There is no doubt that 2021 has been a banner year for Bitcoin, and when compared to the price at this time last year, the mega-popular crypto has risen 113%. Many refer to Bitcoin as “digital gold,” and when compared to other cryptocurrencies, it is seen as a “safe” option against inflation. Though Bitcoin has really taken over the headlines, there are three other cryptos that people should consider, including Ethereum, Cardano, and Solana.

Ethereum: The Second Biggest Cryptocurrency

If you have been paying attention to cryptocurrency over the past few years, you know that Bitcoin is not the only option out there. In fact, several cryptos have made headlines over time, but the one that follows closely behind Bitcoin is Ethereum with a market capitalization of almost $470 billion. The token, Ether, is rising fast, and not only has it exploded in value this year, but it is also being seen as a hedge against inflation.

What is really pushing Ethereum now? It’s technology. The blockchain network of Ethereum is being re-worked, and it is seen as a great launching spot for new applications and brand new services. Since it’s decentralized, it is also an ideal place for new projects. Though the price of Bitcoin might keep rising, Ethereum is betting on quantity over quality, and in 2021, it has risen more than 450%, and it could be only a matter of time that it could surge past Bitcoin.

A New Option That Can Solve Crypto Problems

It’s pretty clear that Bitcoin is the most popular cryptocurrency, especially now that it has its own ETF, but others are coming in strong, including Cardano. Let’s look at why:

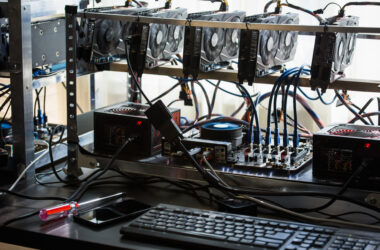

Basically, Bitcoin, and other similar cryptocurrencies, use a lot of energy to be mined. Cardano, however, is a little different. To mine Cardano, it begins with a simple and secure proof that the person mining it already has a stake in Cardano. Once that is proven, they are able to create a coin. This option uses less than 1% of the energy it takes to mine a Bitcoin, which is attractive to many. Basically, Cardano is a good option for people who want to get into altcoins and trade in a more eco-friendly way.

The Hottest Altcoin on the Market

Finally, we want to take a look at the hottest altcoin out there, Solana. In over the past six months, the price has risen exponentially, and it is sitting close to its all-time high as of the publication of this post.

Solana is a very fast, quite scalable, and kind of centralized coin. When compared to Bitcoin, which is scalable and decentralized, but very slow, and Ethereum, which doesn’t shine in any of these categories, you can see why Solana would shine. It has its own blockchain, and when compared to other tokens, like Polygon, it is simply superior. Additionally, it is a pretty unique blockchain with low fees per transaction, and currently, it can process between 1,000 to 2,000 transactions each second, and each transaction cost only a tenth of a penny.

The problem? It could be a little risky because there are more than 1000 validators that help to run Solana, meaning that the chances of hacking are higher than with other cryptocurrencies. However, it also means that the transactions are much faster when you compare this to the Bitcoin blockchain.

No matter what you do, from trading Bitcoin to looking into one of these three other options, you always need to remember to look at what you might be getting into. Solana, for example, is way more risky to invest in than Bitcoin or Ethereum, which is relatively “safe” in regard to cryptocurrencies, but it could be a great option for investors who don’t seem to care to take the risk.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More