401(k) Written on Blue Key of Metallic Keyboard. Finger pressing key

The 401(k) plan is tax-advantaged and is called a defined contribution retirement account. Many employers offer it as a perk or benefit of working with them. It’s actually named for a section within the U.S. Internal Revenue Code.

With it, employees can make a contribution to their 401(k) account through automated payroll withholding. From there, the employer matches some or all of that contribution.

The investment earnings for a traditional 401(k) plan aren’t taxed until the employee chooses to withdraw the money, which is usually after retirement. However, if you choose a Roth 401(k) plan, the withdrawals might be tax-free.

Table of Contents

- How Does the 401(k) Plan Work?

- What Are the Benefits of Having a 401(k)?

- Employer Match

- Tax Breaks

- Shelter from Creditors

- Contributions and Limits

- Split the Difference (Contributing to Both)

- Withdrawals from Your 401(k)

- Taking money from an IRA or 401(k) early

- Why Would You Retire Money from an IRA or 401(k) Early?

- What Happens if You Try to Withdraw Money from an IRA or 401(k) Early?

- Do You Truly Need to Make an Early Withdrawal?

- What Can You Do to Prevent Penalties?

- Method One: Withdrawal from 401(k)’s If You Were Separated from Service

- Method Two: 401(k) Loan

- Method Three: IRA Withdrawal Exemptions

- Method Four: Substantially Equal Periodic Payments (SEPPs)

- What Are the IRS’s Requirements for Setting Up a SEPP?

- What Are the IRS’s Calculation Methods?

- Should You Use a SEPP Plan?

- What Are the Disadvantages of a SEPP Plan?

- Conclusion – Taking Money from an IRA or 401(k) Early

- The Real Scoop on Traditional vs. Roth 401(k)s

- Conclusion

How Does the 401(k) Plan Work?

There are two 401(k) account types available: Roth 401(k) and traditional 401(k). These two are highly similar in most respects, but there are different tax rules for them. Employees may have either or both options.

A set percentage that the employee chooses is automatically removed from their paycheck and invested into the account. Generally, they’re made up of mutual funds, bonds, and stocks that the employee can pick for themselves.

What Are the Benefits of Having a 401(k)?

There are various advantages of having a 401(k), including:

Employer Match

Most employers match their employee’s contributions up to a set limit. This can be dollar for dollar or about $0.50 on the dollar.

Let’s say you make about $100,000 a year, and the employer offers to match 50 percent of the first 6 percent you contribute. Contributing 6 percent of the annual earnings is $6,000, so the employer adds in 50 percent of that ($3,000), which is essentially free money.

Employers can choose how much to match.

Tax Breaks

The contributions you make are pre-tax, so you don’t pay any taxes on that money until you remove it during retirement.

With that, the 401(k) contributions aren’t counted as income. Depending on your circumstances, you might fall into a lower tax bracket. This indicates that the tax bill is smaller because you’re saving money for your later years.

On top of everything else, the savings grow tax-deferred. That means on a regular investment account, the net dividends and gains are taxed. With a 401(k) plan, the money grows tax-free if it stays in the account. Your earnings compound (meaning your earnings earn money).

Shelter from Creditors

If something happens and your finances go south, creditors cannot take your 401(k) money. This is a qualified retirement plan and is protected by the ERISA (Employee Retirement Income Security Act).

Contributions and Limits

Primarily, you make contributions to the plan, and the employer can and often matches them. The IRS does limit you to how much you can put in there a year.

In a sense, the employer shifts the responsibility from it to you to save for your retirement.

You can also choose the specific investments you want to make with your 401(k) account, though the employer might only offer a handful. These offerings include assorted stocks, mutual funds, and bonds, but they can have target-date funds with them.

Sometimes, the employer allows you to invest in its stock and guaranteed investment contracts.

The maximum amount anyone can contribute to a 401(k) is adjusted for inflation periodically. Right now, it is $26,000 for people 50 years and older and $19,500 a year for those under 50.

Now, the employer can also contribute, and the employee might choose to make other non-deductive contributions (after-tax). This is capped off at $58,000 or the full amount of employee compensation, whichever number is lower. However, those aged 50 or more cap out at $64,500.

Split the Difference (Contributing to Both)

Some employers offer a Roth and traditional 401(k) option. If they want to, employees can split the contributions, putting some money in each account. However, the total amount for both account types can’t exceed the limit for each separate account.

With that, employer contributions may only go into traditional 401(k) plans.

