This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

We made an entry into new millennium in style, haven’t we? There is a tendency to go virtual in many aspects of our lives. Finance has incorporated leveraged products, businesses go online, social networks hype cool lifestyles, and credits become more accessible to the point we need reality checks.

The result of this “virtualization” and reality checks have been marked as crises – we had the dot.com bubble and then again we had the MBS (Mortgage Backed Security) banking crisis, both of which went global and had an impact on many economies. There is also one more nowadays when the globe faces a pandemic, many governments went on and printed a lot of M2 money to keep equities (real economy?) above the super crash threshold.

Now, the governments placed laws and strict regulations so these bubbles cannot happen again, but COVID-19 cannot be regulated. China has tried to comb it very strictly in real life, but it didn’t work that well. So governments decided to “go virtual” and fix it with money creation.

This money without collateral (since the gold debasement thirty years before the new millennium) has been used. Is this money another virtual tool? Are we going to “pretend” there is value here because our governments promise us there is? Is this the seed for P2P finance or DeFi? It has been sparked by Satoshi Nakamoto’s paper.

Table of Contents

Blockchain to the Rescue

P2P Finance is not only a technology-based solution for the trust issue. It is also what we need today to cope with the mismatch between the physical asset bearer and the transaction speeds – which is almost instant. Nakamoto aimed to solve this using communications tech – have a scarce, divisible, instantaneous coin on the network itself. Whatsmore, transparency, certainty, and intrinsic value are attained with a public online ledger, and proof of work protocol that ultimately is tied to electrical energy.

This energy is needed to sustain the network and all the computations for encrypted transactions. Bitcoin network was born in 2008 and 2009 and with it P2P Finance idea.

Now, it is getting more and more technical as we open up different “proof” protocols, and networks based on blockchain technology. People do not like complexity. If common people do not understand, it is unlikely they can trust this finance business. Additionally, all the hacks, price volatility, exchange closures, and governments do not add up.

The adoption is slow, but some would say it should be, we need to address many problems before we can dive into it. Let’s start with the Trust issue.

P2P and DeFi – Complexity as a Trust Issue

Decentralized Finance (DeFi) asks for regulation. Sounds silly but it seems most experts agree about the biggest trust issue for P2P Finance. Certainly, this call for regulation has to be a new type of how we handle protocols and risk in the new age finance business. Firstly, it has to be simplified so people can understand DeFi, not all of us are tech-savvy. Although, young generations will be unavoidably involved with various technology, including “very cool” cryptocurrencies, and thus have a better ground understanding as they grow up. But adoption will not come until DeFi faces trust issues. Here is what is going on today.

DeFi Standardization – a Step Up or Down?

In 2023 many experts would like to solve the biggest problem in DeFi. Simplification will lead to trust but for simplification to spread and unify, we need standards. Who will make standards and does it mean centralization of a decentralized idea such as P2P Financing?

A DeFi platform that meets some standards assumes trust, but if we have many different standards it again creates confusion. Should we rank standards now? Nonsense. However, the big auditor companies are in a rush to get involved and impose the standards. Auditor companies such as Earn and Young, Delloite, and others. Hey, aren’t these in an already well-established link with governments and large corporations? If DeFi holds standards set by already “reputable” audit companies, it means the big three are generating business for themselves and serving as a proxy for government control.

This is already happening. According to core DeFi experts in the industry, an example of this process is The Ethereum Enterprise Alliance DRAMA working group.

One example of the DeFi standardization process is C4 CCSS. It is important to crypto exchanges. A security and risk standard that includes how wallets should be handled, how to check capital reserves, AML, accounts, and so on. Who meets this standard? Well, to date, it seems only one DeFi platform – Fireblocks.

Interestingly, the DeFi community has not really put a lot of attention to this. Yields from investing or lending are still more attractive topics. We put more attention to growth than protecting from the risks of losing it all. Silly but true. Can we then get together to find a collective responsibility solution for DeFi?

DeFi Protocols Standardization

The DeFi community can step up and bring to attention so every exchange adopts at least level 1 CCSS. Some experts call to even put a red flag on every exchange not meeting standards, but before regulators or audits get there first. It looks like the next few years will be a fight for gaining trust.

But there is also one more main concern for DeFi. Decentralized Finance and P2P investing lending as the primary functions have risk management issues. If it is decentralized and autonomous, there is no need for risk management, right? Well, the DeFi experts that see the bigger picture disagree.

