Pros

- City Index offers a broader range of tradable assets than other similar brokers. However, with a special focus on equity CFDs.

- The firm’s operations are supervised in three tier-1 jurisdictions making it one of the safest and lowest risk brokers for trading forex and CFDs.

- Vast array of research tools and educational resources to help clients improve their trading skills.

- Fixed and floating spreads available to traders.

- Both fixed and floating spreads are available to traders.

Cons

- City Index portfolio is limited to CFDs and forex.

- Starting a new workspace on the trading platform (WebTrader) can be tiresome as widgets has to be arranged manually.

- Low leverage ratios (30:1) which result in lower gains from successful trades.

- Accounts dormant for 24 months and more is charged an inactivity fee of $15.

- The company provides less video content on market research than other similar brokers.

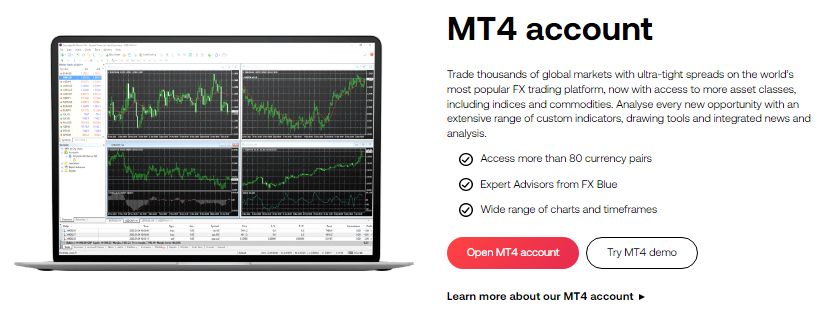

- Broker is still using the older MetaTrader 4 (MT4) trading software. It is yet to launch the latest MT5 which supports advanced functions like future trading and uses cloud storage to conduct backtesting and run strategies.

| 💻 Trading Platforms | Web Trader, AT Pro, and MetaTrader 4 platforms |

| 📞 Customer Service | 24/5 support via phone, email, or online chat |

| 🎁 Promotions/Bonuses | Welcome bonus, refer a friend bonus, loyalty rewards, etc. |

| 🛡 Regulation | Regulated by FCA in the UK; also regulated by ASIC in Australia and MAS in Singapore |

| 💵 Deposit/Withdrawal Methods | Various payment methods; minimum deposit $100; no withdrawal fee |

| 📊 Spreads/Commissions | Variable spreads depending on the instrument and market conditions; commissions from 0.08% (shares) to 0.5% (cryptos) |

| 🔒 Security | Segregated funds; SSL encryption; firewalls; anti-virus software |

| 📚 Education/Resources | Webinars, videos, articles, etc.; economic calendar, market news, market analysis, etc. |

| 📱 Mobile Trading | iOS and Android app with all Web Trader platform features and functions |

| ⚡ Execution Speed | Fast and reliable execution with low latency and minimal slippage; various order types |

| 🔧 Trading Tools/Indicators | Moving averages, Bollinger bands, Fibonacci retracement, etc.; custom indicators and alerts |

| 🌍 Country/Region Availability | Over 180 countries and regions |

| 💰 Account Minimum | $100 for live account; free demo account with $10,000 virtual funds |

| ⚖ Leverage/Margin Requirements | Up to 30:1 leverage on forex and CFDs |

| 📈 Asset Selection/Market Access | Over 12,000 instruments across forex, indices, shares, commodities, cryptocurrencies, options, ETFs, etc. |

City Index started life in 1983 as a spread-betting company before venturing into Contracts for Difference (CPD) trading in 2001 and Forex (FX) in 2005. Although the company originated and has its headquarters in the United Kingdom, it has grown from there to become a global trading platform for traders. Currently, the multi-asset broker operates in the UK, Australia, Singapore, Shanghai, United Arab Emirates and over a hundred more countries. City Index was founded by two traders, Chris Hales and Jonathan Sparke. Now, it is part of the holdings of the financial services giant, StoneX Group Inc. (NASDAQ:SNEX), who acquired the firm in 2020.

