In the near future, 650 banks in the United States are to be in a position to offer Bitcoin purchases to their customer base, estimated to be 24 million. This is the result of a deal between payments giant NCR, community banks, and credit unions. The banks and credit unions can offer cryptocurrency trading to customers through mobile phone applications.

Rather than clients having to deal with burdensome regulations related to holding client crypto, the financial institutions involved rely on the custodial services of NYDIG, a $10 billion alternative asset manager.

NCR Capitalizing on Crypto Demand

Atlanta-based NCR perceives this move as an effort to capitalize on the demand it is seeing from banks and credit unions, both of which are unhappy when purchases of cryptocurrency are made from their accounts to exchanges outside their system.

The President of NCR Digital Banking, Douglas Brown, says they are strong believers and supporters of crypto and crypto’s strategic application.

NCR dates back to 1884 when it was founded as National Cash Register. Today, the company employs well over 30,000 people and its businesses range from digital banking services to ATMs and point-of-purchase kiosks in over 160 countries.

From January through March 2020, NCR stock dropped by 62 percent. Afterward, riding on a wave similar to PayPal and other financial service providers, NCR stock rebounded and is up 238 percent since March 2020. From a low of $13.43, NCR stock is now trading at $45.44. During the calendar year 2020, NCR generated over $6 billion in non-crypto transactions.

With a 45 percent market share, NCR is the largest provider of POS software. In total, NCR provides services to 180 thousand retail stores and restaurants.

NCR Partners with Flexa

In May of this year, NCR and Flexa, a New York-based crypto payment company, formed a partnership, letting customers of a Pennsylvania-based convenience store chain purchase gasoline and other goods using Bitcoin, Ether, Litecoin, Dogecoin, and more.

Brown is seeing dozens of banking and credit union clients complain that their customers were using their savings to purchase crypto.

Rather than lose the assets to third-party crypto exchanges, they decided to capture the value by providing similar services. Banks are seeing a significant outflow of depositor’s money, leaving banks and heading for exchanges such as Coinbase. According to Yan Zhao, NYDIG President, this is the reason why banks are excited about having the same capability for both their customers and themselves.

Phase One

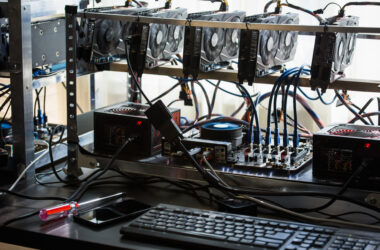

The initial phase provides NCR banking clients the opportunity to buy, sell, and trade Bitcoin and other cryptos directly from their mobile phones.

Although the buyer feels as he or she is dealing directly with the bank, NYDIG will, in fact, act as the custodian.

When a client wishes to purchase Bitcoin, it is actually bought from one of the many regulated OTC exchanges and sold forward at a slight markup, based on the trade size and other factors. NYDIG receives a per-user, per-month fee directly from the bank.

Patrick Sells, the head of bank solutions for NYDIG believes customers may see less costly transaction fees through the bank than what is current. Sells went on to say, “The banks do get to determine the transaction fee.”

Investment Advice

As well as charge clients for investment advice, banks are expected to follow a playbook, not unlike that used by PayPal. In the months following PayPal’s decision to allow their clients to buy and spend Bitcoin, it saw a dramatic increase in the click-through to the app, increasing the opportunity to sell other products on offer.

Today, banking is a normal part of a person’s day. Most bank customers visit their accounts a couple of times a day. Under these conditions, cryptocurrencies get an hourly level of engagement.

The Office of the Comptroller of Currency last year gave banks the right to provide custodial services for the private keys that provide customers with access to crypto on behalf of clients. Clients of NCR will not have any concerns as NYDIG plans to hold the precise amount of assets that are purchased by customers in an off-line, cold wallet custodial environment.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More