This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

The Fidelity MSCI Real Estate Index ETF (FREL) is an exchange-traded fund seeking to track the performance of an index consisting of U.S. real estate assets. More specifically, it’s following the MSCI USA IMI Real Estate Index as a benchmark. The shares of FREL can be acquired through the main U.S. stock exchanges where it’s listed and traded daily.

The fund incorporates several Real Estate Investment Trusts (REITs) as well as stocks of companies operating in the real estate sector. Thus, by purchasing FREL investors gain exposure to an already structured portfolio, instead of searching for individual REITs they may wish to add to their portfolio. Meanwhile, better diversification allows for risk and cost reductions.

Launched and managed by Fidelity since February 2015, the ETF’s total net assets (TNA) currently make up USD 1.6 billion. At the same time, FREL offers a good dividend yield of around 3.3% per annum, distributed to its investors every quarter. Hence, it may potentially be an investment option worth considering, while thinking of an income-generating real estate index fund.

In this article, we intend to highlight FREL’s main features, applied investment strategy, related risks, and possible benefits of adding it to your portfolio.

Table of Contents

Fundamentals

Essentially, the shares of Fidelity MSCI Real Estate Index ETF are traded like regular company stocks, buying or selling those at a market price – called net asset value (NAV) for ETFs. It is calculated by deducting the fund’s total liabilities from its total assets, arriving at the net assets. Then the ETF’s TNA is divided by the total number of its shares, resulting in the actual NAV at the open or close of the market for each trading day.

Currently, the key financial indicators of FREL are as follows:

- TNA is USD 1.57 billion;

- Distributed through 160 holdings (mainly REITs);

- Its top-15 positions make up nearly 53% of all holdings;

- The total number of shares is 21.9 million pieces;

- NAV is USD 26.85 (February 17, 2023).

The fund’s expense ratio is merely 0.08%, which is below the industry average of 0.37% for comparable ETFs. So, the annual cost payable for owning FREL’s shares is calculated based on this ratio and the volume held by the investor. This fee is charged for covering the operational expenses related to the management of the fund.

The current year started positively for the ETF, delivering a +8.6% year-to-date (YTD) gain in its value. Understandably, such a trend is matching with the overall market direction, which after an extremely turbulent and downward movement during 2022, saw some recovery earlier this year. However, given that the main indexes only improved in a range of 2.5-5%, FREL’s better results are comforting to see. Let’s take a closer look at the fund’s short to mid-term performance:

Change in %

1 month 3 months YTD 1 year 3 years 5 years

FREL (NAV) 1.6 6.93 8.6 -10.35 -0.02 7.34

It should be emphasized that according to its strategy, the Fidelity MSCI Real Estate Index ETF is targeting several fundamental investment goals at the same time, more specifically:

- Appreciation of invested capital;

- Distribution of dividend income;

- Diversification through real estate sector exposure.

By pursuing the above-mentioned goals, FREL is offering improved diversification to investors whose portfolios mostly consist of individual stock and bond titles. As a bonus, it also regularly pays dividends out of its earned proceeds.

If the fund’s overall performance of the last 8 years since inception is compared with the broader market, or more precisely with that of the key indexes for the matching period, then we will notice that except for the last year’s long unseen turbulent ride, FREL had a lower degree of volatility throughout. This fact may sound comforting for many investors, especially for those seeking better diversification of their stock and bond-concentrated portfolios, combined with the extra benefit of locking in a dividend flow for their investment.

Given the Fidelity MSCI Real Estate Index ETF’s historical performance and its fundamentals presented above, we believe that FREL will continue staying less volatile through the rest of this year and beyond, compared to the broader financial markets. The latter is still very sensitive to the news on macroeconomic policy decisions by national banks across the globe like rate hikes as well as inflationary pressures.

Our assessment is based on the fact that compared to a stronger impact on equity and fixed-income securities markets, such events have a more limited influence on REITs ETFs in general and FREL in particular.

Our forecasts conclude that the high inflation will unfortunately still last. Nevertheless, we expect the inflation rates to gradually decline during this year and in the future, keeping the policymakers like the FED, ECB, and other national banks away from having to raise the interest rates further.

