This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

The energy sector is going through a massive change in the face of global warming. As people are now demanding big companies to switch towards renewable energy sources, many are taking rapid actions. They are working on initiatives to move rapidly towards sustainable energy.

Energy stocks have always been the preferred choice for investors since they offer high returns. As the bigger players in the industry move towards renewable energy, we can expect to see an increase in their profitability. Renewable energy production cost way less than conventional methods.

Therefore, investors are keeping a close watch on companies like Ormat Technologies. This company has great potential since they use geothermal and renewable energy methods. Consequently, investors believe it can see a massive surge in its price.

Lucien and Dita Bronicki founded Ormat Technologies in 1965, and the company launched an IPO in 2004. The company is continuously enhancing its production capacity to cater to the growing demand for energy.

Also, Ormat Technologies supplies turbochargers to many regions, including Australia, New Zealand, Latin America, North America, and Asia. Here is the company’s financial overview.

Let’s take a gander at the company’s future share price prediction and the historical performance of its stock.

Ormat Technologies Statistical Overview

Ormat Technologies (ORA) Stock Forecast 2023

The global geothermal industry is expected to expand from $62.65 billion in 2023 to $95.82 billion by 2030, according to Fortune Business Insights. Market observers appear to have gotten the message. ORA gained 12.6% in 2023, surpassing other clean energy equities linked to more established solutions such as wind and solar. This achievement is predicted to continue in 2023, resulting in an increase in Ormat stock prices.

Investors are flocking to green companies as governments face increasing pressure to concentrate on renewable energy. They are eager to invest in companies that produce geothermal energy, such as Ormat Technologies. Green energy stocks can help you diversify your portfolio as the globe shifts toward renewable energy due to increased concern about climate change.

CNN analysts have set the median price for Ormat Technologies shares for the next 12 months at $92. They anticipate that the share price will remain around the same as it is now. Furthermore, economists predict that the price will range between $89 and $106.

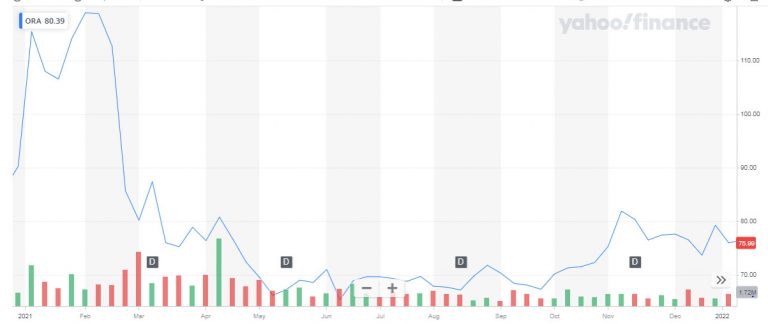

Ormat Technologies (ORA) Stock 2022

Despite having a rough 2021, the stock price of Ormat Technologies saw a steady rise in the first few months of 2022. Though it did see a slight fall in February, the company’s share price was set for an upward trajectory. The stock price closed at around $76 on the first day of trading in 2022.

It plummeted to $65 by the last week of March. However, the share value recovered from the fall and closed at $78 by the last week of May 2022.

The company earned 32 cents per share in the third quarter of 2022. Earnings per share were 33 cents after non-recurring charges were deducted. The outcomes exceeded Wall Street’s expectations. The geothermal company reported revenue of $175.9 million in the quarter, which also exceeded Wall Street expectations.

Ormat Technologies stocks prices were boosted by plans for rapid expansion of its operations throughout various locations. It, therefore, made Ormat one of the most promising green energy stocks of 2022.

Ormat Technologies (ORA) Stock 2021

While the company’s stock price enjoyed growth in the last quarter of 2020, it saw a free fall in March 2021. The share prices touched $118 in the first week of February 2021 before crashing down to $80 within a matter of a few weeks. Ormat Technologies’ share price closed at the $79 mark on the last trading of 2021.

The primary reason for the fall in the share prices was due to the allegations by the short-seller Hindenburg against the company. He lobbied many accusations against Ormat Technologies, such as acts of international corruption. The company’s share price fell by 4% on the next trading day after the news broke out.

Ormat Technologies responded to these allegations and only served the purpose of misleading the investors. The company decided to take strong action against the short-seller, but it caused significant damage to Ormat Technologies’ share price.

Investors looked for safe havens as they pulled out their investments from the company. The allegations caused the biggest fall in Ormat Technologies’ share value in its history.

Ormat Technologies (ORA) Stock 2020

The Covid-19 pandemic wreaked havoc on the stocks of many companies in different sectors. Stock markets around the globe plummeted and wiped out a significant portion of the investors’ wealth. Panic selling became the top cause for different companies’ to see a monumental fall in their value.

