the index weights at the moment with very slight differences. It is not a surprise that these are the largest US tech companies since, as discussed before, the index is market cap weighted which means it will allocate the largest amount of your investments to companies with the largest capitalization.

Some of those companies such as Apple Inc. pay dividends as well, those dividends are collected by the fund and then distributed to the investors on a quarterly basis. This makes additional income for the investors on top of the capital appreciations that you may expect by investing in SPDR S&P 500 ETF Trust.

Before investing in the SPY ETF it is recommended to check all the associated documentation and information provided by the fund manager to verify whether all the holdings, industry allocation, expenses, or historical performance to name a few, are in line with your investment goals, risk tolerance or specific requirements such as environmental, social, and governance (ESG) factors.

How to Buy in SPDR S&P 500 ETF Trust (SPY)

A well-reputed online broker, eToro offers a wide range of options for both beginner and professional traders. In this mini guide, we’ll walk you through the process of opening an account on eToro and investing in SPY.

Step 1: Open your Personal Account

Opening an account on eToro is a simple and straightforward process. First, visit the eToro homepage and click on the “Join Now” or “Sign Up” button. You’ll be directed to the registration page, where you’ll need to provide some basic information, such as your name, email address, and phone number. You’ll also need to create a password for your account. Once you’ve entered all the required information, click “Sign Up” to proceed.

Step 2: Upload ID

After registering, you’ll be asked to verify your identity by uploading a valid proof of identification. You can use your ID card, passport, or driver’s license as your proof of identity. Visit the eToro identity verification page and follow the instructions to upload your document. Make sure the image is clear and legible to avoid any delays in the verification process.

Step 3: Make a Deposit

Before you can start investing, you’ll need to fund your account. Navigate to the “Deposit Funds” section on the eToro platform. You’ll find various deposit methods available, such as credit/debit cards, PayPal, bank transfers, and more. Choose the method that works best for you and follow the instructions to complete the deposit process. Keep in mind that the minimum deposit amount may vary depending on your region and chosen deposit method.

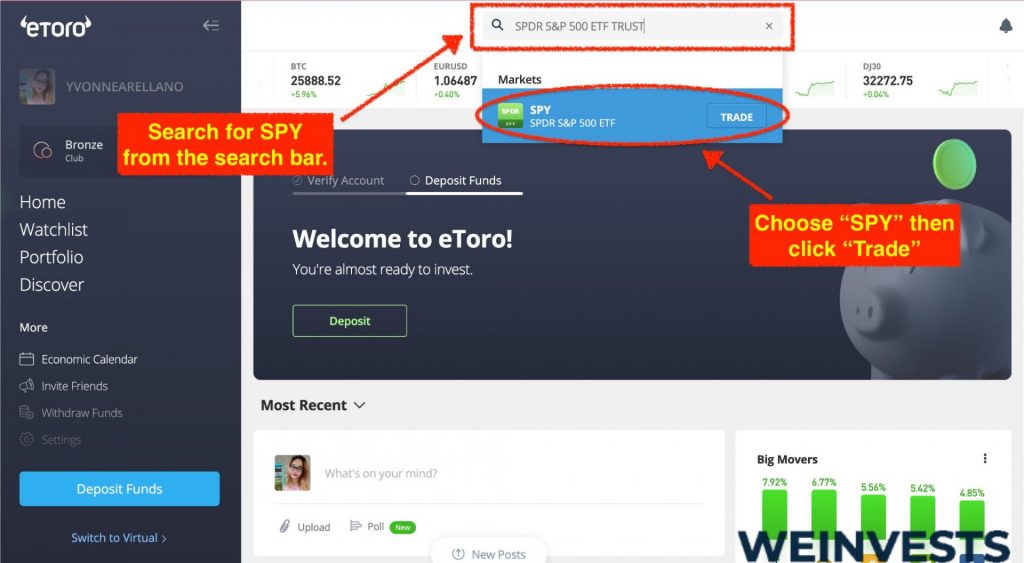

Step 4: Search for SPY

Now that your account is funded, you can search for the SPDR S&P 500 ETF Trust (SPY) on the eToro platform. Go to the “Discover” section and enter “SPY” or “SPDR S&P 500 ETF Trust” in the search bar. The platform will display the relevant results, and you can select the SPY ETF from the list.

