This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

Choosing the right investment can be tricky. There are thousands of exchange-traded funds (ETFs) to choose from, which makes it very difficult to know which one is right for you. Invesco QQQ Trust is a widely traded ETF with a significant amount of assets under management; however, it is often compared to other similar products in the industry. Are the similarities just an illusion? In this article, we will discuss what you should know before investing in this ETF.

Table of Contents

- What is Invesco QQQ Trust (QQQ)?

- What is Special About Invesco QQQ Trust?

- How to Buy in Invesco QQQ Trust (QQQ)?

- How to Buy in Invesco QQQ Trust (QQQ)

- Invesco QQQ Trust’s Historical Performance

- Should You Trade Invesco QQQ Trust Now?

- Risks of Investing in Invesco QQQ Trust (QQQ)

- Conclusion

- FAQ (Commonly asked questions)

What is Invesco QQQ Trust (QQQ)?

The Invesco QQQ Trust is an ETF that invests in the NASDAQ-100 Index and tracks it. It’s designed to give investors exposure to the stocks that make up the NASDAQ-100 Index but without having to trade all of them individually.The index includes companies such as Apple, Microsoft, Alphabet (Google), Amazon, Facebook, Intel, Visa, and Netflix.

The fund was launched on March 29, 1999, by Invesco Asset Management with an initial investment of $1 billion USD in assets under management (AUM). And as of January 2023, the fund has over $100 billion in AUM, according to Morningstar data.

The QQQ ETF includes some of the most widely held stocks in America, like Microsoft or Apple Inc., which makes it a great go-to investment for those who want to diversify their portfolio with a few blue-chip stocks. The fund also provides exposure to other sectors like technology and healthcare that are often overlooked by many investors but remain essential parts of any portfolio plan.

What is Special About Invesco QQQ Trust?

It’s a passive fund that tracks the performance of the Nasdaq 100 Index by investing in all 100 companies equally. As a result, it doesn’t try to beat its benchmark over time—it simply attempts to match it.

It’s also a low-cost way for investors who want exposure to these large tech companies but don’t want to trade individual stocks or pay high fees for an active manager who may underperform their benchmark over time. And because it’s not actively managed, there aren’t any hidden fees that might eat into your returns over time like Management fees.

Finally, because Invesco QQQ Trust trades on one of the largest exchanges in America (the Nasdaq), it should be easy for anyone with access via their financial advisor or brokerage firm to trade shares without paying large commissions or transaction fees

How to Buy in Invesco QQQ Trust (QQQ)?

The Invesco QQQ Trust is a popular ETF. The structure of this investment vehicle is what makes it attractive to investors: it’s passive, meaning there are no managers making decisions about when to trade shares; instead, the ETF simply buys all 100 stocks in its portfolio at once when you trade into it. You can think of this like owning shares in each individual company within your portfolio –you own them all at once! This makes investing easy because there’s no need for constant monitoring or trading activity; if one stock goes down in value while others rise up, then so be it –it’s part of being diversified across many different companies with varying business models and capitalizations.

How to Buy in Invesco QQQ Trust (QQQ)

eToro is an excellent option for investors looking to trade Invesco QQQ Trust (QQQ). As one of the best online brokers available, eToro offers an accessible platform for both beginner and professional traders. In this mini guide, we’ll walk you through the process of opening an account on eToro and investing in Invesco QQQ Trust (QQQ).

Step 1: Open your Personal Account

To open an account on eToro, visit their homepage and click the “Sign Up” or “Join Now” button. You’ll be directed to the registration page, where you can create an account by providing your name, email address, username, and password. Ensure you agree to the terms and conditions and privacy policy before clicking “Create Account.”

Step 2: Upload ID

Next, eToro requires users to upload proof of identity. This can be an ID card, passport, or driver’s license. Navigate to the “Upload Document” section in your account settings and follow the instructions to submit the required documents. Keep in mind that the verification process may take a few days to complete.

Step 3: Make a Deposit

Once your account is verified, you’ll need to fund it before you can start investing. Log in to your eToro account and click the “Deposit Funds” button, typically located in the bottom left corner of the platform. eToro offers various payment methods, including credit/debit cards, PayPal, bank transfers, and more. Choose your preferred method and follow the prompts to complete the deposit.

