This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

The Tech industry has always been the investors’ choice to diversify their portfolios. They can have stock of companies with the potential to grow quickly and offers great dividends. Many investors are eyeing companies, like Palantir Technologies (PLTR), that can have a great potential to grow.

Palantir Technologies (PLTR) is a big name in the tech industry. The company was founded in 2013 by the following people:

- Alex Karp

- Joe Lonsdale

- Nathan Gettings

- Peter Thiel

- Stephen Cohen

Various projects have fueled the growth of this company. Most notably, the Palantir Gotham is a top project of the company that the department for counter-terrorism in the United States Intelligence Community (USIC) uses. Previously, the Recovery Accountability and Transparency Board and Information Warfare Monitor also used Palantir Gotham.

In the early years of the PLTR, it only served federal government agencies. However, it has expanded its customer base and offers services to local governments, the healthcare industry, and companies in the financial sector. Palantir Technologies (PLTR) posted the following numbers for 2021:

- Net income: -$0.461 billion

- Operating income: -$0.062 billion

- Revenue: $1.908 billion

- Total assets: $3.319 billion

- Total equity: $2.387 billion

According to Forbes, Palantir Technologies had a valuation of $9 billion in the first quarter of 2014. This valuation made it the most valuable privately-owned company in Silicon Valley. Thiel retained a significant portion of the company’s ownership by 2014.

The company did not plan to go public, and Karp announced in 2013 that Palantir would not be launching an IPO anytime soon. However, the company started to consider going public in 2018. In the second quarter of 2020, Palantir announced that they were filing for an IPO.

Palantir Technologies listed itself on the NYSE (New York Stock Exchange) in September 2020.

Palantir Technologies Inc Statistical Overview

Palantir (PLTR) Stock Forecast 2023

There is a strong expectation that the Palantir Technologies (PLTR) stock will do well in the year 2023. Though, the positive run for the company will not be as good as those of previous years, especially regarding revenue. The same goes for the company’s EPS (Earnings per share).

The top line expansion of Palantir Technologies, as stated by S&P Capital IQ, will go from 23.4% of 2022 to 21.2% in 2023. This trend is consistent with the trajectory of the share price. At the start of 2022, the share price was pegged at $18.21, with a subsequent $7.48 price at the end of the year.

Fortunately, the dark days for PLTR are expected to see some sunshine in the first half of 2023, with an expected $8.64 at the middle of the year. By the end of 2023, PLTR is expected to trade at $10.30.

Palantir Technologies is doing some major business changes, with an ambition to move away from relying solely on its government institutions clientele. The company is currently losing money as of press time, but there are indications that it’d break even soon.

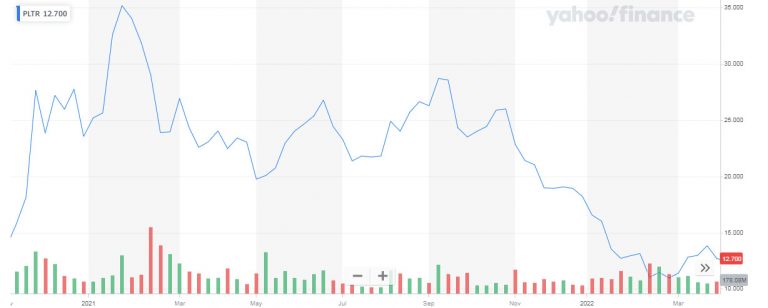

PLTR Stock History 2022

The Tech industry took some hits in 2022, with several companies laying off staff, while others were severely hit by inflation. Palantir Technologies was also not spared, as the Software and Services Company saw its stock price take nose dives for most of the year.

Having achieved its all-time high on the 27th of January, 2021 (at $39), PLTR, spent about half of 2022 below the $10. As of January 3rd 2022, the share price was $18.53, before it experienced a <$10 price on May 6th 2022 (trading at $9.48). The price went back above $10 at some points, but couldn’t hold on. As of press time, PLTR trades at $7.35, a result of the continuous massive sell-offs that have plagued the stock in the year

The stock price, however, does not tell the company’s full story. For 2022, the company was able to reaffirm its revenue guidance of $1.9 – $1.902 billion, despite the $6 million currency setback it suffered. The company’s Q3 revenue also grew by 22% year-on-year to $478 million, while the US revenue 31% YoY to $297 million.

The disastrous year for the company stands as enough indication to not invest in the stock in 2023. Though, there has been some intra-organizational changes that make it seem like 2023 will be a good year.

PLTR Stock History 2021

Palantir Technologies Inc went public in September 2020 at an IPO price of $10. Throughout the last few months of 2020, the company’s stock prices dwindled since investors were not confident about Palantir’s prospects. However, the share price skyrocketed at the beginning of 2021, reaching an all-time high value of around $34.

The primary reason for this growth is that the U.S. Food and Drug Administration awarded a contract worth $44.4 million to the company in December 2020. As a result, it led to a massive surge in the company’s stock price at the beginning of 2021.

Additionally, the company’s total revenues also saw significant growth in the third quarter of 2021. The revenue growth was 36% from last year, reaching $392m. Acquiring new customers and more contracts with governmental organizations were the reasons for the increase in revenue.

However, the loss of investor confidence accelerated the fall in the PLTR share price by the end of 2021. The company suffered a significant hit as its share price dropped from $27.5 in August 2021 to $12.77 on 31st December 2021. This downward trajectory of the company’s value continued in 2022.

Conclusion

Palantir Technologies’ clientele includes some top government companies and financial organizations. The company is further looking to increase its customer base and find clients from different sectors.

It has managed to increase its revenue by expanding its customer base, which is evident from the financial reports for the 3rd quarter of 2022. However, the company has numerous challenges that it would have to deal with first to improve its share value over time.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More