This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

iShares Core U.S. Aggregate Bond ETF (AGG) is an exchange-traded fund, which is an alternative investment instrument to similar mutual funds. AGG aims to track the performance of an index composed of all U.S. investment-grade bonds, namely – the Bloomberg US Aggregate Bond Index. It is a liquid fixed-income asset class, allowing investors to trade its shares similar to a usual stock. Like many others, it is a pool of bonds issued by various companies, offering a more diversified investment opportunity. It can be considered a more attractive alternative to comparable mutual funds, from related costs and liquidity perspectives.

Table of Contents

Characteristics, Performance Analysis, and Expectations

Characteristics

Launched in September 2003 and managed by iShares, AGG offers a very high-quality portfolio, with the below holdings:

- Nearly 70% of its assets are invested in AAA debt (the highest possible rating).

- The remaining 30% is invested in other investment-grade bonds

Instead of cherry-picking among various bonds issued by the government or individual companies, trading shares of AGG or other ETFs provides investors with exposure to-constructed bond portfolios. Meanwhile, the portfolio risk is substantially reduced through a higher diversification, while the costs related to such a single trade are much lower compared to multiple purchases of various bonds to construct a comparable portfolio.

Another important advantage characteristic of most ETFs is their low expense ratio. For iShares Core U.S. Aggregate Bond ETF it is merely a 0.04%, so the payable annual cost is calculated based on this ratio and the volume of the AGG shares you own. This fee is in the average range compared to most bond ETFs and is used by the fund manager to cover its operating expenses.

Currently, the volume of the net assets of AGG amount to around USD 86.8 billion, which includes all of its bond holdings, cash, and other financial instruments. This makes it one of the largest bond ETFs globally.

At the same time, AGG offers an attractive annual dividend yield of 2.32% as of January 2023, paid on a monthly basis. Thus, it is an attractive investment option to be considered by investors looking for index-linked bond portfolios offering good and frequent dividend payouts.

Generally, the ETFs are traded similar to usual company stocks, based on their price per share which is called net asset value or NAV in the case of ETFs. It is calculated by deducting the given ETF’s total liabilities from its total assets, which will result in the total net assets (TNA) of the fund. Then the TNA should be divided by the number of outstanding shares to show the current NAV at the opening or closing of the market each day. Thus below are key numbers for AGG:

- TNA amounts to USD 86.76 billion.

- It is distributed through its 10,000+ holdings.

- The number of outstanding shares is nearly 866 million pieces.

- The closing price of the last trading day was USD 100.28 per unit.

Performance Analysis

The ETF started the year 2023 positively with a +2.84% year-to-date (YTD) return. Indeed, it’s driven by the overall market rebound following the previous year-end drop and is based on some positive expectations of a slow-down in the inflation rate. Provided that the key benchmark indexes have been moving in the same direction and within a similar range of 1.8-3.2%, AGG’s above-mentioned performance can be linked to the general market trend.

It’s important to emphasize that ETFs like AGG are not targeting capital appreciation or share price growth, provided that they are fixed-income debt instruments, holding bonds issued by various companies. Instead, AGG is historically offering stable and good dividend yields, which are paid monthly. The dividend pay-outs are made on the basis of the incoming debt servicing proceeds received from the issuers, which are well-established and largely capitalized enterprises with solid business models with stable growth perspectives.

In fact, if we try to compare iShares Core U.S. Aggregate Bond ETF since its inception back in 2003 with the performance of the broader market and its main indices for the same time period, except for the exceptionally stormy financial year 2022 for the reasons we are all aware of, then we’ll witness notably lower volatility in AGG’s NAV or share price than in those key market indices.

This can be comforting for investors, who are seeking diversification of their equity-denominated portfolios, along with less price volatility involved and with additional dividends received on top.

Expectations

Based on AGG’s past performance and its above-mentioned characteristics, our forecast of this ETF for 2023 would be that it will continue to remain less volatile compared to the rest of the broader market.

Currently, the markets are extremely sensitive to the news on inflation and related national bank decisions on interest rates. However, such decisions have a more limited impact on AGG and similar bond ETFs, compared to the equity markets.

Additionally, we think that the inflation will stay with us for longer, however, it’s expected to slow down in 2023, which would be positive news bringing some stability to the markets in general.

If your country of residence is on BlackRock’s “green list” (which you may easily check on their website), then the best way forward would be that you open a direct brokerage account with BlackRock. This will enable you to start investing in their whole product range, including the purchase of shares in iShares Core U.S. Aggregate Bond ETF if you would decide to do so.

In case your country doesn’t appear on the list of eligible states of BlackRock, then there are two options: if you already are a user of a different online broker (Trading 212, eToro, Interactive Brokers, or else), you may try to search for finding the ticker symbol of AGG. Alternatively, the last door to knock on is your bank, addressing the question if AGG would be an eligible product to be traded through them.