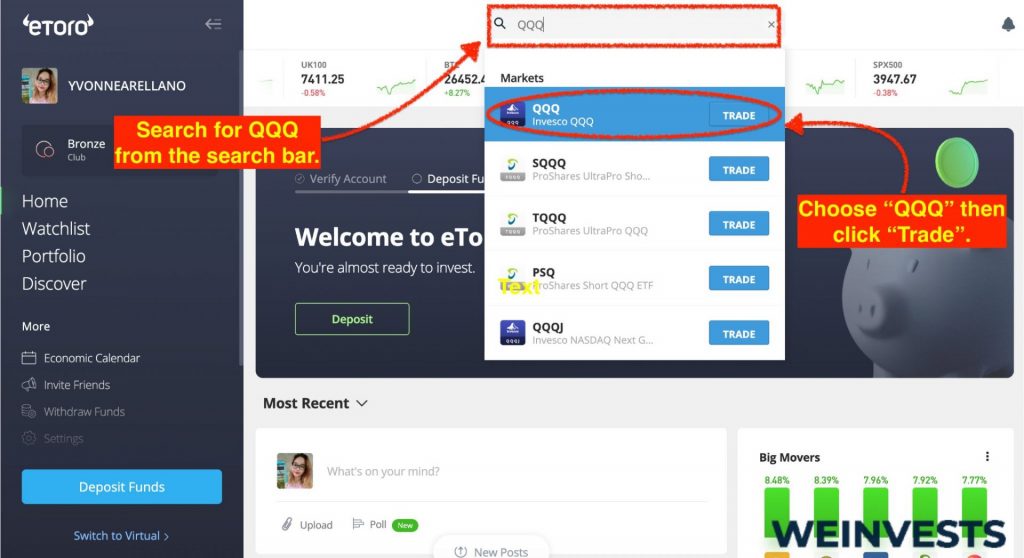

Step 4: Search for QQQ

Now that your account is funded, you can search for Invesco QQQ Trust (QQQ) on the eToro platform. Use the search bar at the top of the platform and type in “QQQ” or “Invesco QQQ Trust.” Select the QQQ instrument from the search results to access its trading page.

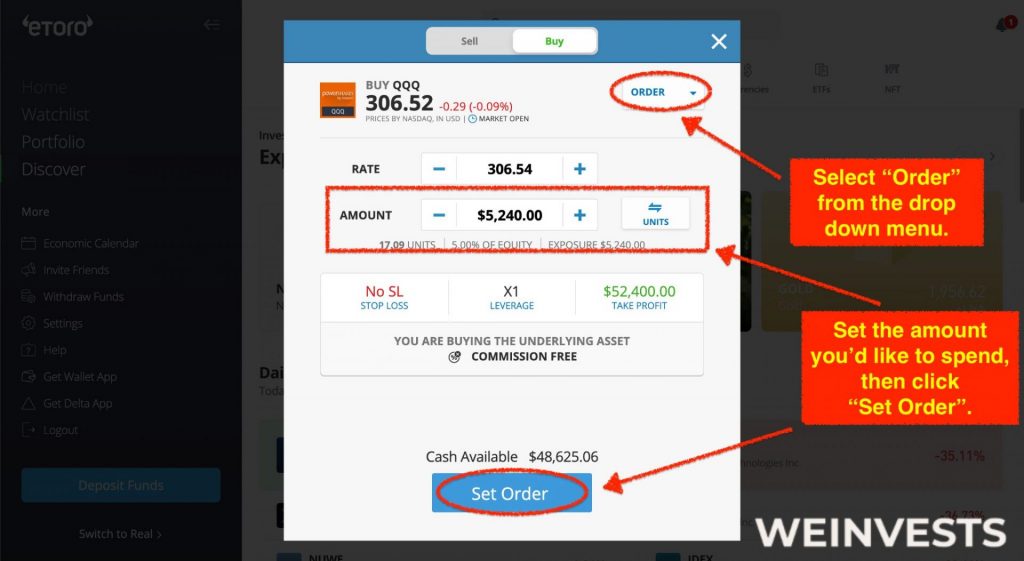

Step 5: Trade Invesco QQQ Trust (QQQ)

On the Invesco QQQ Trust (QQQ) trading page, click the “Trade” button to open the investment window. Here, you can specify the amount you’d like to invest, set stop loss and take profit orders, and choose your leverage if applicable. Once you’re satisfied with your order, click “Open Trade” to complete the transaction. Congratulations! You’ve successfully invested in Invesco QQQ Trust (QQQ) using eToro.