City Index is authorized by top-tier financial regulators in three countries making it a safe and low-risk broker for forex and CFD traders. The firm is regulated by three tier-1 (high trust) regulators – the UK’S Financial Conduct Authority (FCA), Australian Securities & Investment Commission (ASIC), and Monetary Authority of Singapore (MAS). It is also overseen by one tier-2 (average trust) regulator, one tier-3 (low trust) regulator and has $198 million in excess regulatory capital.

Table of Contents

Account Types and Trading Platforms

Available Account Types

City Index offers clients a demo account and four types of real account. While the minimum deposit amount is 100 USD/EUR/GBP, the size of spread and leverage depend on the trading asset the client is using.

This is basically a practice account where novice traders can learn the mechanics of forex and CFD trading with zero risk. Here, users trade with virtual funds and can test their trading skills without risking real money.

This is a dedicated FX platform where users can trade shares, indices, and commodities. It also comes with an integrated risk management feature e.g. negative balance protection.

The retail (MT4) account, users get broker-assisted deals but will lose the leverage limits and negative balance protection that come with an MT4 account. On the plus side, account holders get a credit facility, lower spreads and margins, advanced trading platforms, a relationship manager, and access to premium events. To qualify for this account, a trader has to have an investment portfolio worth €500,000 or more. Further, they must have placed not less than 40 trades within the previous year.

This is for retail business and institutional trading. The account allows multiple authorized users to trade on one account.

Trading Platforms

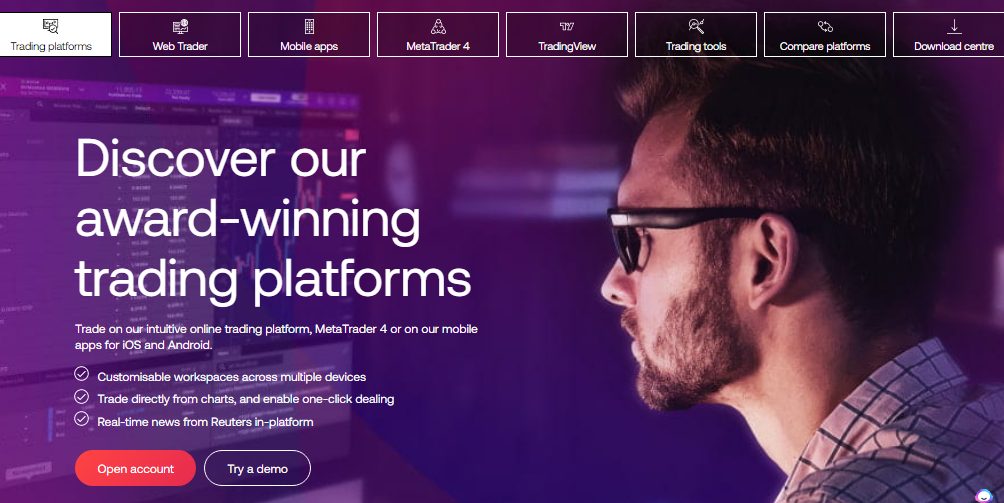

Users of City Index have three trading platforms to choose from. For those looking to trade on the go, there are mobile apps that can be used on iOS and Android devices. There are also web-based trading platforms which comprise more sophisticated trading tools.

This is a downloadable software which can be used on desktop computers, tablets, and smartphones. The platform provides an excellent combination of tools from technical indicators and charts to timeframes and drawing tools. All of which are designed to give traders valuable insights about market conditions and help them make better trading decisions.

This is City Index proprietary trading platform and it gives access to the company’s full product offering. Of all the three trading platforms, the WebTrader gives access to a greater number of tradable markets. It further offers enhanced functionalities like predefined screeners and layouts as well as ability to perform more complex orders like One-Cancels-the-Other (OCO) orders. This platform is ideal for people who do not want to download a bulky software on their computer. It allows users to trade straight from their browser.

City Index has its proprietary app for mobile devices and it comes with a ton of useful features. There is the TradingView functionality which boasts more than 80 technical indicators to keep users updated about real-time happenings in their desired market(s). The app also features critical capabilities like trailing stops and close out orders to mitigate risk of loss.

