- Many assets to choose from

- Great tools and resources

- Multiple regulator licenses

- Good platform for beginners

- Large Conversion fee

- Average ratings

- No specialized account types

| 💻 Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader |

| 📞 Customer Service | Live Chat, Email, Phone |

| 🎁 Promotions/Bonuses | Get up to $2,000 on the first deposit |

| 🛡 Regulation | Markets.com is regulated by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Financial Sector Conduct Authority (FSCA) in South Africa, and FSC (GLOBAL) |

| 💵 Deposit/Withdrawal Methods | Credit/Debit Cards, Bank Transfer, Skrill, Neteller, PayPal, Rapid Transfer |

| 📊 Spreads/Commissions | Markets.com offers fixed and variable spreads, with the minimum spread starting from 0.5 pips. They do not charge commissions on trades. |

| 🔒 Security | Markets.com uses SSL encryption to secure clients’ personal and financial information. They also offer negative balance protection to ensure that clients’ account balances never go below zero. |

| 📚 Education/Resources | Markets.com offers a range of educational resources, including webinars, video tutorials, and trading guides. They also provide an economic calendar and market analysis. |

| 📱 Mobile Trading | Markets.com offers mobile trading through their mobile app, which is available for iOS and Android devices. |

| ⚡ Execution Speed | Markets.com offers fast and reliable trade execution through their trading platforms. |

| 🔧 Trading Tools/Indicators | Markets.com offers a range of trading tools and indicators, including technical analysis tools and charting software. |

| 🌍 Country/Region Availability | Markets.com is available in most countries, including the US, UK, EU, and AU. However, they do not currently accept clients from certain countries, including Canada, Japan, and some other countries. |

| 💰 Account Minimum | The minimum deposit to open an account with Markets.com is $250. |

| ⚖ Leverage/Margin Requirements | Markets.com offers leverage up to 1:10 for retail clients and up to 1:300 for professional clients, depending on the instrument traded. |

| 📈 Asset Selection/Market Access | Markets.com offers a wide range of assets for trading, including forex, stocks, commodities, and cryptocurrencies. They also provide access to major exchanges, such as the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE). |

This is a powerhouse broker online since 2008 founded in Israel. Markets.com brand is well established in the industry however not without fines and controversies that are essentially now part of corporation business. To traders, it is important to have undisturbed trading, ideally, a broker will strive to enhance their trading. Here is how Markets.com fares.

Can Markets.com be one of the best brokers? We compare and review its features, and find more.

Table of Contents

What is a broker? – Introduction

It is great to live in current times, we are witnessing a financial transformation. We can enjoy neo-banking and other platforms that allow us to do personal finance.

Brokers are our middlemen in trading many different markets. They can provide software or mobile apps of their own (proprietary) or use a third-party platform such as MetaTrader. Traders use apps to manage risk, analyze and trade while the broker connection gives us price liquidity with various trading instruments, such as crypto or stocks.

Since most brokers offer CFD trading, it also means we can make profitable trades on downtrends as well. CFD also allows leverage, a kind of multiplier that allows higher-volume, riskier trades.

There are thousands of brokers, some regulated, with low ratings, and some with praises all around. They should keep our funds safe, give us good trading conditions and support our growth as traders. Of course, that is not always the case, so broker research is one of the most important steps.

Let’s see what kind of broker Markets.com is.

Markets.com Trading Platforms

This broker offers proprietary and third-party platforms – a perfect mix. If you are already an accustomed MetaTrader user, you will be pleasantly surprised Markets.com offers both, MT4 and MT5. Beginner traders would probably opt for the proprietary platform which is more pleasant to the eye but also easier to grasp. All platforms are available for mobiles too.

When a broker offers proprietary platforms they usually integrate special features, such as sentiment indicators, for example. Markets.com has that feature using their pool of traders and their position direction to give you sentiment on any given instrument. Such features are not available on MetaTrader platforms, at least not by default.

The platform is less responsive than MT4 or 5, however, it is simplified for beginners. There are about 70 indicators to plug in, but you need to enable the “advanced” view first. Also, window customizations are not completely flexible. If you want advanced technical analysis and automated trading, go and use MetaTrader.

Fees & Commission

Markets.com spreads are floating, however, the spread rarely moved during our observations on forex pairs. EURUSD spread was 0.7 pips and Gold/USD was a round 30 pips. The commissions do not exist with CFDs with this broker so when compared to the industry Markets.com is competitive.

Other fees include an inactive account fee of $10 charged monthly if no trades have been made for 90 days.

There are no fees related to funding but Markets.com offers reimbursement of any fees you have with other parties if you deposit at least $2500.

Now, the biggest con is the conversion fee which is $20 per 1 lot. If you have a USD account and trade USD-denominated assets this fee can be avoided completely.

As for the swaps, they are under normal ranges, however, positive swaps are rare and very low.

Leverage

Markets.com does not go wild with leverage if you apply with a tier 2 regulator such as CySEC Standard forex leverage is 1:30. For crypto is 1:2 and 1:20 for Gold. If you register from a country like Indonesia, then you will have a maximum 1:300 leverage on major forex pairs. According to Markets.com, the leverage will vary on the country.