Investment Strategy

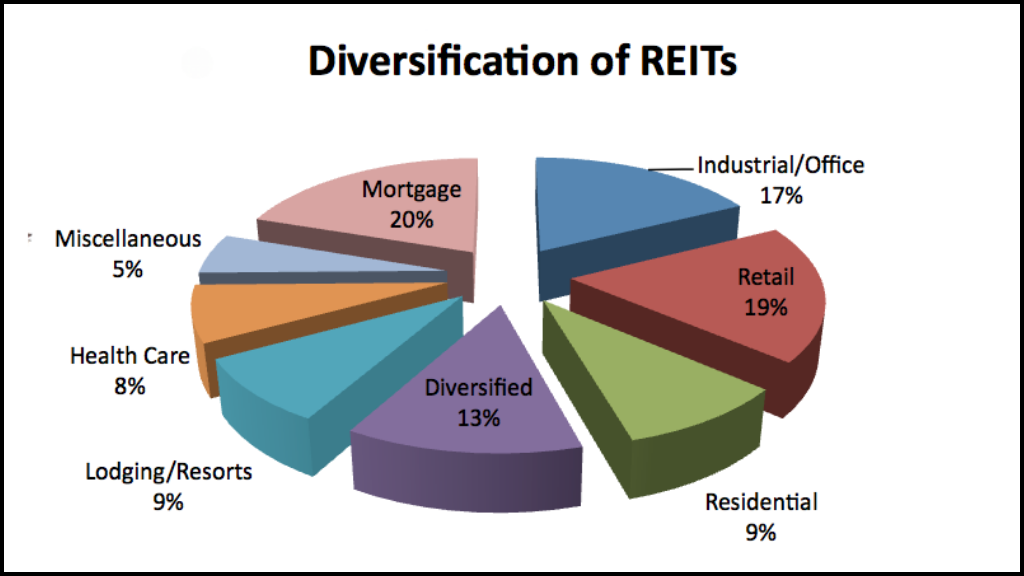

The main goal of Fidelity MSCI Real Estate Index ETF’s investment strategy is to provide its investors with access to domestic U.S. real estate REITs and stocks of selected companies active within the same sector. In doing so, the ETF tracks a benchmark, namely – the MSCI USA IMI Real Estate Index. FREL captures a broad range of the overall U.S. real estate arena, including many of the existing REIT types, particularly:

- Retail and industrial REITs;

- Residential and office REITs;

- Healthcare and other specialized REITs;

- Hotel and resort REITs;

- Mortgage and diversified REITs.

Furthermore, the fund may also hold individual company stocks which are operating in that space and engaged in consulting, development, research, management, servicing of properties, and other related activities.

As per its strategy, FREL invests at least 80% of its assets in securities included in the underlying index. Additionally, it’s using a representative sampling indexing strategy to manage the fund, which is a strategy that involves investing in a representative sample of securities that collectively has an investment profile similar to the index.

The selected basket of securities in aggregate is expected to have investment characteristics such as market capitalization and industry weightings, along with fundamental characteristics like yields and return variability, as well as liquidity measures similar to those of its benchmark index. Finally, FREL may or may not hold all of the titles included in the MSCI USA IMI Real Estate Index, according to its investment strategy.

Similar to other index-tracking ETFs, this fund is passively managed by Fidelity Management and Research Co., one of the leaders in the exchange-traded fund segment. Contrary to an active management approach, when engaged fund managers take investment decisions, the applied management style implies a merely passive tracking of the underlying benchmark index, which enables a dramatic reduction of the related costs for investors.

How to Buy in Fidelity MSCI Real Estate Index ETF (FREL)?

