This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

You may have just $1000 but curiosity is going to add a lot of zeros to that amount, with a few good directions. However, it’s worth noting that the money you’ve saved may not be a result of your efforts. It could be an inheritance, a lottery win, or even a stroke of luck.

As the expert, Robert Kiyosaki states, saving is a crucial step toward generating investment income. It demonstrates maturity and resolves, and it’s essential to develop the mindset of an investor. By investing your money, you’re making it work for you, and in turn, generating an alternative source of income. As your investment grows, so does your independence.

When it comes to investment income, there are four main types to consider:

- Low-risk debt-linked options, which provide income in the form of interest.

- Dividends, which are payments made to shareholders by the company, and rent from residential properties. Both of these forms of income have the potential to grow over time.

- Capital Appreciation is a type of high-risk, long-term investment that can ultimately pay off in the end.

- Income Tax Reliefs, are incentives provided by the government to encourage people to invest.

- But let’s put these general types aside. Here is what we think are the best ways when we take into account the risks and the upsides. Ways you can start exploring right now.

Table of Contents

- High-Yield Savings Accounts and CDs – Starting with a Safe Way

- CFD Leveraged Trading – For the Brave and Persistent

- PAMM –CFD Trading Alternative

- Copy Trading – A Sidekick to PAMM

- Yield Farming – For the New Age Techys

- Metaverse Projects – Early, Promising, and Virtual

- Mutual Funds – A Mix of Safety and Yields

- Where to Invest $1000?

- Conclusion

High-Yield Savings Accounts and CDs – Starting with a Safe Way

High-Yield Savings Account and CDs If saving is good enough for Kiyosaki it is certainly good enough for us. That is why our first suggestion is a high-yield savings account and a certificate of deposit (CD) at a bank or credit union. High-yield savings accounts and CDs can potentially provide a high yet relatively safe return on your investment. The risk is low as these types of accounts are FDIC-insured, which means that the deposits are guaranteed up to $250,000 per depositor per FDIC-insured bank. They are preferable to traditional savings accounts due to offering higher interest rates. Additional contributions to the account are welcome and they serve to pump your balance sheet and, as a result, increase the amount of interest earned.

In the case of CDs, the sum is locked, and you cannot deposit more money before the end of the term. The number of withdrawals from a high-yield savings account is limited, and with CDs, they are even penalized, which serves to stop you from accessing the money until the time is right. The penalty is usually equal to the interest hitherto earned, or the one that you would have earned over a certain number of months.

High-yield savings account’s interest rate is prone to change whereas with CDs it stays locked the entire time. However, it is important to be cautious when it comes to high-yield investments.

Do not confuse High-yield savings accounts with High-Yield Investment Programs (HYIPs)! HYIPs are commonly run by unlicensed individuals who display fraudulent behavior. If something is too good to be true, it probably is, so don’t believe in fairy tales that guarantee 30 – 40% annual returns with little or no risk. Do not give credibility to their posts on social media, and do not go to the HYIP website. Note that the websites often do not provide important legitimate details like contacts, terms, and conditions, privacy policy, etc. HYIPs also go under the name of the “Prime Bank Program” as these banks are big and likely to transact a large amount of money in one transaction. By adding a renowned bank to their scheme, the fraudsters create an air of authenticity, enticing prospective investors with their clandestine transactions with foreign banks. It is important to steer clear of such programs and be vigilant when it comes to high-yield investments.

CFD Leveraged Trading – For the Brave and Persistent

Trading Contracts for difference (CFDs) is among the best investment options but it requires learning and activity. CFDs allow speculation on financial markets such as shares, forex, indices, and commodities without actually having to own the underlying assets. With leveraged trading, you are allowed to put down a small sum of money, also known as a margin, and trade with a larger amount. Being exposed to a large position can then enable you to spread your capital further. However, this kind of trading can amplify both gains and losses which calls for an understanding of the market risks. There are a lot of people who went into high-risk CFD crypto trading and doubled the $1000 deposit in a few days during the crash in 2022.

