This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Cardano has got to be one of the most well-thought-out cryptocurrencies out there.

The market capitalization of Cardano is currently at over $16 billion. The company’s native token, ADA, has also been growing in popularity due to its growing use cases. Recently, the network announced that it has added a new feature to its blockchain that makes it easier to perform transactions.

The year 2022 has not been an ideal one for cryptocurrencies. For instance, the price of ADA has been fluctuating between $0.45 and $0.523 during the last seven days. After hitting a high of $1.60 in January, the altcoin started to trade at lower levels.

Despite the negative market trends during the beginning of March, Cardano was able to bounce back and maintain a positive outlook. However, after it breached the $1.20 mark, the price of the altcoin started to fall.

Is this an accumulation zone indication for Cardano or the beginning of a further bearish fall?

Read on to find out more.

Table of Contents

ADA Price Overview

ADA Price Prediction

2023

Through peer-reviewed research, Cardano was built as the first blockchain platform that can be built with the necessary security measures to protect the data of billions. It is also capable of supporting various global systems.

A steady rise in prominence is needed for Cardano to maintain its position as one of the most prominent cryptocurrencies in the world. In such an optimistic scenario, the price of ADA could reach as high as $1.1308.

If the bears prevail, the price of Cardano could fall to around $0.5993. On the other hand, if the selling and buying pressures are balanced, the altcoin could be at around $0.7555.

2024

The increasing number of developers and the growing popularity of Cardano could help boost the company’s market share. This would also help supplement the network’s planned initiatives.

If the broader market goes through a potential regulatory or financial crisis, the altcoin could drop to around $1.0416. Although the regular price of Cardano could still reach $1.5423, it would be important to avoid getting carried away.

2025

If the network implements an open voting system by 2025, it could affect the price of the altcoin. This could cause it to lose some of its traders. However, in the long run, the price could still reach around $2.6103.

If Cardano can successfully implement various projects and initiatives, the price of the cryptocurrency could reach a maximum of $3.4952 by 2025.

2030

Experts at a leading financial firm predict that the price of Cardano could reach a maximum of $5.84 in 2030. They also believe that the altcoin will continue to grow.

ADA Price Analysis

The above ADA price analysis chart is set to a daily timeframe.

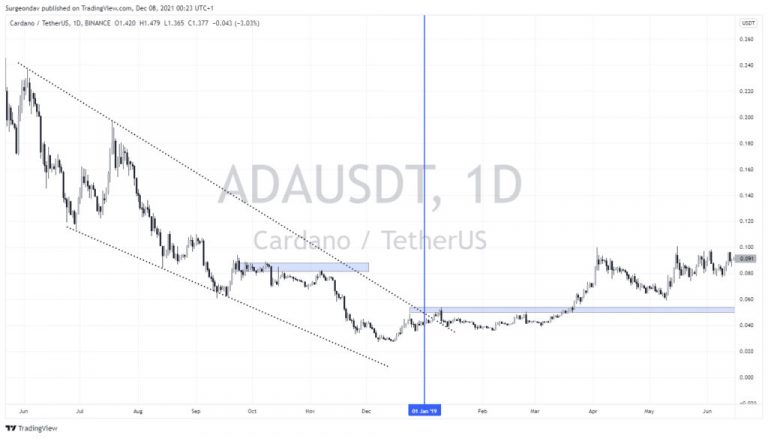

Towards 2018 Q4, ADA moved in a falling wedge pattern with strong bearish momentum.

2019 opened with a consolidation that lasted for about three months before breaking out of the range of $0.04 – $0.05.

After it broke out of the range, the price moved about 85% into the $0.1 upside price.

The new high took out the last significant high, suggesting that the bearish trend was over, and the market is now bullish.

Confluence with the moving averages indicators depicting a golden cross also suggested there might be a change in trend.

Q1 & Q2 2020

ADA’s $0.1 high consolidation continued and created liquidity in the market. This liquidity sponsored the sell that moved and broke the market structure to the downside, hitting an ATL of $0.01.

Before the sell broke, while it was rallying down, it made reactions at the already marked consolidation zone on Nov. 2018, which acted as a support (now a resistance), pushing the price further down to $0.03.

ADA then found support at $0.03 and pushed the price back to $0.07 at a supply zone created on July 13.

This supply outweighed the demand in the market and sponsored the sell move down to $0.01.

The market made this all-time-low on March 20, 2020 and tried hard to buy but got resisted for a few days but finally created a support zone, now acting as a resistance zone.