Market Coverage and Fees

- Range of Financial Instruments Available For Trading

City Index platform is essentially a spread betting and CFD trading platform. As such, users can only trade CFDs and Forex but not real stocks or funds. The company provides access to 13,500 CFD and spread betting markets – which include indices, forex pairs, metals, share CFDs, bonds, interest rates, commodities, and cryptocurrencies.

Users can trade options and cryptocurrencies using CFDs or spread betting. However, the real underlying asset (e.g. Bitcoin) cannot be bought. There is also a market for trading major currency pairs like EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CAD, USD/CNY, USD/CHF, and USD/HKD.

- Fees and Commissions Associated With Trading

Compared to its competitors (CMC Markets, XTB, and IG), City Index charges lower to average trading fees. For example, it has the lowest commissions and spreads for forex but average for CFDs. For financing rates, the broker fees is average compared to other similar brokers. This particular fee is important to know as it can quickly add up for those who hold their position for long durations. When funding or withdrawing funds, traders are not charged any fee or commission.

- Bonuses Offered by the Broker

Most of the bonuses given by City Index are mainly to professional Account holders and they include:

This scheme is designed to give cash rewards to professional account holders who meet the specified minimum trade volumes. For example, in the forex market, traders get a monthly rebate of $4.5 USD per million if their trade volume falls between $2M and $5M.

In this program, pro clients who refer friends to the platform can earn up to $9,000 and trade with reduced fees for 12 months. However, the friend must have spent a minimum of $300 in monthly trading costs at least two times within three months.

The broker credits a welcome bonus of £1,000 into the trading account of new professional traders who fulfill all terms for this account type.

Account Opening

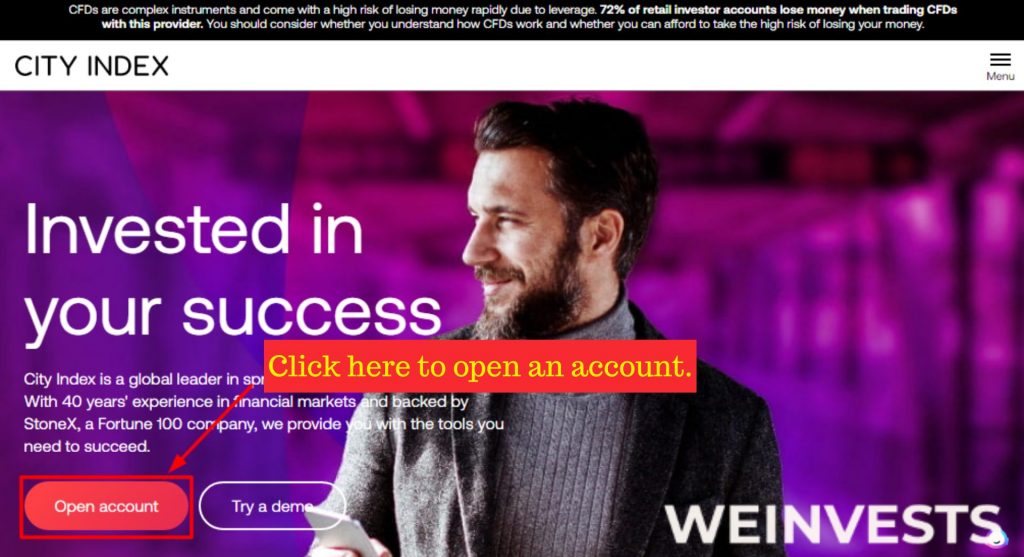

City Index is a leading online trading platform offering access to various financial markets. To open an account, these are the steps :