Withdrawals from Your 401(k)

It’s often hard to remove money from the 401(k) account before retirement age (59.5 years old). Therefore, it’s essential to have a separate savings account you can dip into if necessary.

While the earnings are tax-deferred for a traditional 401(k), money withdrawn must be taxed and treated like regular income. Roth 401(k)s are never taxed, so you don’t owe money for withdrawing funds. However, you must meet certain requirements to do that.

Both types of accounts require the owners to be 59.5 years old or meet certain other criteria that the IRS dictates to make withdrawals. Usually, they face a 10 percent early-distribution tax on top of other taxes owed.

Taking money from an IRA or 401(k) early

A 401(k) and an Individual Retirement Account (IRA) are excellent choices for people who want to save a decent amount of money for the moment in which they decide to retire. There are millions of U.S. residents each year who continually put money into these accounts so that they can prepare for retirement.

Typically, the plan is to start withdrawing the money when you’re at least 59 ½ years old since that’s the minimum requirement according to the IRS. However, there may be some circumstances in which you may need to withdraw your funds sooner. Unfortunately, making a withdrawal before the minimum retirement age isn’t as simple as it may seem.

While taking money from an IRA or 401(k) early can cause you some penalties, there are some exceptions you may consider avoiding the rule. On this page, you’re going to take a closer look at these exceptions that may allow you to withdraw your money from an IRA or 401(k) before the required age.

Why Would You Retire Money from an IRA or 401(k) Early?

There are many reasons why someone would want to withdraw some money from their retirement accounts; for example, someone who became unemployed and hasn’t been able to find a job over a significant period may have to take money from their retirement account.

On the other hand, issues such as forced early retirements, sickness, or other financial problems may be the reason why you need to take money from your retirement account. Regardless of the reason, the saved money from the retirement accounts can put your immediate issues at ease while you look for a solution.

What Happens if You Try to Withdraw Money from an IRA or 401(k) Early?

Many financial experts recommend taking money out of an IRA or 401(k) early as the last resort since doing so can cause significant problems for your financials (unless you reached the minimum age of 59 ½).

First, the IRS can penalize you with a 10% tax rate on the withdrawal you make, as well as income tax. Depending on the case, you may be looking at a 30-to-40% fee for making a withdrawal before you’re allowed to. Keep in mind that this may vary depending on a person’s age and tax situation.

However, the most critical issue with early withdrawals is that the IRS sometimes requires withholding of at least 20% of early 401(k) withdrawals for taxes, meaning you’re going to get a lower amount at the moment of making your withdrawal.

In essence, taking money and assets out of your IRA or 401(k) can negatively impact your retirement plan, which is why you must see it as a final result in case your other plans fail.

Do You Truly Need to Make an Early Withdrawal?

Some people rush to make a withdrawal because they believe there aren’t many options left for them. However, there’s a series of questions you can ask yourself to determine whether making an early withdrawal from your IRA or 401(k) is a good idea.

Regardless of your current situation, consider the following questions:

- Can you make the money you need from another source?

- How urgently do you need the money?

- Can you eliminate discretionary expenses instead of making the withdrawal?

- Is it good to trade your future income from the retirement plan for current income?

If you don’t know the answers to some of these questions, you may consider getting help from a financial planner who can assess your situation.

What Can You Do to Prevent Penalties?

There are many options you can take to avoid the IRS’s 10% penalty. However, keep in mind that these methods may not work for everyone, so make sure you review them thoroughly before making a decision.

Method One: Withdrawal from 401(k)’s If You Were Separated from Service

A 401(k) allows people who separated from their service at the time they turned 55 years old. These withdrawals don’t come with any penalties, so that would be an excellent option if this applies to you.

Method Two: 401(k) Loan

You can withdraw half the vested balance in your account (or less than $50,000) if you have a 401(k). In those cases, you would be required to repay the withdrawn amount during the next five years. If you’re using the money to buy a home, some employers may allow for a longer payment period.

It’s important to note that you may have to pay a bit of interest for the withdrawal. Additionally, not all employers offer these loan types, so you may need to check with yours.

Method Three: IRA Withdrawal Exemptions

The U.S. government allows penalty-free withdrawals for people who want to fund their education or buy a home. In case you need to pay tuition on an IRS-approved college, you may use your penalty-free withdrawal to pay for it. On the other hand, you can use up to $10,000 of your IRA funds to pay for your first house.

Finally, you may withdraw up to $5,000 to help with births or adoptions under the SECURE Act of 2019’s guidelines.