This resistance zone marked the end of Q1 for 2020.

- In the early weeks of April, the price: broke out of the resistance

- Retested the zone as a support

- Held the support

All of these further drove ADA by 55% to the $0.05 upside price, the same zone created since Nov. 2019; this zone has gotten the price to respect it anytime it passes this zone.

As is usual, the ADA price consolidated for a few days at this zone, sold a little to the downside to gather demand strength at the $0.04 demand zone, which worked and pushed the price 55% into the upside at the $0.08-0.09 zone, and mitigated the last high indicating a bullish trend confirmation.

After the price got here, it created a bull flag price ranging from $0.08 to $0.09 for weeks. This bull flag is a continuation pattern, which indicates that the price was still bullish.

The market is just resting to gather more demand strength to continue its move to the upside, and it did after retesting 0.070 IPA with a long wick.

The bull flag ended the Q2 of 2020, which is a good sign that the price would be bullish for the next quarter.

Q3 & Q4 2020

2021 Q2, which ended with a bull flag, sponsored a 51.7% increase, driving the price to $0.13.

Again, the price consolidated as a bull flag, making a 21.44% move and jumped to $0.155.

With the above-described trend, ADA appreciated 755% in six months from an ATL.

Now, the question is if the ‘buy’ would continue, or the bear season is about to start.

The RSI, which is currently trading around 72 and 75, creating a resistance, indicated that the market is overbought, and so ‘sells’ might soon gain ground, which it did before the price found support at a bull flag zone, driving the price to $0.29 on January 1, 2021, after breaking all past highs.

Q1 & Q2 2021

The year started with a 3-day consolidation that drove ADA’s first most extended buy to almost $5 on February 27, 2021.

Upon hitting this ATH, ADA formed a channel-like consolidation leaving trendline liquidity with a projection that price would return to mitigate the liquidity and continue the buy from an order flow zone.

2021 Q2 started with a breakout from the channel-like consolidation, driving the price to hit around $2.45.

But the price encountered a solid bullish rejection upon making this debut, returning the price to the buy zone.

The zone formed a support that held and kicked the price back up to $1.85.

At $1.85 it got resisted back to the buy zone that sent it and could not break through the zone again, further confirming that buy zone as a strong support.

The buy zone again sent the price back to the resistant zone, which tested twice and resisted the price back to the support.

The support got tested twice yet again before sponsoring the most extended buy in ADA history.

These support and resistance zones were the strongest so far, as the resistance zone and support zone were tested three and four times, respectively, before breaking out in Q3.

Q3 & Q4 2021

After ADA’s Price broke out of the long-held resistance zone, leaving a ‘behind zone’ that the market would later return to retest, ADA hit a $3.10 new ATH on September 2.

Since then, the price has been maintaining a bearish structure, as it first came to test a valid order block zone because it took out liquidity twice, after which a controlling supply zone was created still unbroken to date (December 9).

This supply zone has been tested three times, creating a strong resistance zone with a corresponding support zone below created from a past demand zone.

After it was tested twice, this support zone could not hold the sell that came its way as the price broke further to the downside to the 1.19 price zone.

Q1/Q2 2022

In 2022, the average price of ADA was lower than its minimum during the peak of the market in 2021. The bear market that occurred following the November 2021 market boom has affected Cardano more than other top cryptocurrencies.

Despite the negative market trends, Cardano is still expected to continue growing. Although its trading volume has decreased, it still has a strong following.

Three paragraphs on Cardano

Cardano is a layered (settlement and computation layers) smart contract supportive decentralized blockchain network that aims to improve Bitcoin’s PoW scalability, interoperability, and sustainability with its ouroboros PoS protocol.

The blockchain is composed of two layers: the Cardano Settlement Layer and the Cardano Computational Layer. The former allows peer-to-peer transactions to take place within the network. The latter, on the other hand, acts as a bridge between the smart contracts and the CSL.

Unlike the traditional PoS algorithm, Cardano uses a complex version of the PoS called the Ouroboros PoS. Unlike the conventional PoS, the Ouroboros system creates timelots called epochs. Each epoch has a slot leader who gets to perform block creation. This method helps reduce congestion and increase the efficiency of the network.

Cardano is run by

- Cardano Foundation: Promotes Cardano development and innovation

- IOHK: Works on Cardano project until at least 2020.

- Emurgo: Dedicated to bringing new organisations.

ADA is Cardano’s native token; for staking and gas payment.

