Investing in the stock market can be an effective method to grow your wealth. One company that has caught the attention of many investors is Celsius Holdings, Inc. (CELH). A leading global fitness and wellness brand, CELH has created a wide range of health and fitness beverages that align with today’s health and fitness-savvy consumers.

The decision to buy stocks is an important one, with the potential for significant financial gains. Still, it requires a sound understanding of the company and the market. Through buying stocks like CELH, individuals can become part-owners in a company, possibly reaping the rewards if the business thrives.

How Much Does it Cost to Buy Celsius Stock?

Decide How Much to Invest In Celsius Shares

To decide how much to invest in CELH stock, you should take into consideration the following questions:

What’s your budget?

Determining your budget for investing in CELH requires careful consideration of your financial situation. Only invest what you can afford to lose, keeping in mind other essential financial obligations and goals. Your budget should align with your risk tolerance and overall investment strategy.

What’s CELH’s current price?

The price of CELH’s shares is subject to change due to market fluctuations. You can find the current price by checking financial news websites, online brokerages, or financial sections of major news outlets.

What’s your investing strategy?

Your investing strategy should dictate how much you allocate to CELH’s shares. If you follow a long-term buy-and-hold strategy, you might invest a more significant portion of your budget. If you’re a short-term trader, you might invest less initially, adjusting as market conditions change.

What about your other investments?

Before deciding how much to invest in CELH, consider your other investments. Are they diverse across industries, regions, and asset classes? Investing a portion of your budget in CELH should not drastically upset this balance or make your portfolio overly reliant on one company’s performance.

How to Buy Celsius Stocks With eToro (Focusing on eToro Online Broker)

eToro is an excellent option for those looking to invest in CELH Stocks. As one of the leading online brokers, eToro has a strong reputation and offers a wide range of options for both beginner and professional traders. In this mini guide, we will walk you through the steps to open an account on eToro and start investing in CELH Stocks.

Step 1: Open an Account

To get started, you’ll need to create an account on eToro. Visit their homepage at www.etoro.com and click on the “Sign Up” or “Join Now” button. You will be directed to the registration page, where you’ll need to provide your email address, create a username and password, and agree to the terms and conditions. Alternatively, you can also sign up using your Facebook or Google account. A confirmation email will be sent to the email address provided, and you’ll need to verify your account before proceeding.

For more information.

Step 2: Upload ID

Next, you’ll be required to verify your identity by uploading a proof of identity document. This can be a government-issued ID card, passport, or driver’s license. Ensure that your document is clear and valid, as eToro uses this information to comply with regulatory requirements.

For more information on uploading your ID.

Step 3: Make a Deposit

Before you can start investing, you’ll need to fund your eToro account. Log in to your account and click on the “Deposit Funds” button, which is usually located at the bottom left corner of the platform. You’ll be presented with various payment methods, such as credit/debit card, PayPal, bank transfer, and more. Choose your preferred method and follow the instructions to complete the deposit process. Keep in mind that there may be minimum deposit requirements and fees associated with certain payment methods.

For more information on depositing funds.

