If you’re following a personalized financial plan, you might think you’ve got your financial future figured out.

After all, you’ve established retirement goals, created a disciplined budget, and are saving a set amount each month to invest in a balanced portfolio. What could go wrong?

Despite your best efforts, random life events can easily conspire to derail your financial plan. If you’re not prepared, these emergencies can set you back, negating months or years of hard work.

But if you’ve established an emergency fund, you’ll be well-prepared to deal with whatever life throws your way.

An emergency fund is an easily accessible stash of money that you can use to weather high-cost, unplanned life events. It’s an essential, but often overlooked, part of any financial plan.

In this article, we’ll walk through the basics of building an emergency fund. With these tips and strategies, you can ensure your financial plan is ready for life’s unseen twists and turns.

Table of Contents

Emergency Fund Basics

An emergency fund is exactly what it sounds like – a fund to deal with emergencies.

This fund can be kept in many different forms, but, as a rule of thumb, you should be able to access the money in your emergency fund in just a few days without loss of value. Ideally, you’ll be able to access those funds immediately.

That means fixed-maturity bonds, highly volatile stocks, and illiquid gold bars are out.

Instead, most people opt to keep their emergency funds in liquid, stable accounts like money market funds or high-yield savings accounts.

While you could keep the funds in your regular bank checking account, it’s not a wise idea – keeping your emergency fund distinct from day-to-day funds will help ensure you only dip into it when an emergency actually occurs.

So, what constitutes an emergency?

There is a wide range of unplanned life events that might require a sudden need for cash, but popular ones include:

- Unplanned home repairs

- Medical emergencies

- Vehicle repairs not covered by insurance.

In addition, losing your job might require you to dip into your emergency fund if you can’t find another one quickly.

The amount you should save in an emergency fund depends on your life circumstances. But as a general rule, experts advise saving around 3 to 6 months’ worth of living expenses.

Many cautious people choose to save more than that – and there’s nothing wrong with being prepared.

Why Do You Need an Emergency Fund?

Some people don’t like the idea of keeping an emergency fund on hand. After all, why set aside cash for things that might occur in the future, when you could spend that money to enjoy life today?

But there are a couple of reasons why an emergency fund should be a high-priority financial planning item.

Emergencies are inevitable

Life just isn’t predictable, and things often don’t go according to plan. Having an emergency fund helps ensure you don’t wreck your financial future by needing to rely on expensive options when you have an immediate need for cash.

If you lose your job and don’t have the money to pay living expenses, you might turn to credit cards or high-interest personal loans to pay for housing and food.

And that can create a debt spiral that quickly adds up. As the interest on debt compounds, it can be hard to escape from.

Peace of mind to enjoy life

Having an emergency fund can also give you the peace of mind needed to enjoy your life. If you are prepared to support yourself in case you’re laid off, you might be less stressed about bad economic news or possible recessions.

In addition, an emergency fund can give you the flexibility to be more adventurous. Thinking about taking that month-long rock-climbing road trip with some friends? An emergency fund helps ensure things won’t fall apart if you have a medical or car emergency.

Keeps you disciplined

Finally, an emergency fund helps promote financial discipline in terms of saving and budgeting.

Many people start off by setting aside a set amount of money each month in order to direct it to their emergency fund. When the fund has reached their desired amount, they can then direct that same regular contribution toward long-term investments.

That way, an emergency fund helps build the infrastructure necessary to consistently and reliably contribute funds toward your financial goals, including retirement.

Steps to Build an Emergency Fund

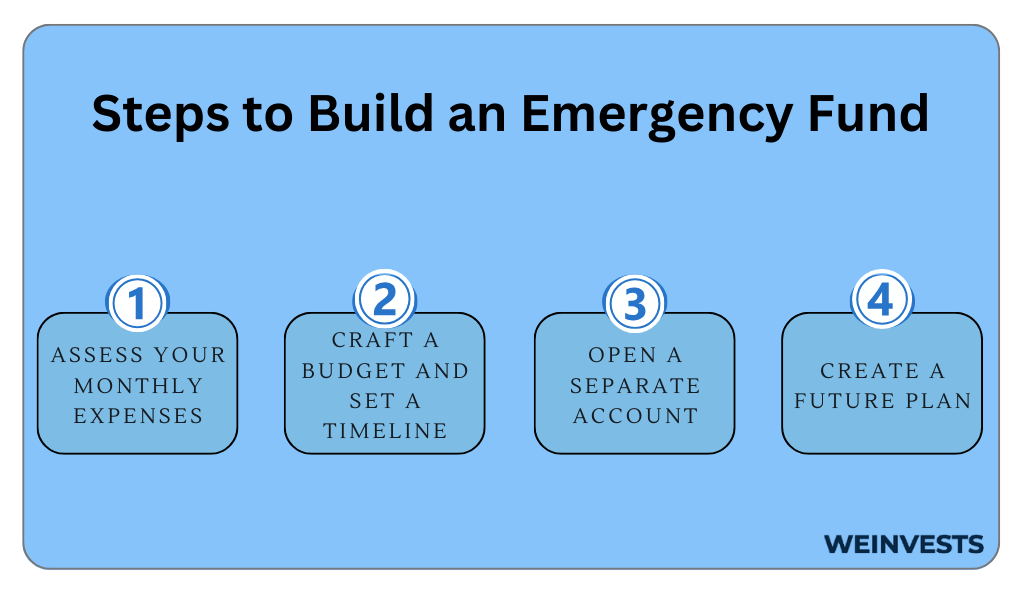

Building your emergency fund can take time, but by following the right steps, you can amass the necessary savings to help prepare you for life’s uncertainties.