ADA features:

- 45 billion total supplies

- Staking rewards is 4.5% APR; no lockup or unlocked period

- The minimum staking threshold is just one ADA

- Flexible staking and reliable reward.

- ADA holders stake about 70% of the circulating coins

- ADA in over 3000 staking pools.

What factors affect Cardano’s Price?

In the fast-paced world of Cardano, trading time waits for no man. This blockchain digital asset has made waves over the years in the financial market news due to its high growth speed. While some are still pondering the fundamentals and legitimacy of this currency, now is the time to buy the cryptocurrency coins as financial predictions are showing price increases in ADA.

Other cryptocurrencies can also affect the price of Cardano. The short-term fluctuations of the currency are mainly influenced by the sentiments of its traders. In the case of Cardano, the price will be influenced by the interest of its potential buyers.

Whales can also manipulate the price of a coin. If a large amount of ADA tokens are held, this will increase the demand for the coin, which will cause the price to increase.

While in the long-term, the price is mainly affected the technologica…

It is important to analyze the performance of different cryptocurrencies against one another to determine the true growth of the altcoin. For instance, Cardano is currently in the 8th position with a market capitalization of over $16 billion. It is expected to continue growing and move up in the rankings

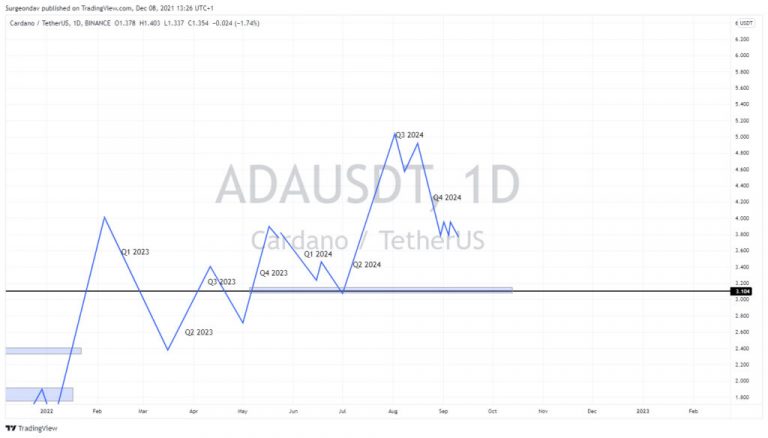

Long-term price predictions for Cardano indicate a fall in price past $2.30 in 2023. However, in 2024, Cardano is expected to start with a bearish move following the 2023 playout and then turn bullish to a new ATH hit of $5.

In summary, Cardano is expected to gain value. Now would be the best time to buy the token as the coins are trading at a price level.

Where to Buy Cardano?

Just like any investment, it is of paramount importance to know the right place to invest your funds. In addition to that, the crypto world is still new and risky hence you would need to make well-informed decisions before making investments. You desire a site more secure, more reputable, and reliable to not lose your hard-earned money. Additionally, you have vast trading platforms and exchanges to choose from.

This trading platform can give you much-needed peace of mind after making such a risky investment. Etoro is a reputable and reliable trading firm and would assist you in meeting your cryptocurrency investment goals.