CeFi ( Centralized Finance) risk managers are in need, as seen by the number of job posts for this position. DeFi is devoid of such job posts with a few exceptions such as in the AAVE lending/borrowing protocol. Risk management means a ruleset, a procedure like for airplane takeoff. If you manage finance, you also need to manage risks, it is an unavoidable part of it. At least that was a lesson learned long ago. These rule sets applied by every platform will perform much better since they hold the patchwork from previous exploits, there will be no room to repeat previous mistakes. Yet, it is up to the DeFi community to address the importance of risk management, as a preventive move.

DeFi P2P Lending Investing – First Steps

We think that the best first step should be the one that addresses your safety of funds. After all, we have discussed it as the major concern in DeFi. For this purpose, you should do research and have a reference point about how secure each platform is on the internet. Comparison portals such as DeFiSecurity.com can help with this.

Here you can just go to the list of the most secure portals and their ranking according to the score called PQR. You will see not only the names of the platforms where you can get involved but also get details about DeFisafety ratings, procedures, supported blockchains, and types of DeFi business (decentralized or centralized platform, exchange, provider, lending, lottery, etc). This will help you to see what are the safest platforms that align with your idea of investing. We especially like the detail of the work this independent rating organization has done for the community, for free.

DeFiSecurity has standardized how the platform assessment is done. Each platform score is a sum of several security categories that each contributes to the score. How these categories are rated is also disclosed. Simply, if a platform passes or partly passes that security category, a percentage score is calculated.

Each category asks critical questions. For example, In the Admin Controls category the question “Is the type of smart contract ownership clearly indicated?”. So the score also considers transparency at the same time.

Once you pick a high-score platform, open up their website and do research about what they do. Most established platforms feature advanced websites and presentations. If it is missing and you are not sure what you see, try to find a video tutorial for that platform on youtube. You will learn a lot about DeFi along the way too! If you are curious about DeFi, you will enter a very immersive finance world that will hook you up for days. Aside from DeFisafety, check out NEXTY and Crowfund Insider.

P2P Finance Advantages and Disadvantages

Now, when you get involved in any way, be it staking, yield farming, lending, or investing, always keep in mind that you are very early in this finance business. As such, it has pros and cons that we are about to present and you will have a bigger picture if it is for you.

Cons:

According to reports, the total value locked in DeFi protocols reached $62 billion as of January 30th, 2023. However, some P2P DeFi platforms have faced challenges in providing sufficient liquidity, leading to slow loan processing times and higher borrowing costs. A recent study by Binance Research found that the average loan processing time for P2P DeFi platforms was around 24 hours, compared to just a few minutes for centralized lending platforms.

The regulatory landscape for P2P DeFi is still evolving, with some countries imposing restrictions on DeFi activities. For example, China has recently imposed a ban on financial institutions from providing services for cryptocurrency transactions. According to Deloitte (one of the big auditors we mentioned), the regulatory environment for DeFi will be a key factor in determining its future growth and success.

Platforms get hacked, however, it is very rare to see such an event for the platforms with a high PQR score from DeFiSafety. To address these security concerns, P2P DeFi platforms should implement robust security measures, such as multi-signature wallets and secure storage solutions, to protect users’ funds. The crypto industry has lost close to $3 billion across 125 hacks as of October 2022.

P2P DeFi platforms are still facing scalability issues, with many protocols experiencing congestion during periods of high demand. Solutions such as sharding and layer 2 solutions (faster, smaller transactions on top of the blockchain ledger as layer 1) will be critical for DeFi to reach its full potential.

Pros:

P2P DeFi has the potential to increase financial inclusion, particularly for individuals in developing countries who lack access to traditional financial services. According to a report by the World Bank, around 1.4 billion adults worldwide are unbanked, and DeFi has the potential to provide financial services to these individuals.

P2P DeFi platforms use blockchain technology to create transparent and immutable records of transactions, which enhances trust and reduces the risk of fraud. The transparency and accountability of DeFi protocols will be critical for their success and adoption.