Pay attention to the leverage ratio at all times, a small adverse price movement could stop out your account. If $1000 is a substantial amount you cannot afford to lose, do not go for this option.

PAMM –CFD Trading Alternative

PAMM, or Percentage Allocation Management Module, is an investment strategy that allows investors to entrust their funds to a professional money manager who will trade on their behalf. With PAMM, a number of traders can invest in one account, but only one person can act as the manager. It is important to note that the manager is not permitted to transfer money from the PAMM account to their own account.

One of the benefits of PAMM is the low minimum investment requirement, making it accessible to investors of all levels. It is crucial to find a money manager with a good trading track record, as they will be risking their own funds first, which can lead to more thoughtful and reasonable trading decisions.

With access to a wide range of financial instruments such as forex, stocks, or commodities, a professional trader can take advantage of market opportunities and potentially generate returns. The benefit of PAMM accounts is the ability to diversify one’s portfolio, which can help to reduce the risk of loss.

Copy Trading – A Sidekick to PAMM

Another currently popular trading technique similar to PAMM is copy trading. It’s like having a sidekick to help you navigate the world of investments. As the name suggests it’s a trading method in which investors or traders can invariably copy the transactions other successful traders have made. It is done via platform which connects the established traders and the would-be traders, the copycats. A potential investor would have a wide array of traders to choose from. All the available information on their past performance and risk management strategies could help with the selection of a suitable candidate. As soon as the choice has been made, the platform will automatically execute the trades on the investor’s account.

This kind of trading is useful for rookie investors who lack the experience and expertise to place trades on their own and are willing to learn from professionals. It’s like having a mentor who is always there to guide you. But, just like PAMM, there is no foolproof trading method. Past performance cannot guarantee future results with absolute certainty. Additionally, unlike PAMM investors who pay only the account manager, copy traders have to pay the platform as well. Hence, they should be aware of the fees that can eat into their income. But hey, with the right choice of trader, you could be well on your way to reaping the rewards.

Yield Farming – For the New Age Techys

Yield farming is a relatively new investment strategy that involves earning interest on digital assets by participating in decentralized finance (DeFi) protocols. This can include borrowing, lending, or staking cryptocurrencies or becoming a liquidity provider for a decentralized exchange. Essentially, it is similar to depositing your money in a bank account, but instead of depositing cash, you deposit your crypto. The rewards you receive in the form of other cryptocurrencies can be much higher than traditional interest rates. However, it’s important to note that the rewards vary depending on the platform or protocol, and the duration of the deposit.

Expected yield farming returns are usually calculated annually (APY) and can be substantial. However, it’s important to remember that large returns often come with significant risks. The high volatility of digital assets poses a constant threat to your investment. Additionally, the relatively unregulated nature of DeFi means that investors need to be aware of potential pitfalls such as rug pulls, hacking, and scams. As always, invest only what you can afford to lose.

Metaverse Projects – Early, Promising, and Virtual

Are you ready to take a trip to the Metaverse and invest your $1000 in the future of virtual reality? The Metaverse is a concept of a universe beyond our own, where virtual reality, augmented reality and games come together to create an immersive experience that never ends.

Investing in Metaverse projects is a hot ticket right now, as the virtual reality industry is on the rise and the market for Metaverse-related projects is expected to expand. You’ll be at the forefront of cutting-edge technology and be the first to know about new innovations.

There are two main platforms that make up the Metaverse. One is where you can leverage non-fungible tokens (NFTs) and cryptocurrencies to buy virtual land and create your own virtual world on platforms like Decentraland and The Sandbox. The other is where users meet up in the virtual world for business or pleasure, using tokens to trade NFT artworks and charging admission to virtual events like exhibitions and concerts.

