This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

The legalization of cannabis in the US is making rapid progress. The House of Representatives has recently passed a bill to legalize marijuana. There is still a long way to go for the United States since the matter also needs attention at the state level.

Nevertheless, the cannabis market has various companies that can produce cannabis products and earn high profits even in such conditions. The legalization will pave the path for these companies to earn more profits and develop various life-saving drugs. They can operate in a regulated market with a proper legal framework that will help them enjoy a high revenue stream.

Since the cannabis market operates in a highly volatile environment, many investors are not keen on investing in cannabis companies.

Companies are taking advantage of the legalization of cannabis by already researching and setting up distribution channels. And one big player in the market actively engages in the research and development of cannabis medications is Cresco Labs. It is a top-notch stock that has been the favorite pick for many investors.

Cresco Labs is a vertically integrated cannabis company that operates in the medical marijuana industry. Charlie Bachtell and Joe Caltabiano founded Cresco Labs in 2013, with its core operations in many states, including Arizona, Illinois, Michigan, New York, Ohio, Florida, etc.

Cresco has plenty of products and aims to increase its exposure to medical marijuana. We will focus on the historical and current stock prices of the company. It will help you understand if this stock is worth investing in or not.

Table of Contents

Cresco Statistical Overview

Cresco Stock Forecast 2023

Experts believe that Cresco’s stock has gotten caught up with the meme stock mania. The gains that share made after March 2020 have been wiped out by now, and investors continue to lose faith in the company’s share price. Nevertheless, Cresco offers a much better outlook for long-term investors.

Most notably, the company is acquiring different cannabis and marijuana brands in Canada and US. It is looking to increase its foothold and expand its operations. The acquisition of Laurel Harvest Labs is a prime example of the company’s aims to expand into untapped markets.

Furthermore, Cresco Labs has launched a project for $40 million that will increase the production capacity thrice. The company has set up the project in Ohio and looks to target the markets of Illinois, Pennsylvania, and Ohio. Therefore, we can expect the company’s revenue to increase in the next few years.

What helps Cresco Labs to stand out from the rest of its competitors is its retail network. While selling cannabis in the retail market will give Cresco labs a lower margin than the wholesale business module, the volume will make up for the difference.

As of December 13, 2022, the stock price of Cresco Labs was $2.64. Analysts have predicted that the median objective for Cresco Labs in the next 12 months to be $6.49. A high price of around $15.00 and a low price of $3.57 is also predicted for 2023. The previous price of $2.64 has resulted in a gain of +145.75% relative to the median expectation.

Cresco Stock 2022

The Bear Run from 2021 continued in 2022 as well since Cresco’s stock prices plummeted in the first four months of the year. Cresco’s share price fell from $6.75 at the start of January to $4.5 by the first week of May. Many factors that contributed to the drop in share value in 2021 persisted in influencing the stock price in 2022.

In the last week of June, the share price fell to $2.5 and it increased through the first two months in the third quarter but it began to fall again towards the end of September. The stock price at the beginning of December, 2022 was $3.55.

Cresco Stock 2021

2021 was not a great year for not just Cresco Labs but a vast majority of the companies in the cannabis industry. Investors saw a massive drop in the share value of companies that operate in cannabis and medical marijuana. Many analysts termed this as a market correction after the meme frenzy, which caused the stocks of cannabis companies to become overvalued.

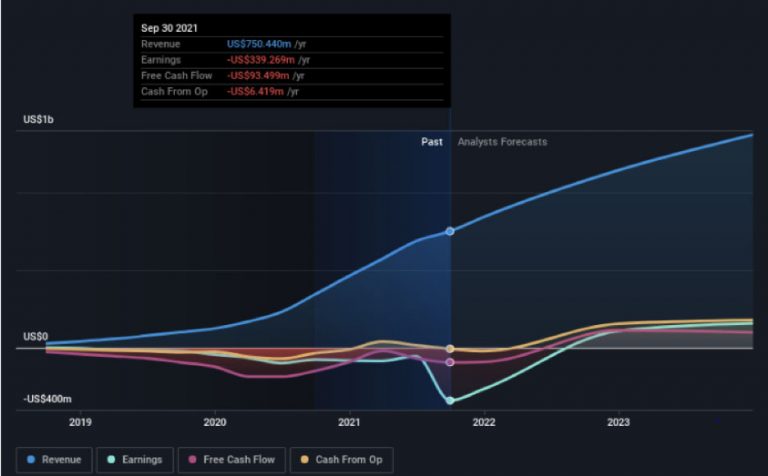

While Cresco Labs’ share price by the end of 2021 was up by 22% from its IPO price, it fell by 21% compared to the last year. The main reason behind this fall is that Cresco Labs incurred a loss in the previous year. The company has attained profits previously, but it couldn’t perform well in the last 12 months.

In addition, the sell-off by the investors of various cannabis companies also became a contributing factor to the share price decrease. Nevertheless, investors looking to capitalize on the long run were still holding on to the share, expecting it to grow. The company’s overall financials offer a fantastic outlook for a bright future ahead.

Cresco Stock 2020

When the pandemic struck, lockdown restrictions were in place to control the disease. Consequently, the majority of the companies in different industries saw a massive fall in their share value. The pandemic impacted various industries, including tourism, retail, aviation, etc. However, businesses in the technology and medical sectors experienced growth after the pandemic.

The case was no different for Cresco Labs, which experienced a massive drop in its share value when the market crashed in the second week of March 2020. Cresco Labs’ stock value dropped to $2.1 in the second week of March from $6.5 at the start of the year.

However, the stock’s rebound was astonishing as the Cresco Labs share price went up to $10 by the last day of trading in 2020. The most contributing factor to this rise was due to the rumors regarding how cannabis can help prevent you from getting infected with Covid-19.

Investors flocked to get their hands on the top cannabis companies, and it caused Cresco Labs’ share price to quadruple within eight to nine months. Another reason for this rise is due to the herding effect. It is when people tend to follow the same pattern as the masses without giving it a second thought.

Since the majority of the people were buying cannabis stocks, many investors decided to jump on the bandwagon and started buying shares of Cresco labs. The Bull Run for the Cresco share price continued for the first couple of months in 2021, but it decreased throughout the rest of the year.

Cresco Stock 2019-18

Cresco Labs IPO was available at $5.3 for the investors to buy the share. The company’s stock price saw rapid growth over the next six months and went to around $13. However, its share price saw a steady decline and eventually came down to $4.3 even by the last week of December 2019.

The main reason for the increase in the Cresco labs stock price in the first and second quarters of 2019 was its acquisition of the Canadian company Origin House. Cresco labs finalized the deal for CAD 1.1 billion, and it was one of the biggest acquisitions in the history of the US cannabis industry.

The acquisition will allow the company to increase its foothold in the Californian market. In addition, Creso also purchased assets from Tryke Companies. It allowed the company to access Reef Dispensary locations in various cities.

The company also experienced a growth in revenue to $87 million compared to $26 million last year. However, the company incurred a loss like the other companies in the cannabis industry. Furthermore, the drop in marijuana prices also made investors skeptical about cannabis stocks.

As a result, it led the stock prices of Cresco labs to go crashing down below its IPO. While the company did outperform in terms of revenue from the previous year, it failed to post numbers as per analysts’ projections. The bearish trend continued till the pandemic in 2020.

Conclusion

The stock offers immense potential in the future. The company is working on various projects and has acquisitions of many brands in the pipeline. Furthermore, the legalization of cannabis will make it easy for them to develop new products and medications. Having cannabis stock in your portfolio can diversify it and help mitigate the negative returns on other shares.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More