Many people are nervous when it comes to investing. There seems to be so much to learn, and there is a lot at stake. No one wants to put their money on the line when they’re unsure of what they’re doing. But investing is essential if you want to grow your wealth and have enough money for your retirment. Luckily, a relatively new financial product makes investing easier than ever, Exchange Traded Funds (ETFs).

You don’t need a lot of knowledge, experience, or even money to start investing through an ETF. ETFs have a lot of advantages; a low bar to get started both from a knowledge and a financial standpoint, low fees, and diversification.

Time is money when it comes to growing your wealth. The longer you wait to invest, the more money you leave on the table. Investing creates wealth through the magic of compounding, and the secret ingredient to really make compounding work in your favour is time.

This article is a beginner’s guide to Exchange Traded Funds. It will explain what ETFs are, how they work, their advantages and disadvantages, types of ETFs, and where to buy them.

What is an ETF?

An ETF (Exchange Traded Fund) is a type of investment that allows investors to buy and sell a “basket” of assets like stocks, bonds, commodities, and real estate. ETFs are designed to track the performance of a specific index, sector, commodity, or asset class. ETFs are traded on a stock exchange, and their prices fluctuate during the trading day as investors buy and sell shares just like individual stocks.

ETFs have been around since the 1990s, so they are relatively young in terms of investment vehicles. The first ETF, Standard & Poor’s Depositary Receipts (SPDR), hit the American Stock Exchange (now known as NYSE Arca) in 1993. SPDR tracked the performance of the S&P 500 and gave investors broad exposure to a diverse portfolio of stocks in a single, tradeable security.

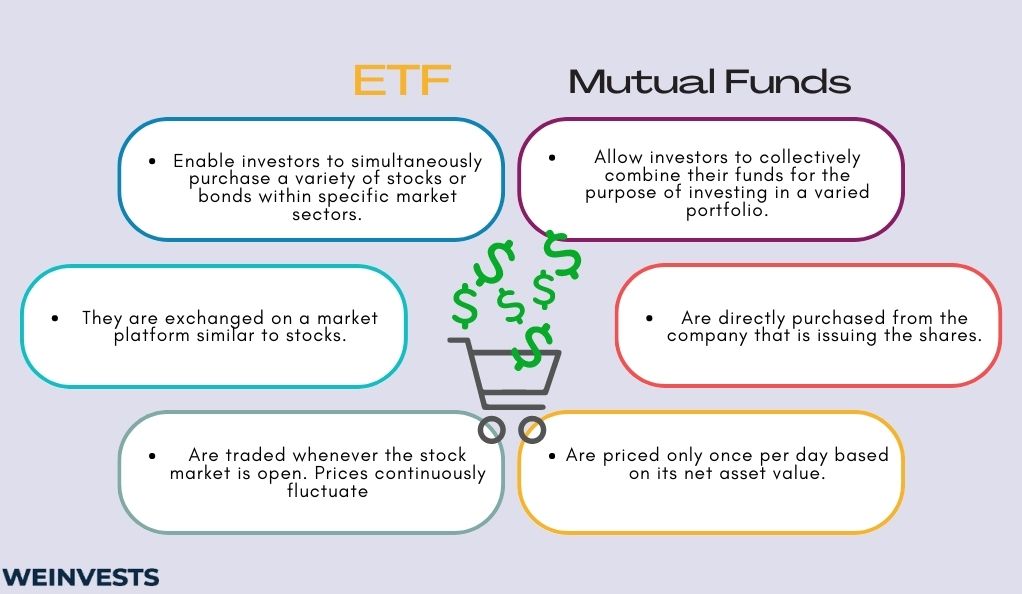

ETFs were created to combine the benefits of mutual funds and individual stocks. ETFs are like mutual funds because they provide investors with diversification but can be traded on stock exchanges like individual stocks.

In the few decades since that first ETF came onto the scene, the industry has seen tremendous growth. Investors can now choose from various ETFs that track different indices, sectors, commodities, and asset classes.

How ETFs Work

An ETF is created when a major financial institution, called an authorized participant (AP), designs a portfolio of assets that closely mirrors the underlying index or benchmark. An ETF tracking the S&P 500, for example, aims to replicate the returns of that index. This is done through different strategies like full replication, where the ETF holds all of the securities in the index, or sampling, where a representative subset of the index is held.