Another way to make a pretty penny in the Metaverse is by trading virtual land, which has seen a rise in value in recent years. So grab your virtual shovel and start building your virtual empire in the Metaverse – have we mentioned you are able to trade, rent, upgrade,sell, and do a lot more with these assets for real $?

Mutual Funds – A Mix of Safety and Yields

A Mutual Fund is a type of investment fund that pools money from numerous investors to purchase stocks, bonds, or other securities. By investing $1,000, many brokerages will provide you with a fractional share of multiple companies. The diverse portfolio of a mutual fund means gaining exposure to a wide range of assets.

One of the benefits of investing in a mutual fund is that the income earned from dividends on stock or interest on bonds is paid to shareholders almost in full. Additionally, if the price of the securities in a fund increases, the fund has a capital gain which is distributed to investors at the end of each year after deducting any capital losses.

Behind a successful mutual fund stands an expert fund manager. Such a person has the knowledge and skill to conduct comprehensive research and make informed decisions and must be compensated accordingly. However, keep in mind that there may be management and other fees that could encroach on your income. Additionally, it is a good idea to review the fund’s prospectus and other fund-related information to confirm that the fund can properly meet your investment goals and risk tolerance. it is a good idea to review the fund’s prospectus and other fund-related information to confirm that the fund can properly meet your investment goals and risk tolerance before taking any steps.

Where to Invest $1000?

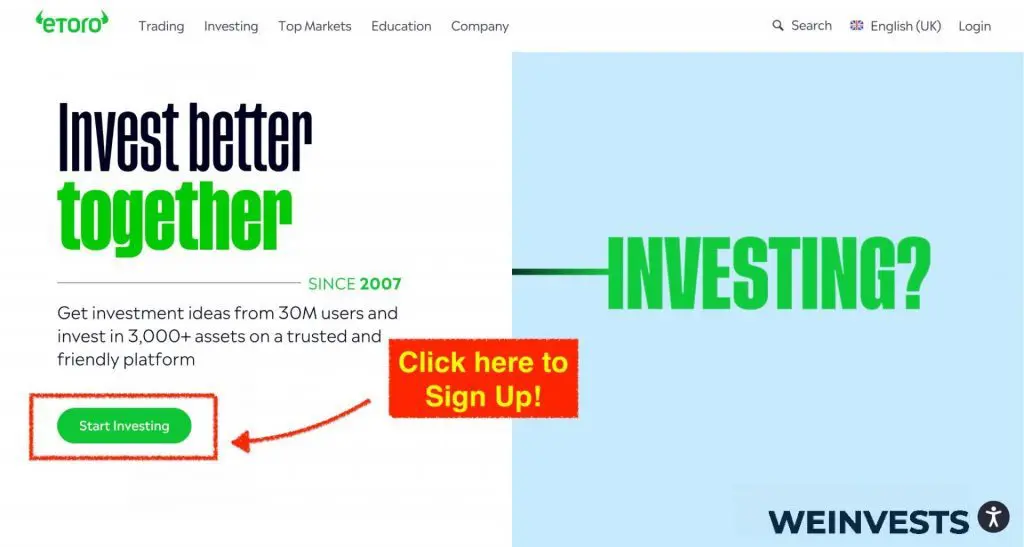

eToro offers a reputable platform with diverse options for both beginners and professional traders. In this mini guide, we’ll walk you through the process of opening an account on eToro and how to invest $1000.

Step 1: Open your Personal Account

To begin, you’ll need to create an account on eToro. To do this, navigate to the eToro homepage and click on the “Sign Up” or “Join Now” button. You will be directed to the registration page, where you’ll need to provide some basic information such as your name, email address, and desired password. Once you’ve completed the required fields, click “Create Account” to proceed.