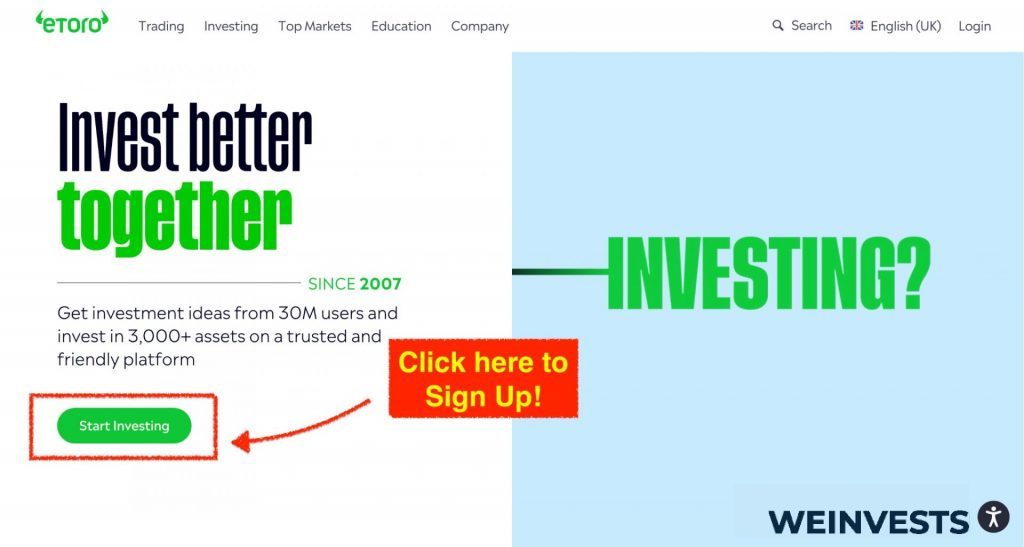

eToro offers a user-friendly platform with a wide range of options for both beginners and professional traders. In this mini-guide, we’ll walk you through the process of opening an account on eToro, making it simple and straightforward for you to invest in FREL.

Step 1: Open an Account

To get started, you’ll need to open an account on eToro. Visit the eToro homepage and click on the “Sign Up” or “Create Account” button. You’ll be redirected to the registration page where you’ll need to provide your personal information, including your name, email address, and phone number.

You will also be required to create a username and password for your account. Once you’ve completed the registration form, click “Create Account” to continue.

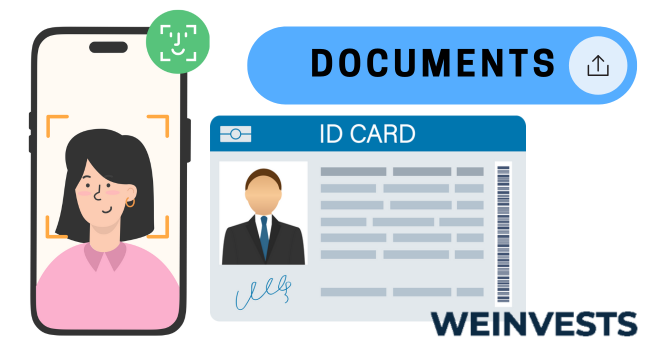

Step 2: Upload ID

After creating your account, eToro requires you to verify your identity by uploading a proof of identity document. This can be a government-issued ID, such as a driver’s license or passport. Navigate to the verification section and follow the instructions to upload your document. Make sure the information on your ID is clearly visible and up-to-date.