If you’re looking to invest in iShares Core U.S. Aggregate Bond ETF (AGG), eToro is an excellent choice. As one of the best online brokers available, eToro boasts a solid reputation and offers a wide range of options for both beginner and professional traders. In this mini-guide, we’ll walk you through the steps to open an account on eToro and start investing in AGG ETF.

Step 1: Open your Personal Account

To begin, visit eToro’s homepage and click on the “Sign Up” or “Create Account” button. You’ll be directed to a registration page where you’ll need to provide your personal information, such as your name, email address, and phone number. You’ll also create a username and password. After submitting the form, you’ll receive a confirmation email. Click the link in the email to verify your account.

Step 2: Upload ID

Next, you’ll need to upload proof of identity to verify your account. This can be a government-issued ID, such as a driver’s license or passport. Log in to your eToro account, navigate to the verification section, and follow the prompts to upload a clear and legible copy of your ID. eToro will review your document and notify you when your account has been verified.

Step 3: Make a Deposit

Once your account is verified, you’ll need to fund it before you can start trading. Log in to your eToro account and click on the “Deposit Funds” button. Choose your preferred deposit method (e.g., credit card, PayPal, wire transfer) and enter the amount you’d like to deposit. Be sure to review eToro’s minimum deposit requirements and any associated fees before proceeding.

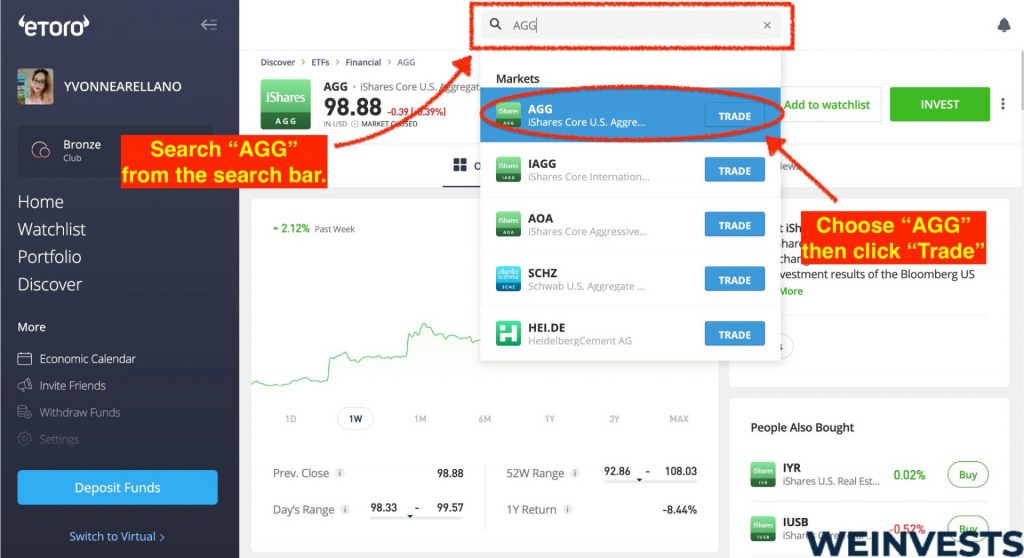

Step 4: Search for AGG

To find the iShares Core U.S. Aggregate Bond ETF (AGG) on eToro, use the search bar located at the top of the platform. Type “AGG” or “iShares Core U.S. Aggregate Bond ETF” and select the corresponding result from the drop-down menu. This will bring you to the AGG ETF’s trading page, where you can view current price data, historical performance, and other relevant information.