Step 1: Open an Account

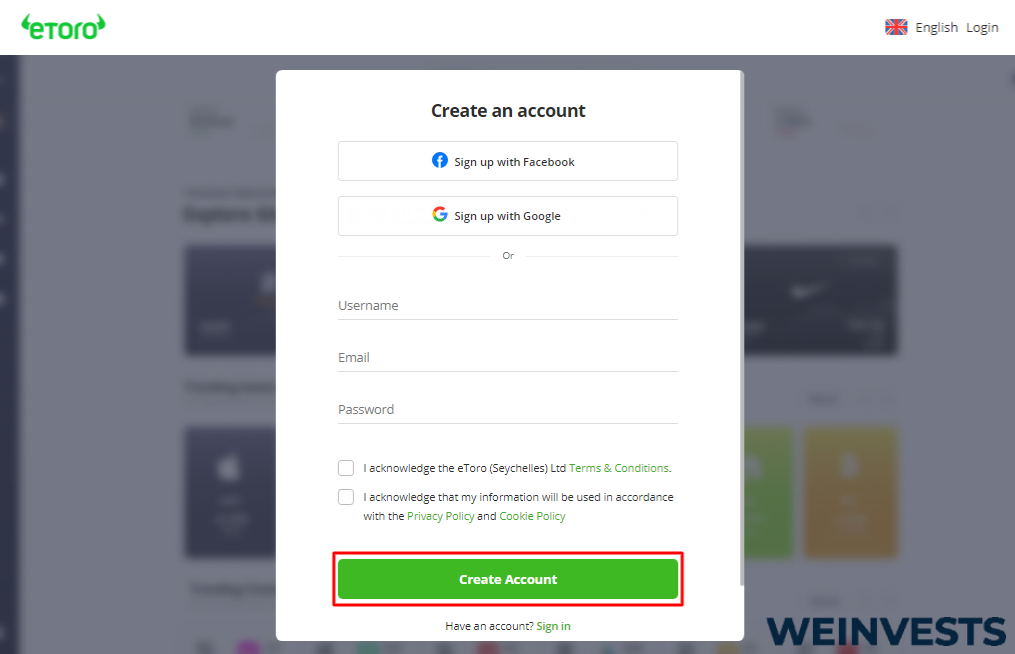

The process to buy Cardano on eToro begins with you going on the eToro website to open a new trading account.

Enter all your data required to open a new trading account on an electronic form provided. Before submitting your information for review familiarize yourself and accept the provided Terms and Conditions as well as privacy policy.

Finally, click the “Create Account” button.

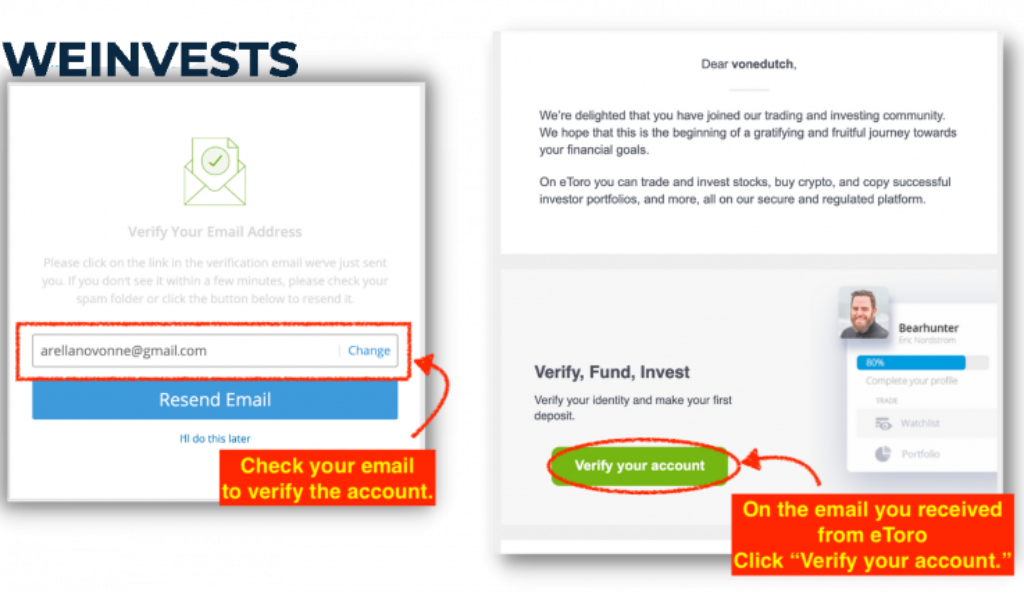

Verify your account, go to your e-mail and open eToro’s e-mail verification and click “Verify your account”:

Step 2: Upload ID

Next, verify your account by uploading both proof of identity and proof of address and wait for the eToro team to verify your documents. You will be required to fill out the questionnaire to assist eToro custom making a service package for you. Some of the information asked includes your trading experience, financial liquidity, investment goals, and accepted level of risk just to mention a few.