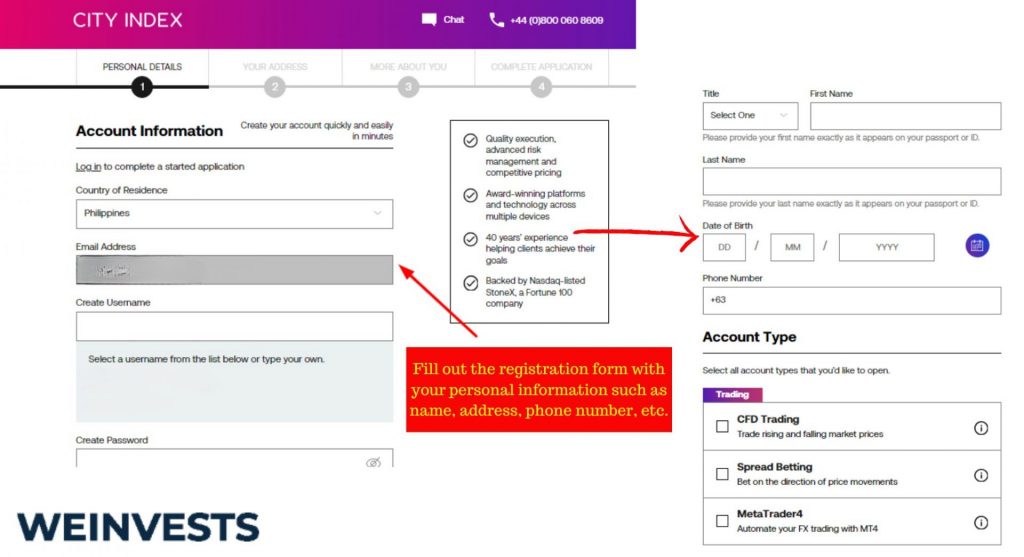

Step 1: Visit the City Index website Go to the City Index website. then locate the “Create Account” button On the homepage, you should see a “Create Account” or “Open an account” button. Click on it to start the registration process.

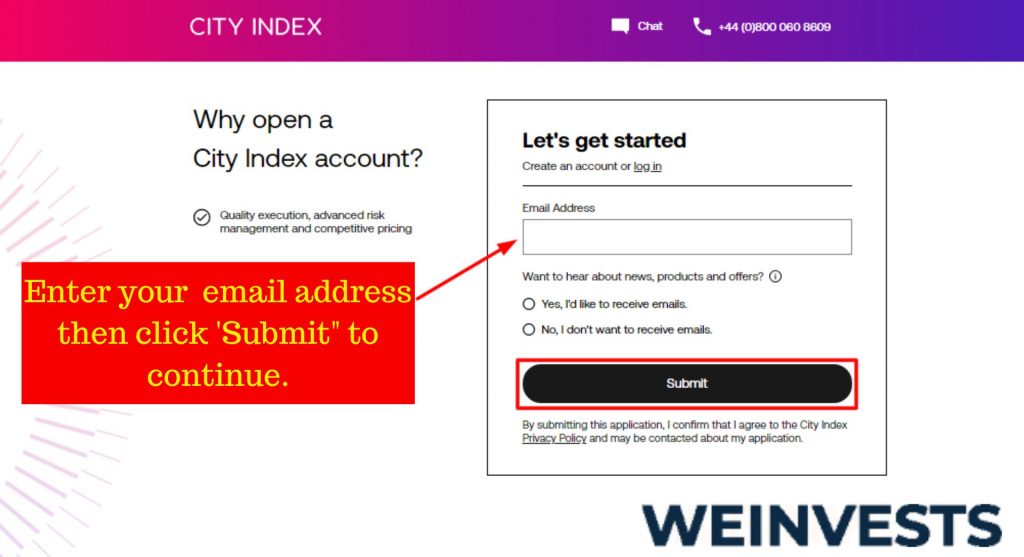

Step 2: Fill out the registration form You will need to provide your personal information, such as your full name, email address, phone number, and date of birth. Additionally, you’ll need to create a username and password for your account.