The AP delivers these assets to the ETF provider in exchange for an agreed-upon number of the ETF’s shares. Investors can trade the shares on a stock exchange, like individual stocks. An ETFs price fluctuates during the trading day based on supply and demand; investors can buy and sell them during trading hours. ETFs are usually structured as open-ended investment companies or unit investment trusts.

Advantages of ETFs

ETFs have several advantages, especially for new investors. They could be considered a “gateway” investment, a way for new investors to get their feet wet and become comfortable enough with investing to begin learning more and seeking out other types of investments.

Investors don’t need to accumulate a chunk of money before opening an account and buying an ETF. Many ETFs have no or a very low minimum deposit to get started, so if you only have a few dollars to devote to investing at the moment, you can begin investing right away.

One of the most important aspects of investing success is diversification. Diversification helps reduce the risk associated with buying individual stocks. ETFs offer this as they comprise a basket of different assets. Investors don’t have to research and choose individual stocks or other assets; the ETF has done it for you.

While mutual funds are typically traded at the end of the market day at the net asset value (NAV) price, ETFs are traded throughout the day, which allows investors to buy and sell shares at market prices providing flexibility and liquidity.

Because of their lower expense ratios due to their passive investment strategies and operational efficiencies, ETFs are generally more cost-effective for investors compared to traditional mutual funds.

ETFs provide tax efficiency because of their “in-kind” creation and redemption process. This typically means that investors can avoid triggering capital gains taxes until they sell the investment.

Disadvantages of ETFs

ETFs are passively managed. They aim to replicate the performance of a specific index rather than actively choosing and managing individual securities. While this offers lower fees for investors, it can mean the fund does not actively respond to market forces or adjust its holdings based on fundamental analysis. This can limit returns during times of volatile or fast-changing markets.

ETFs can result in tracking errors. They are designed to track the performance of a specific index but may not exactly replicate it because of factors like transaction costs, fees, and imperfect rebalancing. This can mean the ETF’s returns deviate from its underlying index, and high tracking errors can erode expected returns.

Many ETFs focus on a specific sector, market, or index, which can limit diversification. If an investor allocates too much of their portfolio to a particular ETF, they can be vulnerable to the performance of that specific sector or market if it underperforms.

Types of ETFs

Investors have several types of ETFs to choose from, each with its own investment strategy and objective:

- Stock ETFs: Stock ETFs track a specific stock market index like the S&P 500 or the Dow Jones Industrial Average. These ETFs offer broad exposure to a wide range of stocks.

- Bond ETFs: Bond ETFs invest in fixed-income securities like government, corporate, or municipal bonds.

- Sector ETFs: Sector ETFs focus on a specific industry like healthcare, technology, or energy.

- Commodity ETFs: Commodity ETFs invest in tangible commodities like precious metals or agricultural products.

- Currency ETFs: Currency ETFs track the performance of foreign currencies relative to a base currency like the U.S. dollar.

- Real Estate ETFs: Real estate ETFs invest in real estate investment trusts (REITs) or companies within the real estate sector.

- International ETFs: International ETFs invest in securities from companies based outside the U.S. MSCI World ETF is an example.

- Dividend ETFs: Dividend ETFs invest in stocks that regularly pay dividends.

- Socially Responsible ETFs: Socially responsible ETFs, also called ESG (environmental, social, governance) ETFs, invest in companies that meet specific ethical or sustainability requirements.

Choosing an ETF

ETFs can help investors simplify investing, but as with any investment, it’s essential to understand some key considerations when choosing an ETF:

- Investment Objective: Define your investment objective. Do you want broad market exposure or specific sector exposure? What is your time horizon and risk tolerance?

- Index Tracking: ETFs track a specific index, so investors need to understand the underlying index the ETF is trying to replicate. Look at the index methodology, constituents, and historical performance to ensure it aligns with your investment objective.

- Expense Ratio: The management fee an ETF charges is known as the expense ratio. Fees cut into an investor’s returns, so it’s important to understand the fees an ETF charges. Still, they are typically lower than the fees many other types of investment vehicles charge.

- Liquidity and Trading Volume: Higher trading volumes generally mean greater liquidity if an investor needs to exit their position quickly.

- Assets Under Management (AUM) and Fund Size: AUM and fund size can be indicators of the popularity and stability of an ETF.

- Performance and Historical Returns: Evaluate an ETF’s performance over time. While past performance is no guarantee of future performance, it can provide helpful information for an investor shopping for an ETF.