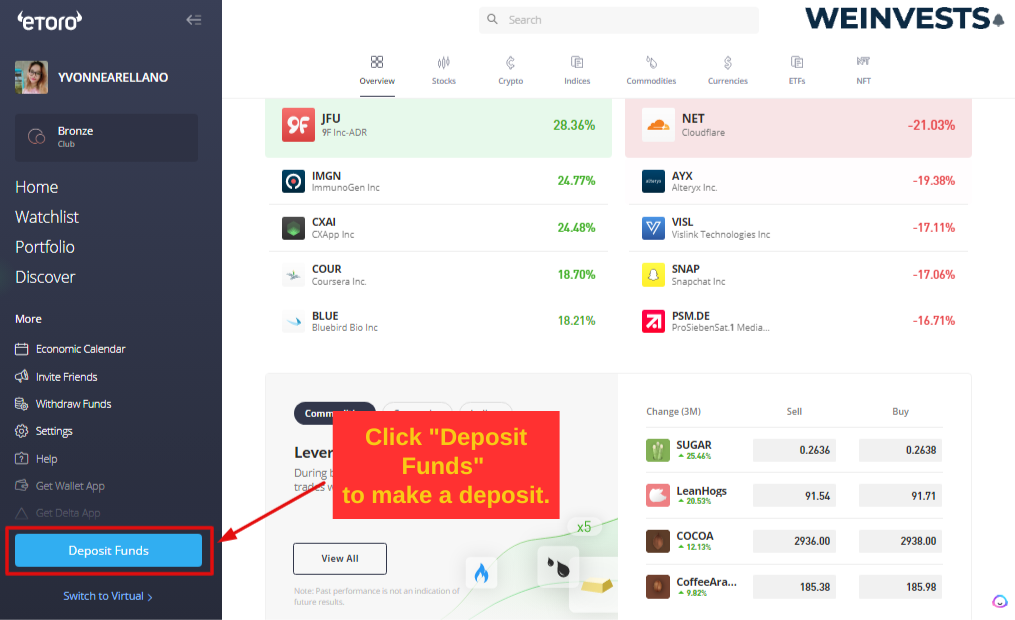

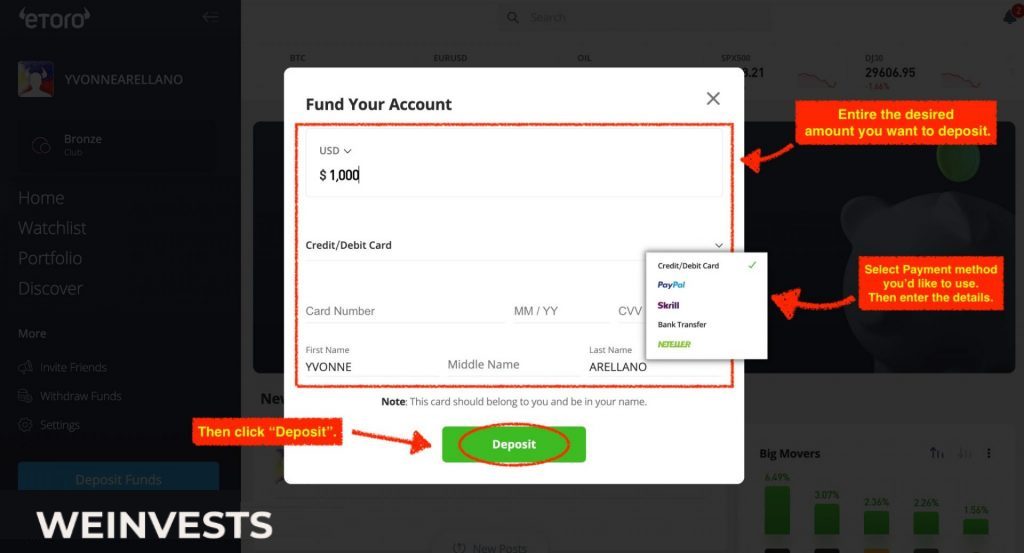

Step 3: Make a Deposit

Once your account is verified, you can then deposit funds into your trading account.

eToro has several payment options to choose from, select one which suits you well.