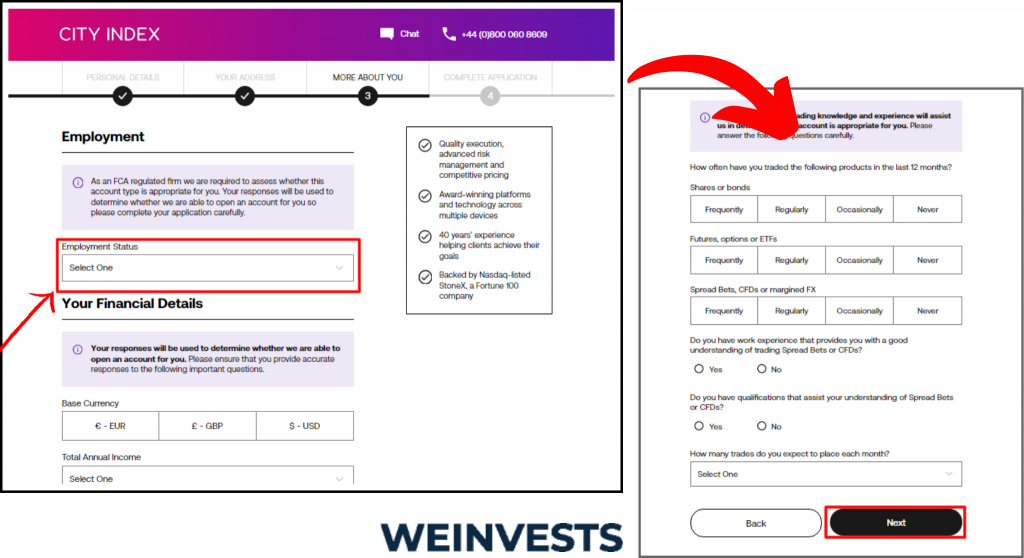

Step 3: Complete the questionnaire City Index will ask you a series of questions to assess your trading experience, knowledge, and suitability. This is to ensure that you understand the risks associated with trading and comply with regulatory requirements.

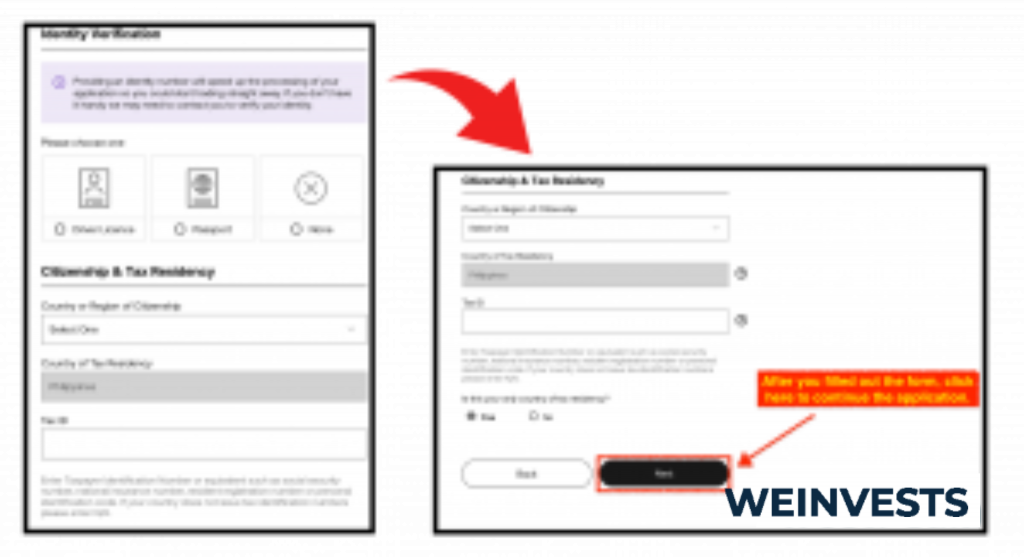

Step 4: Provide identification documents To verify your identity, you’ll need to upload a copy of your government-issued ID (e.g., passport or driver’s license) and a proof of address document (e.g., utility bill or bank statement). This is required for anti-money laundering (AML) and know-your-customer (KYC) compliance purposes.

Step 5: Wait for account approval Once you’ve submitted the necessary documents and completed the registration process, City Index will review your application. This may take a few days. Once approved, you will receive a confirmation email.