- Holdings: Look at an ETF’s holdings to better understand its diversification (or lack of). A diverse exposure to a range of securities helps reduce the risk in your portfolio.

- Fund Provider: Consider the reputation of the ETF provider. Successful, reputable providers will have a proven track record of managing an ETF.

- Tracking Error: Tracking errors measure how closely the ETF is replicating the performance of its underlying index. A lower tracking error means more tracking accuracy, which reduces the deviation between the ETF’s returns and the index’s returns.

Where to Buy ETFs

Investors have several options when it comes to buying ETFs:

- Online Brokerages: Online brokerage platforms like Charles Shwab, Fidelity, TD Ameritrade, and E*Trade offer investors a wide range of investment products, including ETFs.

- Robo-Advisors: Robo-advisors are automated investment platforms that use an algorithm to manage and invest money. They are a simple, low-cost way to invest in ETFs. Popular robo-advisors include Betterment, Wealthfront, and M1 Finance.

- Fund Providers: Investors can purchase ETFs directly from the fund providers like Vanguard, BlackRock, and Invesco.

- Financial Advisors: If you feel as though you need some professional help, you can work with a financial advisor to be your ETF guide.

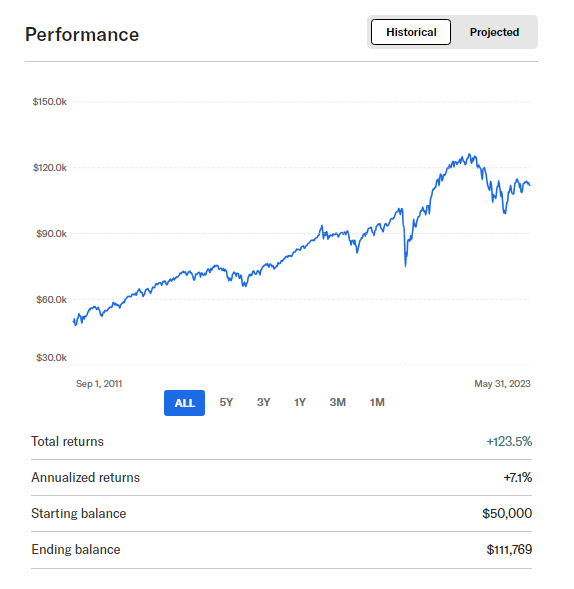

An Example of ETF Performance

This is an example of an ETF’s performance. The ETF is Betterment’s Core Portfolio,“well-diversified, low-cost, and built for long-term investing. With a broad collection of stocks and bonds from across the world, this portfolio is designed to generate long-term returns while reducing risk through diversification. The Core Portfolio also invests more heavily in U.S. companies that are attractively valued relative to their fundamentals.”

You can see the holdings inside the Core Portfolio here. Investors can choose their risk level.

- Initial Investment: $5,000

- Risk Level: 70/30 Stocks/bonds

- Time Frame: September 1, 2011-May 31, 2023

- Total Returns: +119.1%

- Annualized Returns: +6.9%

- Ending Balance: $10,956

Readers can play with different portfolios, risk levels, time horizons, and initial investment amounts to see additional examples of an ETF in action here.

Conclusion

ETFs are an investment that allows investors to buy a mixed basket of assets that can include stocks, bonds, commodities, and real estate. ETFs track the performance of a particular index, sector, commodity, or asset class.

ETFs are an excellent way for new investors to get started. They can be a great tool for an investor of any experience who wants a simple, straightforward way to include diversity into their portfolios without hand-selecting (and researching) individual stocks, which can be time-consuming. There are many types of ETFs to choose from which means almost any investor can find one that aligns with their investing goals, including socially conscious investors.

Before choosing an ETF, it’s crucial for investors to do their research and consider things like the fund’s expense ratio, tracking error, liquidity, underlying assets, and the investment strategy involved. And to understand their own investing goals, time horizon, and risk tolerance.

FAQ

What are ETFs?

An ETF (Exchange Traded Fund) is a type of investment fund traded on stock exchanges. ETFs hold different financial assets like stocks, bonds, currencies, commodities, and real estate.

Are ETFs good for new investors?

ETFs are popular among new investors because they are low-cost, offer diversification, and have a low bar to get started both in terms of investing knowledge and money.

Where can you buy an ETF?

ETFs can be purchased through online brokerages, robo-advisors, fund providers, and financial advisors.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More