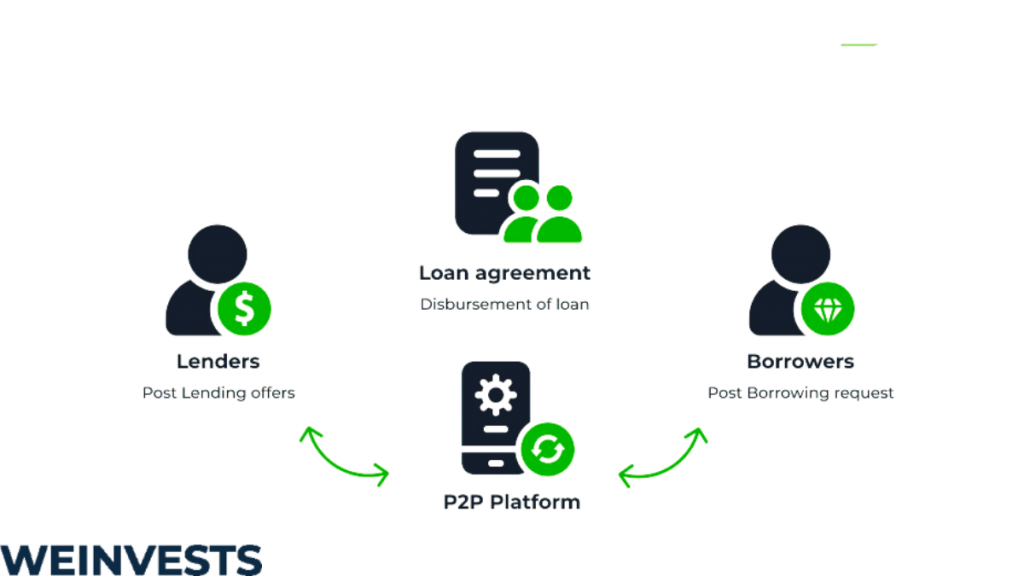

P2P DeFi eliminates the need for intermediaries, reducing costs and increasing efficiency. P2P DeFi protocols have the potential to disrupt traditional financial services, offering more accessible, efficient, and cost-effective financial services to users.

P2P DeFi can offer higher yields compared to traditional savings or investment products, making it an attractive option for savers and investors. The average yield on DeFi protocols reached over 15% in 2020, compared to just 2% for traditional savings accounts. Check up-to-date yield rankings for lending on defillama, for example.

How to Invest P2P Lending?

eToro has built a strong reputation and offers a wide range of options for both beginners and professional traders. In this mini guide, we’ll walk you through the process of opening an account on eToro and investing in P2P Lending.

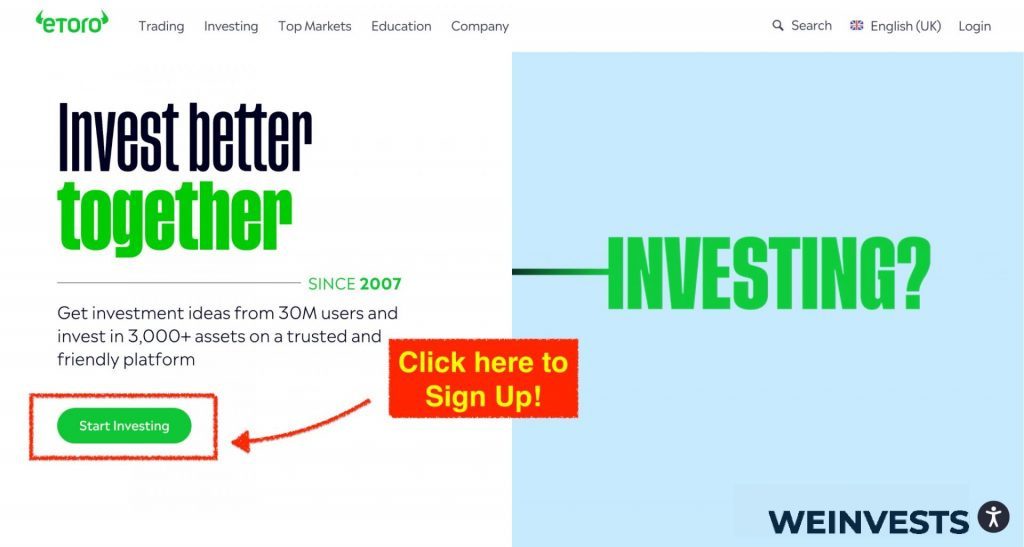

Step 1: Open your Personal Account

To get started, visit eToro’s homepage and click on the “Sign Up” or “Join Now” button. You will be directed to the registration page, where you’ll need to provide your personal information, such as your name, email address, and phone number. You will also need to create a username and password. After filling out the required information, click on “Create Account” to complete the registration process.

