This content represents the writer’s opinions and research and is not intended to be taken as financial advice. The information presented is general in nature and may not meet the specific needs of any individual or entity. It is not intended to be relied upon as a professional or financial decision-making tool.

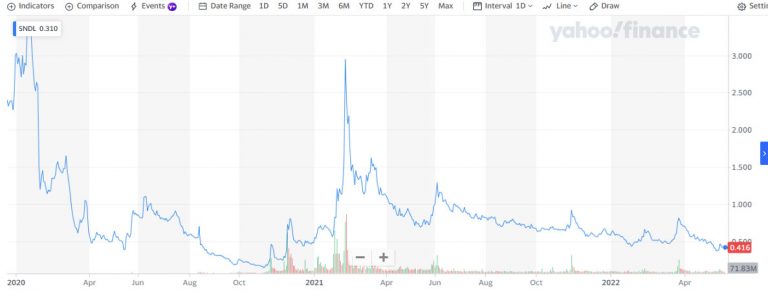

Sundial Growers Inc. (now SNDL Inc) operates publicly and trades on NASDAQ with the SNDL symbol. Since its initial public offering in August 2019, the cannabis-based company has had several ups and downs. In a broader scope, Sundial stock has significantly declined in the last three quarters.

SNDL Inc, formerly Sundial Growers Inc, primarily produces and markets cannabis for the adult-use market. Some of its products in the market are Lemon Riot, Daydream, Zen Berry, Twilight, Tropical Bliss, Pillow Talk, Citrus Punch, and others. In addition, the company primarily produces and distributes inhalable products and brands (flowers, pre-rolls, and vapes). Some of its available brands include Sundial, Top Leaf, Palmetto, and Grasslands. SNDL Inc focuses on three segments: cannabis operations, retail operations, and investments.

Primarily, Sundial revolves around four separate operational segments cannabis cultivation, cannabis retail, cannabis investments, and cannabis production. But despite falling and unpredictable stock levels, Sundial Growers, like the best cannabis players in the market, is a licensed cannabis producer. In fact, Sundial has modern indoor facilities to produce cannabis on a large scale.

For the most part, the modular growth strategy of Sundial has been successful. Plus, Sundial employs some of the most experienced cannabis growers in the industry, allowing the company to stand out in the market. In line with the ups and downs of Sundial’s stock price, the company’s major brands include Palmetto, Grasslands, Sundial Cannabis, and Top Leaf.

As a cannabis producer, Sundial Growers has been around since 2006 with headquarters in Calgary, Canada. But after the IPO in August 2019, it hasn’t been exactly a smooth ride for the cannabis production company.

Table of Contents

Sundial Growers Statistical Overview

Sundial Growers SNDL Stock Forecast 2023

SNDL has been making bold moves since 2022 to improve its financials, primarily through acquisitions and mergers. However, there has been little or no organic growth in manufactured sales in the previous year as the company has been all out more for mergers and acquisitions. Hence, profitability and sales could be significant issues for investors going by what was obtainable in the way the company operated in 2022.

However, the case for buying SNDL is getting stronger than ever before. Its near-term trajectory shows convincing reasons to invest in the stock. The current acquisition and merger spree has spurred growth in a relatively modest way. It has also encouraged business diversification and offered more business opportunities that could help bolster the growth of SNDL stocks.

The 4 analysts offering 12-month price forecasts for SNDL Inc from historical data have a median target of $3.35, with a high estimate of $3.89 and a low estimate of $2.91. This median estimate represents about a 47% increase from the last price of $2.28.Also, the consensus among top analysts for SNDL is to “hold” this stock. This consensus rating has been held steady since November 2022. The implication is that the general market outlook for SNDL stock in 2023 tends toward growth.

In a short while, the market will soon feel the effect of these acquisitions, especially that of Alcanna in March, 2022 and Zenabis in November 2022. The expected market reaction is that the stock share price will go upward, driving the price upward. Therefore, SNDL remains in the acquisition mode; since October 2022, the pot stock has increased by more than 25%. Suppose acquisitions and mergers could drive revenue and impact prices this much. In that case, when organic growth from manufactured sales, coupled with licensing of cannabis use, stock share prices are expected to skyrocket.

Sundial Growers Stock 2022

In 2022, Sundial Growers transformed its business by changing its corporate name to SNDL. The stock itself was grossly decimated in 2022. Trades were at half their book value, with lots of cash and no debt. The stock fell about 57.5% from its price at the turn of the year. The price drop also includes a stunning 98% from its all-time highs. SNDL traded at $6.19 at the start of the year (January 3), but the price level by December 5 was at $3.12

Despite the fall in prices of stocks generally in 2022, it was an eventful and busy year for the company. The harsh macroeconomic environment and pricing erosion that hit the Canadian cannabis market had a disastrous effect on both products and stock prices. During the meme stock craze in 2020 and 2021, SNDL raised about $1 billion from stock sales. This was adequately used to clear all outstanding debts of the company and hence put the company in a strong financial position for acquisitions, expansions, and innovations.

In a relatively low-risk way, SNDL consolidated the oversupplied cannabis market in Canada and the US. It completed the acquisition of Alcanna in March 2022. Alcanna has a majority stake in Nova Cannabis (NVAC.F) and a robust alcohol retailing infrastructure. The alcohol retailing arm of this acquisition has helped in the generation of recurring positive cash flow for the company.

