This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Hecla Mining Co (Hecla) was incorporated in 1891 and is based in Coeur d’Alene, Idaho, USA. It is primarily a precious metals mining company with some exposure to base metals. Hecla evaluates, acquires, develops, produces, and trades gold, silver, zinc, and lead ores. It trades carbon, gold, and silver concentrate to custom smelting houses, metal traders, and processing centres.

The company runs redevelopment projects in Libby, and Noxon, Montana. The Silver Valley, Idaho, and Monte Cristo, Nevada, are other notable projects in the USA.

There are mining projects in Colorado and Washington as well. Hecla’s Canadian exploration projects include sites in British Columbia and some in Quebec. It also has operating control over a major project in Mexico.

The company trade its products in Canada, China, Japan, Korea, Mexico, the Netherlands, and the US.

Table of Contents

Hecla Mining Company Stock Forecast in 2023

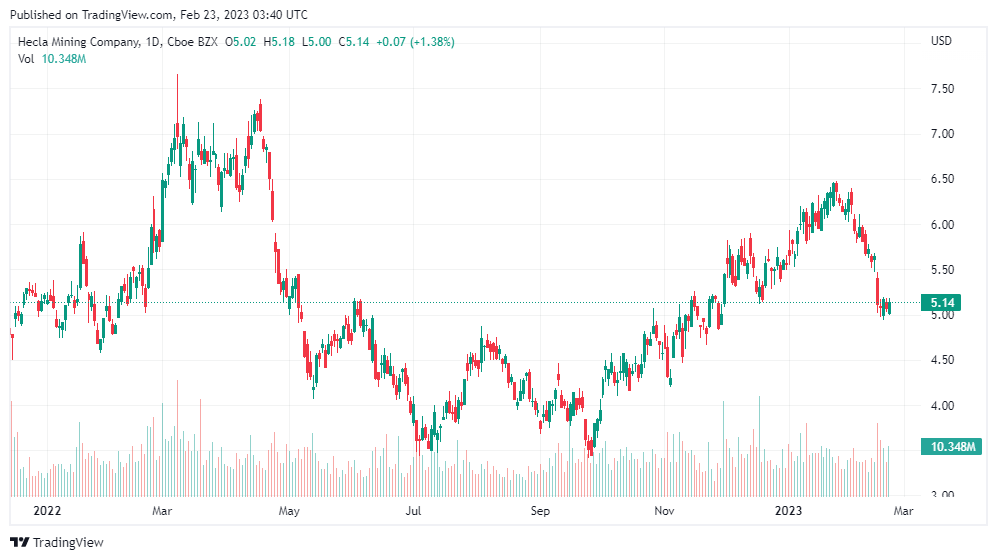

The YTD performance of the Hecla Mining Co. has been rising. The share peaked (for now) on January 25, 2023, at $6.46 when the company announced a 6-year union agreement at its Lucky Friday operations. This caused stock prices to rally as Lucky Friday is Hecla’s primary mining center.

Overall for this year, Hecla seems to be a good option for investors looking for short-term growth in share prices. The stock is undervalued even at its 2023 high of $6.46 and should be added to any portfolio for short-term gains anticipated over the year.

Gold and silver, its primary commodities, have been recovering since September/October 2023, and Hecla is benefiting from this as its Q4 and annual reports are positive. The future is also positive as the company’s Keno Hill development will go into operations and production by Q3. This is something to watch, and if the news remains optimistic going forward, the price expectations may increase if the commodity prices sustain through the rest of the year.

Hecla Mining Company Stock in 2022

The company’s first peak and trough around its January 19 production guidance was released, which had positive information about its gold and silver production in different mines. This led to a steep rise in its price in the short run and then continued volatility as traders continued to trade actively in the stock. The stock continued to rise based on a solid performance in Q4 and annual performance for 2021. This was a record year for the company regarding earnings and output; the market seemed to lap it up. Share prices remained comparatively high until May 10, after which the prices crashed almost 20% from April to May.

On May 10, the company released its earnings for Q1, 2022. While operationally, the company was doing OK. It reported inflationary pressures on trading both silver and gold. Gross and operating profits declined from Q4, and market sentiment crashed. This downward trend continued onwards as Q2 and Q3 financial reports continued to be gloomy. The company revised its production guidance on October 15, in which it claimed that its silver production was going to exceed expectations. This led to reviving market sentiment and marked the upward price movement in the stock. This continued onwards into the first quarter of 2023.

Hecla Mining Company Stock in 2021

Hecla started 2021 with a deep dive on January 25, when the share lost 25% of its market price. This deep dip was mainly due to lower-than-expected gold production values released by the company. Even though the company announced improved silver production compared to the previous year, the lower gold production level impacted market sentiment significantly.