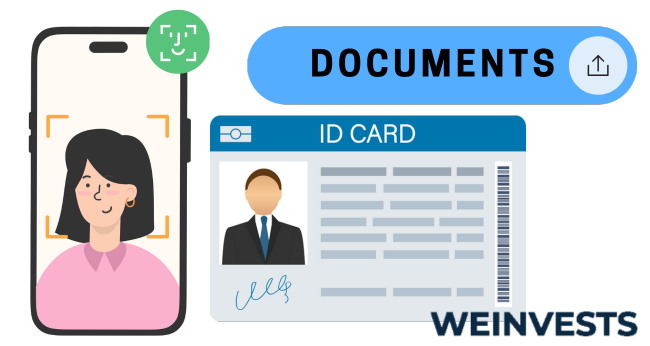

Step 2: Upload ID

Before you can start investing, eToro requires you to verify your identity. You will need to upload a clear and legible copy of your government-issued ID or passport. This is a crucial step to ensure the security of your account and to comply with anti-money laundering regulations.

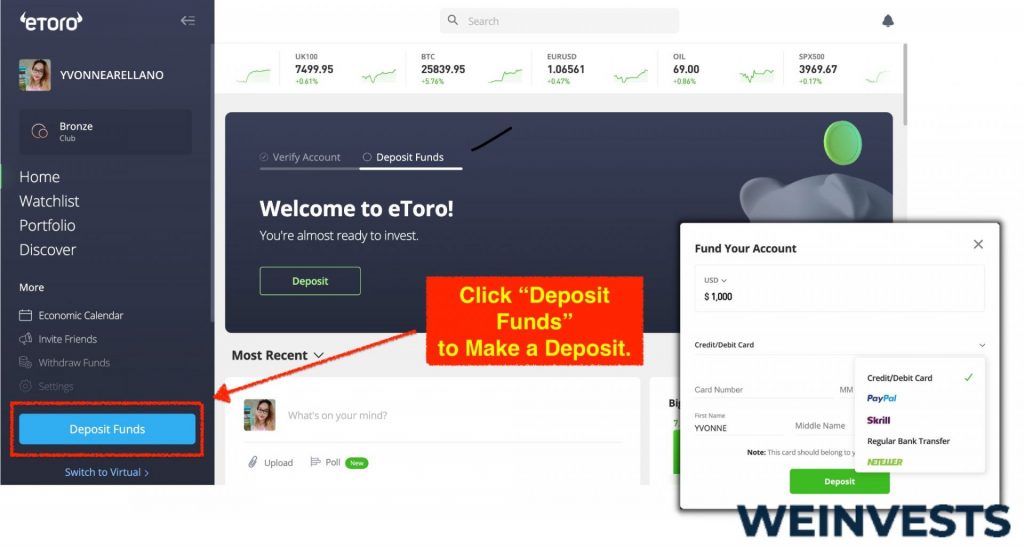

Step 3: Make a Deposit

Once your account is verified, you’ll need to fund it before you can begin investing. To do this, log in to your eToro account and navigate to the “Deposit Funds” button. eToro offers several funding options, including credit/debit cards, PayPal, bank transfers, and more. Choose your preferred method and follow the on-screen instructions to complete the deposit.

Step 4: Search for the P2P Lending platform you want to Invest

Now that your account is funded, you’re ready to search for P2P Lending Investing opportunities. To do this, log in to your eToro account and use the main search bar located at the top of the platform. Type the name of the specific P2P lending stock you’re interested in, and the search results will display relevant options for you to explore.

Conclusion

In conclusion, the world of Decentralized Finance (DeFi) and Peer-to-Peer (P2P) lending and investing is rapidly evolving, with great potential to transform the traditional finance industry. However, with its growth come challenges such as trust, complexity, and risk management. To overcome these obstacles, the DeFi community must work together to establish and adopt standards, prioritize security, and promote transparency.

As we move forward, it is essential for individuals interested in DeFi and P2P finance to conduct thorough research and use reliable sources to evaluate platforms before investing. By focusing on the safety of funds and understanding the advantages and disadvantages of this emerging sector, investors can make informed decisions and contribute to the development of a more accessible, decentralized financial system.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More