Method Four: Substantially Equal Periodic Payments (SEPPs)

A SEPP is one of the most popular methods to make penalty-free, early withdrawals. In essence, you may withdraw a particular amount of money each year according to guidelines set by the IRS.

You may choose one of three IRS-approved methods to calculate your SEPP annual distributions. Keep in mind you should choose the method that fits your financial situation the best because you may only change the method once within your plan’s duration.

If you don’t comply with the IRS’s requirements for SEPP distribution plans, you may have to pay a penalty for all previous distributions plus interest, which can cause a problem for you.

What Are the IRS’s Requirements for Setting Up a SEPP?

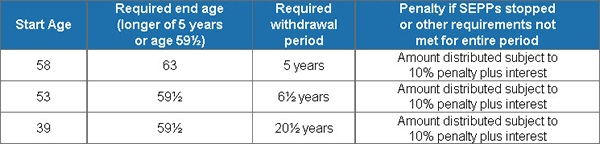

- You must take equal withdrawals for at least five years or until you become 59 ½ years old, whichever is longer.

- You must make at least one annual withdrawal using the IRS’s approved calculations.

- You can only end your SEPP plan in case of disability, death, or depleted balance. If you end the plan before its required date, you may have to pay penalties.

- You cannot make contributions or take withdrawals from the account linked to your SEPP plan until five years and one day has passed from your first withdrawal.

Keep in mind you may still make contributions and take withdrawals from any other retirement accounts you may have.

What Are the IRS’s Calculation Methods?

Amortization Method

In this method, the IRS takes the life expectancy of the taxpayer, their beneficiaries (if applicable), and a fixed interest rate of up to 120%. Keep in mind that the annual payment amount is the same every year.

Annuity Method

The amount of money is calculated by dividing the taxpayer’s account balance by an annuity factor derived from a mortality rate provided by the IRS. The annuity is based on a taxpayer’s and their beneficiaries’ age (if applicable) plus a fixed interest rate.

Required Minimum Distribution Method

The annual payment is calculated by dividing the taxpayer’s account balance by their life expectancy and their beneficiaries’ life expectancy (if applicable). This is the only scenario where the annual payments are recalculated every year, meaning the amount can change.

Should You Use a SEPP Plan?

If you’re planning on using a SEPP plan to make early withdrawals from your retirement savings account, you must first evaluate whether it’s a valid option for you. Here are some of the most common scenarios where having a

SEPP may be a good idea for you:

- You’re retiring early.

- You can pay any penalties that may come from ending the SEPP plan.

- You’re only going to use a small number of assets for your SEPP plan.

- You’re five years away from turning 59 ½ years old.

What Are the Disadvantages of a SEPP Plan?

There are three main issues with SEPP plans you should take into account. First, you must comply with the SEPP’s plan duration, meaning that if you start the plan too early, you may have to make annual payments for many years to come. Additionally, keep in mind you cannot quit the plan without having to pay penalties (unless you’re quitting due to disability or death).

Finally, you cannot make any contributions or withdrawals to your SEPP plan’s account, meaning your retirement balance is not going to grow until the plan ends, and you’re also going to avoid the tax-saving benefits that you would get if you didn’t make the early withdrawal.

Conclusion – Taking Money from an IRA or 401(k) Early

While making an early withdrawal from your qualified retirement plan may not be the most appropriate option to take in most cases, it can save you from some unforeseen problems in your life.

It would be best for you to consider other options before going for an early withdrawal. Additionally, make sure to consult a financial or tax advisor to draft a solid retirement plan and determine whether one of these methods is good for you.

The Real Scoop on Traditional vs. Roth 401(k)s

The 401(k) became available initially in 1978, and companies/employees only had the traditional option. In 2006, though, the Roth 401(k) showed up. While most people aren’t as familiar with Roth 401(k) plans, most employers offer them now.

Therefore, employees have to decide between the two.

If you expect yourself to be in a low marginal tax bracket after retirement, a traditional 401(k) plan is often better. It provides an immediate tax break. However, if you think you might be in a higher tax bracket, a Roth account might be wise to avoid more tax later.

Regardless of the one you choose, tax rates might be higher when you decide to retire. For this reason, many financial advisors recommend people using both accounts and adding money to each.

Conclusion

Though the financial world is often confusing, it helps to understand what a 401(k) plan is and the types available. With that information, you can make an informed decision about what’s right for you.

Both accounts are excellent to help you save for retirement, though they are best left alone until then. Still, it’s possible to withdraw funds at times. Regardless, you now understand the Roth and traditional 401(k) plan options and could decide which one to use if both are available from your employer.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More