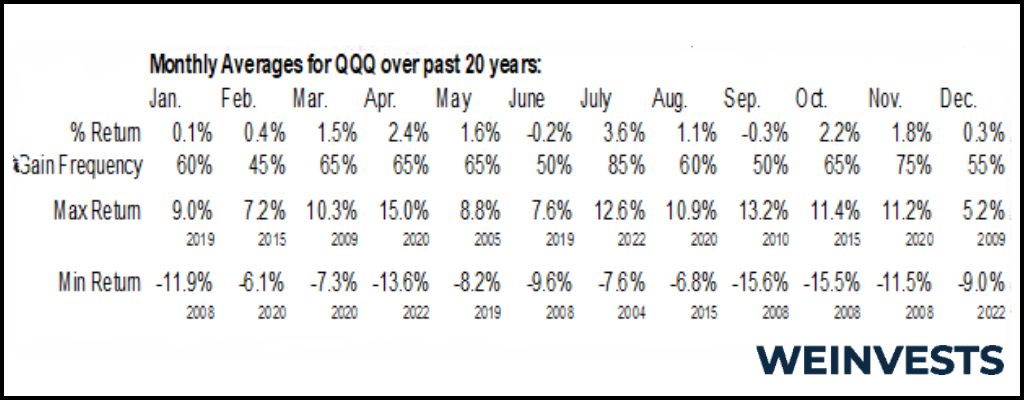

Invesco QQQ Trust’s Historical Performance

From its inception on March 10, 1999, to January 28, 2023, Invesco QQQ Trust has had an average annual return of 20.4%. It has also outperformed the S&P 500 Index over the same period, which had an average annual return of 9.2%. However, past performance is not a guarantee of future results.

It’s important to keep in mind that ETFs like QQQ are subject to market risks and fluctuations, and it’s essential to do proper research and seek advice from a financial advisor before investing.

Should You Trade Invesco QQQ Trust Now?

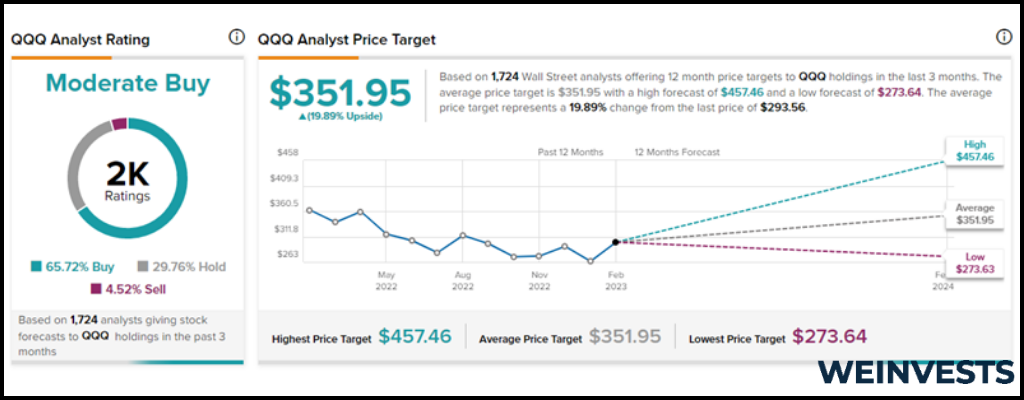

Before investing in any financial product, including QQQ, it’s essential to consider your investment goals, risk tolerance, and overall financial situation. In this section, we will look at some of the key data and growth analytics for QQQ to help you decide whether it’s a good time to trade it now.