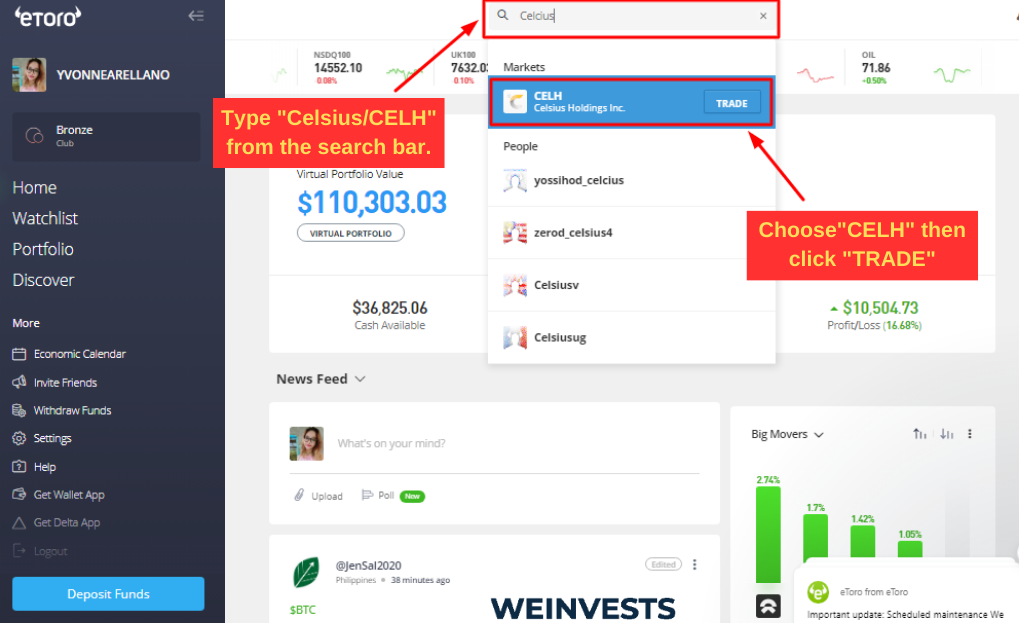

Step 4: Search for Celsius

Now that your account is funded, you can start searching for the CELH Stocks . On the eToro platform, locate the search bar at the top of the screen and type “Celsius Stocks ” or the stock ticker symbol, “CELH” The platform will display the search results, and you can click on the CELH Stocks option to access its trading page.

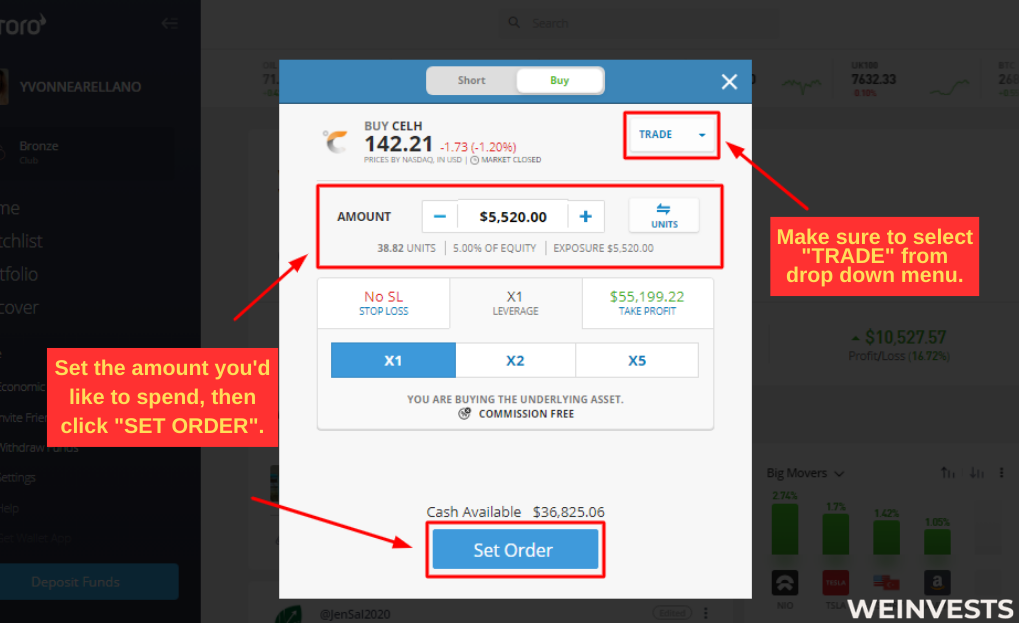

Step 5: Buy/Sell Celsius

On the CELH Stocks trading page, you’ll find an overview of the Stock, including its performance, historical data, and relevant news. To purchase the Stock, click on the “Trade” button, which is usually located at the top right corner of the page. A trade window will open, where you can enter the amount you want to invest, set a stop loss or take profit level, and choose between a market or limit order. Once you’ve entered your desired settings, click on the “Open Trade” button to execute the order. Congratulations, you’ve just invested in the CELH Stocks on eToro!

Remember to monitor your investments regularly and adjust your portfolio as needed to meet your financial goals. Always conduct thorough research and consider consulting a financial advisor for personalized advice.

Choosing the Right Brokerage

When it comes to buying stock in Celsius Holdings Inc. or any other company, the first step is choosing the right brokerage. Broadly speaking, brokerages are one of two types: online brokerages and full-service brokers.