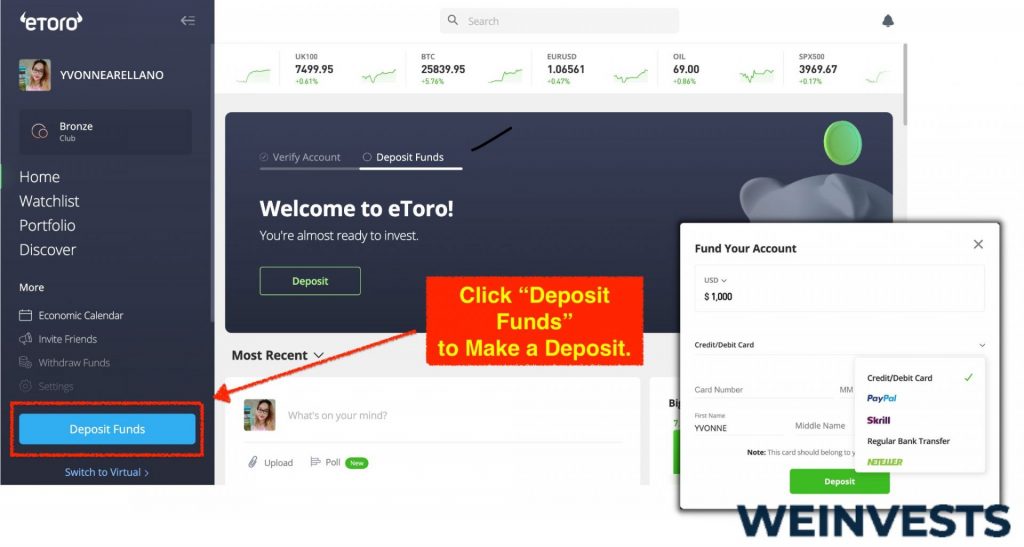

Step 3: Make a Deposit

Before you can start investing, you’ll need to fund your eToro account. Log in to your account and locate the “Deposit Funds” button, which is typically found in the left-hand menu or at the bottom of the screen. Click the button and choose your preferred deposit method, such as credit/debit card, PayPal, or bank transfer.

Enter the required information and the amount you wish to deposit. Keep in mind that eToro may have minimum deposit requirements depending on your location and chosen deposit method.

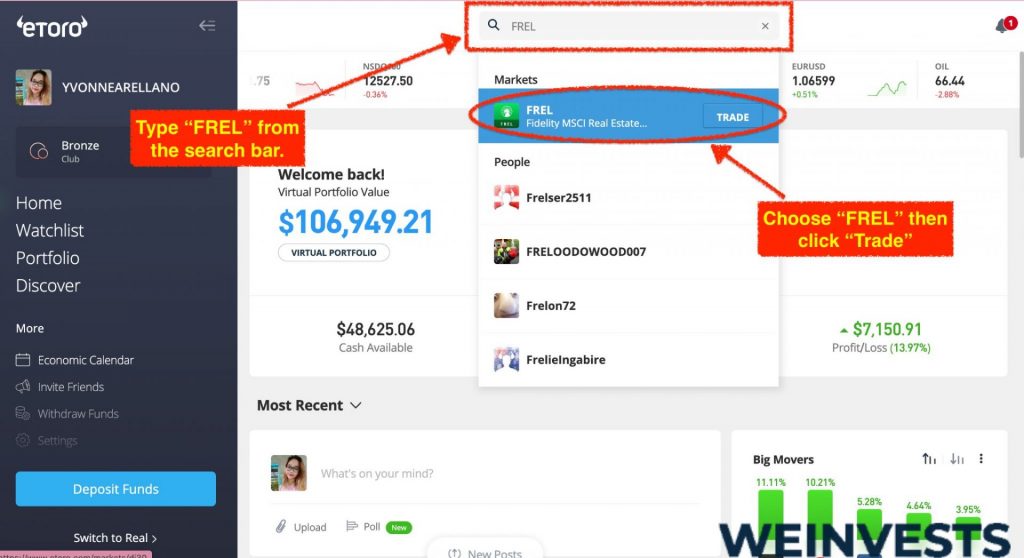

Step 4: Search for FREL

Once your account is funded, you can search for the Fidelity MSCI Real Estate Index ETF (FREL) on the eToro platform. Locate the search bar at the top of the page and type “FREL” or “Fidelity MSCI Real Estate Index ETF” to find the ETF. Click on the result to access the ETF’s information page.