The next dip and peak occurred around its Q4 and annual financial results. These were received positively, and the price rose to $6.79. The next significant price change occurred around April 30, when the company released its Q1 figures. the Q1 performance was much better than previous years, leading to a continued upward trend that peaked on June 2.

The announcement of upcoming management changes on June 18 seems to start a downward trend until August 20. The company announced its Q2 results which were positive and showed improving metrics on several major financial items. What was encouraging was that silver and gold were improving, leading to an overall upper strength for the stock up till November 2021. The high results seen in Q2 were not sustained in Q3 results announced in November. Due to this, the share price started to follow a downward trend.

Hecla Mining Company Stock in 2020

January started well as the company reported improved productivity and lower operating costs. The positives from this meant that the share price remained somewhat stable. Prices began to fall in February and dipped to their deepest in March as Quebec started implementing COVID-19-related protocols. The March dip reflects the global jerk that shared experience when markets crashed due to COVID-19 and the lockdown-related stressors. Prices rose in may when Q1 results were announced, and it was seen that the prompt response to COVID-19 ensured that hackleback mines were operating with minimal reduction in outputs.

Prices continued to rise to August 5, when Q2 results showed that the company was doing well in almost all its key production areas. Its product outputs were also up, along with the prices of gold and silver in the international markets. From October onwards, prices dipped somewhat when Q3 results were announced. Overall, the state of the stock remained buoyant, based on recovering markets and the high costs of silver and gold internationally.

Hecla Mining Company Stock in 2019

January started well as the company reported improved productivity and lower operating costs. The positives from this meant that the share price remained somewhat stable. Prices began to fall in February and dipped to their deepest in March as Quebec started implementing COVID-19-related protocols. The March dip reflects the global jerk that shared experience when markets crashed due to COVID-19 and the lockdown-related stressors. Prices rose in may when Q1 results were announced, and it was seen that the prompt response to COVID-19 ensured that hackleback mines were operating with minimal reduction in outputs. Prices continued to rise to August 5, when Q2 results showed that the company was doing well in almost all its key production areas. Its product outputs were also up, along with the prices of gold and silver in the international markets. From October onwards, the company prices continue to rise based on growing output results for silver. This was coupled with favorable news from its key mine, Lucky Friday, and good Q3 results announced in November. This led to the share closing in 2019 on a steep upward trend, which continued to the first month of 2020.

Hecla Mining Company Stock in 2018

2018 started on a high note and ended up on a low. The year begins on a high and ends on a deep low. The year started with growing earnings from record production in silver and gold in its three significant mines. The first dip for the year occurred on February 15, when the company released its Q4 and annual results. After the drop for adjustment, the stock prices continued on high based on news of additional mines acquired by the company and capital invested by a new partner.

From August onwards, the prices continue to show negative sentiments as Q2 results disappoint the market. Q3 results announced in November supported the negative trend further, and the market price of this company’s stocks continued to fall till the end of the year.

Hecla Mining Company Stock in 2017

2017 started on a high for the company, and 2016 was a record-breaking year in production. Stock prices remain on an upward trend, mainly through January and February. The first significant dip of the year occurred in March when the company released news about a labor strike in its Lucky Friday operations. Prices continue to fluctuate based on Q4 and annual results and Q1 results which received a mixed response from the market. Q2 results announced in July received mainly positive responses, and the price continued with its varied trends in August and September. The announcement of Q3 results in this in November led to a sustained dip that continued till the end of the year due to weak performance results and a low-performance outlook.

Conclusion

The Hecla Mining Company is currently an undervalued stock. It can be invested in short-term games as its price varies in response to improving commodity prices and an overall improving sector. However, while the share is undervalued and can yield value when managed carefully, it should not be left unattended and should be managed actively.

This is because the company is comparatively smaller and has shown vulnerability to market fluctuations and changing commodity prices. Historically it has demonstrated weakness in operational costs and fluctuating markets. While the weaknesses remain, it is clear that the stock at its current price has an enduring value to offer investors willing to commit to it for up to a year.

FAQ

How High will Hecla Mining stocks go?

Hecla Mining shares are expected to reach a high of $7 by the end of 2024. It can also touch a low of $4.75 in case of adverse performance and market news.

Mining shares are a good investment as they offer good returns and long-term growth. This is true in companies with minds with established pipelines of the minerals they are mining.

Why is Hecla Mining so hyped?

Hecla Mining is the largest silver producer in the US. Since silver is a popular metal for investors, it is usually in the news whenever commodities and their productions are discussed.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More