- Performance: Over the past five years, QQQ has delivered strong returns, with an average annual return of approximately 20%. In 2020, the fund outperformed the S&P 500 by a significant margin, returning 43.6% compared to the S&P 500’s return of 16.3%.

- Diversification: QQQ provides broad exposure to the NASDAQ-100 Index, which is heavily weighted toward technology and growth stocks. This makes QQQ a good option for investors who are looking to gain exposure to a diverse group of high-growth companies while also reducing the risk of holding a single stock.

- Volatility: QQQ has a relatively high level of volatility compared to other ETFs, as its holdings are largely comprised of technology and growth stocks, which can be subject to sharp price swings. It’s important to consider your risk tolerance and investment goals when deciding whether QQQ is right for you.

- Expense ratio: QQQ has a relatively low expense ratio of 0.20%, which is lower than the average for actively managed funds. This makes it a cost-effective option for investors who are looking for broad exposure to the NASDAQ-100 Index.

Risks of Investing in Invesco QQQ Trust (QQQ)

Investing in ETFs like the Invesco QQQ Trust is a great way to diversify your portfolio, but before you jump into this type of investment, it’s important to understand not only how ETFs work but also what risks can accompany this type of investment.

Market risk is the chance that your investment will lose value because of fluctuations in the overall market. The value of the securities held by an index fund may go down as well as up, resulting in a decline in the value of its shares. This type of market risk applies to all mutual funds that hold stock or bond investments, including those that invest only in stocks, only bonds (fixed-income funds), or both stocks and bonds.

The issuer of any security could default on its obligations, causing losses for investors who own those securities because there would be no one else left to pay them off if something went wrong with their investments in those securities.

An ETF’s ability to buy and sell its holdings quickly depends on whether there are enough buyers at any given time willing to purchase them at reasonable prices; if not enough investors are interested, then this will affect their ability to trade efficiently within their portfolios which could result into lower returns over time due to increased transaction costs – especially when trading large positions such as QQQ’s $100 million worth daily volume!

The biggest risk for ETF investors is valuation risk. This refers to the possibility that even though a fund, such as the QQQ, might be able to replicate an index like the Nasdaq 100, that doesn’t mean that it will be successful in doing so. This risk comes into play when a fund’s holdings are weighted differently than they are in the index they’re trying to capture.

Other important factors you should consider include:

This is the chance that inflation will reduce the purchasing power of your portfolio over time.

This relates to how well an investment performs against other investments denominated in different currencies or paying different rates of interest.

Refers to situations where companies cut their dividends or stop paying them altogether; this can cause share prices to drop dramatically as investors sell off their holdings, looking for better returns elsewhere.

Conclusion

The Invesco QQQ Trust (QQQ) is a popular exchange-traded fund (ETF) that tracks the performance of the Nasdaq-100 Index, providing investors with diversified exposure to some of the most innovative and dynamic companies in the technology, healthcare, and consumer services sectors. This ETF enables investors to tap into the growth potential of these industries, which have been key drivers of the global economy in recent years.

FAQ (Commonly asked questions)

What is QQQ?

QQQ (Invesco QQQ Trust) is an exchange-traded fund that tracks the Nasdaq-100 Index. The fund invests in stocks of 100 of the largest U.S.-listed companies, including Apple Inc., Microsoft Corp., Amazon Inc., Facebook Inc., Alphabet Inc.’s Google and Intel Corp.. The average market capitalization of its holdings was over $1 trillion at the end of March 2021, according to Morningstar.

How does it work?

The fund is designed to provide two times (2x) long exposure to the Nasdaq-100 Index. It invests primarily in U.S.-listed securities that are components of the index, including common stock and preferred stock; American Depositary Receipts (ADRs); and convertible securities whose underlying security represents an equity interest in a company that is not listed on any U.S. exchange but is included in the index.

What is QQQ’s Expense Ratio?

The Invesco QQQ Trust (QQQ) has an expense ratio of 0.20%. The expense ratio is the annualized percentage of assets that are used to pay fund operating expenses. The lower the number, the less you will have to pay in fees.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More