Ormat Technologies’ share price opened at around $75 in the first week of 2020. It saw a slight increase in its value and reached $85 by the last week of February 2020. After the outbreak and lockdown restrictions, the company’s stock plummeted to $63 in March 2020. The stock price continued to tumble down and reached $55.38 by the end of Q3 2020.

Nevertheless, it saw a huge spike, and the stock price surged, closing at $90 by the start of 2021. Due to the Covid-19 pandemic, many groups realized how a reduction in the consumption of fossil fuel and non-renewable energy could benefit the environment in the long run.

As more and more people stayed at home, the pollution levels started to decrease, and it had a positive impact on the overall environment. Therefore, the state governments throughout the US started emphasizing energy companies to focus more on renewable energy, particularly geothermal. Hence, the share price saw a spike from the end of Q3 to the next year.

Ormat Technologies (ORA) Stock 2019

Unlike last year, Ormat Technologies’ share price increased gradually throughout 2019. The company’s share was the top pick for investors looking to get an energy stock in their portfolio. Thus, the high demand for the Ormat Technologies shares caused its price to go up.

The share opened at around $52 on the 7th of January 2019 and closed at $74.75 on the 30th of December 2019. Increasing demand for geothermal energy and pressure from climate protection groups, such as IPCC (Intergovernmental Panel on Climate Change), made the investors turn their eyes toward green stocks.

Furthermore, the laws and regulations by the Californian government for geothermal energy further strengthened its position. It gave the company new avenues to explore and expand operations in various regions. Investors viewed these developments with optimism, and they were keen to get shares of Ormat Technologies.

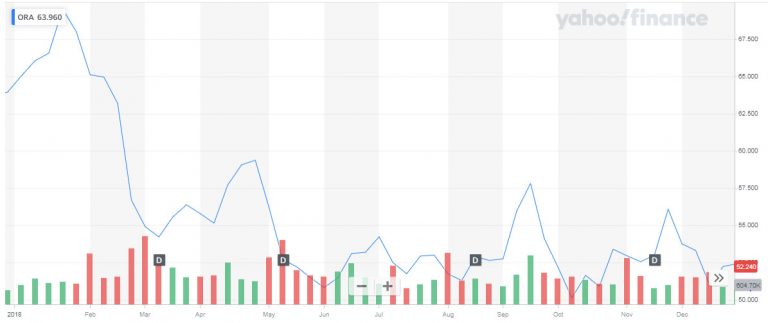

Ormat Technologies (ORA) Stock 2018

The bull run of Ormat Technologies’ share price came to a stop in 2018 as the company’s stock continued to go down. Ormat Technologies’ share price opened at $65 at the start of the year. However, it couldn’t sustain its growth, and the stock price fell gradually throughout 2018. Eventually, the company’s stock price closed at $52 by the end of 2018.

The primary reason for the fall in share price was the Kilauea volcano eruption in 2018. In early May 2018, the volcano caused the Ormat Technologies and other geothermal power plants in that region to shut down. As a result, the revenue for the second and third quarters of 2018 declined.

While the company remained a leader in geothermal energy products, many investors were skeptical about its revenue growth. Consequently, many short betters took advantage of the opportunity, causing Ormat Technologies’ stock price to go down.

Ormat Technologies (ORA) Stock 2017

The stock price of Ormat Technologies continued to enjoy the Bull Run from the previous year. The share price closed at $52.5 on the first day of the trading. It closed at $63.8 by the last week of December 2018. Investors’ confidence was boosted because of the exceptional numbers the company had posted throughout the year.

Consequently, they wanted to add the company’s share to their portfolio to enjoy long-term returns. In addition, Ormat Technologies was also eyeing closing the deal with the US Geothermal for its acquisition. The acquisition would have added more than 38MW to Ormat Technologies’ portfolio.

Ormat Technologies (ORA) Stock 2016

2016 was a good year for the investors of Ormat Technologies since the company’s share price saw a tremendous change. The share price opened at $35.6 on the first day of trading in 2016. It continued to go on an upward trajectory before closing at $53 by the last week of December.

Part of the reason for this growth is the deal between Ormat Technologies and Cyrq Energy. The company’s affiliate signed a deal worth $36million with Cyrq Energy for Engineering, Procurement, and Construction (EPC). It made investors confident that the company’s stock revenue will enjoy growth in the coming years.

Conclusion

Ormat Technologies has enjoyed steady growth in its share value over the last few years. The company is looking to expand into different regions and sign up deals with other businesses in the renewable energy industry. These initiatives can help the company increase its revenue in the long run and reduce its expenses.

Moreover, Ormat Technologies progressive strategy helps it understand the risks, mitigate the impact of changing situations, and evaluate the challenges ahead. It will strengthen the company’s overall position in the next few years. Therefore, investors looking to invest in green energy stocks should monitor the changes and developments from Ormat Technologies closely.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More