Sundial has managed to exhaust its grace period to revert the negative fall of its share price and ensure compliance. However, Q2 2022 was a turnaround quarter for Sundial Growers’ stock.

Furthermore, the company has also made it clear that it is in the interest of Sundial Growers to remain publicly listed. If SNDL shareholders unanimously voted for a reverse stock split, it would make the company a privately traded, illiquid, and discounted entity in the market. Fortunately for investors, CEO Zach George who has been very candid about the troubles of the Canadian cannabis market, said at the Q3 conference call with top analysts that due to the increased pace of bankruptcies in Canadian cannabis, “for the first time, I see contrary indicators suggesting that the Canadian industry is nearing a trough, warranting a more bullish stance.” The recent acquisition of Zenabis will allow Sundial to acquire an EU certified grow facility, further enhancing international trade, especially in Europe and Israel. SNDL is working on developing Valens Company (VLNS) by purchasing about $138 million of its stock. The impact of this acquisition on the SNDL stock is not yet clear, yet it is believed that it must be a strategic fit by the executives.

Sundial Growers Stock 2021

In the last six quarters, investors have spotted many red flags around SNDL stock. The truth is that cannabis sales of Sundial Growers started to shrink drastically in 2021. In fact, the net revenue of Sundial Growers decreased by 8% in 2021. By December 31, 2021, the net income of Sundial Growers came down to $22.7 million from $56.1 million.

In terms of the stock split of SNDL, the consolidation won’t have a direct impact on the operational fundamentals of the company. However, it would impact outstanding shares and the total share count. In addition, there would be diluted cash flow against total shares and earnings on each claim.

And these diluted values may seem higher than before with a small denominator. Analysts, however, insist that the stock market has (almost) always managed to punish stocks that go through a split reverse. And that’s because the market regards reverse split as evidence of an underperforming company. But when it comes to the future outlook of SNDL and its stock, many investors continue to have high hopes.

Sundial Growers Stock 2020

After acquiring Alcanna, Sundial became the most prominent private cannabis company in Canada. However, cannabis producers and cultivators want to make more strategic decisions to boost their stock levels in the market. In fact, by the end of December 2020, the market perception of Sundial stock was negative, and optimism among investors was at an all-time low.

One of the significant strengths of Sundial’s stock levels is that it gains a great response from strategic capital investments, partnerships, and acquisitions. However, regarding the global cannabis market, Sundial wants to establish a more direct position to increase annual revenue, profit margins, and stock price.

On top of declining cannabis sales, the high-valued and premium products of Sundial Growers started to struggle in 2020. This, in turn, had a negative impact on its stock price throughout the year. However, in 2020, the ground reality for Sundial Growers is much different than it is now.

In fact, the company wanted to add and roll out low-valued cannabis products into the market to appeal to a bigger market. And then, the prices of vaporizers, edibles, and concentrates became highly aggressive. On the flip side, high-valued product segments like oils and marijuana started to decline in 2020. In fact, cannabis oil sales shrank by 65% alone.

In all seriousness, it would be fair to state that 2020 was an eye-opening year for Sundial Growers. On the bright side, Sundial increased its revenue stream due to more sales of concentrates and edibles. Overall, there was a balanced approach from Sundial to navigate back and forth between high-valued and low-valued product segments in 2020-21.

In 2020, SNDL investment losses were huge, and the risk of dwindling stock levels loomed throughout the year. Speaking of SNDL stock red flags, the company’s investment shares with other cannabis businesses in Canada also led to significant losses. In fact, Sundial Growers’ investment shares in Village Farms International had losses of over CA$17.7 million. At this point, the stock price of Village Farms had already been down by 63% by the end of 2020.

This unrealized and nonstrategic approach from Sundial had a negative impact on its stock price. Later, the company understood that there were more productive and safer investments. But the sudden shift in market conditions due to the COVID-19 crisis had a negative impact on cannabis stocks all over North America. Therefore, it would be fair to state that 2020 was an eye-opening year for Sundial Growers.

Sundial Growers Stock 2019

Sundial Growers went public on August 1, 2019, and since then – the company has had a tumultuous journey. Right from the start, the acquisition of Alcanna helped the company increase its revenue generation. On March 31, 2019, the acquisition of Alcanna was finalized and closing hinted to investors at a significant revenue increase for SNDL.

Interestingly, the opening stock price of SNDL is still its highest in 2019. At the time, it was obvious that Sundial Growers had a profitable and brighter future ahead. But back to disastrous years, investors and market perception towards Sundial Growers started to change. As a result, on August 5, 2019, SNDL stock hit its highest price of $13.55, and the company hoped it would regain the same stock price by the end of Q4 2023.

Conclusion

In 2023 SNDL’s Q3 earnings report (September 30), SNDL had impressive results, which should encourage investors. The company’s sales totaled $230.5 million (mainly due to alcohol retail revenue of $152.5 million), which increased by 3% from the previous period. It also returned to adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) profitability, with adjusted profits up to $18.3 million (versus the $25.9 million loss SNDL reported in the previous period). The most surprising is that Sundial also reported positive operating cash flow of $8.6 million, compared to a negative operating cash flow of $17.9 million in the second quarter.

Overall, 2023 Q3 was an impressive period for SNDL as it helped shape the possible outlook and what to expect in 2024. The key will be how consistently the company can generate growth without worsening cash flow or profitability. Anytime there are so many changes involving a business (e.g., acquisitions), it can create uncertainty.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More