Online Brokerages vs. Full-Service Brokers

Online brokerages, often called discount brokers, offer a quick, easy, and usually cheaper way to buy and sell stocks. They provide a platform where investors can carry out transactions on their own without personalized investment advice or financial planning services.

On the other hand, full-service brokers offer a more comprehensive suite of services. Alongside the buying and selling of stocks, they provide personalized investment advice, retirement planning, tax advice, and more. While these services can be helpful, they come at a higher cost.

Understanding Fees and Commissions

Before choosing a broker, it’s crucial to understand the fees and commissions they charge. These costs can considerably impact your returns, especially if you make numerous transactions.

Online brokerage costs typically include trading fees or commissions, although many have started to offer commission-free trades. There may also be account maintenance fees, withdrawal fees, and inactivity fees.

Full-service brokers often charge a percentage of the assets managed, a flat annual fee, or a combination of both. They often also have trading fees, which are usually higher than online brokerages. However, these tend to be less of a concern for long-term investors using their services.

Ultimately, your choice of the type of brokerage will be guided by the services you need. If you are a hands-on investor and prefer to make your own trading decisions without much guidance, an online brokerage might be a suitable choice for you.

However, if you’d prefer to have more personalized advice, assistance in creating a diversified portfolio, or access to advanced financial planning services, a full-service broker could be a more appropriate choice.

Opening a Brokerage Account

Once you have chosen your broker, your next step is setting up and funding your account.

Required Documents and Information for Account Setup

The setup process usually involves providing some basic personal information like your name, address, social security number, and date of birth. The broker might also ask about your employment status, financial situation, investment goals, and tolerance for risk to ensure they are providing suitable services.

How to Fund Your Account

After setting up your account, you need to deposit money into it to start investing. You can usually fund your brokerage account via bank transfer, wire transfer, check, or sometimes even a rollover from a retirement account.

Placing an Order to Buy CELH Stock

Once your account is funded, you can place an order to buy CELH stock. There are primarily two types of orders: market orders and limit orders.

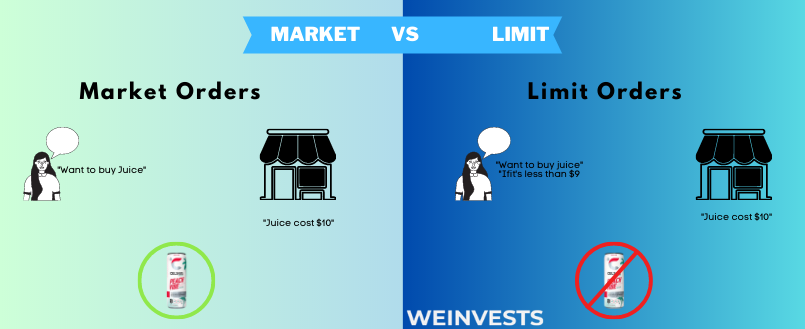

The Difference Between Market Orders and Limit Orders

A market order is a request to buy a stock immediately at the best available current price in the market. This type of order guarantees that your purchase will be executed, but not the price at which it will be executed.

In contrast, a limit order is a request to buy stock at or below a specific price. This guarantees the price you’ll pay, but not that the order will be executed, as the stock price may never reach your set limit.

Implementing Dollar-Cost Averaging

One investment strategy you might consider is dollar-cost averaging. This involves investing a fixed amount in CELH stock at regular intervals, regardless of the price. Over time, this strategy can reduce the impact of volatility on your investment, as you buy more shares when prices are low and fewer shares when prices are high.

Monitoring and Managing Your Investment in CELH Stock

Once you’ve purchased CELH stock, it’s important to monitor your investment regularly. While checking it daily is unnecessary, staying updated with company news and stock performance can help you make informed decisions.

Analyzing CELH’s Financial Performance Before Buying

Before purchasing any stock, all investors should perform a complete financial analysis of the company. This research helps you understand the company’s financial health and the potential for future growth.

When considering Celsius, there are several key metrics to evaluate. Understanding these financial indicators will give you a more comprehensive picture of the company’s performance and its potential as an investment.