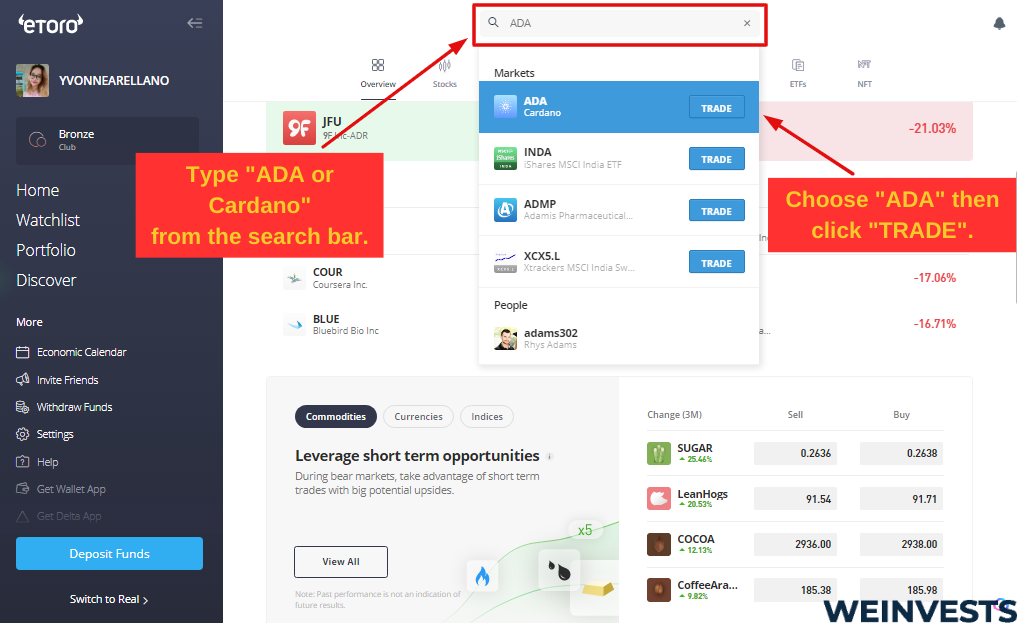

Step 4: Search for Cardano

After funding your trading account, search for Cardano on the cryptocurrency market.

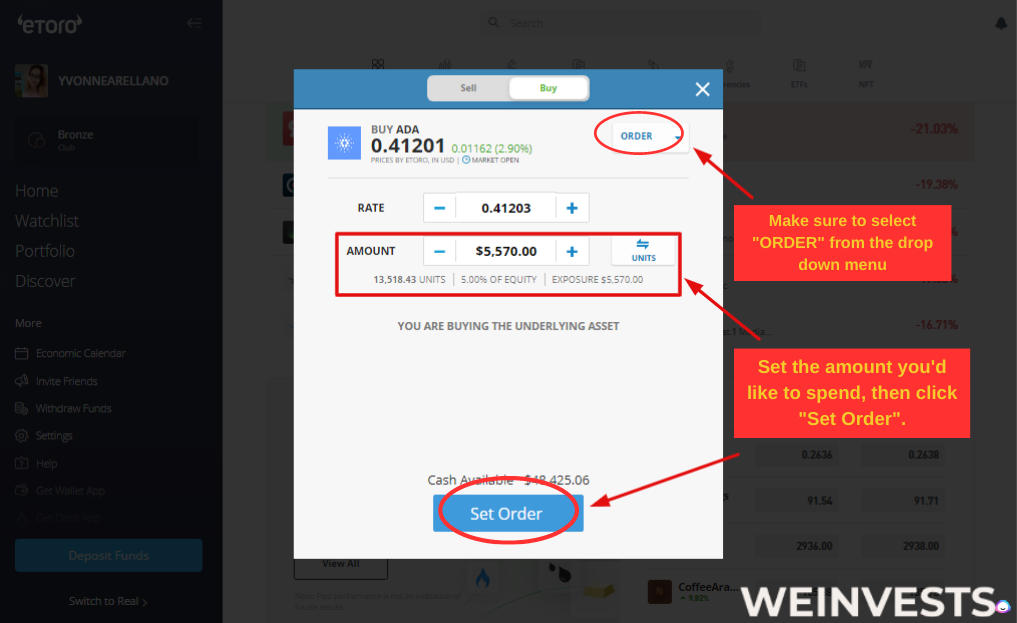

Step 5: Trade Cardano

After the search, click “Open trade” to make your investment.

FAQs

Will ADA fall below $1?

As of December 9, 2021, the ADA live price charts show preparation for some sidewards trading before a very likely bullish consolidation run despite its recent bearishness.

In the worst-case scenario, ADA will retest the solid support at around $1.09 to $1.2 it’s held since March, but it is doubtful to fall below $1; not with Cardano’s new partnership and constant technology and innovation improvement.

Even if it happens against all odds, you can be sure of an immediate recovery to hit a new ATH within record time after such a fall.

Disclaimer: Cryptocurrencies are highly volatile; only trade what you can afford to lose.

Will Cardano reach $3 before 2023?

‘No’ is the short answer.

Since dipping below $2 in November 2021, Cardano has hit strong resistance at $1.4 and $1.79, respectively. People are getting scared of holding their ADA token past that price level.

Until ADA can form strong support at $1.4, it’s unlikely to break its $1.79 resistance.

The chart doesn’t indicate an immediate significant short-term bull run preparation, and thus, ADA is unlikely to end the year at above $2; therefore, ADA hitting $3 before 2023 is a dream too big to come true.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More