Let’s take a look at how to build an emergency fund in practice with a step-by-step approach.

Step one is to figure out how much money you spend each month. Sit down with your credit card and bank statements to determine what your fixed expenses are and how much you usually spend day-to-day.

This will give you a good idea of the amount you need to save in your emergency fund. For instance, if you spend about $3,000 a month and want to save 3 months’ worth of spending in your emergency fund, you’ll need to target $9,000.

Making a budget should be relatively simple after calculating your monthly expenses. All you need to do is see how your expenses compare with your income.

If you find that there’s not enough money left over after paying your expenses, you may need to consider a shift in your finances. That might mean looking for extra income or trimming down unnecessary spending.

Based on how much you can afford to save each month, you can set an appropriate timeline to build up an emergency fund.

If you can save $500 a month, for instance, it will take you 18 months to build up a $9,000 emergency fund starting from scratch. If you can save $750, though, it will take just a year.

Once you have a budget and timeline in place, it’s time to get the process started.

You should open up a separate savings account to keep your emergency fund separated from your standard day-to-day funds.

As we mentioned, popular choices for this emergency fund account include regular bank savings accounts (especially high-yield savings accounts) and money market funds.

Whatever account you choose, ensure it will have a stable value and can be easily accessed within just a few days.

Many people also find it helpful to set up automated transfers to this account on a regular basis.

For instance, if you need to save $500 a month, you might consider transferring $250 twice a month from your regular bank account to your emergency account.

That frees you of the burden of needing to manually transfer the money each month – which should also help keep you disciplined.

Now that you know how much you’ll be saving each month, where the money will be going, and the target level your account needs to hit, it’s time to think about the future.

Once your emergency fund has reached the level you want, you can use the savings infrastructure you’ve built to achieve longer-term financial goals.

For instance, you might consider routing your savings into an investment portfolio or retirement account.

An emergency fund is just one part of a financial plan – but you can use the savings and budgeting techniques you develop to help bolster all the other parts of your plan as well.

Avoiding Common Mistakes

As you build your emergency fund, there are some common traps that people fall into.

But if you understand how to avoid them, you can stay firmly on the path toward building a resilient financial future.

Let’s take a look at the most common mistakes people make and how you can avoid them.

Treating emergency funds like regular funds

There’s a reason that your emergency funds should be kept separate from the accounts you use to pay your day-to-day expenses.

This money is designed for an emergency, not for supplementing your monthly budget.

Some experts even advise keeping your emergency funds at a separate bank entirely – just to avoid the temptation of spending it.

Not using emergency funds in an emergency

But just as you shouldn’t use emergency funds for day-to-day expenses, you also shouldn’t shy away from turning to those funds when a real emergency occurs.

Some people get so attached to the idea of having a “full” emergency fund that they hesitate to use it when a real emergency occurs.

That can lead to unnecessary struggles and a lower quality of life.

Remember that you’ll have time to replenish your funds once the initial emergency fades – but if an unexpected situation creates an urgent need for cash, don’t shy away from using the funds you’ve earmarked for emergencies.

Not reviewing their spending periodically

When you calculate the amount necessary for your emergency fund, it can be easy to set and forget.

But our lifestyles change over time, and the amount you spend today could be wildly different than the amount you spent a year ago.

If you’ve noticed a change in your spending habits, it might be time to conduct a brief review of your expenses. Depending on the results, you might find that your emergency fund target needs to be shifted up.

Not celebrating milestones

Building up a suitable emergency fund is a long process. It can take many months to feel like you’re prepared for real emergencies.

It’s important to celebrate important milestones along the way so that you don’t get discouraged.

Try and take a little time to celebrate when your funds have reached certain monthly expense targets – such as one month, two months, or three months or expenses covered.

You might even consider taking yourself out to a nice dinner – just make sure you don’t pay with the funds from your emergency account!

Conclusion

Building up an emergency fund is a key part of achieving financial health.

Unfortunately, it’s often overlooked at the expense of long-term savings and retirement planning.

But to be resilient to the uncertainties of life, you’ll need a little money socked away for emergencies. Ideally, these funds should be able to support you for several months if you’re out of work or cover situations in which you have an urgent need for cash.

In this article, we’ve reviewed some basic tips and strategies you need to start building up your emergency fund.

Remember, we can’t plan for everything in life. Ensuring an emergency doesn’t derail your spending and savings is key to building a resilient financial plan.

FAQ

What is an emergency fund?

An emergency fund is a separate account in which you hold enough money to cover unexpected expenses like car or home repairs. In addition, an emergency fund can be used to pay living expenses if you lose your job. Generally, you should save 3 to 6 months’ worth of expenses, but some people might want to save more.

Best emergency fund account?

There’s no one account type that’s best for all emergency funds. Some people like having their funds in a high-yield savings account at the same bank as their checking account. Others like keeping the funds in a money market investment at a brokerage. Whatever account you choose, ensure it will be easily accessible in just a few days without losing value.

Is $10,000 good for an emergency fund?

Depending on your expenses, $10,000 may or may not be suitable for an emergency fund. If you live an expensive lifestyle, $10,000 may not cover even one month of expenses. However, if you’re more frugal, it could last a long time. Always consider your unique spending habits and lifestyle when determining the amount that you need to save in an emergency fund.

When to use an emergency fund?

There’s no one-size-fits-all rule to determine when a situation is a genuine emergency that calls on you to use your emergency fund. Just remember that if an unexpected event requires a sudden influx of cash that would otherwise derail your financial plan, it might be smart to dip into your emergency fund – after all, that’s what it’s there for.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More