The rapid ascent of Bitcoin is forcing the banking industry to think hard about embracing Bitcoin. The pressure is building on banks to accept digital currency as a legitimate asset class, and the pressure is building from within.

JPMorgan Chase held a town-hall meeting last month; in attendance were traders and salespeople from around the world. During a recent Zoom call, Troy Rohrbaugh, head of the bank’s global markets, was asked a pointed question by employees of the bank. “When will the bank get involved in Bitcoin?” To answer the question, Rohrbaugh asked co-president Daniel Pinto to respond.

During the call, which took up almost an hour, Pinto indicated that he was quite open-minded about Bitcoin. Later, when questioned by the press, Pinto said the decision would be influenced by whether a critical mass of the bank’s clients wanted the bank to trade in cyber currency. Pinto was quoted as saying, “If an asset class develops, one that investors and asset managers will use, the bank will have to be involved.” Although the demand does not appear to be there at the moment, Pinto stated, “I’m sure it will be at some point.”

Interest in Bitcoin is not Confined to JPMorgan Traders Only

In the last few days, Goldman Sachs hosted a private forum with the founder and Chief Executive Officer of crypto-firm Galaxy Digital. Attendees at the forum were bank employees and clients. During the hour and a half presentation. Galaxy Digital CEO, Mike Novogratz, discussed Bitcoin, Etherum, and other digital currencies and their macroeconomic backdrop.

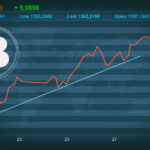

The newfound openness to cryptocurrency being shown by Wall Street is an indication that the banking industry has no option but to contend with bitcoin. The value of Bitcoin has gone up in a dizzying fashion and is being adopted more and more by corporations and institutional investors.

Banks have traditionally faced a great deal of financial inspection among financial firms. This regulatory scrutiny is due to the crucial role banks play in the U.S. economy. As such, banks have been hesitant to join in the crypto space. Banks have, however, shown a liking for related technology, including blockchain.

If one of the top banks in the country elects to embrace Bitcoin, it will legitimize this nascent asset class.

Bitcoin’s Earlier Boom

Bitcoin went through a boom-cycle in 2017. At that time, banks, including Goldman Sachs, toyed with the idea of creating dedicated crypto trading operations. The plan was ultimately shelved. Bitcoin, which was less than a decade old and born out of the global financial crisis, was seen as too speculative, posing a considerable risk for bank clients.

At the time, JPMorgan Chase CEO Jamie Dimon went so far as to declare Bitcoin a fraud, one that would not end well. However, Bitcoin continued to exist even through 2018 and 19, a period known as the “crypto winter.” Then the world was hit hard by the coronavirus pandemic. Governments, led by the United States, plowed billions, perhaps trillions, of dollars in support of markets, businesses, as well as individuals.

BlackRock and Tesla Adopting Bitcoin

The financial industry is seeing a steady stream of news on adopters. BlackRock, the world’s largest asset manager, is adding Bitcoin futures in two of its popular funds, proving evidence that the crypto is gaining traction.

Last week, Tesla, the electric car manufacturer, became the latest entity to plow cash into bitcoin. MasterCard, amongst others, stated they are planning to become more involved in crypto. With every new announcement, it appears more likely that JPMorgan Chase and other large banks will join the party.

Damien Vanderwilt, Galaxy Digital co-president, stated, “Banks will get strong-armed by clients into developing crypto products for their clients.” Vanderwilt knows what he is speaking about. Before joining Galaxy as head of its global markets division, he led Goldman Sachs efforts to modernize their trading infrastructure.

During Vanderwilt’s tenure at Goldman, there were times when the bank was slow to spot emerging trends, forcing them to play catch-up. To avoid a similar fate with cryptocurrency, Galaxy is poised to help clients accelerate the development of new products.

As the price of bitcoin continues to surge, big banks are beginning to envy the growth. As little as two months ago, bitcoin was trading well under $20,000. Late last week, the digital currency was closing in on $50,000.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More