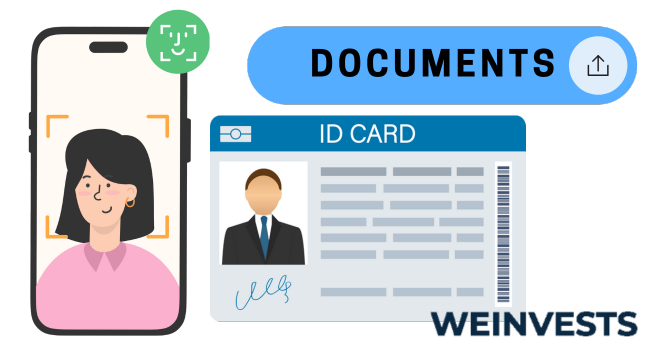

Step 2: Upload ID

After creating an account, you’ll need to verify your identity by uploading a proof of identity document. This could be a government-issued ID card, passport, or driver’s license. Make sure the document is valid and clearly shows your name, photo, date of birth, and expiration date. Follow the on-screen instructions to upload your ID.

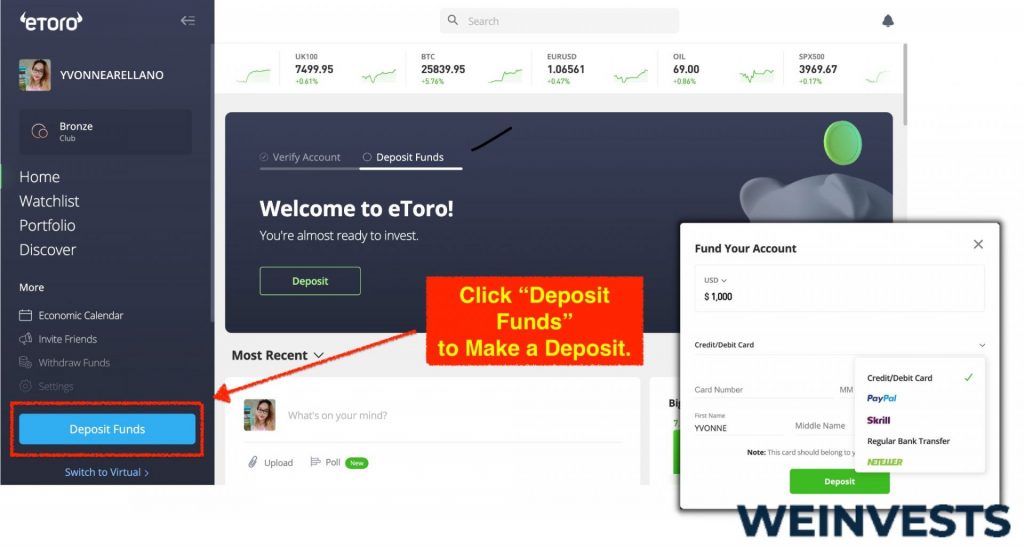

Step 3: Make a Deposit

Once your account is verified, you’ll need to deposit funds before you can start investing. To do this, log in to your eToro account and click on the “Deposit Funds” button. You can choose from various payment methods such as credit/debit card, PayPal, or bank transfer. Keep in mind that there may be minimum deposit requirements and fees depending on the payment method you choose.

Step 4: Search for the platform you want to Invest

Now that your account is funded, you can search for investment options within your $1000 budget. Use the search bar on the eToro platform and enter keywords related to your desired investment, such as specific stocks or ETFs. The platform will display a list of matching results for you to browse and research.

Conclusion

In conclusion, investing your $1,000 wisely is crucial for achieving long-term financial prosperity. With a myriad of investment options available, such as high-yield savings accounts, CDs, CFD leveraged trading, PAMM, copy trading, yield farming, Metaverse projects, and mutual funds, it’s important to carefully assess your risk tolerance, financial goals, and the potential rewards of each investment strategy. As you embark on your investment journey, remember that diversification and thorough research are essential for minimizing risks and maximizing returns. By making informed decisions and staying vigilant against potential scams.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More