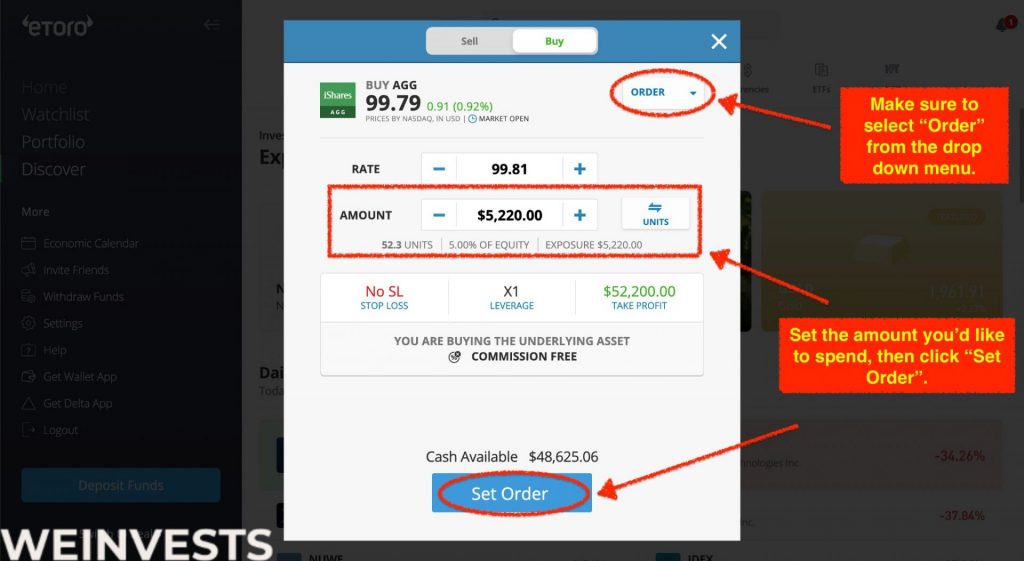

Finally, you’re ready to invest in the AGG ETF. On the AGG trading page, click the “Trade” button to open the order window. Here, you can specify the amount you’d like to invest, set stop loss and take profit orders, and choose between a market or limit order. Review your order details and click “Set Order” to execute the transaction.

Risks associated with AGG

The market risk is the overall risk related to multiple factors driving the financial markets, which may negatively affect your investment. Among such factors are the interest rates, sharp drops in ETFs share price (caused by an excess supply or strong decline in demand for the ETF or its major holdings), inflationary pressures or foreign exchange fluctuations, as well as adverse economic and geopolitical events which may have a negative impact on the financial markets.

Since the iShares Core U.S. Aggregate Bond ETF is mainly holding bonds issued by large companies it is affected by their overall financial performance, as well as any changes in their credibility and capacity to service their debt. Negative news related to companies and the bonds which AGG holds, such as deterioration in cash flow, missed targets of quarterly earnings, revision of announced financial estimates, lawsuits, etc. will certainly impact the ETF’s share price negatively.

Hence, prior to undertaking any investment, it is recommended to do your own small research for understanding the market-related risks, as well as other risks described below, which may have an adverse impact on your investments.

Credit risk is usually associated with the risk of the counterparty failing to pay its obligations. As a fixed-income ETF holding just bonds, AGG is exposed to multiple counterparties which may potentially fail to fulfill their financial liabilities partially or completely.

However, as we are talking about investment grade bonds only, nearly 70% of which hold the best possible – AAA rating, the probability of default of issuing corporations is minimal. Nevertheless, it is important to look closer into the ETF’s holdings for understanding the degree of the credit risk involved could be, prior to taking your final investment decision.

Generally, under liquidity risk, we should understand any circumstances which may create obstacles for fast and complete cash-out of your investments once you decided to do so. Liquidity risk related to large ETFs like iShares Core U.S. Aggregate Bond ETF provided its overall credibility, degree of high diversification, multimillion share trades per day, and many other factors are considered to be extremely low.

Valuation risk is associated with possible inaccuracies in the pricing of a given financial instrument. When considering ETFs, this type of risk is relatively low provided that ETFs are primarily traded through stock exchanges, where the price is determined by the relation of actual supply and demand for any given moment of time.

Nevertheless, there are still some internal or external events, which can impact the given ETF’s share price, depending on its underlying holdings. Still, particularly in the case of AGG and its solid holdings, the valuation risk is quite low.

Risk Summary

| Risk | Relatively Low | Average | Relatively High |

| Market Risk | – | – | x |

| Credit Risk | – | x | – |

| Liquidity Risk | x | – | – |

| Valuation Risk | – | x | – |

Conclusion

iShares Core U.S. Aggregate Bond ETF is an exchange-traded fund that tracks the Bloomberg US Aggregate Bond index as a benchmark. This ETF is owned and passively managed by BlackRock, therefore offering a very low expense ratio of 0.04%.

Although like with any other investment, there are different risks involved, however as AGG consists of only investment grade US bonds, it has a high ranking and is considered to be very liquid.

Nevertheless, given the probability of events that may negatively impact the financial markets, causing a partial or complete loss of the capital you may intend to invest in this or any other ETF, your investment decisions must be well-thought-through.

Frequently Asked Questions

1. Are bond ETFs the same as bonds and how are they traded?

Not really. Like any other exchange-traded fund, these ETFs are pooled investments consisting of various bonds, depending on the fund’s focus. Investors can trade bond ETFs like usual stocks through major exchanges.

2. Are bond ETFs a good investment?

Individual and institutional investors should allocate some part of their total capital to bonds depending on their risk tolerance, preferably through bond ETFs. These ETFs tend to be more liquid and cost-effective than bond mutual funds. There is a wide choice of bond ETFs available to pick from (U.S. Treasuries to investment grade corporates to junk bonds, etc.), so anyone with a special investment focus may easily find a suitable option to diversify their portfolio.

3. Does AGG pay dividends and if so, how frequently?

Like the majority of bond ETFs, AGG pays dividends on monthly basis. The amount of the pay-outs depends on the actual performance of the issuing companies during the last 12 calendar months, the size of the coupon, and other payments to AGG, etc. Hence, it is actually based on the interest income earned on the total holdings of the fund’s portfolio.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More