Additional Tools

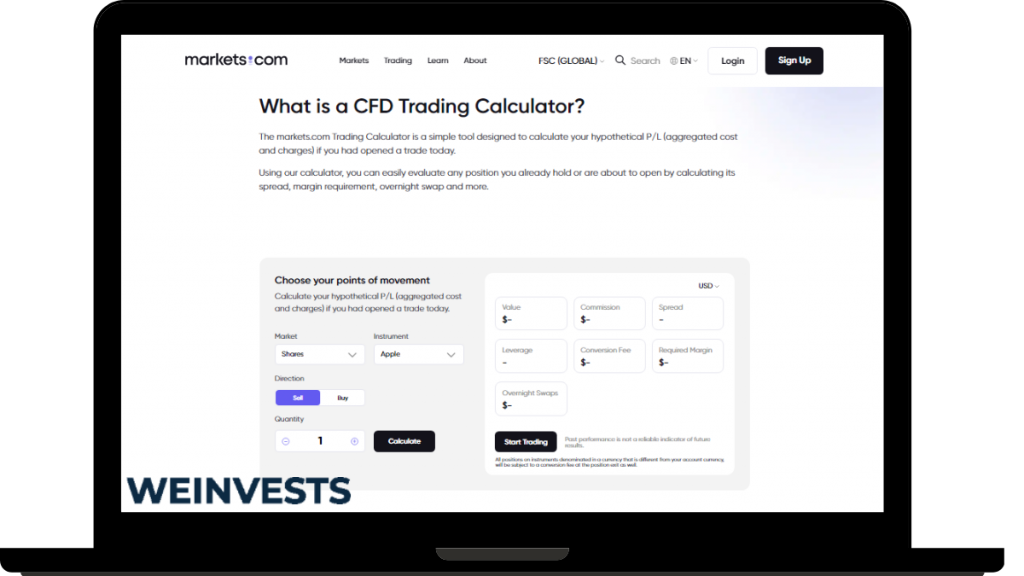

We like how this broker developed a simple calculator that covers all the costs, and specifications and easily calculates your trades using the slider.

Markets.com utilizes a sentiment indicator called “Traders Trend” showing the balance percentage between bullish and bearish traders.

Another great tool is the Analyst Recommendations which aggregate opinions of several public analysts and present them with price targets, upsides, pie charts, etc.

We especially like “Key Stats” and the “Related instruments” tab on the platform for each asset you select. It will give you additional information on which you can base your strategy, hedge, or see correlations.

Account Opening & Deposit and Withdrawals

Markets.com has a step-by-step way of collecting your data for registration. As with a bank but with a bit more information. What you need to disclose is your phone number, ID documents, Proof of Residence, and more if required. In some cases, you will need proof of phone number or a letter of confirmation from your bank. So, account opening requires some time, however, demo accounts are not that demanding, but you will still need to disclose your phone number.

Deposit and withdrawal channels are Credit Card, Wire transfer, Skrill, Neteller, and PayPal, where available.

The minimum deposit is $100.

Withdrawals come to the same source used for the deposit. Credit Cards will be processed first. Processing time is up to 7 days.

Account Types

There are no Account types to choose from, there is only one account that allows all instruments. Joint and Corporate accounts are optional.

Customer Service & Support

Markets.com always has a chat button available. There are no bots and you can directly chat with a live agent available 24/5. The response time is less than a minute. Now, it looks like the agents are not up to date with the renewed markets.com platform and portal, so it looked a bit different to us than their screenshots. We had no issues with the agents, although we didn’t like requests for location and email even when this information is not relative to your question.

Education, Learning and Research Resources

The educational material available on the website is not very broad but covers the basics and has a well-organized Glossary. However, the best content is integrated into the Markets.com platform.

The broker is proud of additional and unique gadgets such as Financial Commentary, Analyst Research, Blogger opinions, Hedge funds sentiment for stocks, and more. Each of these features is also neatly explained if you watch a tour.

Although the broker does not offer much reading, instead, it focuses on the ease of use of their special resources that certainly can provide a trading advantage. If you try a demo you will still have access to these resources.

The News section is rich, there are good articles about the markets, events and summarized video commentary. Also, Markets.com tweets are presented too, further enhancing the experience with the most buzzing topics.

Regulatory Compliance & Security

Markets.com is very careful about AML and KYC. Your funds will be in segregated accounts. Depending on your country you will be under FCA (UK), CySEC (EU), ASIC (AU), FSCA (South Africa), and FSC (BVI) for the rest of the globe. Now, some countries are not supported even though FSC BVI is not a strict regulator, it is simply a choice of Markets.com.

Markets.com has a good overview page (Global Offering) about what is covered by each regulator, including compensation scheme amounts with FCA and CySEC, complaints, etc.

Markets.com Summary

This broker is established in the industry and the wide asset range places it as one of the best. You also have a good range of platforms and what looks like competitive spreads. And here is the biggest drawback in our opinion. High conversion fees are too high for non-USD-denominated assets if your account is in USD. Meaning even if you choose a USD account you will have conversion fees on certain assets.

Markets.com also does not enjoy great ratings, and to some extent, the broker even pursued portals that posted negative reviews.

Markets.com can offer more about correlations, news, etc. Using the tools and materials a beginner could develop their own critical thinking about how the markets work and essentially develop their trading ways.

Risk warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

WeInvests is a financial portal-based research agency. We do our utmost best to offer reliable and unbiased information about crypto, finance, trading and stocks. However, we do not offer financial advice and users should always carry out their own research.

Read More