Key Financial Metrics to Consider

Several metrics can provide valuable insights when analyzing a company’s financial performance. Here are a few that are particularly important:

- Revenue and Net Income of CELH

Checking Celsius Holdings Inc.’s revenue and net income trends over several years can provide insights into the company’s overall profitability. These are basic indicators of a company’s profitability. A consistent increase in these figures generally points to a healthy, growing, and profitable business.

These figures are usually readily available in the company’s annual reports or quarterly earnings releases. High or steadily increasing revenue and net income figures are generally seen as positive signals.

- Earnings Per Share (EPS) of CELH

EPS measures the portion of a company’s profit allocated to each outstanding share of common stock. It can be a valuable indicator of profitability and is often used by investors to compare companies within the same industry.

A high EPS can be a positive sign as it indicates the company is generating a significant amount of profit per share of common stock. However, comparing the EPS with companies within the same industry is important for a better perspective. A consistent growth in EPS over time may suggest a company’s profitability is on an upward trend.

- Price-To-Earnings (P/E) Ratio of CELH

This valuation ratio is calculated as a company’s current share price divided by its EPS. It can help investors determine if a company’s shares are over- or under-priced. Again, this ratio should be compared to the company’s competitors to have a better picture of valuation through comparison.

Competitive Landscape

Before investing in CELH, it’s vital to understand the competitive landscape in which it operates. This analysis can give you insights into the company’s market position and potential for future growth.

Major Competitors of CELH

Celsius faces stiff competition from major global energy drink and health beverage players. Some notable competitors include Monster Beverage Corporation, Red Bull GmbH, and PepsiCo, which owns Gatorade.

These companies have a significant presence in the market and a broad consumer base. It’s good practice to consider how CELH’s product offerings, marketing strategies, and overall performance compare with these competitors.

CELH’s Market Share

Another key factor is understanding CELH’s market share in the fitness and wellness beverage sector. A company with a high market share may have a competitive advantage, including increased purchasing power and stronger brand recognition.

However, a significant market share does not automatically equate to future success. It’s important to consider how CELH’s market share has changed over time and how it compares to competitors. If CELH has been gaining market share, it could suggest that its strategies are working effectively. Conversely, if its market share has been decreasing, it may signal potential challenges ahead.

Alternative Ways to Invest in CELH

Here are some alternatives to investing directly in CELH shares.

Investing in Exchange-Traded Funds (ETFs) And Index Funds Containing CELH

Investing in ETFs or index funds that include CELH is an alternative way to gain exposure without buying the stock directly. This strategy allows for diversification and potential risk reduction.

Understanding Stock Options and Futures of CELH

Options and futures provide another method of investment. These derivatives offer the opportunity to speculate on CELH’s future price movements or to hedge existing positions.

The Option of Buying Fractional Shares of CELH

Buying fractional shares of CELH enables investment with a lower capital outlay, making the stock more accessible to a broader range of investors.

Conclusion

Buying CELH stock involves a series of steps, starting from choosing the right brokerage, understanding key financial metrics and the competitive landscape, to assessing potential risks and rewards.

Alternative investment options like ETFs, futures, options, and fractional shares also offer varied avenues to gain exposure to CELH. Thorough research and due diligence remain paramount before making any investment decision.

Whether you’re a seasoned investor or just beginning your journey, investing in CELH can be a rewarding experience if done thoughtfully. Remember, every investment starts with the first step. Here’s to embarking on your journey to becoming a shareholder in Celsius Holdings Inc. and potentially reaping the rewards of your wise investment decisions.

FAQs

What is Celsius Holdings Inc. (CELH)?

Celsius Holdings Inc. is a global fitness and wellness brand known for its health-conscious beverage portfolio. The company’s drinks aim to provide functional energy to consumers and are often popular among health-conscious individuals.

What are some key financial metrics to consider when buying CELH stock?

When analyzing CELH’s financial health, consider metrics such as Revenue, Net Income, Earnings Per Share (EPS), Price-to-Earnings (P/E) Ratio, and Debt-to-Equity Ratio.

Who are the major competitors of CELH?

CELH operates in the fitness and wellness beverage sector, facing stiff competition from major global players like Monster Beverage Corporation, Red Bull GmbH, and PepsiCo.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More