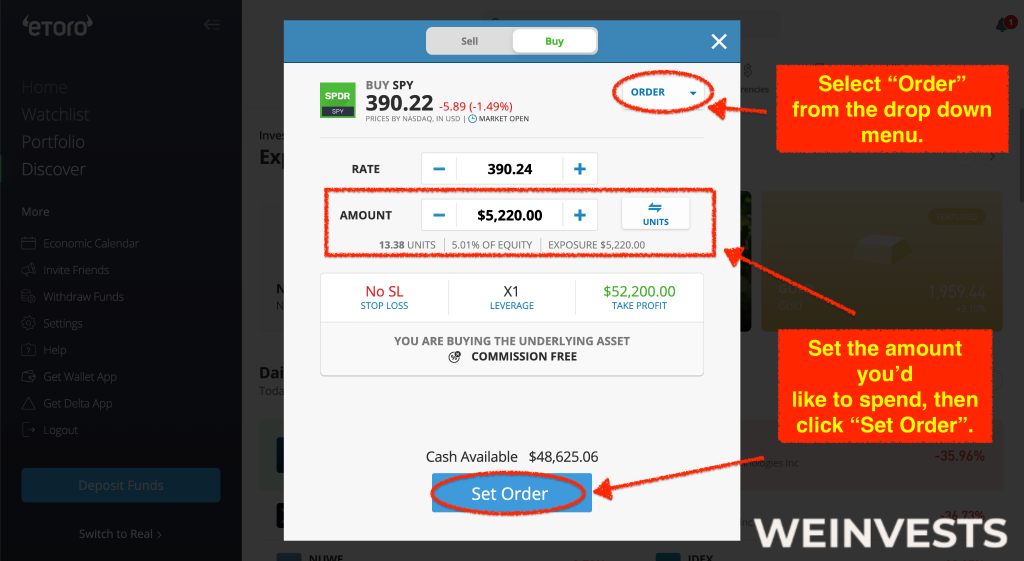

Step 5: Buy/Sell SPDR S&P 500 ETF Trust (SPY)

To invest in the SPY ETF, click on the “Trade” button on the SPY ETF page. A new window will appear, allowing you to specify the amount you want to invest and set any additional parameters, such as stop loss or take profit levels. Once you’ve entered the desired investment amount and adjusted any settings, click “Open Trade” to complete the transaction. Congratulations! You have now successfully invested in the SPDR S&P 500 ETF Trust (SPY) using eToro.

Market Risk

Even though SPY is an ETF tracking the performance of a market index, as with any other investment or financial instrument there are certain risks associated with this investment and one of the most common risks is the market risk. Market risk can impact the value of your investment due to changes in certain market factors such as a plunge in the stock prices in the basket of SPDR S&P 500 ETF Trust for various reasons. Furthermore, there is a risk of interest rates being higher and hence impacting the valuations of most of the stocks. In other cases, economic and geopolitical events might negatively affect the valuation of some of the companies such as the energy crisis in western countries due to the disruptions from the war.

These are just some of the market risk factors that can have an impact on the value of the SPDR S&P 500 ETF Trust, you will need to do a thorough analysis and research to identify all the associated risk factors to understand whether you are comfortable with bearing such risk after purchasing the SPY ETF.

Credit Risk

In general investments in stocks and ETFs are associated with low credit risk exposure since the risk is defined to be on financial instruments that have a probability of a counterparty failing to pay its obligations – examples are fixed-income instruments or over-the-counter (OTC) derivatives.

Although it might be considered an indirect credit risk for the investors in SPDR S&P 500 ETF Trust the risk of one or more of the companies not being able to pay their debt obligations which might lead to bankruptcy is a kind of a credit risk you should consider when performing your due diligence to invest in SPY ETF.

Liquidity risk

Given the fact, that SPDR S&P 500 ETF Trust is one of the largest and most famous ETFs out there the liquidity risk associated with the investment is theoretically very low. In practice as well if you look at the number of shares traded currently for the most recent business day it is reaching around 17 million shares of SPY for a single day. With this number of transactions in the market, there are almost no risks associated with investors being unable to convert their holdings into cash very quickly.

Nevertheless, liquidity may be affected by different market factors hence you have to be mindful that current or historical volumes might not happen in the future and do your analysis to verify the liquidity concerns before investing in any financial instrument.

Valuation Risk

One of the risks in valuation for the ETFs, in general, is the fact that during the trading day, the price in the market is determined by the demand and supply which might slightly deviate from the actual NAV of the fund, and from here we have the premium or discount to NAV. If you purchase based on the market price during the day you might pay up to 0.01% premium or receive a discount which was the number we saw for the current market. This creates the valuation risk of the actual NAV of the fund being too far from the market price.

Although the market is expected to be well-informed and efficient in trading certain behavioral aspects might cause some mispricing from time to time. Even though for a liquid ETF like SPDR S&P 500 ETF Trust it is not expected to see a mispricing that reaches a significant materiality, you should always perform your research and try to identify whether the market behavior might cause a significant premium or discount for the specific period.

Conclusion

SPDR S&P 500 ETF Trust is one of the first exchange-traded funds of its kind and one of the most popular that focuses on replicating the performance of the S&P500 index – the 500 largest US companies based on their market capitalization. The ETF has a relatively low expense ratio of around 0.09% and an annual dividend yield of around 1.6% that is paid quarterly. It has a large value of assets under management making it one of the largest ETFs globally.

The historical and current holdings of the SPY fund have been closely matched with the benchmark and thus the ETF was mostly able to deliver on its mandate of replicating the index performance as shown by history.

SPDR S&P 500 ETF Trust is meant for passive long-term investors who want to invest in value companies with the expectation of long-term capital appreciation. It is for investors who value the low expense rate of the ETFs and think that markets are efficient with the expectation that no active manager is able to beat the market.

As with any other investment, there are certain risks associated with SPY such as market, and credit, as well as some liquidity and valuation risks that need to be considered before making any investment decision.

FAQs

Why does SPDR S&P 500 ETF Trust track the S&P500 index?

Usually, each fund in the industry has a benchmark to which it compares its performance. Some of the funds, that are actively managed, try to beat the benchmark by taking directional views and trading actively based on their market expectation. Others such as SPY use a passive investment strategy and try to replicate the benchmark index S&P500 in this case without taking any directional views.

What did cause last year’s negative returns of the SPY?

It was caused by the overall economic uncertainty with high inflation rates, central bank rate hikes which cause lower valuations, and worries that those aggressive rate hikes may create a recession.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More