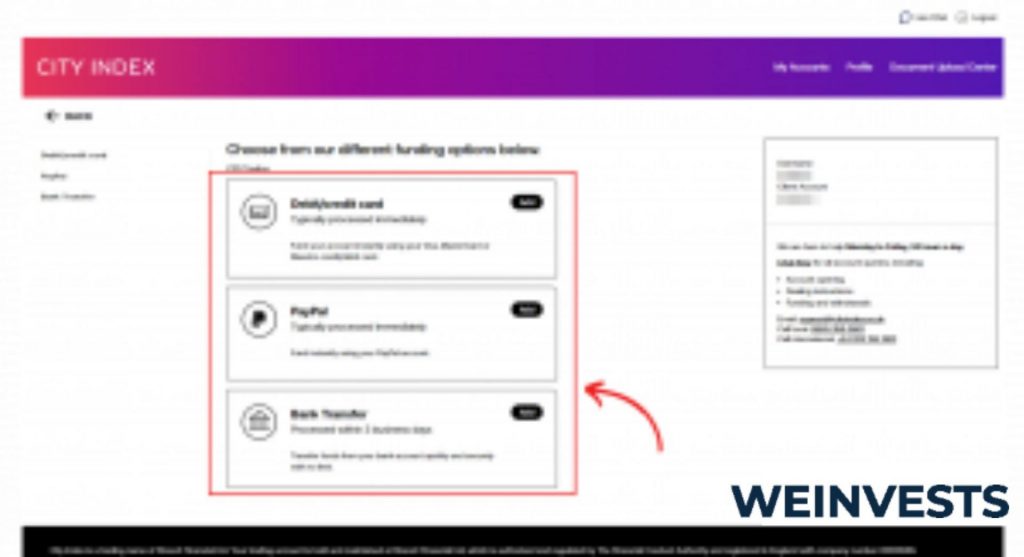

Step 6: Fund your account and start trading.

Remember that trading involves risk, and you should only invest what you can afford to lose.

Regulatory Oversight and Security Measures That Protect Client Accounts and Funds

As stated earlier, City Index is fully regulated by top-tier regional entities across the 3 continents they serve (Europe, Australia, and Asia). The primary regulator of the broker is the Financial Conduct Authority (FCA) which monitor their activities in the UK. Due to regulation by this body, UK traders are assured that their funds are secured in segregated client accounts – which is one of the top client money rules of the FCA. In the event of liquidation, the Financial Services Compensation Scheme (FSCS) of the FCA ensures traders receive compensation of up to £85,000.

In Australia, City Index is licensed by the Australian Securities & Investment Commission (ASIC). This authorization guarantees traders in this jurisdiction that they are conducting business with a trustworthy broker that conforms to all the country’s investment laws. However, unlike the UK clients, there is no scheme that can help trader within this region recover their money should the company fold up.

Same goes for traders in Singapore. City Index complies with all financial laws stated by the Monetary Authority of Singapore (MAS). Investors’ funds are protected in segregated client accounts. However, the country does not have a scheme like UK’s FSCS to help them recover their money should the firm go under. Beside the UK, another region that offers investors compensation is Dubai.

Conclusion

In its over 35 years of existence, City Index has proven to be one of the most reliable brokerage for CFD and forex trading. In the area of trading fees and commissions, the platform has no hidden fees and all charges are disclosed on the company’s website.

No commission is deducted for withdrawing funds or replenishing an account notwithstanding the payment system. Clients are offered a competitive pricing structure, an outstanding trading platform, and a well-regulated trading environment.

Although, the broker has many attractive features to draw in investors, there exist significant drawbacks it needs to address. For one, while the platform has tremendous information and data relating to trading instruments, all this are only available English. This is a big disadvantage to non-English speakers and reduces the platforms ability to have a more extensive pool of investors.

Overall, in terms of costs, fees, functionality, promotion type, and market research resources, City Index delivers fair to high quality services that ranks above the industry average.

FAQ’s

Is City Index legitimate?

Yes. Like many CFD and forex broker, City Index certainly has its downsides such as a platform that malfunctions periodically. However, the broker is transparent, reliable, and poses low-risk to investors due to the many regulations they have to comply with.

Who is City Index best for?

City Index is ideal for seasoned traders who are actively trading in various markets. This is so because CFD trading is a very complex and high risk investment product. The potential lack of liquidity, low industry regulation, and the need to maintain a sufficient margin of safety makes it unsuitable for novice investors.

Who does not benefit from City Index?

As stated in earlier sections, the platform mostly give their best incentives to people with higher trading volumes and who are active traders.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More