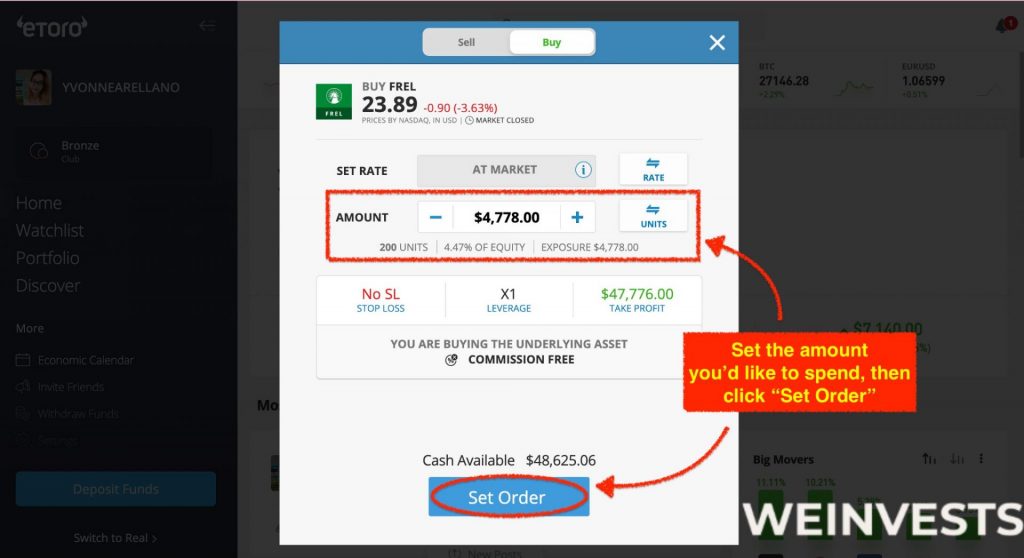

Step 5: Trade FREL

Now that you’ve found the FREL ETF on eToro, you’re ready to make your investment. On the ETF’s information page, click the “Trade” button to open the trade window. In the window, you can choose the amount you’d like to invest, either in units of the ETF or in a specific dollar amount. Adjust the settings, such as the leverage (if applicable) and stop loss, according to your preferences. Once you’re satisfied with your trade settings, click “Open Trade” to complete the transaction. Congratulations, you’ve now invested in the Fidelity MSCI Real Estate Index ETF (FREL) through eToro!

Risks and Considerations

It’s well known that various risks are an integral part of any investment activity. If triggered, these may hit your portfolio. Therefore, potential investors should be taking balanced decisions when acquiring any kind of securities, including FREL shares.

When compared to other ETFs holding equity or bond titles, the major risks are pretty similar, nevertheless, their impact on REITs is somehow different. The main risks related to REITs are:

- Market risk;

- Liquidity risk;

- Leverage risk.

While traded on stock exchanges like normal stocks and bonds, REITs are subject to price changes driven by supply and demand (market risk). Events like natural disasters, military conflicts, economic recessions, and interest rate hikes may negatively impact the price of FREL. Liquidity risk may apply if due to a sharp decline in demand, you’re not able to liquidate the shares you own quickly and at their full value.

Needless to say that prior to making up your mind and pushing the “buy” button, it’s strongly advisable to complete the homework by conducting your research in addition to this overview.

Conclusion

Launched in 2015, the Fidelity MSCI Real Estate Index ETF provides investors with access to U.S. REITs and companies directly or indirectly involved in the sector. Such may include firms actively investing in real property or providing related services like design, development, construction, management, or else.

Similar to stocks or bonds, FREL is to be traded through online brokerage platforms like eToro or others. Adding this ETF to classical portfolios dominated by company shares or bonds may have two fundamental advantages – better diversification and dividend earnings.

Although the acquisition of FREL comes with potential risks attached, this index-linked instrument is well-diversified among 160 various holdings.

Frequently Asked Questions

Who initiated FREL? Is it managed actively or passively?

This ETF is initiated and managed by Fidelity Management and Research Co. since 2015. The management approach applied to FREL is passive, which makes it possible to reduce the related operational costs and the fund’s expense ratio down to 0.08% per annum.

What is the benchmark index for FREL? Do the holdings of both have to fully match?

As an index fund, FREL is following the MSCI USA IMI Real Estate Index. According to its investment strategy, the ETF may or may not hold all titles included in its benchmark. It’s fixed, however, that the difference in holdings can’t exceed 20%, meaning that it has to hold at least 80% of the same titles as the underlying index.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More